October 29, 2019

Promo Industry Ponders Political Climate

Promotional products professionals air their views on a possible recession and presidential candidates in new research from ASI.

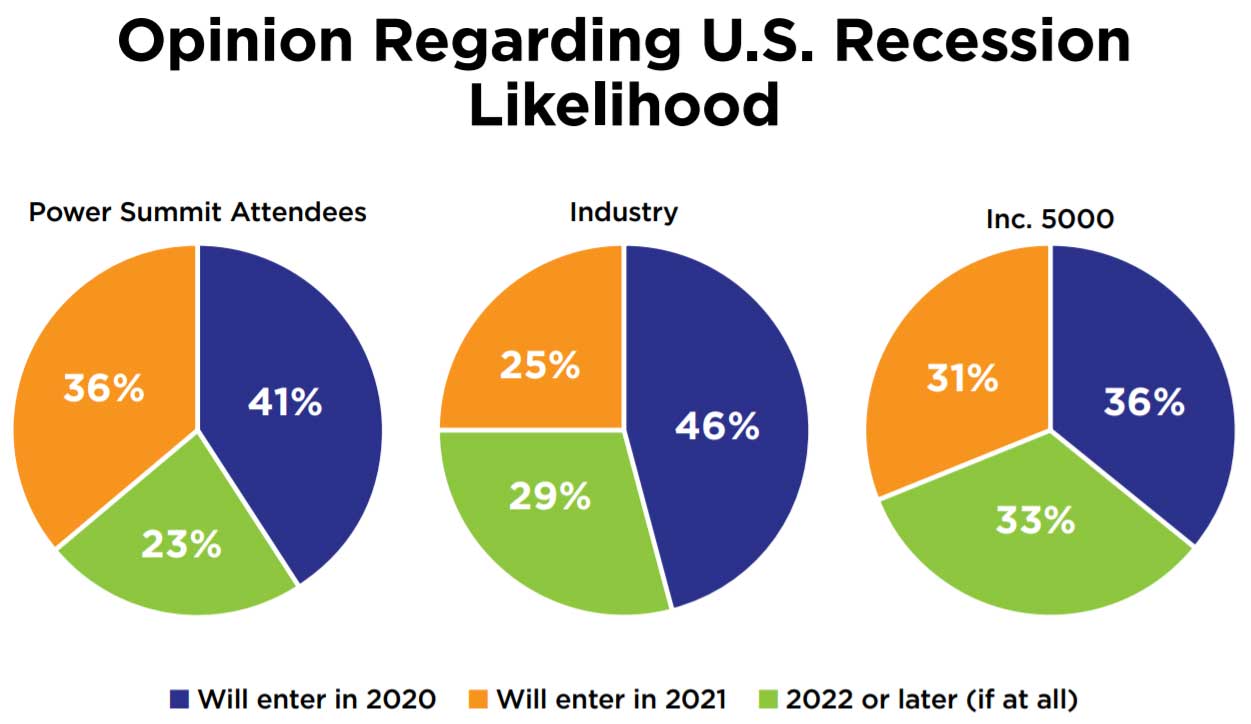

More than four in 10 promo professionals believe the U.S. is likely to enter a recession in 2020, according to research just released by ASI in conjunction with its annual Power Summit. That revelation comes as the industry contends with Brexit challenges, pricing woes spurred by the ongoing trade war with China and a ramp up to a contentious presidential election next year.

ASI’s wide-ranging survey of the current political climate covered industry sentiment for many of those very issues. It also explored which campaign issues resonate most with Power Summit attendees, compared with the promotional products industry as a whole and members of the INC 5000 list.

Opinion regarding likelihood of U.S. recession

The majority of promo pros surveyed think a recession is imminent, even if an exact date can’t be pinned down. “We’ve had an extremely long period without a recession. We’ve had a lot of stimulus put into our economy with lower interest rates along with lower oil prices, which has prolonged our growing economy,” said Paul Lage, president of Top 40 supplier IMAGEN Brands, parent company of Crown Products (asi/47700) and Vitronic (asi/93990). “However, everything seems to be reaching a peak, and it’s a matter of time before something pushes us over the edge.”

