July 10, 2019

SOI 2019: Top Markets in the Promo Industry

A thorough look at the leading sectors for promo product sales and advice for making further gains.

Largest Overall

Education

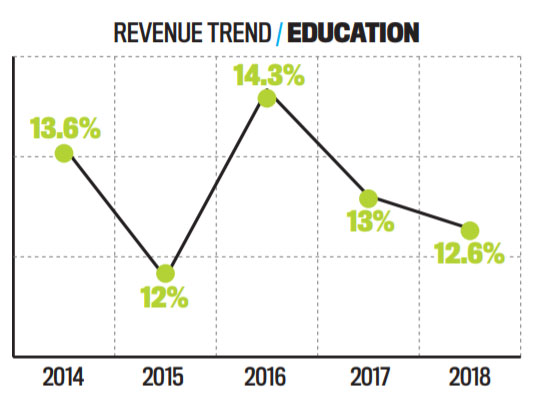

Once again in 2018, the education sector paced promo products spending, accounting for 12.6% of industry sales. Education has been the top distributor market for each of the last five years, bolstered by a variety of buyers across all types of schools.

More SOI 2019: Back to Main Page

“This sector is a portal to a younger audience, which tends to have a significant impact in the marketplace,” says Bill Mahre, president of Top 40 supplier ADG Promotional Products (asi/97270). “Distributors used to focus mainly on high schools and universities, but now we’re seeing demand from preschools, plus elementary and middle schools, a previously untapped market.”

Podcast

Dave Vagnoni interviews the CEO of CIC to get his take on the rise of distributor profit margins, the impact of tariffs on promo and the top markets to target for sales.

The popularity of personalization is another factor driving the education market’s strength. “It can be done cost-effectively, and provides a much higher perceived value,” Mahre says. In particular, customized promo products make teacher appreciation gifts and college dorm welcome packages, according to suppliers.

While education sales remain strong, it’s notable that its growth versus other sectors has been stunted a bit in recent years. Nina Bloomstein Shatz, the director of business development at Top 40 distributor BAMKO (asi/131431), believes the slippage could be tied to funding issues in public education. “State budgets are being shifted, and fewer dollars are being sent to our schools,” she says.

Even if that trend continues, Shatz still thinks there are endless opportunities to boost education-related revenue if distributors are willing to try new avenues. “Informal education is a market that’s growing exponentially,” she says. This includes any learning that takes place outside of a classroom, like a Model Congress, teen travel programs, or coding and robotics conferences. Teen travel programs send students on a learning adventure, and often feature a community service component so kids get volunteer hours that can be applied to their regular school year requirements. “These programs order a lot of promo, including apparel, backpacks and luggage tags,” Shatz says.

Some other trends for distributors to keep in mind when working with education clients: buyers want to see what products will look like, so pick pre-production samples over virtuals; among college students, die-cut stickers featuring their school’s logo or mascot are hugely popular; and protecting the environment is increasingly important to school administrators, making reusable straws, nonwoven totes and BPA-free water bottles big sellers. In terms of sustainability, “everything is with a purpose in mind,” says Shatz.

On the Rise

Construction

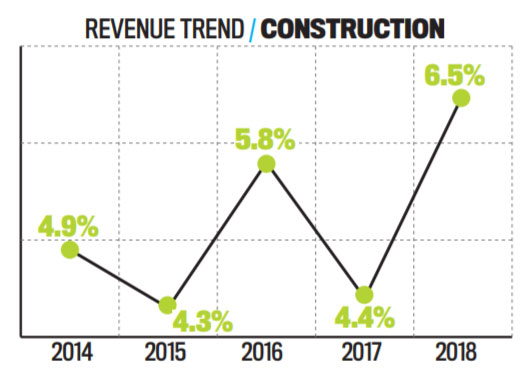

Now the fifth largest market for promo sales, the construction industry made up 6.5% of distributor revenues in 2018. A year ago, the construction sector contributed only 4.4% and was the tenth biggest market. What’s changed? Distributors point to one key difference.

“The economy is stronger, and people are feeling more comfortable spending money,” says Rod J. Thomas, an account executive manager at Marketeer Group/HALO Branded Solutions (asi/356000).

And more growth could be coming. The Bureau of Labor Statistics expects hiring of construction laborers and helpers to outpace the rest of the economy, projecting gains of 12% between 2016 and 2026.

“New construction and home renovation drives our local economy. When the construction business is booming, all trades do well and they have more money to spend on promotional products,” says Ron Fisher, owner of Long Island, NY-based Fisher Signs & Shirts (asi/194583). “Budgets are increasing, companies are fully staffed and busy. They’re buying promo items to thank customers and to encourage new customers to check out their website.”

Kimble Walch, who counts construction as one of her biggest sectors for sales, thinks the election cycle and politics have played into construction’s recent leap. “My business tanked before the last election,” says Walch, a senior account manager at Zebra Marketing. “People were afraid and held off making any decisions to see who would be in office – now they’re building again.”

