July 10, 2019

SOI 2019: Top Products in the Promo Industry

This year’s best-selling categories include a nod to apparel and a new leader in the hard-goods segment.

Largest Overall

T-shirts

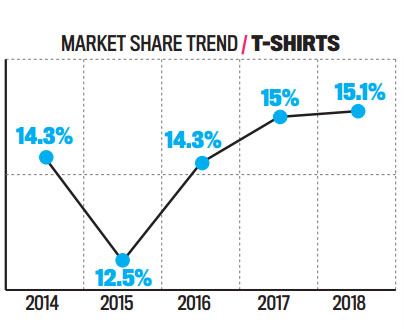

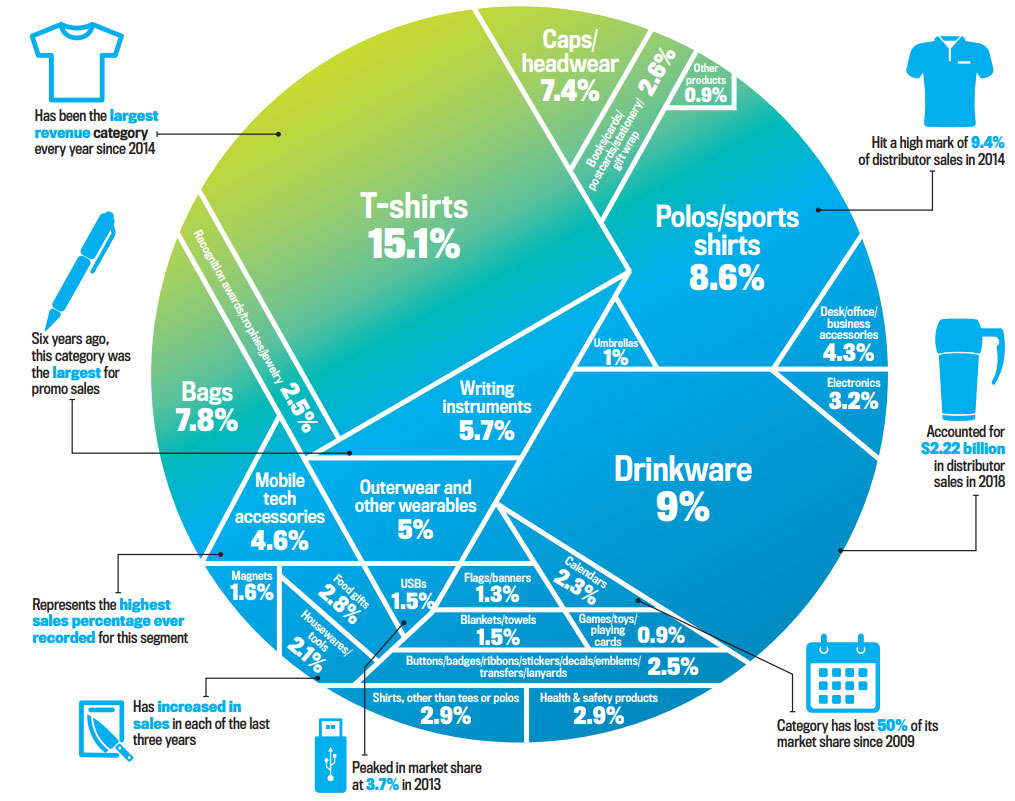

In 2018, for the fifth straight year, T-shirts reigned as the number-one promotional product category. Logoed tees made up 15.1% of distributor sales last year, a slight increase from 2017. The continued success of the product, distributors say, is partially because it’s just so easy to sell.

“T-shirts make a great giveaway. They’re both a memory and a walking billboard of what you’re doing at the time you’re doing it,” says Jacque Lee, CEO of Silva Screenprinting & Distribution (asi/326062), which mostly sells tees for the corporate recognition and direct-to-retail segments. “They’re also an easy way to document what’s going on in your life cycle, like college or a new job.”

More SOI 2019: Back to Main Page

Other distributors find they’re selling tees mostly to professional groups, schools, small businesses and youth organizations like camps. Across the board, clients are sticking with moisture-wicking tri-blends, says Jeffrey Conger, owner of Infini-Tee Designs (asi/231079), because “cotton shrinks more.”

