August 03, 2018

SOI 2018: Top Products in the Promo Industry

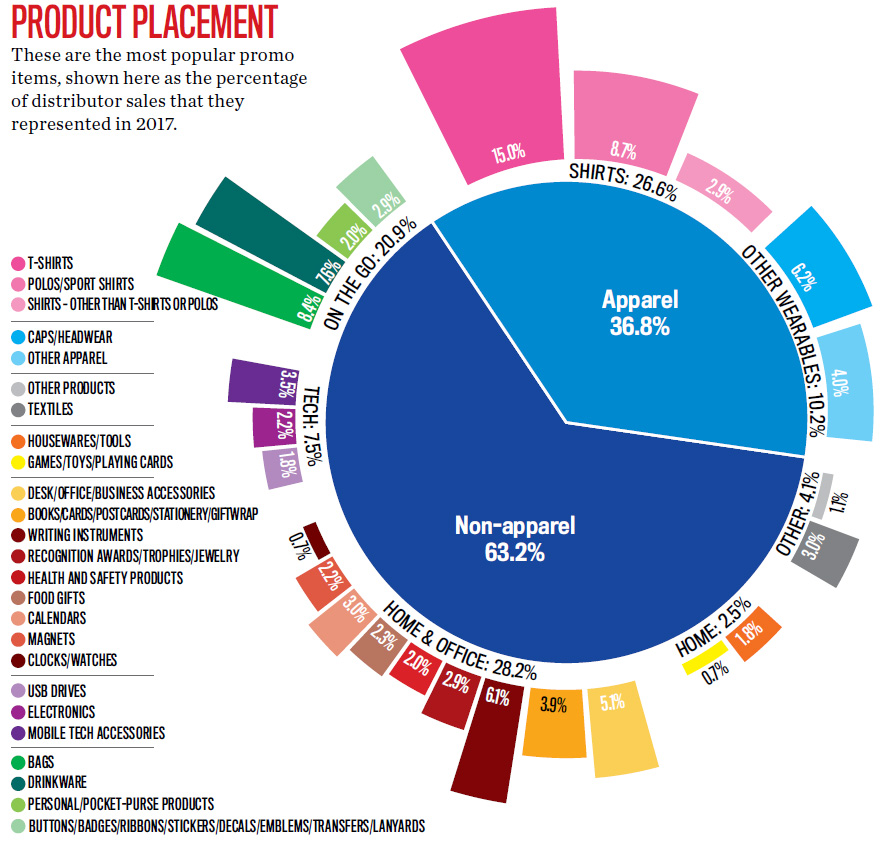

A breakdown of the best-selling promo items features a dominant leader and a rising category to watch.

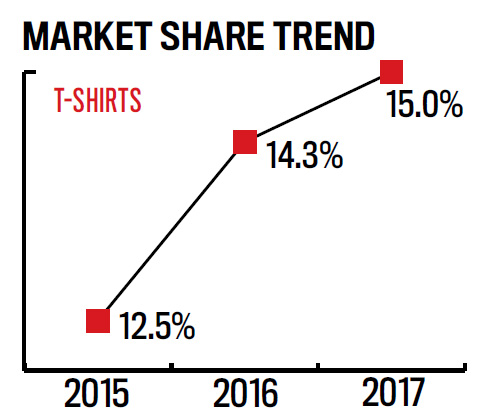

Largest Overall: T-shirts

Largest Overall: T-shirts

Tees are still tops when it comes to flexing a brand’s marketing muscle – in 2017 they accounted for 15% of distributor sales. That figure also represents the largest market share for any promotional product over the past decade.

State of the Industry 2018 Index Page

“T-shirts are easy to sell because they have a reasonable price point and a myriad of decoration options, plus they work for adults and kids,” says Joanne Worrall, president of JPR Consulting (asi/232678). “We sell them for corporate events like picnics, product and program launches, special in-house events as well as race and walk sponsorships.”

What styles are popular among buyers? “Our customers prefer lighter-weight fabrics with a fashion-forward styling,” says Worrall. “For ladies that means a scoop-neck and V-neck with a contour cut. The weathered slub is a big hit in high schools and college campuses and we’re seeing an uptick in requests for tri-blend.” Meanwhile, for general giveaway items, “the standard 100% cotton crew neck is still king, but even then, our customers prefer colors, rather than white,” Worrall says. “We’re seeing an uptick in colors like frost and heather looks.”

At Shirtwerx LLC (asi/567544), the company’s top buyers also include education markets clients, but with a different twist, according to owner Danny Lakey. Shirtwerx does orders for lots of church groups who use tees at nearly every event they organize, like youth camps, vacation Bible schools and retreats.

High schoolers and college students, particularly members of fraternities and sororities, love Comfort Colors tees, Lakey has noticed. “They’ll pay extra for them. The ringspun fabric gives a soft feel, plus there are lots of color choices, including a pigment dye that looks faded and worn, which the kids like,” he says.

Demand for ringspun cotton tees has also been on the rise, according to Lakey. “My SanMar (asi/84863) rep told me I bought almost as many ringspun shirts as I did pure cotton last year,” he says. Part of it is cost: The price differential between the two used to be significant, but as the cost of cotton shirts has risen and ringspun has come down, the gap has narrowed and the difference is negligible, Lakey explains.

