June 01, 2016

Is Falling Entrepreneurship Hurting The Promo Market?

Despite it being easier than ever to start a business, American entrepreneurship has fallen to new depths. How did we get there, and what does it mean for the industry?

Three years ago, a USA Today columnist penned an article titled “How to Start a Business in 10 Easy Steps.”

Step 1: Choose a business name. Step 2: Get a domain name. The subtext was unmistakable: the barriers for starting a new business have fallen so dramatically that all it takes is an email address and working website to set up shop.

Because of that, entrepreneurship should be thriving. The truth, however, is something very different.

American entrepreneurship has dramatically fallen over the last 40 years. The once-mammoth gap between new and closing businesses disappeared completely by the recession of 2008. According to the U.S. Census Bureau’s findings four years ago, the United States was in the red by 70,000 businesses.

By all appearances, the promotional product industry remains immune to this predicament. The industry has recorded six consecutive years of annual growth, and the Counselor Confidence Index (which measures industry health) has remained consistently high the last three years. Anecdotally, distributors cite a wealth of willing buyers with healthy spending budgets. “More companies are entering the industry and growing because we’re going through a good cycle,” says Jordy Gamson, co-owner of The Icebox (asi/229395) and co-recipient of ASI’s 2013 Distributor Entrepreneur of the Year award. “Since the last recession was so potent, it took a little more time for people’s behavior to come back with large budgets and brand investments.”

Those are encouraging words, but how long can the industry insulate itself from America’s larger dilemma? After occupying first place for 35 years, the U.S. now ranks 12th among developed nations in terms of business start-up activity, according to Gallup. Without new businesses entering the scene, there are fewer employment opportunities and less taxable money to fuel the government. “I don’t want to sound like a doomsayer,” wrote Gallup CEO Jim Clifton last year, “but when small and medium-sized businesses are dying faster than they’re being born, so is free enterprise. And when free enterprise dies, America dies with it.”

By acknowledging the crisis, major questions arise. How did the U.S. get to this place? Is the promotional product industry susceptible to the same root causes? And how can it be fixed?

Young Blood?

At the Kauffman Foundation, which tracks start-up activity across the U.S., experts have witnessed this long-term decline – occurring across all sectors and geography – in real-time. Pinpointing the exact reason is tricky. “There’s no smoking gun,” says E.J. Reedy, senior fellow in research and policy at the foundation. And though the number of closing businesses leapfrogged start-ups at the recession, Reedy says a specific economic link can’t be found until more research is conducted.

However, in terms of demographics, Kauffman found that the rate of millennials creating businesses is far below the rate of prior generations. Whereas 34% of new entrepreneurs in 1996 were between the ages 20-34, that number dropped to 24% in 2014. Conversely, baby boomers continue to carry the entrepreneurial itch; a quarter of all new entrepreneurs in 2014 were baby boomers, compared to 14% in 1996. “It’s not clear whether student debt and other difficulties in the job market are really impacting young people to take risks,” Reedy says, “but baby boomers continue to produce and own businesses at a much faster rate than other generations.”

Even though half to two-thirds of millennials aspire to own their own business someday, a large majority have not acted yet on those desires. Many experts point to the difficulties of post-graduate life in the teeth of the recovering economy, where jobs were lacking and underemployed millennials had fewer opportunities to sharpen their skills. “Failing to gain workplace experience, they missed the chance to apprentice with more experienced professionals,” wrote Amy Wilkinson, entrepreneur and author of The Creator’s Code, in The Wall Street Journal. “Many lack the practical knowledge of how to strike out on their own.”

Could it be generational attitudes too? Howard Schwartz, founder and CEO of HDS (asi/216807) and ASI’s 2014 Distributor Entrepreneur of the Year, says the demographic schism can be traced to the idea of the “microwave generation.”