As for color trends, Jo Girard, owner of Hot Shots Apparel (asi/227751), has seen an uptick in plain white tees with kitschy quotes from movies or sitcoms on them. Conger says the basic core shades are still winners, and safety colors – like neons – are always popular. Coral, Pantone’s Color of the Year, has been gaining traction as well.

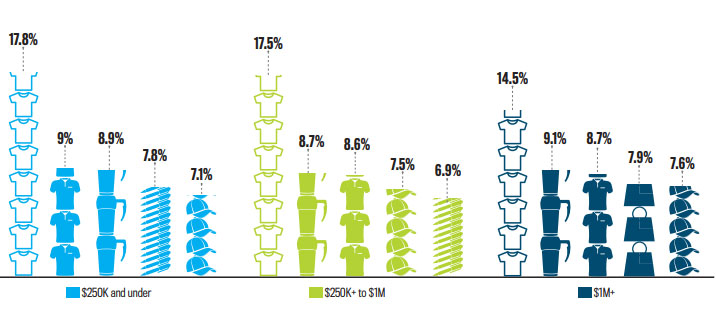

One Size Doesn’t Fit All: Here’s a look at the best-selling product categories for three different distributor revenue classes in 2018, with numbers showing the percentage of promo revenues.

Fashionable decoration styles continue to range from a bit retro – think fringe and tie-dye – to tech-enhanced and modern looks involving printing direct-to-garment. And while V-necks remain trendy, Lee says people are gravitating more toward gender-specific fits and designs and away from generic unisex styles. “People associate unisex T-shirts with trade show giveaways,” she adds.

Don't Miss: Get More Out Of Promo Bags

Of course, while trade show T-shirts may not be über-personalized, they can still be valuable for newer brands. “They last a long time, they’re a crowd pleaser, and they make one’s business feel legitimate once it’s imprinted on a T-shirt,” says John Fallon, general manager and partner at Speedy Bee Tees (asi/332198).

On the Rise

Drinkware

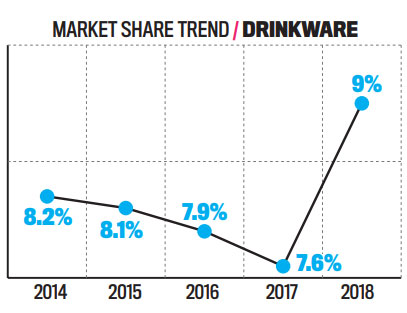

The second-largest category for 2018 promo sales, drinkware has vaulted higher in popularity. Why? A few reasons: Increasingly, drinkware has become a fashion accessory; more buyers are moving away from single-use water bottles; and retail brands like YETI are now trendy in promo.

“These products have really increased sales for a lot of people,” says Henya Betras, owner at Henya Direct (asi/224464). Back in the ’90s, Benya thinks higher-end drinkware pieces were too expensive, “but all of a sudden, there’s been incredible awareness” in terms of value and functionality.

As ROI has improved, customers have been willing to pay more for durability and distributors see that continuing. “Stainless steel isn’t going anywhere any time soon,” says Palma Frable, operations director at Palm Trends Marketing (asi/348373).

An emphasis on health and sustainability has also given the drinkware category a boost. “So many people are into recycling and reusing,” says Brandy Meeks, owner at Element One Promotions (asi/161686).

Frable agrees, noting “people are so much more focused on taking in enough water every day. A lot of businesses are seeing that, and pretty much any company can put their logo on it.”

Will sales of this market slow down? Betras doesn’t see it, believing drinkware could well surpass other products in popularity in the near future. “Pens are great, and so are T-shirts and caps,” she says. “But a two-year-old isn’t going to use a pen. A two-year-old to a 90-year-old, though, is going to use a drinkware product every day, all day.”