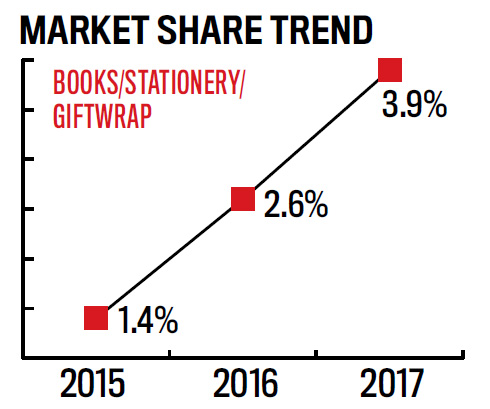

Largest Riser: Books/Stationery/Giftwrap

Largest Riser: Books/Stationery/Giftwrap

When it comes to wrapping up a promo sale, the box can be as significant as the gift inside. Distributors believe last year’s jump in sales in the books/stationery/giftwrap category – which grew to account for 3.9% of distributor revenues – was powered by an increased emphasis on creative packaging.

“It makes a ton of sense that packaging is taking more market share. This has been a huge growth area for our team over the past three or so years,” says Kevin Mullaney, VP of Brandito (asi/325944). “We started doing ‘New Hire Kits’ for our clients, and now suppliers want to provide the products inside and the packaging as well.”

Brandito isn’t the only distributor leveraging improved packaging for sales. Execs at Los Angeles-based Brandinc (asi/145212) say their firm has “tripled their gift wrapping and custom packaging sales in the last two years.” Meanwhile, at nearby Jack Nadel International (JNI, asi/279600), reps admit some orders come in based entirely on the company’s reputation for stylish design. “I’ve had clients come to me just for the box, and I tell them ‘hey, we also offer stuff to put in the box,’” says Mallory Ebrahemi, a creative branding specialist at JNI.

“We’re seeing an uptick in colors like frost and heather looks.” Joanne worrall, JPR consulting

What kind of packaging do clients want? Bob Chester, senior sales consultant at American Solutions for Business (asi/120075), says four-color process printing, spot varnish pictures and Velcro closures are some of the features his clients favor. “I get referrals when people see my boxes,” he adds.

And clearly, boxes can be big business. In 2017, the City Paper Co. (asi/162267) design team created a Bud Light box that was sent to various media influencers in town for the Super Bowl in Houston. When the box was opened, speakers inside produced the sound of a roaring crowd and an official calling a touchdown. “Print and packaging, together with promotional products, are so much more powerful in combination,” says Stephanie Friedman, City Paper’s VP of sales and marketing.

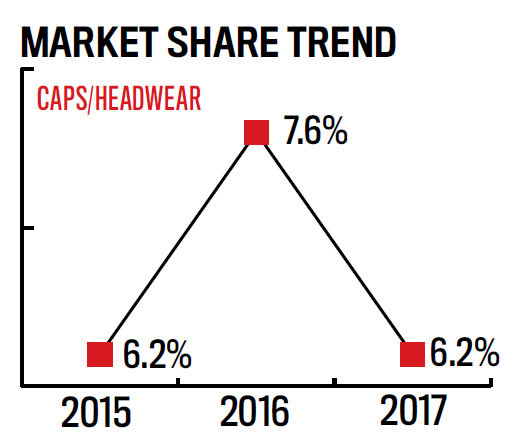

Largest Decliner: Caps/Headwear

Largest Decliner: Caps/Headwear

In terms of market share, sales of promotional hats dropped the most in 2017, declining from 7.6% of distributor revenues in 2016 to 6.2% last year. “I used to do more business selling hats for giveaways – I don’t see that anymore,” says Lakey. “It could be partly because embroidered hats cost more than a shirt. Also, not everyone wears a hat, but everyone wears a shirt.”

At California-based JPR Consulting, “we sell a good number of caps to our customers who work outdoors,” says Worrall, “but I don’t sell as many to our corporate accounts. Part of the reason is people have a tendency to have a few ‘favorite’ caps for their personal use and aren’t interested in getting additional caps. They’re not as versatile as T-shirts for promotional purposes, and they’re also more expensive. Not everyone likes caps.”

While the caps category overall dipped in 2017, there are styles that remain popular, according to distributors. The Richardson 112 trucker hat remains hot, while “dad caps” also have their place. For example, JNI’s Ebrahemi says “dad caps” are on trend for younger people, including her entertainment clients.

Yet, Shelly Aberson, president of Aberson, Narotzky & White (asi/102667), adds “Dad is popular, although not in the quantities we used to see.”

Click here for a larger image of the above graphic.

Click here for a larger image of the above graphic.

Click here for a larger image of the above graphic.

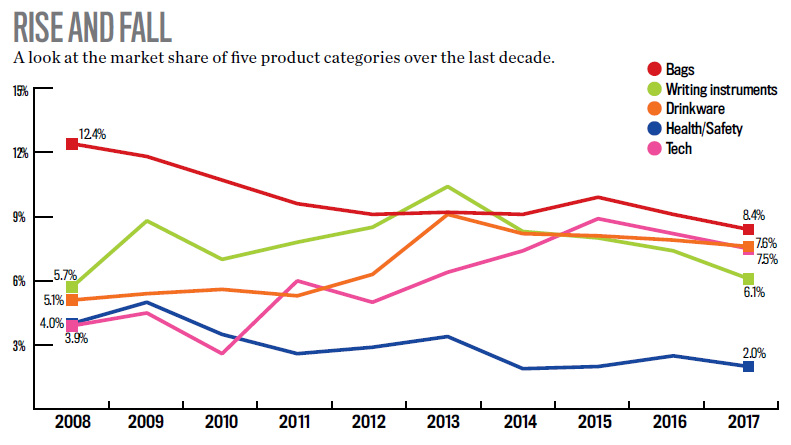

Click here for a larger image of the above graphic.