July 10, 2019

SOI 2019: Supplier Sentiment

Geopolitical strife, rampant consolidation and shrinking margins have dampened spirits.

If distributors are a bit unsure about the 2019 promo products industry, suppliers are downright uneasy – and for several reasons. For example, a one-two punch of tariffs forcing cost increases and California raising its minimum wage has led Top 40 supplier Sunscope (asi/90075) to move its printing division from The Golden State – its home for more than 75 years – to Nevada.

More SOI 2019: Back to Main Page

“Unfortunately, we don’t have much of a choice,” says Dilip Bhavnani, COO of Sunscope. “Our clients don’t want to pay higher prices, so it forces you to change up your business.”

29% of suppliers generate all their sales from promo products.

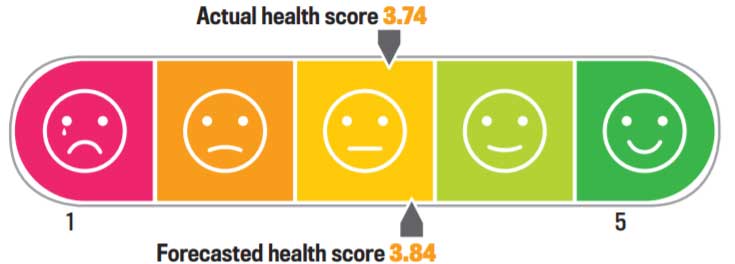

The sense of overall restlessness is reflected in more than just market chatter and operational decisions, but in SOI data as well. Suppliers reported a lower average health score for 2018 and fewer said their annual sales increased versus 2017. While suppliers note their average dollar value per order has risen sharply over the last two years – with the median order size increasing to $800 – they add that their profit margins are slowly eroding as costs, related to areas like healthcare and compliance, rise.

Going forward, “smaller companies will have a hard time absorbing these costs,” says Sharon Eyal, CEO of Top 40 supplier ETS Express (asi/51197). “It will become too expensive.”

A tight labor market is another hurdle for suppliers to navigate. While smaller suppliers are more concerned with growing their business, larger firms are focused on recruiting and holding onto employees as quality control becomes a bigger issue. Asked to predict the future of the promo market, Yuhling Lu, CEO of Top 40 supplier Ariel Premium Supply (asi/36730), says this: “Finding and retaining good labor will be the dominant cost conversation.”

The overall industry health score for suppliers declined in 2018. The drop is noticeable because suppliers previously predicted better results for the year. (Score: 1=ailing, 5=robust)

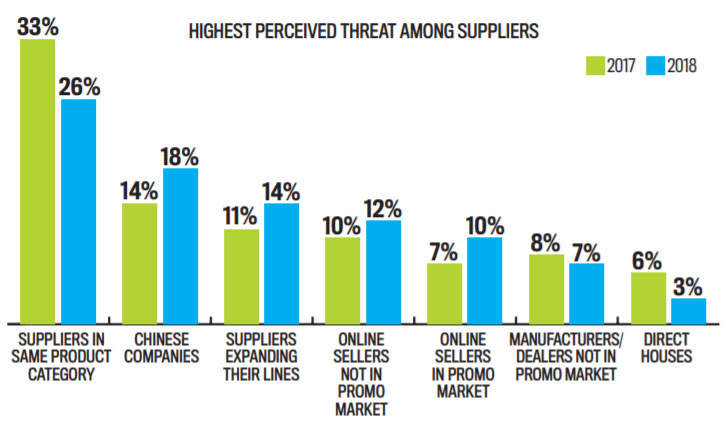

While suppliers feel most vulnerable to other firms that offer the same types of products, they’re also increasingly worried about China-based companies taking their business.

Another topic among suppliers: consolidation. Over the past few years, several Top 40 suppliers have been expanding their product lines through acquisitions to become one-stop shops, encouraging distributors to limit who they do business with. “Big suppliers now have such market power that it’s challenging for us to compete with them when we’re an under-$20 million company,” says Kippie Helzel, senior vice president of sales at CPS/Keystone (asi/43051). “The same thing is happening on the distributor side. We’ve had to enact price increases separate from the tariffs partly because of what it costs to be a preferred vendor to a big distributor.”

11% of suppliers think the biggest 2019 challenge will be increased financial demands from distributors, like rebates.

Faced with consolidation domestically, are suppliers looking abroad for more business? The answer is a resounding no. Beyond heavy hitters like Top 40 supplier Next Level Apparel (asi/73867) and Sign-Zone – parent company of Showdown Displays (asi/87188) – which are accelerating their expansion into Europe, most suppliers don’t appear very interested in following suit. According to SOI data, more than half of suppliers (60%) don’t sell outside the U.S., and most (70%) don’t plan on expanding beyond where they’re currently operating. Simply put, many suppliers still view North America as the sole place to invest resources.

“The U.S. economy is still the largest and there’s so much potential here,” says Alan Tabasky, vice president and general manager of BEL USA (asi/39552). “There’s a lot to do here without learning the intricacies of foreign markets.”

