December 14, 2018

Quality Control in the Promo Products Industry

Misprints, delays, incorrect shipments and other issues are increasingly plaguing distributors. What can suppliers do to alleviate these growing concerns?

Kristina Newsom was on vacation when she got a call from her client. It didn’t seem unusual because as anyone who runs a business can attest, you’re never truly off the clock. But the owner of Specialties Plus of NC (asi/331384) was jarred by her customer’s complaint.

An order of 7,000 blank bags had arrived at the client’s doorstep. They weren’t customized, they weren’t printed and they were a massive disappointment. Newsom was upset, but she wasn’t exactly surprised.

“We’ve dealt with more weekly errors recently than any other time,” Newsom says. “Our company is going on its 30th year in business and we’ve never experienced more issues, misprints, delayed turn times, incorrect shipments and lack of basic quality control checks and balances as we did in 2018.”

Newsom is far from the only distributor dealing with increasing headaches. “I’ve had issues with larger suppliers that seemed out of character; you know, the big guys that you can normally count on,” says Lizzz Kritzer, owner of New York-based distributor Kritzer Marketing (asi/245947). “I have no complaints about customer service, but someone isn’t checking the orders before they leave. I’ve often had product ship with problems that should’ve been caught in quality control.”

“It’s almost like you pray every time you do a huge order.”Mike Beckman, Proforma-BPM

Mike Beckman, head of Proforma-BPM (asi/300094) in Atlanta, says he has a weekly call with two other Proforma owners. Lately, they’ve been talking more often about numerous problems they’ve faced, particularly from some of the largest suppliers in the industry.

“The attention to detail is lacking recently,” Beckman says. “It used to be when we did a large apparel order, we’d have no problems. Now it seems every order has missed sizes or wrong colors. It’s almost like you pray every time you do a huge order.”

As in any industry, the big names are always going to be dragged through the mud in message boards and on social media. But Justin MacDonald, general manager of Florida-based TJM Promos (asi/342485), says issues have come from everywhere. “I wouldn’t say we’ve encountered problems only with larger suppliers – it’s just more noticeable with them because more people are using them,” MacDonald says. “We’ve run into quality control, shipping and timing issues more lately than in the past two or three years.”

Not Getting Better

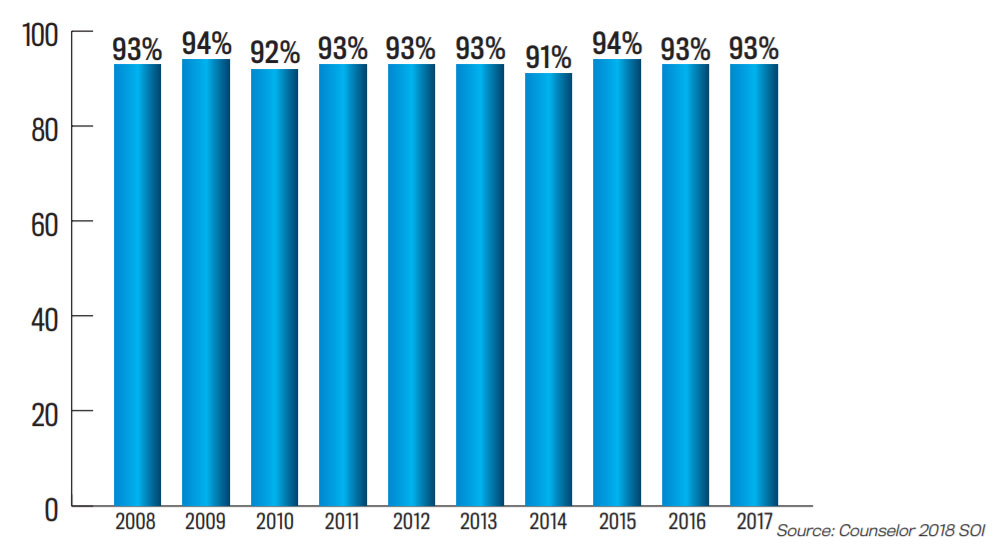

Distributors report the vast majority of orders from suppliers arrive by the due date. The problem? The on-time rate hasn’t improved at all in the last decade.

Percentage of orders from suppliers delivered on time, according to distributors

So what made 2018 different than other years? Well, the promotional products industry is rapidly evolving. Amazon is threatening to disrupt the market’s supply chain. Suppliers are under pressure to raise prices as the United States and China go tit for tat with tariffs. And perhaps most importantly, consolidation has become the number-one industry trend as large firms gobble up their competition, creating transitionary periods that naturally spur mistakes.

Despite the turbulent times we’re in, the industry continues to grow with distributor sales reaching a record high of $23.6 billion in total revenues. Such historic acceleration has led to growing pains throughout the industry, according to Newsom. “My intuition tells me people aren’t getting trained enough to catch these quality control issues, or maybe it’s just human error because of the constant demand,” she says.

In the Fast Lane

With the breakneck pace of 21st century business, distributors have been forced to ramp up their operations to satisfy customers’ want-it-now mentality. Recent Counselor State of the Industry data shows 70% of distributors say customers are demanding faster turnaround times. As a result, suppliers have been flooded with rush orders, which are more likely to have errors.

“The industry has put unnecessary pressure on itself by offering 24-hour shipping at no charge,” says Trevor Gnesin, owner of Top 40 supplier Logomark (asi/67866). “This has allowed the end-user the ability to leave everything to the last minute for their promotional product requirements. Both suppliers and distributors are working around the clock to make these orders happen, adding a tremendous amount of stress to all employees on both sides.”

