May 29, 2018

Decorators’ Nightmare Scenarios – Solved!

We have the answers to the burning questions that keep you up at night.

When you’re a small-business owner, your busy days are filled with putting out fires and bouncing from problem to problem. But once the day’s din has quieted and you have time to think, something else arrives: the burning questions that keep you up at night.

We checked in with readers to find out some of their biggest fears and how they deal with them, and reached out to industry experts for their insight on common business pitfalls and how to prevent them. Do you have the answers to overcome these business-defining questions?

>>Don't Miss! Q&A: Why Decorators Need Online Design Tools

Q: What’s the best way to ensure a steady cash flow during the inevitable peaks and valleys?

A. Require a deposit on custom jobs.

B. Diversify into new markets, decoration methods or services.

C. Use e-commerce to ensure upfront payments.

D. Seek better terms from your suppliers. E. Rob a bank.

Answer: Any of these actions will help solve your cash flow problems (though robbing a bank is likely to cause a slew of other problems, so we don’t recommend it). Diane Robb, owner of Screenprintz in Sarnia, Ontario, says she learned her lesson about ensuring steady cash flow the hard way – after a client’s $2,200 check bounced, throwing her shop out of balance for more than a week. Now, Robb says, she requires customers to provide a 50% deposit for any custom order. Danny Friedman, vice president of Added Incentives, agrees that asking for a deposit can be a necessity. “Sometimes it’s uncomfortable to ask for that, but it’s more uncomfortable not to be able to pay your bills and go out of business,” he says. “A lot of times you just have to go with your gut to determine whether you should ask.”

Diversification is also a great tool for improving cash flow. Screenprintz, for example, fills its downtime by selling graphic design services for print materials, Robb says. It’s important to diversify in a calculated way, however. Jimmy Lamb, an industry veteran and regular columnist for Wearables, says apparel decorators should have a firm grasp on their sales cycles to help them determine how to proceed. Lamb followed his own advice when he ran an embroidery shop: “We found that January and February were our worst months. That’s when we started doing mobile embroidery for boating shows to fill in the gaps. We almost had a different business model for three months of the year.”

Another way to help with cash flow is to invest in e-commerce. “Customers are accustomed to paying for goods up front at checkout, so you get positive cash immediately,” says JP Hunt, a partner and co-founder of InkSoft, a software developer for apparel decorators. When you set up a group buying program (such as school spiritwear for a team), there’s typically a 30-day buying period, where individuals go online, select items and pay. The decorator generally waits to fill the entire order once the campaign ends. “You’re harvesting and benefiting from upfront cash flow because of the way those programs work,” Hunt says.

It also may be worth considering negotiating better terms with your suppliers, perhaps getting them to extend payments from 15 days to 45 days, says John Story, a business consultant and marketing professor at the University of St. Thomas in Houston. When business is going well, you take care of accounts payable within 10 days, but during lean times, take advantage of the full 45, he adds. Don’t try this unless you’ve already established a good relationship with your suppliers, Hunt warns. “The potential to abuse it is serious,” he adds.

>>Online Exclusive: Distributors, Decorators Share Business Fears

Q: My niche market customer base has been shrinking. What can I do?

A. Follow up with existing customers to address unmet needs and seek referrals.

B. Ramp up your marketing efforts on social media and beyond.

C. Branch out into new markets.

D. Rig a net outside your showroom to scoop up unsuspecting passersby.

Answer: Option D takes the idea of “customer capture” to an unhealthy extreme. However, A, B and C are all valid strategies for this situation. Consider the case of Susan Campbell of 3 Moms Stichin’ in Creston, OH. Campbell’s small family-owned shop specializes in embroidered patches, particularly for motorcycle rallies. “We fear the biker population is dwindling,” she says. “We’re all getting old and are wondering if there will be a younger biker generation to take their place.”

Campbell’s issue is very familiar to Joyce Jagger, a business consultant known as The Embroidery Coach. Jagger points out that Campbell’s client base could already be larger than she realizes. “These people are all part of something else other than just motorcycles,” Jagger says. They probably have jobs, children and grandchildren, memberships with other organizations. All of these areas have their own custom apparel needs. “Sometimes it’s as simple as picking up the phone and calling them and letting them know of the other things you do,” Jagger says. “Ask them, ‘What can I do for you that you’re not getting someplace else?’”

