September 24, 2020

Promo Distributor Sales Improve in August

Although sales are down year over year, they continue to recover from the COVID-19 crisis, rising slightly, compared to July 2020.

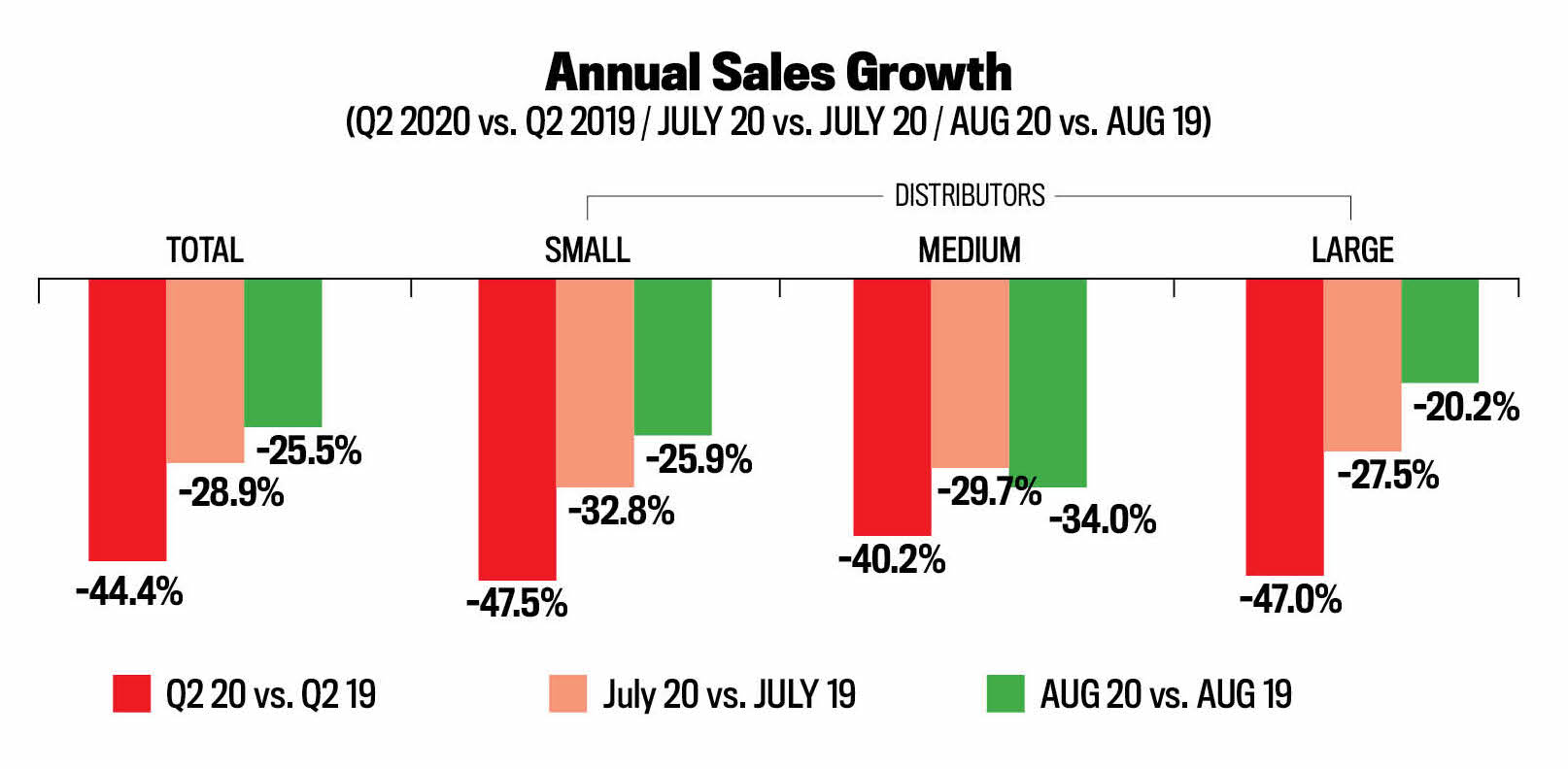

Sales of promotional products in North America continued to tick up slightly last month, though distributors’ numbers were still well shy of where they had been in August 2019. Year-over-year sales were down 25.5% in August, a hair better than the 28.9% drop in July, according to ASI’s just-released Distributor Sales Survey.

