August 03, 2018

SOI 2018: The Margin Myth in the Promo Industry

While e-commerce players are as prevalent as ever, the theory that distributors are sacrificing profits to compete is more fable than fact.

With the tectonic shifts caused by the e-commerce era, distributors have faced a clear challenge in recent years: evolve into creative agencies or get left behind. Of course, even with deft shapeshifting, plenty in the industry figured margins were destined to shrink – but that hasn’t happened at all.

State of the Industry 2018 Index Page

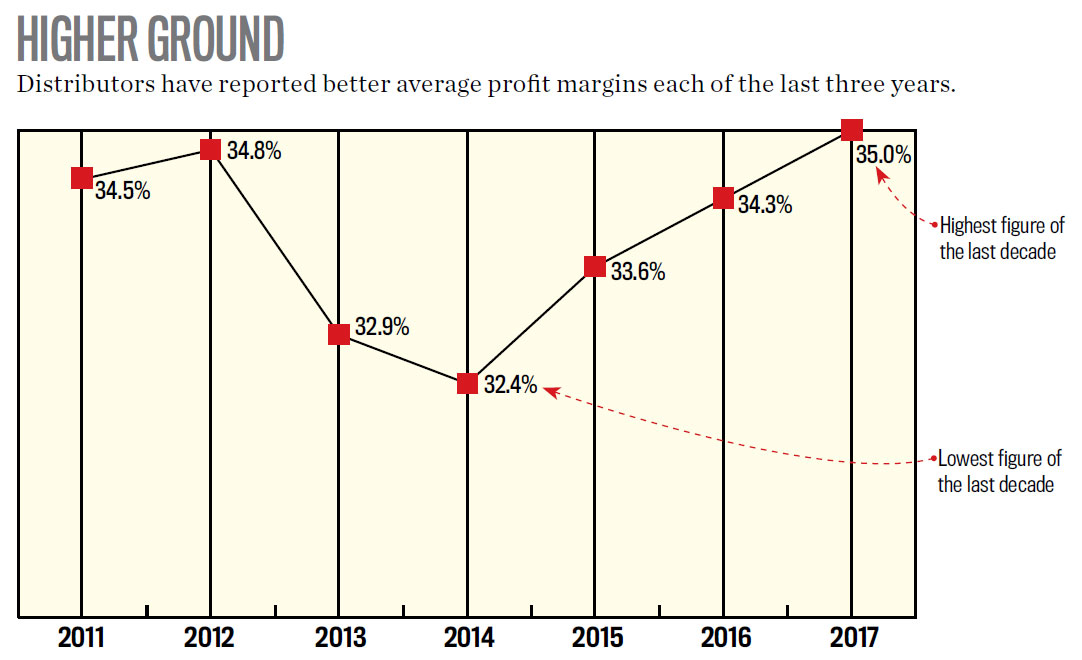

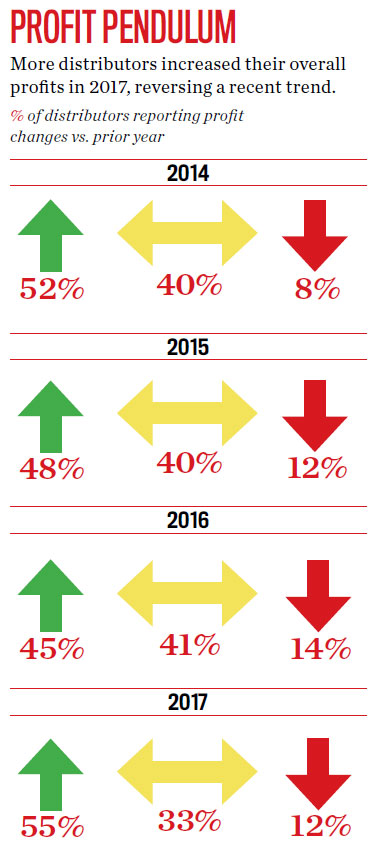

Instead, the average gross profit margin among distributors has increased in each of the last several years, reaching 35% in 2017. What’s more, a higher-than-usual percentage of distributors reported increased profits last year, while a smaller percentage said profits went down.

“It happens often where organizations say, ‘I found this online and it’s 20% less,’” says Mike Emoff, Chief Visionary Officer of Shumsky (asi/325300). “We’re seeing that the distributors who’ve gotten that business before are now losing that business, and that’s forcing them to be something they need to be in the future: a value-added consultative seller.”

