July 10, 2019

SOI 2019: Product Safety: Concern & Responsibility

Promo firms recognize the need for more awareness, but is that enough?

Most distributors agree that product safety is a serious issue – about 90% of them feel a personal obligation to ensure the items they sell are safe. To actually improve safety, though, that feeling must translate into action: properly vetting suppliers, learning labeling protocols and educating themselves and their clients.

More SOI 2019: Back to Main Page

“Distributors need to do their research and realize this is an issue that’s going to affect more products in the coming years,” says Kim Bakalyar, chief compliance officer and director of vendor relations at Top 40 supplier PromoShop (asi/300446). “Large clients have their own strict regulatory protocols that we have to follow, but the majority of smaller clients rely on their distributors to be proactive in delivering a safe and properly documented product.”

Larry Whitney, director of global compliance at Polyconcept (asi/78897), believes distributors need to be aware of two product safety categories as they evaluate vendors: the incidence of immediate harm caused by a product, like the battery of a power bank catching on fire; and regulations aimed at protecting against the effects of longer-term chemical exposure, even coming from common materials like plastics.

“As suppliers, we need to have testing processes in place to account for both situations, ensuring that we’ve considered all possible scenarios before we launch a product, and our labs need to provide us with documentation for chemical testing,” says Whitney. “If we’re shipping to the U.S., we’re checking for chemicals like BPA and phthalates, while Europe has been more focused on lead and cadmium.”

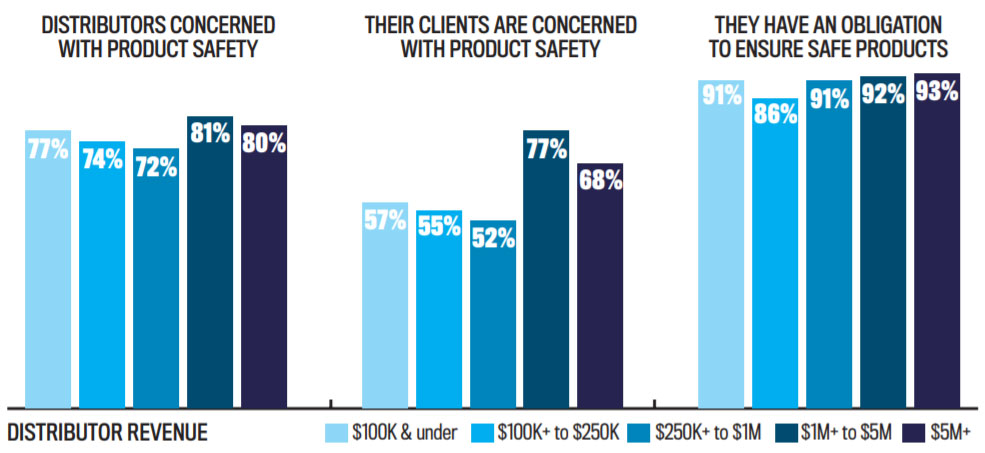

State of the Industry data shows that while distributors and suppliers agree safety matters greatly, end-buyers don’t feel as strongly. Geography and markets that distributors serve factor into the equation.

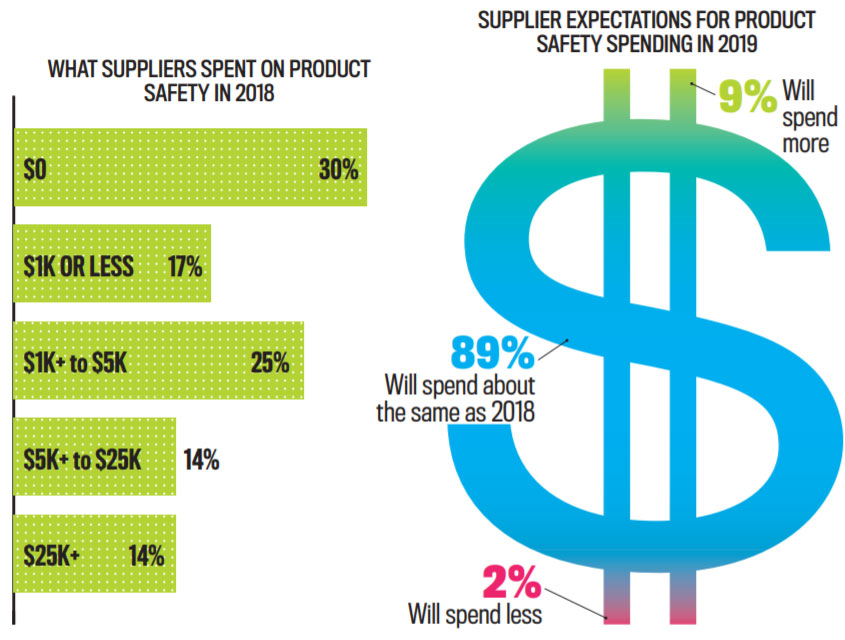

More than one-third of suppliers didn’t spend any money on product safety measures in 2018. Looking ahead, the vast majority of suppliers don’t plan to boost product safety spending in 2019.

The Ken Young Company (asi/343681), for example, a $4 million operation based in Cairo, GA, sells primarily to the agriculture sector, hospitals and schools within a 100-mile radius of its warehouse. CEO Ken Young trusts his manufacturing partners to do their due diligence on fabrics and performance features before the product reaches him. To this day, none of his customers have proposed their own compliance processes specifically for promotional apparel orders. The process works for Young and he hasn’t faced safety issues.