The majority of Walch’s construction customers are buying apparel for onsite safety programs. She also sells T-shirts for new hires, as well as backpacks and higher-end items for recognition and sales incentives. “My clients’ budgets are increasing and they’re hiring more people,” says Walch.

Even though construction sales are soaring, Thomas insists understanding the market’s business cycle remains the key to success. “Early spring and summer are prime building season, not the time to approach this industry,” he says. “Lay the groundwork and reach out in the off season, which is late fall through winter.”

Trending Down

Associations/Clubs/Civic Groups

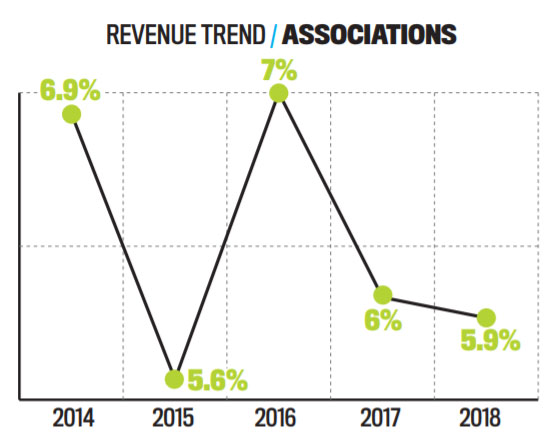

As recently as 2016, this market was a top three sector for promo sales, annually producing about 7% of distributor revenues. The market has been on the decline since, though, presenting a challenge to firms that bank on local membership organizations for consistent sales.

“This is both an economic and generational occurrence,” says Tommy Levin, western sales director for Top 40 supplier Hit Promotional Products (asi/61125). “Attendance and membership has been steadily dropping with brick-and-mortar meeting halls and groups in favor of online activity and more contemporary organizations.”

Levin adds that younger crowds just aren’t interested in joining Elks clubs, hanging out at lodge meetings or mingling at monthly mixers like past generations. Without the financial support of membership dues, many of these groups face strained budgets, resulting in a drop in promo spending. So what can be done?

TJM Promotions (asi/342485) found a way to buck the overall trend by going where the money is – youth sports groups. “Our share of total sales to little leagues and associations is higher than the industry standard – we’re actually up around the 17%-19% range,” says Justin MacDonald, TJM’s general manager. “Most people ordering for a team or organization have full-time jobs apart from this task and need help to get these orders completed. If you make your customer look like a rock star, they’ll keep coming back.”

As with nonprofits, being involved with a local organization offers an edge in winning orders. “It’s always easier to sell from the inside,” says Levin. Pitching promo products well in advance of specific events, like fundraisers, is also a good approach. Distributors should aim to make the buying experience straightforward – reducing steps, providing good/better/best merch options and offering guidance after hours.

“We encourage our reps to make themselves available for a conference call if a customer is presenting to a group and needs feedback,” says MacDonald. “In addition, if you do a good job, these team or group parents that own, run or work at other businesses could all be looking to you for their other promotional needs as well.”

Forecasting Growth

Elections

The 2020 presidential election may be well over a year away, but the field is already filled with potential contenders hoping to unseat President Trump. In the bare-knuckle 2016 election, Trump leveraged now iconic Make America Great Again (MAGA) hats, pushing the elections market to a multi-year highmark for promo sales. What will 2020 bring?

“The MAGA hats set a new standard for branding that’ll be picked up by other candidates,” says Nate Kucsma, executive director of research at ASI. “Distributors should certainly point to the success of the MAGA hat as a launching point for discussions.”

A&P Master Images CEO/partner Howard Potter expects “an even higher spike” in promo spending in 2020. “Trump showed a different side of running an election and proved that promotional products are much stronger than people running for office knew,” says Potter.

Realizing that only a select few distributors will partner up with national campaigns, Mike Malinowksi, VP of sales for Top 40 supplier Gill Studios (asi/56950), suggests promo firms get started early to woo more local candidates.

“Once the filing deadline has been reached, the list of candidates becomes public record, effectively meaning it’s go time for distributors,” says Malinowksi. He adds: “At House and Senate levels, there are strong contenders and gubernatorial races providing opportunities in 11 states in 2020. New candidates love social media to create traction. Rally signs and bumper stickers are great takeaways from those events.”

Pitching swag for school board and mayoral candidates can also be lucrative. “Some of the local, mom-and-pop style campaigns may have smaller war chests, but they’re easily approached, and their business is likely to have better margins,” says Shelby Goldblatt, owner of Gold Leaf Promotional Products.

Sector Swings

All industries have periods of strength and weakness, but looking at long-term trends can help determine where distributors should invest their resources. Here’s a snapshot of some featured markets, with percentages showing the difference in promo product spending between 2010 and 2018.