Craig Nadel, president of Top 40 distributor Jack Nadel International (asi/279600), agreed that growth is likely to slow, though he wasn’t prepared to put a timeline on it. “I do think the ‘sugar high’ from the deficit spending tax cut is now gone, and that tariffs and immigration policies both hurt growth,” he added.

Not everyone in the industry is convinced, however. Gregg Emmer, vice president and chief marketing officer for Top 40 distributor Kaeser & Blair (asi/238600), believes recession chatter is the work of “partisan political actors” and not based on the work of actual economists. Still, he added, “if the resident in the White House changes, a recession will likely follow quickly” because “all Democrat contenders are anti-business and pro-tax, which will kill the economy.”

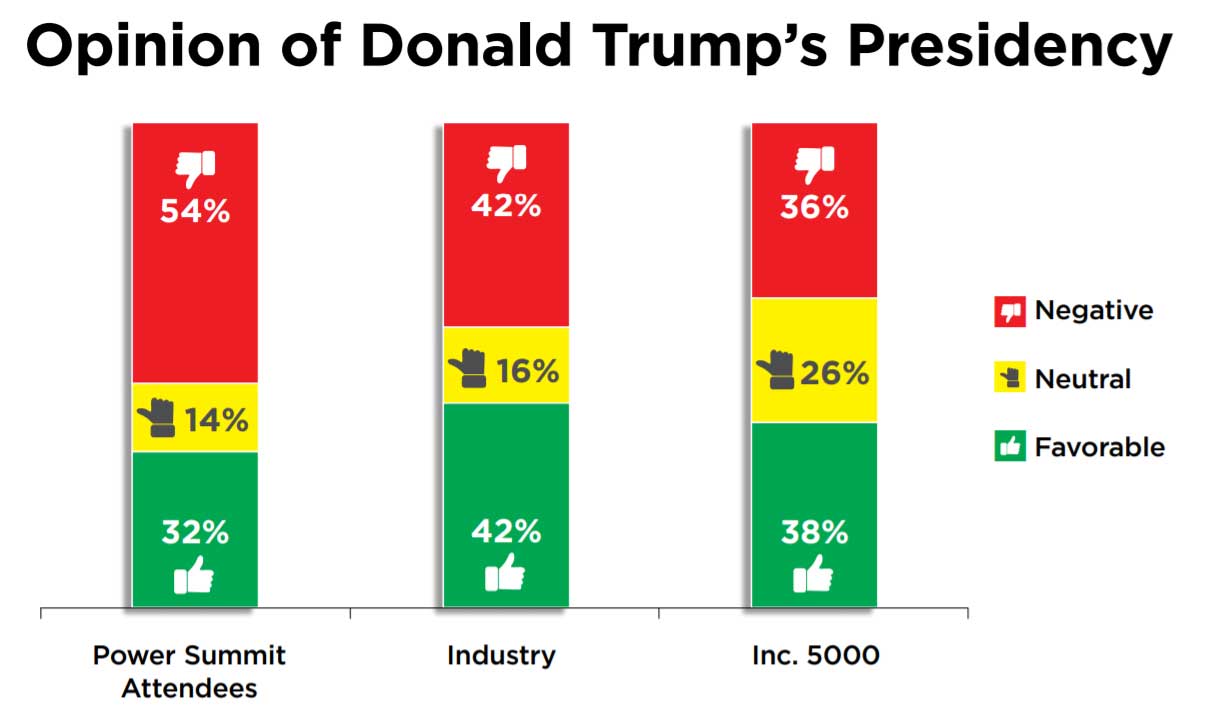

Opinion of Donald Trump’s presidency

Favorability of the current administration was among the areas measured in ASI’s political survey. Within the industry, opinion of President Donald Trump is fairly evenly split, but among Power Summit attendees sentiments skewed more negative.

