April 05, 2018

Promo Market to Target: Beverage Industry

Are you thirsting for sales success? Then target the evolving, vibrant beverage market and its vast growth opportunities.

The $354 billion beverage industry never seems to lose its fizz. From high-profile marketing campaigns to significant shifts in health attitudes, this dynamic environment presents big opportunities. As new brands emerge and established ones remake their image, there’s a demand for up-to-the-moment marketing that reflects current tastes for clients large and small.

Soft drink purveyors may remain the gold standard in branding (Coke, Pepsi, Dr. Pepper and Mountain Dew spent a combined $730 million on advertising in 2016), but those sugary drinks have been losing their appeal, even among high school students. The desire for healthier options has unseated soft drinks as the most consumed beverage in the U.S. and made bottled water 2017’s winner, selling roughly 400 million gallons more than soda.

Meanwhile, on the harder side of the beverage spectrum, choice is the overriding theme. In beer, the paltry selection of taps that used to dominate your father’s favorite watering hole would be unthinkable; today’s curious imbiber is more likely to opt for one of the many pubs that proudly feature a wide variety of ales and lagers from around the nation. And in wine, there are nearly 8,700 wineries in the U.S., a figure increasing by about 5% annually.

What’s similar in all these market segments is a desire to appeal to passionate consumers who have suddenly become the drivers of innovation. “Without a doubt,” says Mark Aselstine, co-founder of online wine club Uncorked Ventures, “consumers are trying to make more informed choices and are more interested in the entire process.” Beverage producers are paying attention.

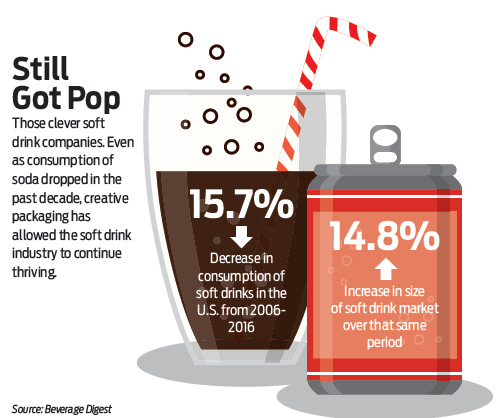

The Sweet Stuff

From “soda taxes” to public health outcries, soft drinks have been in the spotlight. But, it’s important to note, U.S. soda sales actually increased in total to $80 billion – a counter-intuitive result of savvy changes in packaging that resulted in higher prices for less product. But given the scrutiny they’re under, image-conscious soft-drink brands have begun to tailor their promotional methods in response. “Some campaigns use T-shirts, but they might not offer youth sizes anymore,” says Andy Shape, president of Stran Promotional Solutions (asi/337725). “They’re not promoting sugar drinks to children. They made a conscious effort to do that; it’s not a matter of law, but they’ve chosen not to.”

Point-of-purchase signage and floor graphics make up a big part of his soft-drink promotional arsenal, says Shape, often at supermarkets and convenience stores. For event-based promotions, he sees a lot of opportunity for cross-branding between the beverage sponsor and the host, with event-specific giveaways geared toward whichever demographic is being courted by organizers.

“Soft-drink manufacturers are casting a wider net than alcohol vendors,” says Steve Friedman, CEO of Tangerine Promotions (asi/341609). Consequently, they have to appeal to a broader range of consumer. But within that wider target audience, it’s not just children who are being steered away from sugary drinks, but also people with elevated health risks. But not all carbonated drinks need to be lumped together. Seltzer is reaping the benefits of the health-conscious shift, with a 42% increase in sales in the last five years, totaling 170 million gallons. Boldly flavored varieties and the association with healthiness is helping seltzer outperform other styles in the fizzy drinks niche, with one in three American households purchasing sparkling water regularly.

In general, the products of choice for the bubbly brands tend to be lower-cost items, but apparel seems to be an exception. “We do a lot of wearables,” says Friedman. “Buyers are trending toward softer, custom T-shirts.” He recalls the cheap tees that once dominated soft-drink promotions but have now fallen victim to soda brands’ demand for quality shirts and specific hues. “More buyers want, and are spending, on higher end wearables,” he says. And if it’s a client as demanding as Coca-Cola, you’d better get its shade of red exactly right.

Something Stronger

Alcoholic beverages make up 60% of the U.S. beverage market’s total revenue, and beer comprises almost half of that. And while this sudsy category has seen declining revenue in its larger brands, smaller craft breweries are helping buoy overall beer revenues, more than doubling their percentage of volume share to 12.3% between 2011 and 2016.

The craft beer industry is littered with smaller producers eager to establish and maintain their identity. New Jersey’s Flying Fish Brewing Company was established in 1995 – an eternity in craft beer years, making the brewery a relative old-timer in this fertile market. Its appetite for promotional products helped it become a local institution and the largest brewery in New Jersey, while still maintaining its independence and regional focus. “We use all kinds of promos: coasters, openers, can coolers, water bottles, for both consumers and retailers.” says founder Gene Muller. Tasting events give Muller a chance to reward purchasers with pint glasses (what he calls the “gold standard” of beer promos), while a bar promotion might see keychains or openers being handed out liberally. “There are so many brands,” he says, “but that’s where promos are really valuable. We can do a promo night at a bar and reward our customers. That helps us stand out.”

