December 04, 2017

Eye on the Healthcare Market

This top sector for promo sales has been losing market share for several years straight. Here’s how distributors can reverse the trend.

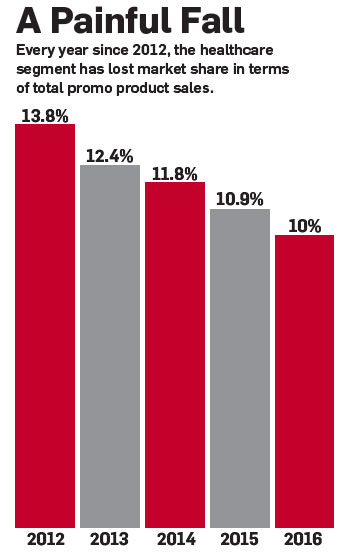

It was 2012 and the healthcare market was soaring. Far and away the top revenue generator for distributors, healthcare-related companies were responsible for 13.8% of total industry sales. Every year since, though, healthcare’s market share has dropped. The education sector has now taken over as the #1 promo market as healthcare sales have slid under the weight of new legislation and a shift in who holds the money.

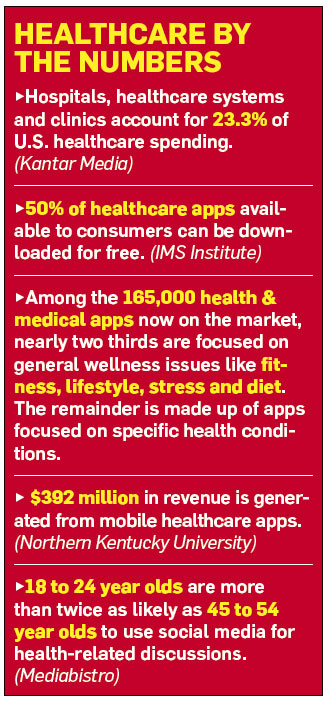

Consider that hospitals, healthcare systems and clinics alone have grown to account for $2.3 billion – 23.3% – of total healthcare ad spending, according to data from Kantar Media. Distributors just aren’t getting sales from local doctors’ offices like they used to.

>>Case Study: Rise Above the Ordinary

Jon Swallen, chief research officer for Kantar Media, believes that the Affordable Care Act ushered in the major market shift. “The ACA changed the landscape for healthcare companies, and advertising and marketing strategies have evolved to meet the new challenges,” Swallen says. “As insurance plans push more of the costs of healthcare coverage onto subscribers, patients are empowered and incentivized to shop around for healthcare and to be more cost-conscious, leading to a much more competitive environment for hospitals.”

As such, Swallen notes that for hospitals and providers, promotional messaging has to accomplish several objectives. It must enlighten about disease awareness and treatment options, educate consumers about services and specialty technologies, and highlight quality and expertise. That’s a tall order – one that distributor sales reps can help fulfill using smart, effective promotions. In other words, the opportunities for stronger healthcare market sales do exist, but the same old targets and strategies need to be tossed aside.

Capitalize on Rebranding Efforts

As the number of hospital mergers increases, healthcare systems both big and small are spending more to differentiate themselves from one another, leveraging affiliations, expanded services and a focus on overall wellness. Paula Gossett, senior brandologist at Geiger (asi/202900) in Port St. Lucie, FL, has helped her largest urgent care client open and brand more than 175 centers in 14 years. “Knowing my client was acquiring new centers all the time, I started asking about what I could do to help,” Gossett says. “Clipboards for waiting rooms, floor mats, wall decorations – all of these products help their brand remain consistent across the country, especially with the new centers they bring in under the national umbrella.”

These days, Gossett doesn’t specifically target the marketing department, noting that many buyers are now shopping online for promotional items and aren’t as open to reps bringing in new product. “Where you can really grow your business is with human resources, procurement departments and larger companies that have multiple locations,” says Gossett. “You can even work with building management to make their offices look more uniform. There are hundreds of products that go into branding or rebranding a center.”

Recently, Gossett’s client spent $250,000 on decorating their facilities to ensure uniformity. In collaboration with supplier Bruce Fox (asi/42330), Gossett created a website portal where office managers can log in and choose from a selection of wall art, mission statement plaques and wall mount kits for hanging required materials such as HIPPA laws, prevention advice and reminders. “When you start working with people on what they need every day, budgets are there,” Gossett says. “Slip-and-fall safety programs through the environmental department, programs surrounding good practices like hand washing, making sure spills are mopped up – I’m constantly finding ways to get involved in programs.”

Create Unique Promotions That Serve a Function

Another lucrative avenue for distributors to pursue is the growing assisted living market. Jill Andrew, senior sales and marketing director at Superior Residences Memory Care in Brandon, FL, has been in the business for more than 20 years, and has witnessed this branch of the healthcare system surge with aging baby boomers. “Five years ago, I spoke at a women’s club, and I asked the audience how many know someone with dementia. Four people raised their hands,” Andrew recalls. “I recently returned, asking the same question, and all but four people raised their hands. People are living longer, and the demand for nursing homes and facilities has increased dramatically.”