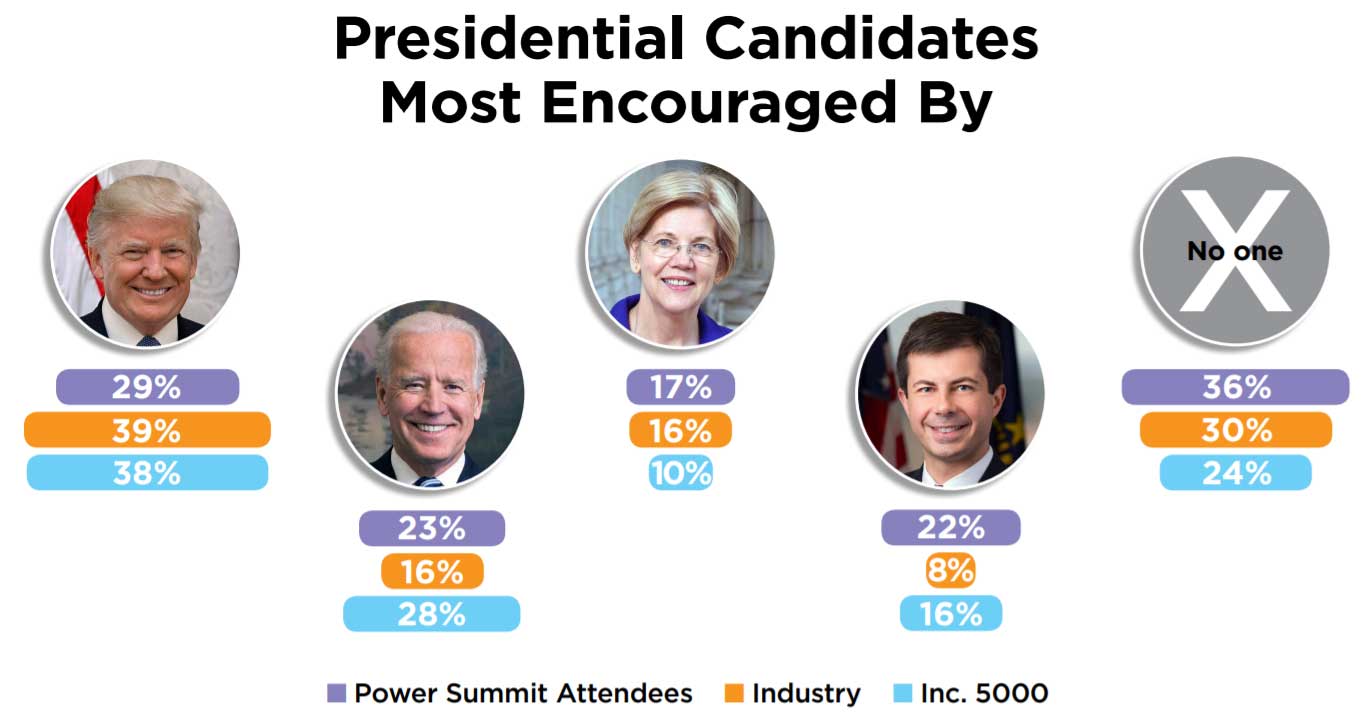

Presidential candidates most encouraged by

Looking ahead to next year’s election, however, business leaders are still most encouraged by the incumbent. The campaign season is still early, and the landscape is likely to change once a democratic nominee is narrowed down. “Those who can appeal to the center will win,” Lage said. “We all know what Trump is like. The Republicans can only hope that the Democrats go far left and the middle won’t vote.”

Regardless of who’s elected in 2020, many of the biggest issues of the day will remain. “If you look at the betting markets, it suggests there’s a roughly 70% chance that the next president is either Donald Trump or Elizabeth Warren,” said Phil Koosed, president of Top 40 distributor BAMKO (asi/131431). “Warren appears to be every bit as hawkish on China trade as Trump is. For those thinking about what comes next in the trade war with China, that 70% likelihood should cause you to sit up and pay attention.”