Trending Down

Writing Instruments

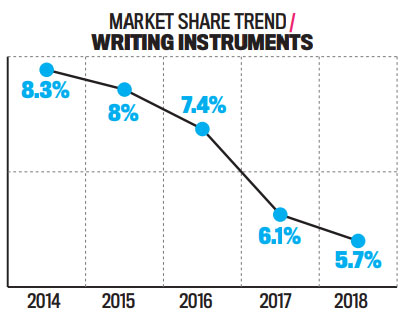

In 2013, logoed writing instruments accounted for 10.4% of distributor sales. After several years of market share declines, the category contributed just 5.7% to distributor revenues in 2018. The reason for the shift, according to distributors, is simple.

“More people are going toward electronic data,” says Sally Back, owner of Backhome Creations. “It may be that they’re using their tablets instead of using paper and pen. I do sell more pens with styluses now.”

Indeed, while styluses are in, oversized and single-function pens are not on-trend, according to George Taggart, president of Medical Print Group (asi/267106). He further suggests distributors push fancy rubber grips, full-color imprinting and hybrid inks, as these features have been gaining popularity in the market.

“The key is getting the pen to someone,” says Dale Hannasch, owner at LA Advertising (asi/255484). “Put it in their hand and give them the feeling of getting a free pen. If they give their own pens out, their customers will probably feel that way too.”

Forecasting Growth

Health & Safety

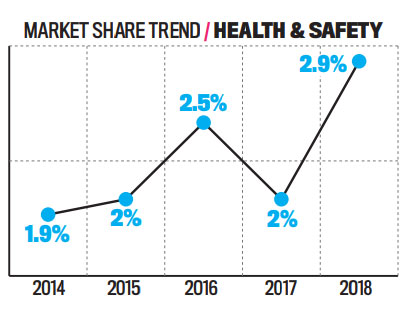

If you’re looking for a category to watch for gains, health and safety products certainly has a number of advantages. First, the segment increased market share to 2.9% in 2018, up from 2% the year prior. Also, the category benefits from practicality – items like hand sanitizers and lip balms are universally appreciated. Finally, the segment is ripe for new product entrants, especially as more Americans crave wellness ideas.

“When a new product is introduced in some product categories, there might be a long adoption time,” says Nate Kucsma, ASI’s executive director of research. “But in this particular market, there’s a quick adoption time. Be alert for new products and innovations coming out.”

And with new innovations come a chance to profit, and the health and safety market is one of the more lucrative places to find it, according to Timothy Lang, owner and founder of Team Lang Promotions (asi/466861) and a former healthcare director.

“There’s usually a good budget, and if you provide a consistent and high level of service, you can generally keep clients longer than some other industries,” Lang says.

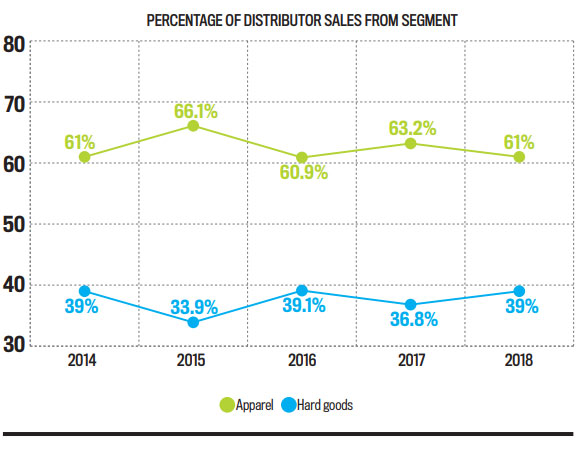

Perception vs. Reality: With the rise of logoed T-shirt sales, some might think apparel is taking market share away from hard goods. However, the segment split has actually been relatively stable over the last five years.

The market dynamic is changing as well, Lang notes, giving distributors an edge. “Historically, there was split within the medical industry of B2B and B2C,” he says. “Most primary care providers, urgent care centers and chiropractors would market direct to consumers, and large specialty groups would market B2B to other providers to get referrals.”

With consumers more educated today “they’ll often change providers if they’re not satisfied,” says Lang. “This is causing specialty groups, which is a very large segment, to start focusing more on B2C for engagement and retention.”

The World of Promo Products: A breakdown of the most popular items, shown here as the percentage of distributor sales they represented in 2018. Click here for a larger image of the graphic above.