July was a sharp improvement over Q2, when distributor sales were 44.4% off from 2019, signaling the possibility of a V-shaped recovery in the industry. But with August’s slower sales growth, those hopes were tempered, bringing the expectation of a longer, slower climb through the rest of 2020 and into 2021.

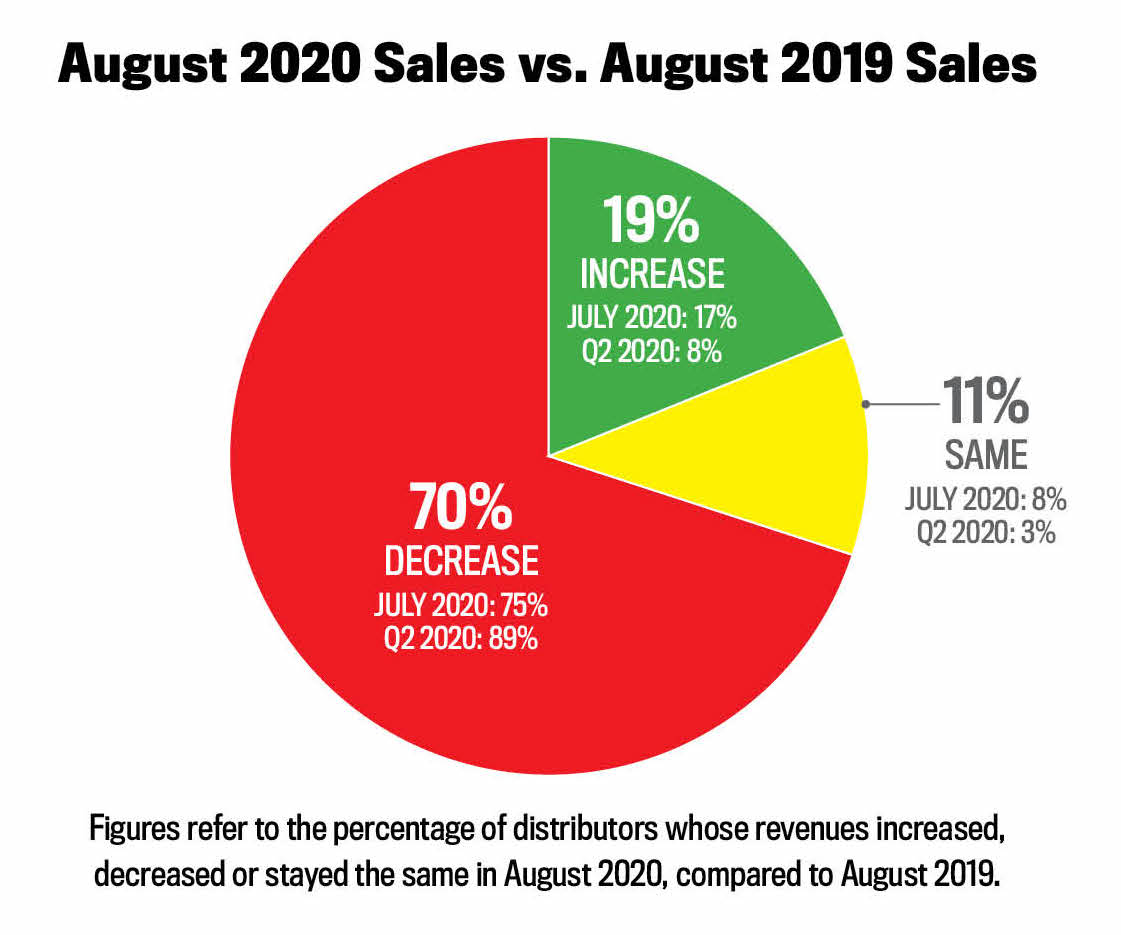

Almost one-fifth – 19% – of distributors say their year-over-year sales were up in August, with 11% reporting flat numbers.