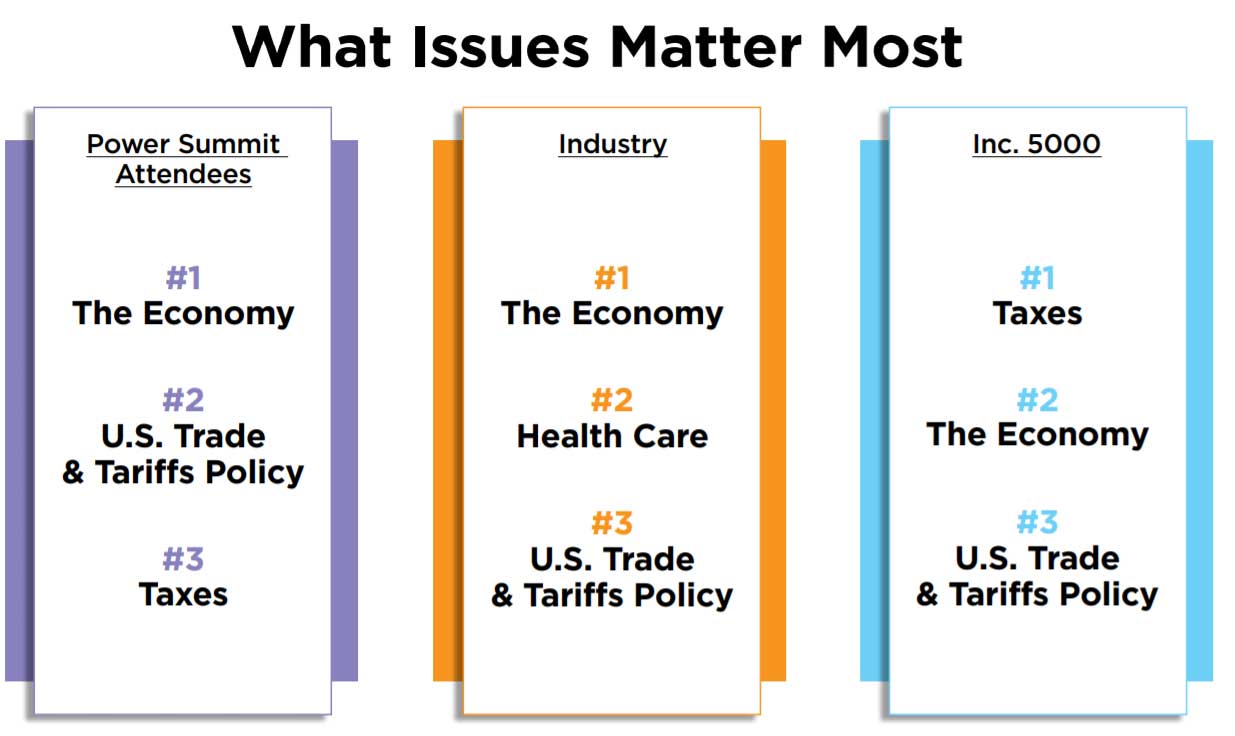

What issues matter most

U.S. trade and tariff policy, particularly as it relates to China, is among the top three campaign issues of interest to the promotional industry. The vast majority of promotional products sold domestically are made in China, and Trump’s tariffs on approximately $360 billion in Chinese imports to date have triggered price increases on ad specialties, and also caused uncertainty in the marketplace. According to the survey, 60% of ASI members think tariffs and the trade war with China have had a negative impact. (That figure increases to 79% for Power Summit attendees.) Most have their fingers crossed that a détente in the ongoing trade war comes sooner, rather than later.