On the other hand, Doing Good Works (asi/222095), a Santa Ana, CA-based distributor that does 90% of its multimillion-dollar business in the Golden State, sells to a more environmentally conscious market. “We only work with suppliers that are certified by Worldwide Responsible Accredited Production (WRAP), which has incredibly high standards for every step of the supply chain,” says Logan Altman, director of customer experience at Doing Good Works, a role that covers operations, compliance and all vendor and client relations. “To us, safety means no pesticides on the cotton, to the clean and ethical factory environments, to the processing and transportation. Every step is important – and that’s what our customers appreciate.”

The Burden of Cost

According to SOI supplier data, suppliers really aren’t ratcheting up their spending on product safety from year to year. While the median amount suppliers spent on product safety in 2018 nudged higher to $2,000, 51% of firms spent $1,000 or less. To understand costs, $1,000 is about the price of a mere two chemical tests from a third-party lab. Just as troubling, about nine out of 10 suppliers don’t plan on spending more on safety investments in 2019. It’s simply a market reality that the only big spenders on safety are the highest revenue firms.

“In the last five years, we’ve hired two more full-time compliance personnel, increased third-party testing, developed internal screening equipment and incorporated two facilities into our QCA accreditation,” says Nathan Cotter, compliance manager at Florida-based Top 40 supplier Hit Promotional Products (asi/61125 ), a firm with annual sales of more than $400 million. “We spend over $1 million annually, an expenditure that continues to increase each year as more oversight is required.”

Indeed, large manufacturers cover the costs for required testing to meet U.S. federal regulatory standards and work with clients on a case-by-case basis if additional concerns arise. Some larger distributors, meanwhile, are forming compliance departments and appointing vendor and safety relations roles to keep up with ever-changing regulations so reps can focus on what they do best: sell product.

Counselor’s SOI survey asked distributors how much product safety matters to them and their clients. While distributors across every revenue class believe they have a personal responsibility to sell safe promos, larger firms are generally more concerned about safety overall.

“My role was created because it was taking reps an inordinate amount of time to sift through regulatory information for clients,” says PromoShop’s Bakalyar. “We’re proactive with what’s coming down the pike, performing random testing on stock products, calculating costs for testing on custom orders – a fee that’s passed on to the client if the requirements are beyond federal standards – and preparing reps to communicate with customers in advance to avoid frustration, confusion and unwanted surprises.”

Distributors like PromoShop are clearly more the exception than the rule, however. Most distributors just don’t have the budget for safety investments, meaning they’re 100% reliant on suppliers to source responsibly.

“The cost of staying up to date on safety measures can be out of reach for some distributors, which limits their ability to compete for bigger clients,” says Shamani Peter, COO of Top 40 distributor Axis Promotions (asi/128263) in New York City. “But safety is a culture, and the values must come from the top down, with CEOs and COOs being willing to pay for the necessary systems and protocols to deliver safe products and grow the business.”

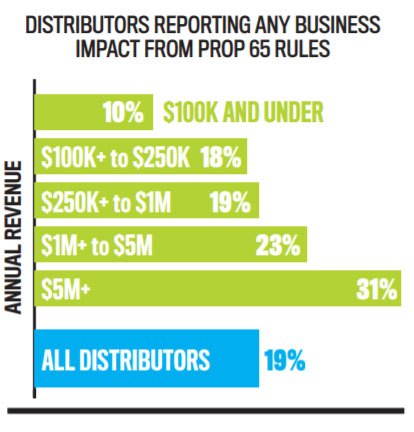

The Impact of Prop 65: Although California states manufacturers have the primary responsibility for providing Prop 65 warnings – which alert consumers to potential cancer-causing chemicals – everyone in the supply chain is liable. Following new and more rigorous mandates that took effect in 2018, some suppliers have upgraded their websites to include Prop 65 icons on certain pages to show distributors which products contain warning labels. Some worry the labeling will scare off buyers.

Unwanted Listings

Over the last year and a half, six promo companies have been publicly named in product safety recalls.

February 2018

Alstyle Apparel & Activewear (asi/34817), in conjunction with U.S. and Canadian officials, recalled approximately 297,600 infant bodysuits manufactured in Mexico. The firm said snaps on the crotch of the garments could detach, posing a choking hazard.

June 2018

In a similar case, Mississauga, ON-based Reward Connections Inc. (asi/307656) recalled more than 5,000 Ottawa Senators-branded infant bodysuits. In one case, the metal snaps on a suit detached. Reward Connections purchased the China-made apparel through supplier Blessing Promo Inc. (asi/37761).

July 2018

In mid-summer of last year, Houston-based Hirsch Gift (asi/61005) recalled 21,000 wireless charging pads. The supplier received seven reports of the chargers overheating. The pads had been distributed as a giveaway to employees and customers of various companies.

December 2018

AAA Innovations (asi/30023) issued a recall on Tito’s Vodka-branded cooler/grills that circulated in the promo industry. The Norwood, NJ-based supplier said it determined the grills could overheat and catch fire. While the grills were mainly used as part of retail store displays, some were also given away or raffled off.

April 2019

Earlier this year, Spector & Co. (asi/88660), based in Saint-Laurent, QC, recalled about 7,000 of its Elf power banks. Spector received two reports of the power banks overheating, though neither case resulted in fire or property damage and no one got hurt.