Jagger also recommends creating a formal follow-up system to keep your shop top of mind, even after a customer has placed an order. You should be checking in on your regular clients, in person, several times a year, according to Friedman. “They have to know you’re more than a phone number and an email address,” he says. “It’s a lot easier to say no to an email or 800 number than it is to a person.”

Q: Business is booming – I can’t even keep up with all the orders! How should I handle the volume?

A. Contract some of your work out to a trusted partner.

B. Hire more employees and/or purchase additional equipment.

C. Examine your systems and scheduling to make sure you’re working as efficiently as possible.

D. Install cybernetic third arms for each of your employees.

Answer: A and B are both acceptable moves, but before you shell out hard-earned money – or shunt off jobs to a potential competitor – it’s worth taking a deep dive into operations to make sure you’re really as busy as you think you are. Oftentimes, Jagger says, small businesses are scrambling because they’re disorganized, not overscheduled. “They don’t have a system in place,” she says. “They don’t know where a job is or when it’s due. There’s nothing on the schedule. It’s just whoever is screaming the loudest to get their order.”

Once you have a handle on your production schedule and have organized your workflow, you might be surprised at how much time you gain back. If you still find yourself with too many jobs to handle, it’s time to explore expanding your equipment and staffing. Oh, and we’d advise against those illegal limb enhancements – sourcing might be tricky.

Q: I’m finally serious about protecting my business in case of a natural disaster. Now what should I do?

A. Consult with your insurance agent to make sure you have ample coverage.

B. Put together an emergency plan and train your employees to follow it.

C. Prepare by watching a Sharknado marathon.

Answer: The key to dealing with a natural disaster is preparation. If you hear about a hurricane on the news or see it approach on the horizon, it’s too late. “They will cut off insurance as soon as they see something forming,” Lamb says. “You need insurance now, and you need to know what’s covered.” Lamb also suggests looking into business interruption coverage, which can be pricey, but could be essential. Business interruption insurance will provide income while you work on getting your business back up and running. “If your business is full-time and that’s your whole source of income, you should talk to an agent about it,” Lamb says.

In addition to robust insurance, business owners should put together an emergency plan, including detailed protocols for every possible disaster that may strike. Make sure your employees are aware of and trained for their roles in an emergency, and have an up-to-date and accurate contact list for employees to ensure quick dissemination of information if something happens. You should also back up all your paperwork and art files off-site regularly so you don’t lose vital information if you’re a natural-disaster victim. Consider taking photos of your equipment and how it’s arranged for your own records and to share with an insurance agent if needed.

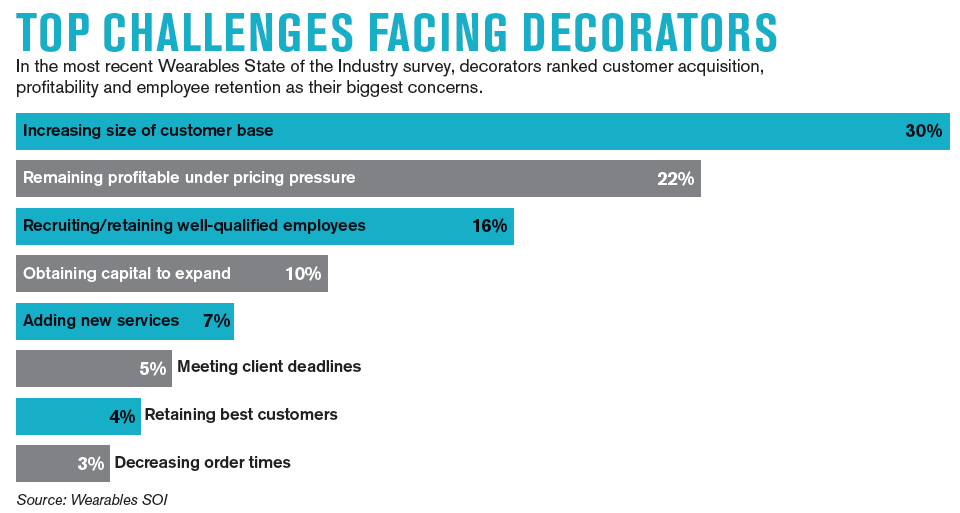

Click here for a larger image of the chart above.

Click here for a larger image of the chart above.

Q: How can I compete with the Amazons and Custom Inks of the world?