“They want to find instant success and you can’t find that as an entrepreneur,” Schwartz, 46, says. “It’s a pure classification, but they don’t have the work ethic that my generation or the baby boomers have.” Schwartz says when he was growing up, he delivered newspapers, served beer, worked at a sporting goods store and any odd job available. That hustle led him to launch HDS in a bedroom in his parents’ house using two phones and a fax line to sell keychains and license plate frames to car dealerships around Pittsburgh. “A lot of companies laughed at me saying ‘you’re this new kid,’ but after a few years, they noticed that I was still there,” Schwartz says.

The issue with millennials is doubly concerning for the promotional product industry, which already has to combat its graying reputation and the persistent notion that younger generations aren’t receptive to it. When Erin Reilly and Sterling Wilson, co-founders of Pop! Promos (asi/45657), began selling branded sunglasses to universities while still in college, they had no idea what promotional products were. “It’s not that young people aren’t starting businesses,” says Reilly, 26. “It’s that they’re not starting businesses in an industry that’s intentionally guarded and private.”

Joseph Sommer, owner of Whitestone Works (asi/359741), blames the lack of mainstream coverage about the industry. “In my marketing class in college, there was maybe a paragraph on promotional products when it’s a $22 billion industry,” says Sommer, 27. “It’s not trendy at the educational level, and people don’t understand how creative it can be from an advertising level.”

It’s an uphill battle, but Sommer has been trying to change the perception by recruiting young people to his company. One of his sales representatives is 28, his operations manager is 24, and his account manager is 23. No one at Whitestone Works is over 30. “When you walk into an industry trade show, there are no millennials in that room,” Sommer says. “While there are some companies attracting young talent, that’s not to say the industry as a whole is doing the same.”

Reilly adds that it’s also not the “sexiest” industry for young people to enter. “All of these suppliers are offering virtually the same thing and competing on just price,” she says, “which is such an unattractive thing for a small, fledgling business to compete with.”

Capital Concerns

Beyond demographics, there has also been a fundamental shift in the available financing that shepherds companies beyond fledgling start-up status.

The Brookings Institution, a Washington D.C.-based think tank, reports that the share of companies aged 16 or older has increased by about 50% since the 1970s. This includes major Internet companies such as Amazon and Google which, due to their longevity and track records, attract professional investors with deep pockets. It’s not that money isn’t available for start-ups; there’s just not enough of it at the beginning when they need it most to survive. Mattermark, which tracks start-up data, shows that while the size of seed investments made by venture capitalists remained the same between 2005 and 2014, the size of later venture rounds doubled. Investors simply aren’t willing to shell out the big bucks until there is evidence that a company will make their money back. This forces entrepreneurs (about 77% says Gallup) to rely on their personal savings for start-up funding.

Financers are also increasingly judicious about which sectors they fund. Tech still rules while mainstream sectors suffer. “Capital is very hard to come by if you’re looking to open up a bakery or a lawn care service,” says Chris Myers, founder of small-business management firm BodeTree. “For a long time, capital flowed relatively freely in the tech spectrum for somewhat questionable ideas like a Netflix for Legos.” And while tech start-ups can draw more investments and seemingly lift up entrepreneurship as a whole, “in reality, the world of tech start-ups is much smaller than it looks,” Myers says.

In addition, banks simply aren’t lending as much to small businesses. While commercial lending (catering primarily to the middle market) is setting 30-year records, small loans from 10 of the largest banks declined 38% since 2006. Venture capitalists have little interest in mom-and-pop shops because the owners don’t have visions of national or global expansion. Even something as simple as a name (Bob’s Corner Café) can hinder loans, says Catherine Fazio, managing director at the MIT Innovation Initiative, because it indicates the owner wants a strong local business rather than the next Starbucks.

“Look at Silicon Valley,” says Fazio, who co-authored a study on innovation-driven entrepreneurship, measuring the growth potential of start-ups at or near the time of founding. “It’s part of an ecosystem that promotes thriving. There is a link between companies and new firms and universities and government.” Start-up small businesses, she says, need different support that isn’t available to them currently.

