July 19, 2017

Staffing with Caution

As the cost of running a distributorship increases, hiring and wages have plateaued – but it doesn’t have to stay that way.

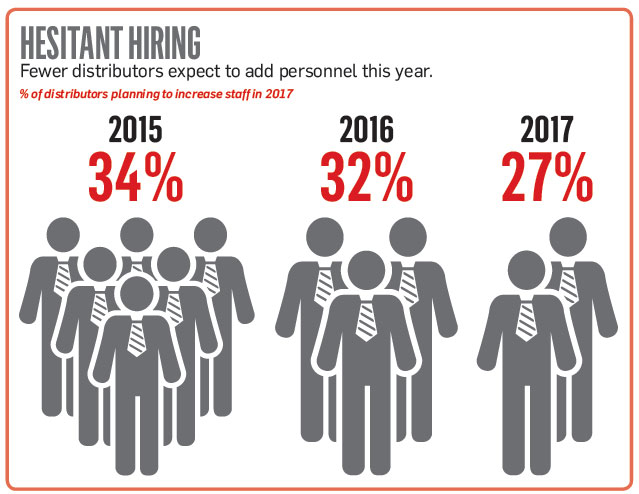

As the promotional products industry evolves, a new group of corporate buyers, technological advances and unprecedented competition begs for fluid business models and compensation packages. Easier said than done, as the saying goes. Although they’re not cutting staff, 67% of distributors are proceeding with caution and not planning to hire more staff in 2017. Additionally, fewer firms are expecting to give out near-term raises, despite 45% of distributors reporting increased profits last year.

>>Back to the State of the Industry 2017

Billy Booe, president of the Eastern U.S. region for BrandAlliance (asi/145177), sees two reasons for the trend: distributors are waking up to the true costs of running a modern business, and the market has changed exponentially with the younger generation of buyers. “The costs associated with running a business, even health benefits alone, are such a drain on a company’s working capital that they’re no longer able to afford a 50/50 split with reps,” Booe says. “Buyers are making smaller, more frequent purchases, which leads to a higher cost of processing and longer sales and pay cycles.”

BrandAlliance now aligns compensation directly with margin: If an order is written at 45%, the rep earns 45% of the split. “If you are a commodity salesperson, this model doesn’t appeal to you, but if you are a good rep that knows the true value of your time and you are selling at higher margins, you’re making out well,” says Booe.

With the rise of internet-based companies and heightened competition in the industry, some reps settle for lower margins, which trains the consumer to shop by price and not by value.

“Salespeople who don’t know the value of their time have no clue how important it is to match margin with the time and effort it takes to produce an order from start to finish,” Booe says. “Conversations about true cost are really hard to have, whether it’s internally among reps and sales managers or whether it’s directly with your clients. You have to be willing to have these conversations, but have them based on true and accurate data.”

Distributor owners who are surviving these major shifts are finding a middle ground and implementing changes that will both support their team and grow their businesses. Danny Rosin, co-founder of BrandFuel (asi/145025), has seen six years of consistent growth. What used to be a company built on traditional 100% commissioned reps now hires one account executive for every five account managers, a base-plus-commission role.

“We want people who are hungry but we also realize the landscape has changed due to many competing factors,” Rosin says. “We are all about people power: We provide reps with continuing education courses, partnership with the American Marketing Association, sales coordinators to handle processing, plus weekly meetings to talk strategy and address challenges. We won’t hire someone unless we have a small book of business to start them off and all the tools to train and support them.”

Rosin admits that he’s lost sales reps over compensation, yet in the same breath, adds that hiring the right people for his company is the most important first step. “For us, it’s a succession plan, and I’m an advocate of compensation change for that reason,” he says. “If we want young people to come into this industry and build a career, we need to rethink our compensation structures and invest in those people.”

At Boundless (asi/143717) in Austin, TX, managing director Noel Garcia acknowledges the industry shifts in hiring and compensation, but hasn’t seen these particular changes within his company. Nor does he want to.

“When I first started, I was on a small base plus commission, but quickly moved to 100% commission and that’s how I like it,” Garcia says. “When you’re younger, you don’t need much money, so I understand new hires going for the different splits or salaries, but even salaried positions aren’t completely stable – you could get fired tomorrow, I could lose an account tomorrow – I prefer this risk and reward.”

David Blaise, owner of the industry consulting firm Blaise, Drake & Co., thinks there’s another reason beyond a changing marketplace for the hesitancy in hiring. In fact, he sees it every day: distributors who want to grow, but don’t know how to make the leap from main sales generator to owner.

“A lot of distributors are so busy selling, they don’t make time for hiring, for training, for motivation, and it’s really hard to bring on great reps when you’re stuck in the mindset of a salesperson,” he says. “They are so focused on keeping costs down that they won’t pay to get the right people on board and train them properly.”

Blaise says the number-one question he hears is: “What if I train my sales reps and they leave?” His answer: “What if you don’t train them and they stay?”

When an untrained rep gets in front of a prospect, “it makes the sales rep look foolish, the company look irresponsible and it gives the whole industry a black eye,” Blaise says. “The pool of people who want straight commission is drying up, and companies aren’t willing to take the risk of paying base or salary, so they’re simply not hiring.”