December 03, 2020

Report: Advertising Bound For 'K-Shaped' Recovery

GroupM forecasts a quick rebound for some and a continued downward trajectory for others.

The advertising industry will continue to resemble a tale of two cities in the wake of the coronavirus outbreak, analysts say.

A recent forecast from global advertising corporation WPP’s ad-buying unit GroupM predicts a “K-shaped” recovery for not only the overall U.S. economy, but also the advertising industry. The “K” shape indicates a quick rebound for some marketers and a continued downward trajectory for others. For example, e-commerce and advanced digital services such as telehealth and remote learning have exploded during the COVID-19 pandemic. On the other hand, restaurants, bars, travel, entertainment and nonessential businesses have all suffered.

In terms of the advertising market, digital advertising dropped in the second quarter of 2020, but rebounded in Q3 to approximately Q1 or pre-pandemic levels. By contrast, traditional media such as radio, newspapers and outdoor advertising fell by nearly half in Q2 and continued to decline on a year-over-year basis by nearly one-third in Q3. GroupM attributed digital advertising’s strength to the accelerated spending of small businesses, many of which had no choice but to establish an online presence during the shutdowns.

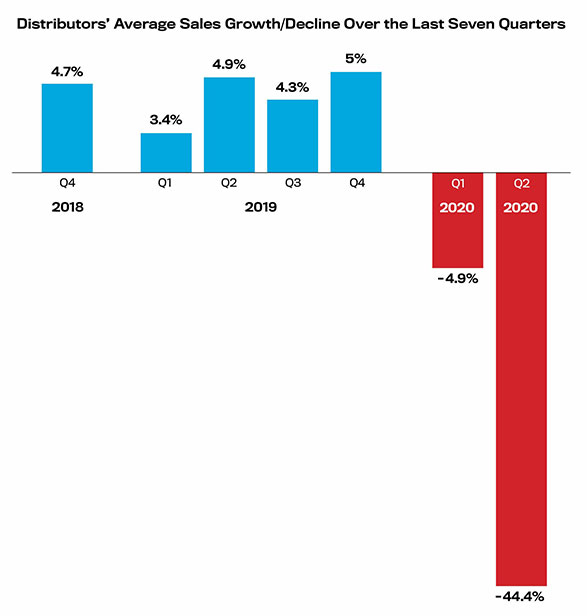

The promotional products industry has mirrored digital advertising’s trajectory. Distributor sales plummeted a record-breaking 44.4% year over year in Q2 and rebounded to a 24.8% decline in Q3, according to ASI’s Distributor Quarterly Sales Survey.

Total advertising is projected to decline only 3.9% this year, buoyed by political campaign spending during the election season. That’s much better than advertising’s decline of 6% in 2008 and 16.6% in 2009 during the Great Recession.

Looking ahead to 2021, “an assumed second-half return to normalcy paired with the significant growth that followed the trough of the second quarter this year leads to expectations for robust growth of 11.8% on an ex-political basis, or 6% including it,” the report said. GroupM anticipates slightly higher growth – 5% in 2022 followed by 4% in 2023 and 2024 – due to increased investment in digital media by marketers of all sizes.

GroupM is the world’s leading media investment company responsible for more than $63 billion in annual media investment through agencies Mindshare, MediaCom, Wavemaker, Essence and m/SIX.