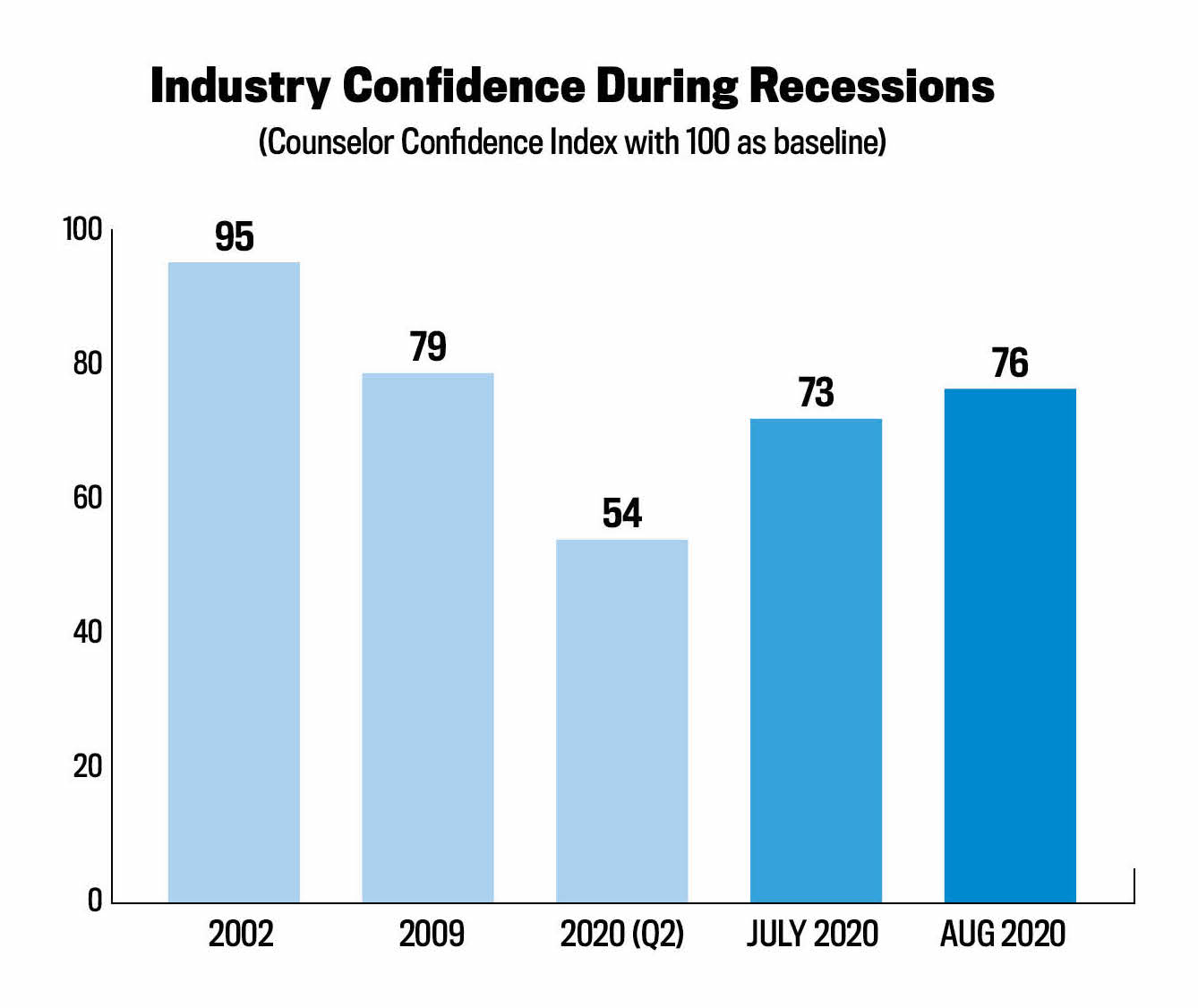

The Counselor Confidence Index also continued a tentative rebound from the second quarter, when it was at its lowest recorded point. In August, confidence jumped three points from July, reaching 76 points. The index, which has a baseline of 100, is a measure both of distributors’ financial health and their optimism. During the second quarter of the year, when societal lockdowns triggered by the coronavirus pandemic were in full swing, the index plunged to a record-low reading of 54.

Generate Sales and Marketing (asi/444517) in Crown Point, IN, was one of the distributors that surpassed year-over-year sales in August. “We had 20 fewer orders than last August, but the actual revenue was higher,” said owner Lisa Fronek. That was thanks mainly to sales of personal protective equipment (PPE), Fronek noted.

Requests for PPE products have shifted six months into the pandemic, however, with more clients looking for branded masks, mask lanyards and no-touch tools, as opposed to the disposable items that were sought after early on, she added. Traditional promo products orders are also making a comeback. “We’re seeing a return to items for fundraising, colleges and corporate gifting,” Fronek said.

Williams Advertising (asi/360402) has also had a good summer, onboarding new clients every week, according to owner Sarah Whitaker. The small distributor in Hopkinsville, KY, repositioned its services, doubling down on the promo side of the business, a pre-COVID game plan that began rolling out in the middle of the pandemic, she added. “After March/April and the halt things came to for a bit, the remainder of the summer has bounced back,” Whitaker said. “Our clients are weathering COVID well now, and we’re seeing a lot of community support for our small businesses, and otherwise, we work with many essential businesses.”

Elsewhere, year-over-year sales for Perfection Promo “weren’t too great,” according to owner Harry Ein. The San Francisco-area distributor was down about 41%, which Ein attributes to a client base that includes a number of professional sports teams (which can’t currently host fans at their venues). “For the year, we’re only down 29% to 30%,” he added. “We did pretty well with PPE. … We were selling a lot to other distributors actually. We’re really good at sourcing and had the inventory and knew how to get stuff. We did pretty decent in April and May, but June, July and August tilted more back to normal, with promo still down a lot.”