Muller is still looking for the perfect distributor, however, and as new potential partners emerge, he’s not averse to giving them a shot. “We source from different places,” Muller says. “We give more work as people prove themselves. We’re always mixing things up.” New methods of imprinting on glass have caught Muller’s attention, for example, and he’s eager to see which of his partners adopts the technology first.

Complicating these efforts is the number of larger beverage companies seeking to co-opt the craft clout by buying up esteemed indie brands. This trend underscores the difference in branding between larger and smaller players, says Shape, and demonstrates the “distributor-up” type of branding more common in craft labels. “A smaller or moderately sized brand, their wholesalers are selling the heck out of it and they want to promote it with their retailers,” he says. Then, with the blessing of the mother brand, Stran will work with these wholesalers on a promotional plan that involves both wholesaler and retailer.

This approach doesn’t fly with larger clients, Shape says, regardless of the exclusiveness they try to confer on their recently acquired craft brands. “Larger brands want to control the messaging. They’re conscious of how they’re going to gain that market share, and if they direct it brand-down, they feel they’ll have more success.”

A similarly broad underdog movement is unfurling in the spirits market. While the biggest names have dominated sales and liquor store shelves, the notion of “craft spirits” is finally taking hold. From 2015 to 2016, U.S. craft spirit producers reached $3 billion in sales for an increase of 25%, according to The Craft Spirits Data Project. And these producers have achieved 2.2% in market share (compared to 0.8% in 2010), according to the American Craft Spirits Association.

But, as Fortune noted late in 2016, “just 2% of producers today are responsible for 60% of the cases sold. The smaller producers have tiny distribution and are almost always bleeding cash.” That, of course, establishes a need for smaller producers to promote themselves to resonate in the marketplace.

By contrast, established spirit brands have always been image-conscious and promo-focused and are ready to tweak their brand to keep up. Witness the makeover that Jägermeister has recently undergone. Sensitive to the liquor’s reputation as a frat-party staple, it’s chosen instead to focus more on its European heritage by introducing its first rebrand in its 80-year history: a chilly, Weimar-futurist version of itself. The company is specifically targeting 20-somethings, aiming to grow up alongside them. Whether this rebranding effort will resonate with Delta House has yet to be proven, but when companies are looking to change direction, distributors and suppliers have to be ready to follow suit.

Liquor and beer promos are a staple of the bar scene, and brands can tailor their products for on- or off-premise promotions. “A lot of on-premise promotional items are more permanent,” says Shape, citing mirrors or menu holders as examples. “They become part of the décor rather than a marketing tool.” Off-premise strategies tend to be more temporary, he continues, like special point-of-purchase signs, decals or floor graphics. “Alcohol,” he adds, “really separates marketing needs differently, much more than the non-alcohol world.”

Holidays are another important foothold for alcohol promotions. “Cinco de Mayo, St. Patrick’s Day and the holiday season – these are important in a different way for Johnny Walker or Crown Royal than for Coca Cola,” explains Friedman. “You don’t see that so much in soft drinks. You see summertime, beach products, stuff like that. The alcohol industry, however, pays huge attention to holiday spend.”

He also contrasts the relatively inexpensive choices of many soft-drink makers with his alcohol clients who shop the same categories. “We do a lot of private-label wearables and custom-dyed pieces that you wouldn’t see in soft drinks,” Friedman says.

Showcase

Pitch these products and watch your beverage market sales pour in.

Closing Time

No matter where you look in the beverage industry, there are growth opportunities to be found. After all, the global nonalcoholic beverage market is projected to grow nearly 6% annually through 2025, while global alcohol sales are expected to grow 3% annually through 2023.

Take the growing market for modern wine sippers – U.S. retail sales are forecast to increase by 11% up to 2020. (Only China is outpacing America in growth.) Not surprisingly, the biggest share of consumer wine purchases is in the $4 to $8 range, but as those customers mature, says Uncorked Ventures’ Aselstine, their spend is increasing. “The buyer of a $4 bottle today ends up buying $10 wine at some point,” he says. This movement isn’t hurt by the growing research showing that moderately priced wines are often just as good as the more expensive, $100-a-bottle varieties. Along with that gravitation toward better wine comes a push for other options, like “natural” wines and lower alcohol wines.

While California has the most wineries in the U.S., there are still nearly 5,000 wineries in the other 49 states. In truth, the whole supply chain – wine distributors, retailers, grocers, wine clubs, bars – are fair game for promo products to pass along to consumers. Distributors tick off standards like corkscrews, wine stoppers, wine glasses and gift bags as being more popular, while Shape notes the influx of retail brands like Corkcicle and GoVino that offer appeal to the market.

Back on the nonalcoholic side, several lucrative niches await. In fact, of the 10 fastest-growing food and beverage categories, five belonged to nonalcoholic drinks: both refrigerated and ready-to drink tea and coffee, energy drinks, bottled water and sports drinks. In another report, fruit and functional beverages that offer health benefits are poised to capture notable market share in the next few years at the expense of soft drinks. There’s no secret why: Beverage market analyst Barbara Harfmann looks ahead and sees health awareness continuing to impact the industry, with boozeless cocktails and clean-label juices gaining popularity. Whatever lies ahead for the beverage industry, if distributors and their clients put their heads together, they can create a promotion worth raising a glass to.

Chuck Zak is a contributing writer for Advantages.