Emoff has outmuscled the lower-priced online competitors by doing just that: playing up the added value his company provides. “What we offer that e-commerce sellers don’t are in-person visits and consultative brainstorming – things that require experience,” Emoff says. “It could be setting up a kiosk in their lobby. Think of when you go into a fancy hotel – it’s the things you can’t get at a low-end hotel that make it stand out.”

Some online competitors also can’t promise the same standards that other distributors are able to provide. “We tell them ‘you have a choice. You may be buying something from an organization that doesn’t have a quality and safety regulatory plan within the organization, and then you, your brand and your client could be at risk,’” Emoff says. “Some don’t care, and those clients go away.”

Rob Marshall, owner of Universal Marketing (asi/349570), says he’ll sometimes sacrifice margins in order to win a sale – but thanks to the personal service his company provides, it doesn’t usually come to that. “Most of our customers believe in long-term, face-to-face relationships, so over time they end up not beating us up on every order but trusting us to make sure we get the job done on time to meet their in-hands date at a reasonable price,” he says. “Our relationship ends up being the winner over just the cheapest price in town.”

“Most of our customers believe in long-term, face-to-face relationships.” Rob Marshall, Universal Marketing

Emoff isn’t fond of sacrificing margins to compete with the online guys, but there are times in which he says it could make sense to do so – specifically, when trying to win a large order with a first-time client. “If there’s a big opportunity and it’s about price, then we can give a little bit,” he says. “To lose a couple points of margin on a million-dollar order isn’t as bad as losing 20 points on a smaller order where you work your tail off and get nothing for it.”

But ultimately, maintaining a strong profit margin will likely mean losing to the e-commerce competitors from time to time. Emoff doesn’t think that’s a bad thing. “We don’t win them all,” he says. “We have people call in who know us from finding us online or through our reputation, and they don’t see the value proposition, so they go someplace else. But that’s not the kind of business we want.”

7 Ways to Boost Margins by Cutting Costs

Consultative selling and strong client relationships aren’t the only keys to lifting profits. Operating leaner and smarter can also create sizeable gains. Here are steps some firms are taking.

1. Buy instead of rent. “We recently purchased our building vs. leasing. This saved on general overhead costs and lowered our month-to-month expenses,” says Sara Webb, owner of InTandem Promotions (asi/231285).

2. Combine orders. “Mostly with apparel, we’ll combine multiple orders for free freight when we have suppliers that offer shipping at no charge for a certain dollar amount,” says Jessica Ibsen, director of customer delight at Fully Promoted Mandeville (asi/384000).

3. Reduce catalog costs. “The days of boxes of paper catalogs are long gone,” Ibsen says. “I remember shipping annual catalogs to customers that weren’t local, but now we simply email them a digital copy or create a custom presentation of products we recommend.”

4. Trim art costs. “We save on art costs when our clients don’t send us the best art by having staff trained in graphic design. They can resize and format logos for imprint areas as well as create virtuals and custom logos,” Ibsen says. “This is a charge we can give the customer without a large cost that many people incur by sending art out to be done.”

5. Check your software. “We routinely evaluate our software package to see if it’s functioning in an optimal way, if it still complements our business model or should be eliminated, if all users are in need of licenses, or if we can reduce,” Webb says.

6. Offer in-house decoration. “We have in-house embroidery and heat-transfer services for smaller orders. Orders up to 72 pieces can get expensive when using an outsourced decorator. We save costs by doing these in-house,” Ibsen says.

7. Invest in e-stores. “For our larger clients who reorder the same items repeatedly or have a program established, we do a customer e-store. This includes features such as automated order entry and payment processing, which eliminates the overhead of manual data entry,” Ibsen says.

What The Future Will Bring

Will profit margins go up or down in 2019? Several distributors weigh in.

Aimee Zeidman, owner of Unforgettable Goods, LLC (asi/348200), thinks margins will improve as clients are eager to spend. “There’s a lot going on in the world of tech, and many smaller startup companies – apps, software, etc. – are excited to get their names out there,” she says. “There are all sorts of fun gadgets available right now.”

Sara Webb, owner of InTandem Promotions (asi/231285), believes the future of profit margins depends on distributors’ willingness to add value. “Being brand-focused, we see that our profit margins will remain strong through this year and into next, while looking to decrease internal costs and overhead on our side,” she says.

Mike Emoff, CVO at Shumsky (asi/325300), predicts organizations doing over $5 million per year will be fine, but he’s pessimistic about smaller distributors. “If they don’t have a value-added proposition strategy, I don’t see them staying at the margins they’re at,” he says.