August 09, 2016

How to Identify the Best New Suppliers

As distributors become reluctant to audition new suppliers, they must find a process to separate the most reliable ones from all others.

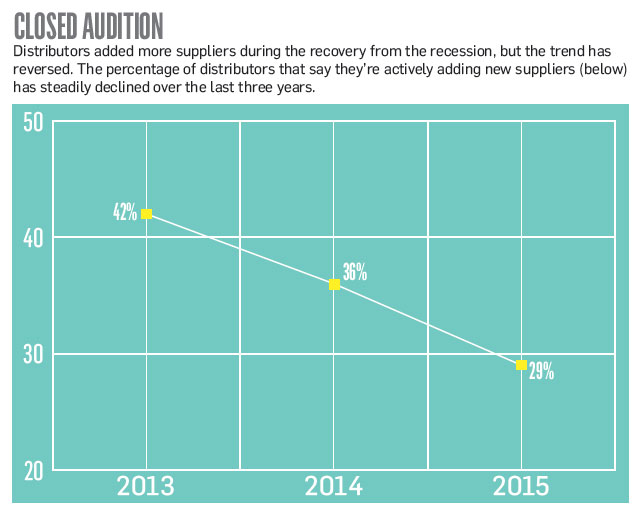

Last year, over a third of distributors (37%) increased the number of suppliers they used, compared to 8% who decreased their roster, according to State of the Industry statistics. But those numbers hid another fact: over the last three years, fewer distributors were adding to the number of suppliers they use in any given year. Ultimately, then, it’s harder for all suppliers to thrive if distributors won’t give them a chance.

The easy answer to this quandary: create processes that distinguish the outstanding suppliers from the average ones. In practice, however, it’s no longer simple because suppliers transcend categories to be all things to all distributors. “Years ago, you knew what everybody did. There was a pen supplier. There was a mug supplier. Now, everyone’s selling everything,” says Larry Cohen, president of Top 40 distributor Axis Promotions (asi/128263). “My expectation from our supplier partners is the expectation we present to our clients: If we can’t make your job easier, we’re not a good fit. That should be the driving factor.”

Mike Emoff, CEO of Shumsky (asi/326300), says every distributor should begin by having a checklist for all potential supplier partners. That includes making sure the supplier is willing to provide special pricing at certain volumes; verifying it’ll stand behind its product if something goes wrong and confirming the supplier has a safety and social compliance policy in place. “If you’re not conscious about quality and safety, you’re setting yourself up for problems,” Emoff says.

Fortunately, much of this information is available even before establishing first contact with a supplier. “There are services within ASI that offer supplier feedback,” Emoff says. “There are also multiple supplier industry awards, and that’s a really easy place to go and check. Who are the winners? Who are the distributors’ choices of suppliers out there?”

Cohen prefers to do business with suppliers that can prove they’re better at something than any of their competitors are. “Tell me what you’re best at, and be best at that and prove it,” he says.

This is the mission that Al’s Goldfish (asi/33300) has recently taken on. After being in the fishing supply retail business for over 60 years, Al’s Goldfish has navigated into the promotional waters in the last two years, with the goal of making distributors aware of its expertise in the fishing market. “We have the understanding that we are considered very much a niche in this space,” says Mike Lee, president of Al’s Goldfish. “We go about building a brand in promo vs. someone who just lists products.”

Al’s Goldfish has piggybacked on its knowledge of fishing (according to Lee, one in six Americans fish) by informing distributors on its website and at trade shows that it can tailor promotional marketing to the kinds of fish and fishing supplies that are popular within each geographical region.

But most importantly, fishing is the only thing that Al’s Goldfish specializes in – and it makes sure potential distributors are aware of the advantages of this. “The bigger players that carry fishing products, carry everything. You might as well be picking up a keychain,” Lee says. “We offer that value of being very particular and offering products that fit their specific needs.”

The supplier identifies and profiles target customers, including the scope of their knowledge regarding the fishing market, and then strives to educate them on the value of the product that the supplier sells.

The supplier identifies and profiles target customers, including the scope of their knowledge regarding the fishing market, and then strives to educate them on the value of the product that the supplier sells.

There’s no doubt this kind of niche expertise among supplier partners can be highly valuable. On the flip side, no exceptional product or pricing should transcend warning signs that distributors must look out for. “Depending on your size, if a supplier asks for payment up front, that’s a red flag for me, because I think the supplier might be in trouble,” Emoff says.

Emoff once ran into this situation when a new supplier asked for a deposit on a big order and admitted its cash flow wasn’t good. “If they’re hurting, you will suffer with them, so you’ve got to be careful,” he says. “Just like suppliers run credit checks on us, I run supplier credits. I’ll check in on their financial health. I believe that’s a smart move.” Bottom line: When the time comes to pick new supplier partners, it’s a good rule of thumb to have the same expectations of them that your customers have of you.

“Picking the right supplier is like picking an employee,” Emoff says. “If organizations are just doing business with suppliers because they have a product they’re looking for, that’s a strategy that’s very short-lived, and I don’t believe the benefits a supplier will give you are going to equal that of one that’s a solid relationship.”

At a loss with social media? Our experts use actual posts from businesses to illustrate their best tips.