“Tariffs have had an impact on what a customer chooses to purchase, sometimes reducing quantity, sometimes choosing a lower-priced item,” said Jo-an Lantz, CEO of Top 40 distributor Geiger (asi/202900). “Tariffs have also increased our costs, as we have to update prices on the web constantly. For years, we enjoyed prices increasing only once a year. Now we must remain vigilant when prices increase mid-year.”

Price increases caused by tariffs have also made promotional products less competitive with other forms of advertising, like print and digital, Koosed said. “Any time you’re increasing the cost of goods by something like 25%, it’s going to make alternative options more attractive.”

Still, not everyone in the industry is sounding alarms. Nadel described the tariff’s effects as “a mild headwind,” rather than a gale-force event. Promotional products remain among the most cost-effective advertising mediums. The cost per impression (CPI) of promo items can be as low as one-tenth of one cent, which is still lower than any other advertising medium, according to the 2019 Ad Impressions Study.

Emmer sees a positive side to tariffs, especially if they spur new trade policies. “Our industry allowed ourselves to become drunk on Chinese-made goods,” he said. “A major overhaul in trade policies is way past due. It may be painful for the short term, but in the long term we will all benefit.”

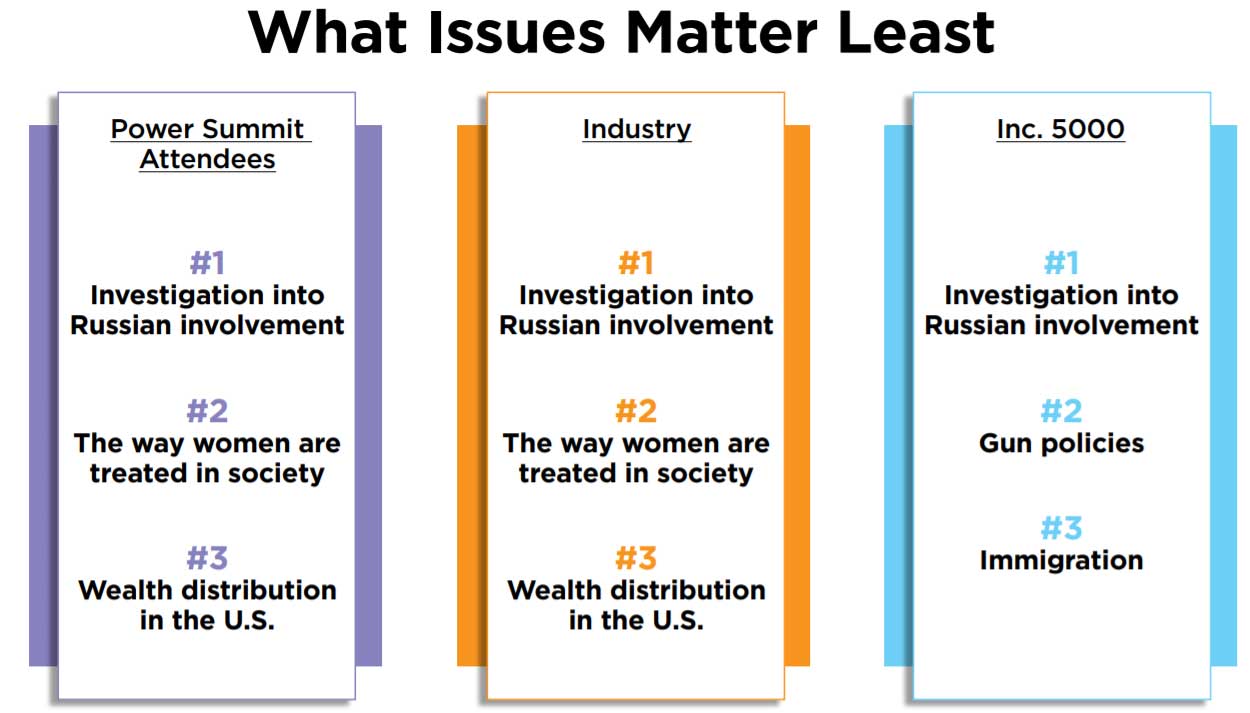

What issues matter least

Among the 12 issues included in ASI’s political climate poll, the three at the bottom were the same for both Power Summit attendees and the promo industry as a whole, with investigation into the Russian involvement in U.S. politics coming in dead last. Other topics like immigration fell somewhere in the middle, with many promo executives saying the president’s immigration policies have little impact on their businesses.