A. Set up a robust online designer and e-commerce solution.

B. Focus on the business strengths that differentiate you from the online giants.

C. Build a time machine and relocate your business to the 1950s.

Answer: The majority of distributors and decorators are never going to be a Custom Ink. “The brutal truth is you can’t compete on that level,” Hunt says. “Most decorators don’t have what they have: the funding, personnel or marketing.” However, he adds, asking how to compete with Custom Ink is the wrong question. Instead, you should be asking yourself “What makes me special? How would Custom Ink compete with me?”

Distributors and decorators should leverage their strengths: their local presence, the relationships they’ve cultivated and anything that differentiates them from large, faceless online entities.

It would be a mistake, however, to disengage completely from the internet. Social media marketing is a necessity, and most consumers expect every business to have a user-friendly website, working in conjunction with in-person service. But you don’t have to spend a ton of money on your website, says Cory Dean, owner of Ignition Drawing, a vector art and digitizing service. Dean recently launched Layout Lab, a private label online designer that he says decorators can set up in about a minute. The motivation was a troubling trend he noticed where smaller shops would send customers to sites like Custom Ink to mock up their T-shirt, then have them email the screenshot of what they’d created. “Every time that small decorator tells the softball team to design on Custom Ink and come back to me, there’s some chance they go to Custom Ink and never come back,” Dean says.

Q: How do I attract millennials to my business?

A. Make it convenient for them to buy online.

B. Get comfortable connecting via email and text, in addition to talking on the phone and in person.

C. Stay up to date with fashion trends and the latest decorating technology.

D. Repaint your showroom #MillennialPink, post a photo of #AvocadoToast on your website and wait. The millennials will come to you.

Answer: As lovely a shade as pale “Millennial Pink” is, connecting with 20- and 30-somethings requires more than a quick paint job and a crash course in memes. Focusing on A, B and C should help the younger set relate to your business. Part of it is product, incorporating fashion trends that appeal to all demographics (soft-hand tees, for example) and more specifically to millennial buyers (such as joggers). The other part is the buying process. Using technology to create a convenient and simple ordering experience is key, according to Matt Peterson, director of marketing at InkSoft. “Millennials and younger people we deal with don’t even know how to do a purchase order or use an older order system. They know online,” he says. “You have to have the option for them to purchase online and make it easier.”

But that doesn’t mean you have to throw out your tried-and-true playbook. “I know you have to adapt to technology, and technology has helped, but even with millennials, interpersonal selling is never going away,” Friedman says.

In essence, you can meet younger customers where they’re comfortable – in front of a screen – then slowly show them the benefits of old-school relationship-based selling. That’s the tactic Andy Lantzman, a sales rep with HDS (asi/216807) in Pittsburgh, is using with a new prospect who won’t take phone calls, preferring to be contacted exclusively through email. “It’s taken three times as long and is quite annoying,” Lantzman says. “For now, I’m doing it her way, but further down the line, I’ll tell her she has to get on the phone and grow up.”

Quick Hits

Q: How can I match my competitors’ low prices?

A: Don’t. Identify the things that differentiate you, and sell against them. “I’ve seen many decorators come and go, all over a pitch to sell the cheapest,” says Mike Harmon of America’s Best Apparel & Promotions in West Des Moines, IA. “This never works. It merely trains our customers that a custom shirt is no more valuable than a quarter-pounder.”

Q: How do I avoid screwing up someone’s order?

A: When you take a verbal order, be mindful of dialects and accents, says industry veteran Jimmy Lamb. Make sure everything is spelled out and proofed ahead of time. Also, when you give a customer a sample for approval, make sure you use a product material that’s identical to what will be used in the final order. A design sewn out on felt will look different when it’s embroidered onto, say, brocade mesh, Lamb says.

Q: How can I cope with increasing labor costs?

A: Streamline operations and automate everything you can, says Cory Dean. That’s been his strategy at Emerald City Embroidery, the Greater Seattle contract shop he owns. “In Seattle, wages have skyrocketed,” he says. Minimum wage is $15 an hour, which has put pressure on his firm. To help offset this, his shop uses software and A-B testing to determine the most efficient way to use each machine. Emerald City is also increasing online ordering capability to reduce the overhead associated with order processing.

THERESA HEGEL is the executive editor of Wearables. Contact: thegel@asicentral.com; follow her on Twitter at @theresahegel.