July 19, 2019

How to Find Sales Success in the Finance Market

A strong economy has given this market renewed stability.

In its 2019 Banking Industry Outlook, Deloitte reported that “there’s a new kind of promise in the banking industry.” That broad statement highlights the current stable footing of the financial industry. Aggressive policy interventions and regulations have rejuvenated U.S. banks, as favorable GDP growth, tax cuts and rising rates have further bolstered the state of the financial industry.

One of the most notable developments under the Trump administration has been the U.S. Tax Cuts and Jobs Act, which has already positively impacted banks’ financials. Without the lower tax rate, the banking industry’s net Q2 2018 income would’ve increased only $5.6 billion year over year instead of the $12.1 billion realized, according to Deloitte.

“Business has been great in the financial market,” says Rachel Leone, president of Massachusetts-based Leone Marketing Solutions (asi/251966). “The economy is doing well so they’re ordering lots of promotional products for trade shows and events. Business cards and brochures aren’t cutting it anymore. They want pens, hand sanitizer, credit card mints, wallets, even socks.”

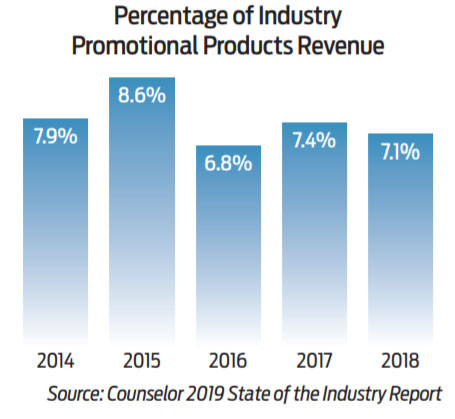

Five-Year Snapshot: The financial market experienced a slight decline last year and is the fourth largest for promo products sales.

The finance and insurance markets may no longer be the third-largest market for promotional products (manufacturing overtook it in 2018), but it remains a steady sector full of clients – banks, credit unions, mortgage lenders, private equity firms and others – that frequently re-order, leading to repeat business once a relationship has been established.

Beneath the optimism, however, the financial industry is weathering tremendous change. The biggest issue is cybersecurity – or more accurately, the lack of it, says Linda Neumann, president of San Diego-based Brilliant Marketing Ideas (asi/146083) and someone who worked in the banking industry for 20 years. There were 106 confirmed data breaches in the banking, credit and financial industry from September 2017 to September 2018, with more than 1.7 million records exposed, according to the Identity Theft Resource Center (ITRC). “Fraud is rampant,” Neumann says. “Banks are trying to figure out how to protect customer data.”

Top Tip Deloitte’s 2019 Banking Outlook states that “banks should empower clients to serve themselves when and how they desire.” Distributors can play a key support role by building campaigns to increase customer adoption of new service models.

In addition, banks are facing intense competition in the digital age, as payment apps like PayPal, Apple Pay, Google Pay and Venmo disrupt the market. “As you see all these people entering the financial market, banks are becoming less and less important,” Neumann says. “The trend started years ago when banks got customers out of the branches to use ATMs. Now they’re trying to get customers back in and they’re using promotional products to do so.”

With so much uncertainty in the market, Neumann has noticed that banks and credit unions are doubling down on keeping their staffs happy. Over the past year, she’s seen a lot more internal promotions, such as employee recognition and new hire initiatives. “They seem to be valuing employees more, ordering awards and branded clothing to make them feel appreciated and part of the team,” she says.

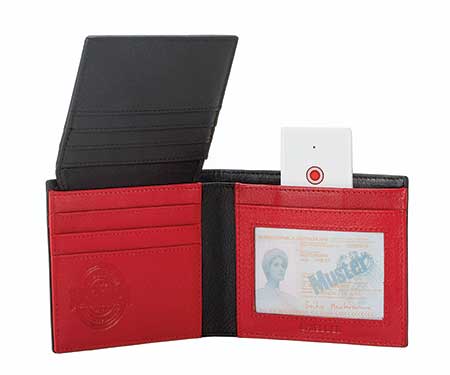

Financial security has two meanings with this RFID shielding smart wallet (1162). Voyager Blue (asi/94218); voyager-blue.com