The study also found that firms of all kinds with significant growth potential had it more difficult since the dot-com bust. According to the data, a 1996 start-up was four times more likely to achieve a growth event in six years than a start-up founded in 2005.

Smaller industry distributors do have built-in fallbacks for capital, including acquisitions by larger companies or a multitude of larger distributor networks that offer benefits like order financing and back office support. The growth of these networks over the last couple decades (several reside in the Top 40) indicate the tangible appeal for companies who want to stabilize and grow.

Learning Curve

What was the biggest challenge in starting your company? Young industry entrepreneurs share their struggles.

--Hiring and Retaining Talent: “You can have the smartest person in the world that is well equipped for the job, but if they don’t fit in with the company culture, it’s just not going to work,” says Erin Reilly, co-founder of Pop! Promos (asi/45657).

--Delegating: “My biggest mistake is I hired an additional salesperson when I needed someone on the back end,” says Joseph Sommer, owner of Whitestone Works (asi/359741). “I needed operations and accounting. When you’re ready to hire, hire your weakness.”

--Time Management: Daniel Fine founded promotional sunglasses company Glass-U and multiple other start-up ventures all before he graduated from the University of Pennsylvania in 2015. “It comes down to optimizing every moment,” Fine says. “I had to balance running a company while being a student athlete and most importantly, having fun, because that’s what you do in college.”

Entrepreneurship’s Future

There are millions of U.S. workers who set their own hours and generally operate independently. They make money driving cars with Uber or transporting goods for delivery apps like Postmates. They are freelancers who accept temporary work or do jobs on the side without a business name. These freelancers are key cogs in the growing “gig economy.”

The Bureau of Labor Statistics calls those Americans “contingent workers” – those who don’t have an explicit contract for ongoing employment, and are part of alternative employment arrangements. According to a poll commissioned by Time, more than 90 million Americans (44% of the U.S. adult population) have participated in this business arrangement. For the first time since 2005, the Bureau and the Census Bureau plan on surveying the scope of contingent worker arrangements for the Current Population Survey of May 2017.

Do these people qualify for another label: entrepreneurs? The answers could provide new framing on America’s entrepreneurship struggles. Reedy says it will be tough to classify such workers because the margins and distinctions have drastically changed in the last decade. For example, would an Uber driver consider himself an entrepreneur? “It’s harder to follow people who run businesses on the side or identify as self-employed. It’s difficult to measure because of how people respond to these traditional surveys,” Reedy says.

The distinction may re-center the dominant traits in entrepreneurship by placing emphasis on reduced overhead and enabling platforms – qualities that fall neatly into the framework that the promotional product industry has carved out. To start, “all you need is an ASI membership, a simple website, file your business with the state, and you’re up and running. With under $5,000, you could be in business,” Sommer says.

“It’s appealing because folks have started in their homes while operating on a shoestring budget,” says David Blaise of Blaise Drake & Company. “If you’re able to sell product and get it manufactured by suppliers, then it’s just a matter of collecting money and doing it again.”

Adds Gamson: “You can leverage relationships, keep a low-cost structure and make a living. The industry rewards people who want to come in with different visions.”

Testimony like that can give the industry hope that it can withstand the country’s entrepreneurial crisis. The additional good news is America’s start-up activity is finally displaying promise. Kauffman research shows that in 2014, the five-year downward trend reversed with the largest year-over-year growth in two decades: about 530,000 new business owners each month, up .31% per month over the previous year’s .28%.

Experts, meanwhile, are exploring solutions such as engaging millennials, increasing start-up funding and recruiting the support of the federal government. The Brookings Institution has called for policy reforms which would allow more foreign entrepreneurs, who are statistically twice as likely as native-born Americans to start businesses, to receive permanent work visas. (Massachusetts and Colorado have already created pilot programs to employ immigrant entrepreneurs on college campuses to advise students on building businesses.) Brookings has also called for states to shorten the duration of non-compete agreements.