Andrew and her distributor partner, Jerry McNeill of Vernon McGraves Promotions, have collaborated to keep Superior Residences front of mind with community members, choosing products that display the company’s messaging in a standout way for prospective patients and caregivers. The main tactic behind their successful promotions: Avoid healthcare product clichés. “We want to be creative with our marketing,” Andrew says. “I don’t want the pill holders or (adhesive bandage) dispensers. I want something that will differentiate us, while also providing a function for the recipient.”

Acting on dementia research that proved drinking from red cups promoted patients to stay more hydrated, McNeill went on the hunt for a brandable red drinking cup that would have a unique, attention-grabbing twist. Vernon tried several products, but in the end, it found the perfect item in the mood bike bottle. The product is white when empty and red when filled with cold liquid. A nipple top prevents spills. “We did an order of 400 to start,” says McNeill. “Some went to the current residents so caregivers could monitor their liquid intake. Jill uses the rest out in the community to educate the public on the importance of hydration for those suffering from dementia.”

Following this campaign, Andrew won the Florida State of Assisted Living Innovator of the Year Award for her work at Superior Residences. Residents who use the bottles are drinking more water, which helps their overall health in a number of ways. Andrew continues to gift the bottles to elder law attorneys, home health companies, companion services and assisted living organizations. “I’m in this business because I care about people,” Andrew says. “If I can spread knowledge to keep people in better health for longer, even if that means staying out of my facility, I’m happy. I know my purpose.”

Network Within the System

Super healthcare systems, those that house hospitals, assisted living centers and in-patient therapy all under one brand, are on the rise. These are great opportunities for distributors, providing a variety of roads to sales expansion.

Wendy Franklin, sales rep at Geiger in St. Louis, MO, works with a faith-based Catholic hospital system headquartered in Missouri with facilities in Arkansas, Texas and Oklahoma. Franklin’s sales are up $60,000 from last year with this client. She expects revenue to grow more in 2018. “We do a lot of internal campaigns for the different departments within the hospital,” says Franklin. “Birth and babies; children’s hospital; programs for the community such as babysitting, big brother/big sister; lactation classes; compliance; ER. This particular client’s buying is decentralized so each department has its own budget.”

One niche in which Franklin finds opportunities lies in marketing the client’s services to patients currently enrolled in one department of the system. “There’s a huge effort by the hospitals to keep services within the system, as opposed to patients going somewhere else,” says Franklin. “If a patient comes in for surgery, there are a lot of materials and education about further services in physical therapy after surgery or in-patient care to heal. They’re all vying to keep people in their system.”

As part of efforts to keep current patients loyal, the birthing unit gifts new moms with Mother’s Day Tiffany-inspired bracelets, Father’s Day hats for dads, and baby’s “First Christmas” ornaments when a child is born over the holiday season. “The hospital wants patients to have a top experience starting from day one, with the hope that new parents will bring their children back to pediatrics for services they’ll need growing up, as well as for services their aging parents will need.”

Focus on the Future With Digital, Wearable Tech

Momentum toward a digital future is gaining ground, especially in the healthcare field. Nearly 37% of American adults use at least one digital platform to track their health, according to Kantar’s 2016 National Health and Wellness Survey. Interestingly, wearable health-related devices are among the digital offerings starting to become more popular. These include everything from web-connected glucose monitors to more widely used wearables like FitBits and Apple Watches that detect heart rate, hours of activity and calories burned.

“Wearable technology has been used in medical for 60-70 years with defibrillators, pacemakers and implantables, but now these types of devices are becoming more well known to the wearer, and medical companies are leveraging the same technology, like Bluetooth and GPS, that allow our fashion wearable items to work,” says James Hayward, senior technology analyst at ID- TechEx and co-author of Wearable Technology 2017-2027: Markets, Players, Forecasts.

For distributors interested in selling to the healthcare market, this means it’s important to become educated on wearable technology and companion applications because they can potentially serve as branded pieces – or products to be promoted – that figure into healthcare clients’ plans. “People are taking responsibility for their own health through these devices, and that will change how doctors interact with patients, how insurance companies target their audience and how many people will still use traditional healthcare services,” says Ross Rubin, director of research development at The Relevancy Group.

The opportunities don’t stop with wearable devices, though. As personal health records fill with data from sensors such as Fitbits and medical-grade devices, more related app development will follow. The healthcare companies making these apps will need to increase awareness of the benefits and ease of use of their products and related offerings through different marketing channels, including patient education kits available at doctors’ offices and medical facilities. Distributors who are aware of these rising trends can support the push with on-point promo products.

Slideshow: Products to Target Healthcare

Email: avantrease@asicentral.com