While not necessarily a quality control issue, delayed orders remain a common complaint. According to SOI data, distributors report 93% of their orders from suppliers arrive on time. At quick glance, that may seem like good news. But if you’re a glass half-empty type, or a customer waiting on an important order, that remaining 7% isn’t promising. Over the past decade, the on-time delivery rate in the promo industry hasn’t improved at all.

“The industry has put unnecessary pressure on itself by offering 24-hour shipping at no charge.”Trevor Gnesin, Logomark

“We have really great clients that are understanding and know we’ll do whatever it takes to fulfill their needs,” Newsom says. “Of course, they’re stressed because the pressure is now on them, too. You can’t have an event and not have gift bags ready to rock and roll. What’s really frustrating is you have to spend double the time making up for these errors.”

Although 24/7 availability and instant gratification have become the norm in the digital age, Memo Kahan, president of Top 40 distributor PromoShop (asi/300446), argues that the toothpaste can go back in the tube, as long as the industry bands together.

“If we slowed everything down a little and gave factories enough time to produce, it would diminish the rushes and the issues we’re all having,” Kahan says. “The customer is pissed off for sure, especially when we have time-sensitive dates and events. But it’s up to us to go back and retrain them that they shouldn’t be ordering things today for tomorrow. If you want it to be perfect, give me a couple weeks. Let’s do a pre-production sample. Let me give you the stuff a couple days before instead of opening the boxes the day of the event. It’s sort of pushing the boulder up the hill, but I think we can.”

Shallower Talent Pool

A side effect of the 24-hour turnaround is nonstop production. In order to keep the machines constantly running, companies must have employees scheduled to work around the clock. That’s proven quite challenging over the past year as fewer people are looking for jobs. According to the Bureau of Labor Statistics, the unemployment rate in the U.S. declined to 3.7% in late 2018 – the lowest jobless rate since December of 1969.

With a shortage of qualified candidates to choose from, companies are forced to sacrifice staffing options in order to get the job done. “It goes back to working 24-hour shifts, especially night shifts,” Kahan says. “The night shift workers aren’t as qualified as those who work the day shift. There’s less management and things don’t go as well when you’re printing overnight as opposed to the whole two weeks we used to be comfortable with.”

35%of promo products orders require a five-day or less turnaround, Counselor SOI data shows.

Entry-level positions have become hardest to fill, as the pay doesn’t entice job seekers with a plethora of opportunities. MacDonald says quality control will understandably suffer by default. “There’s less urgency to take care of customers who you may have taken extra care of in the past,” he says. “People are having less issue with customer service simply apologizing.”

Quality and timing issues became so frequent that MacDonald had no choice but to end a 12-year relationship with one supplier who hired a temp to handle a $7,000 order from a return customer. That was the last straw.

“Temps don’t have the same investment that an employee or owner would have,” MacDonald says. “One of our customers had three issues in a row. They were typically rush orders, so we called ahead of time to ask for extra care. The temp said, ‘I’m just here for the day, I don’t know what to tell you.’ It wasn’t important enough to handle this customer that had been an issue. We’re paying more for our product right now because we trust the vendor.”

Some suppliers are struggling to maintain their profit margins in the face of all these challenges, being forced to cut costs to stay afloat. As a result, workforces are being trimmed, according to Dan Jellinek, senior vice president of sales at Top 40 supplier The Magnet Group (asi/68507).

“Maybe it’s some of the talent on the second shift and someone in order entry and now a smaller group of people have to do more and work faster,” Jellinek says. “Thankfully, we have fantastic people in customer service and production and we continually turn out great work.”

Outsourcing production is another option for companies having to cut back. While outsourcing may save money, it also allows more room for error as added parties are involved with the order. Miscommunication is almost expected when parties are thousands of miles away. “We’ve had some stock shortages due to quality controls we set up in China, which have added some weeks to shipments of our regular inventory,” Gnesin says. “Fortunately, we don’t have many orders that are errors.”

Beckman argues, though, that it doesn’t matter what time of the day people work, they simply aren’t as dedicated as they used to be. “It’s the ‘millennialization’ of America,” he says. “Work ethic just isn’t there anymore. It seems like the industry is growing too fast, so we just have to accept the mistakes.”

Under Pressure

As competition and consolidation increase, and the trade war between China and the U.S. continues, the promotional products industry is faced with unprecedented disruption heading into 2019. With so many threats and challenges coming from outside the industry, execs believe it’s imperative that suppliers and distributors maintain efficient operation of their own companies.

“The vendors need to know we’re getting frustrated,” Beckman says. “All these Facebook groups have been created for distributors to find products. Lately, they’ve been a sounding board for complaints. Suppliers can stop it before it gets any worse.”

“If we slowed everything down a little and gave factories enough time to produce, it would diminish the rushes and the issues we’re all having.”Memo Kahan, PromoShop

So how can suppliers minimize these growing issues?

“There has to be quality control and it needs to be taken seriously,” Newsom says. “Distributors are only as good as their suppliers. We try to partner with companies that we feel confident can handle a negative situation. But we get to a breaking point and then we have to pump the brakes with that company for a little bit. If errors continue, we’re more prone to outsource.”

If the budget is tight, it’s vital for suppliers to find another aspect of the company to scale back on. Employees in every department are too important to the bottom line, MacDonald says. “You’re only as strong as your weakest link,” he says. “I can pay minimum wage for shipping and receiving positions, but they’re just as important as any other position in the company. You can’t have one area to cheap out on, especially one the customer deals with.”

As tensions mount between suppliers and distributors, perhaps cooler heads will prevail. After all, Kahan says, it’s only natural for things to fall through the cracks during periods of change. “It’s not the end of the world,” Kahan says. “It’s just an adjustment we have to all make. We have to work through it and suppliers need to continue to communicate with us about what they can and can’t do.”