Marketing Methods

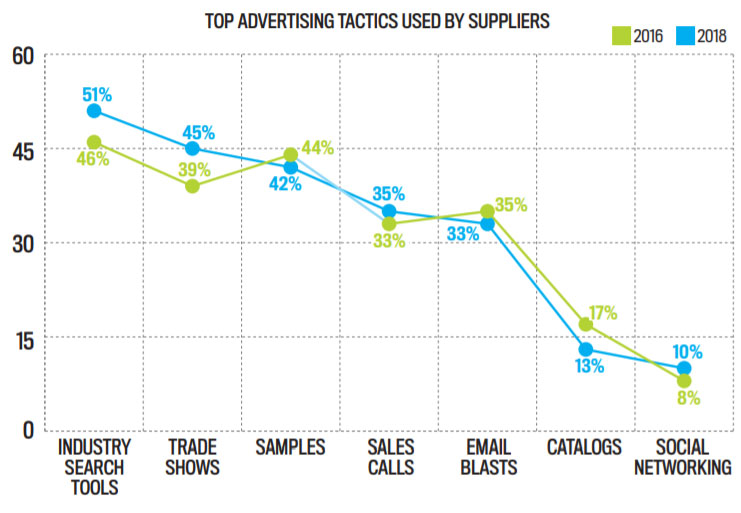

More than 50% of suppliers use online search tools like ESP to promote their brands, making this tactic the most successful of any approach. It’s something that makes a lot of sense to Tabasky.

32% of suppliers have e-commerce-capable websites.

“Our marketing is more digital than anything else,” he says. “BEL hasn’t attended a regional or national show since 2010. It’s not that we don’t see value there, but we just focus where we see the highest ROI, and for us, it’s digital and some print advertising.”

Keeping with the online theme, 55% of suppliers say they’re likely to increase email blasts in 2019. Additionally, both large and small suppliers claim they’re going to boost their usage of social networking.

Web Workings

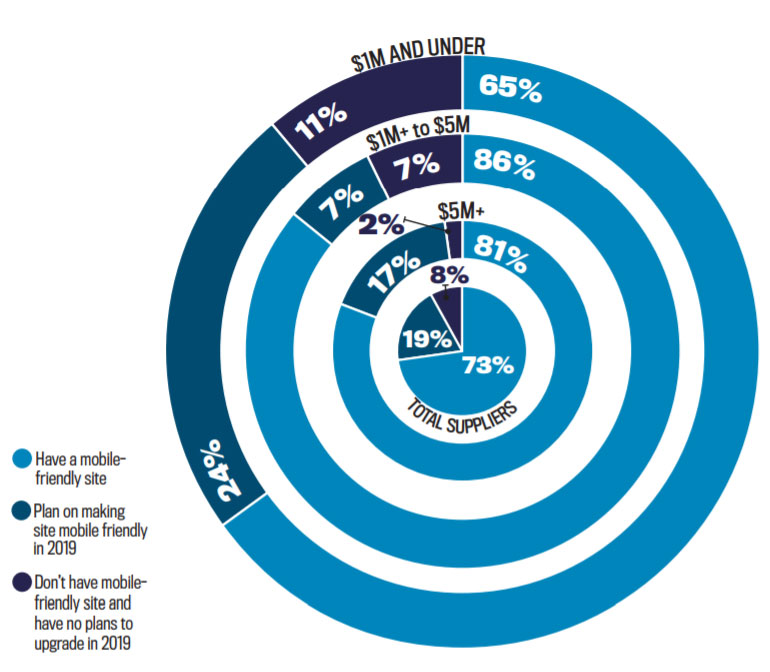

After years of saying that maintaining a web presence is important, many suppliers are finally practicing what they preach. Nearly three-quarters of suppliers report their website is mobile friendly, up significantly from 2018. Meanwhile, about three in 10 suppliers say their website is e-commerce-capable, a number that’s been growing steadily every year since 2016.

The most successful marketing strategies for suppliers in 2018 continued to be industry search tools, followed by trade shows and samples. The chart below shows what’s changed over the last two years.

“We don’t even touch a lot of our orders anymore – they come to us online,” says Gary Schultz, president and CEO of Top 40 supplier Edwards Garment (asi/51752). “Our distributor customers log in to a secure space on our website and we only see that increasing. We’ve already been mobile-friendly, but we’re in the process of looking to upgrade our website.”

SanMar (asi/84863), the promo industry’s second-largest supplier by revenue, has significantly invested in its website by transitioning to e-commerce platform SAP Hybris. Blending its familiar design with upgraded technology, SanMar has enhanced its website’s hosting and data accessibility. “It’s the number-one way we get orders,” says Jeremy Lott, president of SanMar. “It’s the primary way our customers access product information and sourcing.”

Talk Soon-ish

Did you know Amazon is delivering orders faster than suppliers are getting back to distributors after a trade show? According to SOI data, on average, three days will pass after a trade show before a supplier responds to a distributor’s request. Of course, that depends on the size of the trade show and whether the distributor’s request is a quote, product question or order.

“Three days is our absolute max on every sort of touch point, even though we’re most likely to respond within 24 to 48 hours,” says Lucas Guariglia, president and director of sales at Rowboat Creative (asi/83710). “If you’re looking for a quote, you’ll get an immediate response. If we’re stretched to our limit and you’re looking for something else, we’ll certainly do our best to respond as quickly as possible.”

Nearly three-quarters of suppliers report that their website is now mobile friendly. By the end of this year, more than nine in 10 suppliers expect their sites will be responsively designed.

Trade shows have become the primary marketing method for Top 40 supplier Next Level Apparel (asi/73867), which exhibits at roughly 60 events a year. The supplier has found immense value in making these personalized experiences with a kiosk for visitors to share more information about themselves.

“We have a longer dialogue than normal at our booth because we want to maximize what our customers get out of the experience,” says Mark Seymour, the firm’s chief sales officer. “Every customer has their own unique situation, whether they’re looking for catalogs, samples or just have a question. We send a follow-up email within a few days to make sure our visitors got everything they needed during the trade show. We want them to know we’ll support any needs they have.”

In an era where customers want answers fast, suppliers are still taking several days to engage with distributors following industry events.