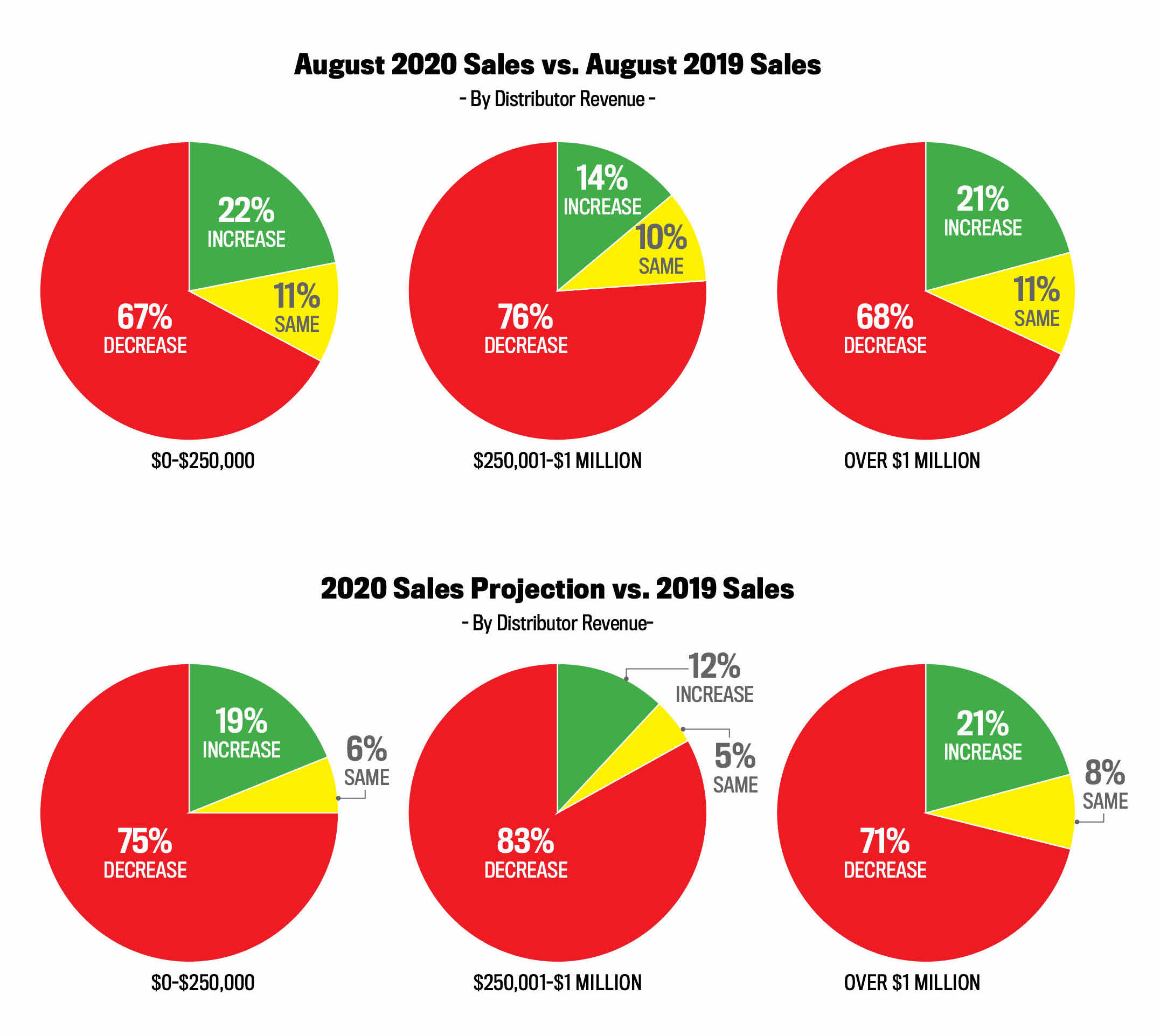

In August, medium-sized distributors (those with revenue between $250,000 and $1 million) fared the worst, with year-over-year sales down by 34%. Large distributors (with revenue exceeding $1 million) were the least affected, down by 20% compared to August 2019.

At American Solutions for Business (asi/120075), traditional promo sales and PPE have carried the Top 40 distributor forward, according to Jay Harman, regional manager for Southeast sales and distribution.

“The overall year has been good, just very different,” he said. “We’re seeing a slowing in transactional and repeat business overall, but not to a point of detriment. New opportunities seem to be overcoming our shortcoming in traditional business.”

Employee gifting programs have been big, thanks to the distributor’s ability to kit large jobs and ship them to people’s homes at discounted rates, Harman says. The distributor also has a few large opportunities lined up on the horizon. “Some companies that weren’t impacted as bad by COVID are looking at large spends to reinvest in their branding, client support and even employees,” Harman said.

Several distributors say they plan to lean hard into holiday gifting, marketing earlier and more heavily than in the past to try to offset losses from earlier in the year. Fronek hopes Generate will be able to finish the year ahead by courting holiday sales and budget spend downs. Ein is also making a big push – starting now – to garner gift-giving sales. “I’m very curious to see how the whole holiday season pans out,” Ein said.

2020 sales, on the whole, are projected to be down for about three-quarters of distributors, compared to 2019, with overall sales expected to drop 26% year over year, according to ASI research.

“We have high hopes that the outreach and new client acquisition measures we’ve been taking will pay off when COVID is in the rearview,” Fronek said. “Sales projects were a little less fun this year, more stressful and more problematic with supply chains, delivery issues and more, but we’ve been through tough years before. We do our best to keep a positive outlook and see the opportunity.”