Enacting these strategies can allow would-be entrepreneurs to summon the courage to start a business. But entrepreneurs aren’t judged by how many businesses they start, but rather if they succeed. New businesses constantly fail (80% close within 18 months, reported a 2014 Bloomberg study), and owners need skill to guide their fledgling entities through those early months and years. Entrepreneurs in the promotional product industry, says Blaise, “feel they can get involved in the industry and have the same advantages as others,” Blaise says. “It’s a good start, but without the skills necessary to get and keep customers on a consistent basis, it’s not enough.”

Blaise says his favorite business reference is the E-Myth by Michael Gerber, who suggests that most businesses aren’t started by entrepreneurs, but rather technicians suffering from an “entrepreneurial seizure.” For example, a plumber realizes he has skills to perform the job, so he then wants to open his own plumbing company to maximize his earnings. Blaise says screen printers and embroiderers fall under the same spell. “With the advancements in technology, the barriers to entry have been reduced quite a bit,” Blaise says. “People coming in from ancillary industries are now dipping their toe in the water. But most people who start a business lack the skills involved to run it and the resources needed to hire someone with those skills.”

“Most entrepreneurs try to do everything,” Schwartz says. “But you can’t. I’m a business developer. Being an entrepreneur is good when you have a vision, but you need to find the other people to help put it together.”

There are elements in the promotional product entrepreneur’s favor. Solid fundamentals and creativity are rewarded. Digital really has leveled the playing field. Plus, people know much more about promotional products than they did 10 or 20 years ago, says Mitch Weintraub, CEO of Pinnacle Promotions (asi/295986). The demands of the digital age cause you to work faster and harder, he says, but those same technological advancements give you a wider reach to succeed. “The beauty of our industry is that you can be whatever you want to be,” Weintraub says. “If you’re scrappy, resilient, somewhat creative and entrepreneurial at heart, you’ll find a way to succeed.”

General Motivations

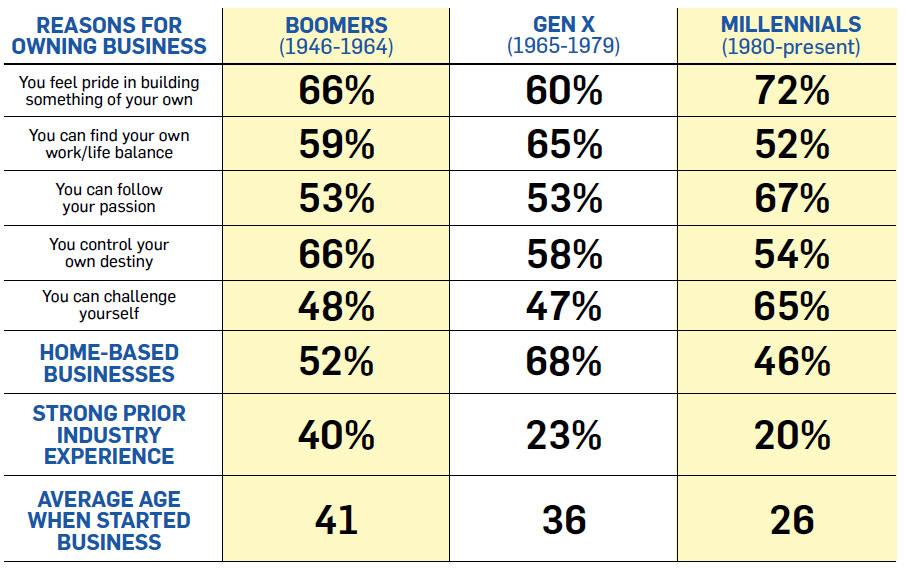

Why do entrepreneurs start and continue to run their businesses? We polled 375 business owners (the majority of whom sell promotional products) to find their key motivations. The results reinforce several generational perceptions – millennials want to be passionate about their work, Gen Xers value family time and boomers prefer industries they already have experience in.

Click on the above chart for larger image

Click on the above chart for larger image

– Email: jcorrigan@asicentral.com; Twitter: @NotReady4Radio