Nearly half of promo pros surveyed (whether part of the Power Summit or not) said they were in favor of the current administration’s immigration policies.

Though immigration issues haven’t played a significant role in the promo industry on the whole, certain regions have been hit harder than others. “Overture operates in a crowded labor market, competing with Amazon and Uline for warehouse and production staff,” JoAnn Gilley, CEO/owner of Top 40 distributor Overture Promotions (asi/288473) said. “The reduction in legal immigration has made it tougher to fill our open positions.”

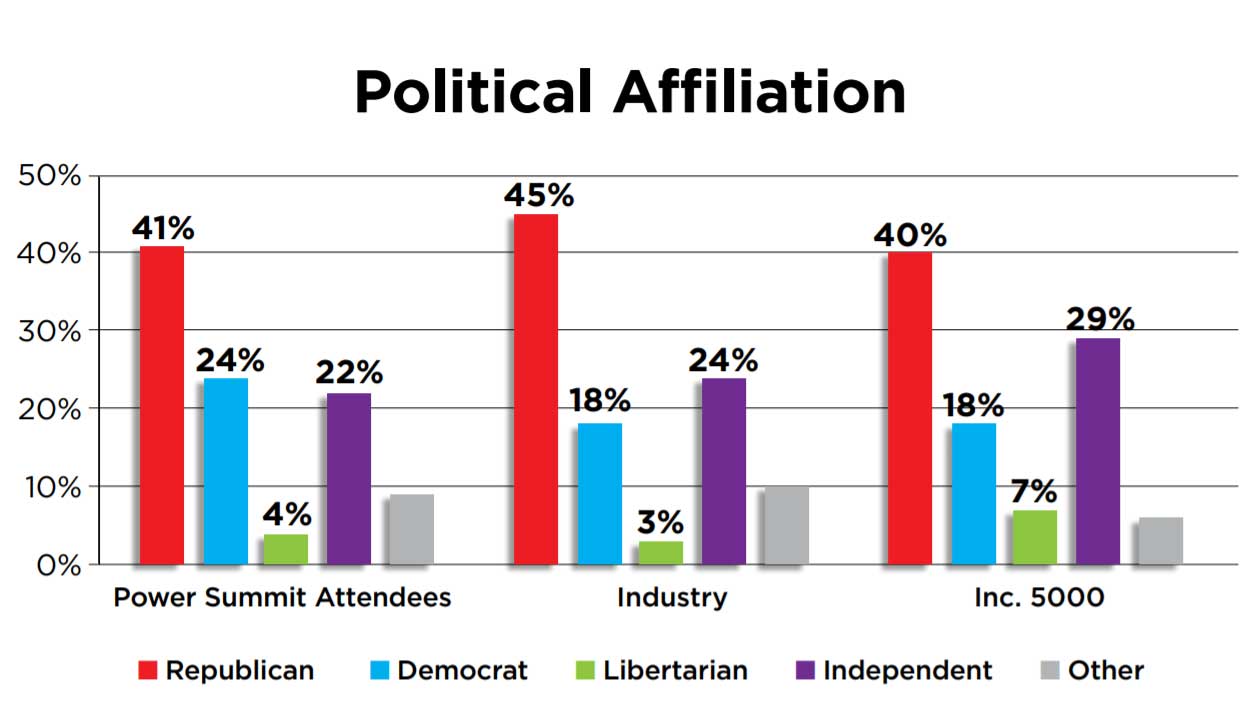

Political affiliation