October 04, 2017

Promo Market to Target: Retail

For an industry in transition, compelling promotional products are more important than ever.

For retailers scrambling to satisfy the demands of the modern shopper, the furious pace of change has left many – from big-box to boutique – scratching their heads. Malls are closing and Amazon is the scapegoat on everyone’s tongue, yet other retail outlets have survived and thrived in this age of uncertainty.

Despite some well-publicized bankruptcies and store closings this year, revenue in the retail market has remained fairly steady. According to Kiplinger, retail sales, excluding gasoline, are expected to increase 4% in 2017, following 3.8% growth in 2016.

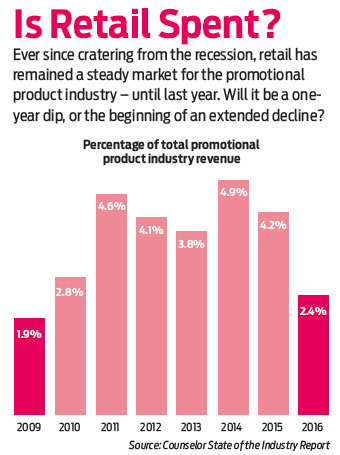

Retail’s spending on promotional products, however, may be a different story. In Counselor’s State of the Industry report, retail last year fell to 2.4% of the total promotional product revenue after averaging 4.3% from 2011-2015. It was the lowest figure since the aftermath of the recession in 2009.

On the other hand, distributors and suppliers who spoke with Advantages saw no impact on their retail clients’ expenditures. “Fortunately, we cannot say our retail clients have decreased,” says Tej Shah, vice president of marketing and e-commerce at Overture Promos (asi/288473), based in Vernon Hills, IL. “It just doesn’t apply to us.”

Mitch Mounger, CEO of Sunrise Identity (asi/339206) in the Seattle area, also has not experienced a decrease in spend with its retail partners. “A successful promotion usually leads to more in the future,” he says. “If you can drive traffic, you will get another shot.”

In truth, growth in the retail space is not distributed equally, and overall numbers alone don’t reveal the seismic shift the market is undergoing. In particular, e-commerce sales are expected to increase 14% this year, while in-store sales will have an uptick of just 1.8%.

This shift has already irrevocably changed some parts of retail, with more to follow. “Electronics and bookstores have seen a demise,” says Steve Caine, a partner who specializes in retail and customer service & marketing for Chicago-based consultancy Bain, “and structural changes are coming to the grocery industry, because they don’t want to be next.” Online grocery delivery is growing as a result, Caine says.

The demographic retailers cater to is also determining their fortunes. Caine says the rapid change in what consumers want is causing midlevel retail to struggle mightily. Nine major midlevel retailers – among them Payless ShoeSource, Radio Shack and Gymboree – went into bankruptcy in the first quarter, more than the total number of retail bankruptcies in all of 2016.

By contrast, discount stores are thriving. Retail’s biggest expanders this year read like a who’s who of discounters: Dollar General, Dollar Tree, grocers ALDI and Lidl, H&M, TJX (parent company of Marshalls and T.J. Maxx), Five Below and Ross all occupy the Top 10 in most stores opened this year.

Cost isn’t everything, however. Shoppers are increasingly seeking personalized, curated shopping experiences and are willing to pay more for it. Whole Foods (which Amazon recently acquired) and Italian specialty marketplace Eataly are two examples, Caine says.

It’s all couched in value and the shifting notion of convenience. The demise of shopping malls, often anchored by a major retailer such as Macy’s, JC Penney or Sports Authority (all of which had major closings this year) signals the move away from an “under one roof” concept, says Caine. Now, he adds, “convenience” means shopping online.

While in-store shopping is not going away entirely (and studies show that even millennials, the savviest of e-commerce shoppers, like going to brick-and-mortar stores more than shopping online), the online shift has caused retail companies to rethink nearly every facet of their promotional product spending. From more attractive gift-with-purchase (GWP) options to social media tie-ins, the retail market is fine-tuning its marketing spend to its new reality.

Renewed Purpose

In the fierce competition for shoppers’ dollars, both in brick-and-mortar and online stores, retail companies must provide items that check any number of boxes: creative, high-quality, purposeful.

Scott Pearson, executive vice president at California-based supplier Logomark (asi/67866), says he recently worked with a customer placing Home Depot–branded products like flashlights and stainless-steel tumblers near registers at the home-repair retail chain. Items like those that offer a “high-use quotient” have been gaining in popularity, Pearson says, adding that employee-reward program staples like branded mantel clocks, watches and stationery are dwindling by comparison.

The same rules apply to GWPs, Pearson adds: They work as promotions, but they need to have purpose. He cites PacSun (which filed for bankruptcy protection in 2016 but exited after successfully slashing debt) as an example of a retailer that has invested in of-the-moment “clip-and-go” products like Bluetooth speakers, power chargers, cables and cleaning cloths. “Millenials are loyal to promotional products that will have utility,” Pearson says, “and that they’ll use multiple times throughout the day. They need a benefit or a function tied to it.”

Exclusivity is also a tremendous draw. Sunrise Identity often utilizes GWP and on-pack promotions for clients like GameStop and Nintendo, and says the gaming space provides interesting opportunities to boost foot traffic and compete with online game sellers. “Retailers are saying, ‘Come here and get your collectible figurine,’ ” he says. Even something as small as hologram stickers, medallions, coins and pins are attractive to game-store owners buying promotional products, he says. Those store owners are gravitating to those products for a good reason; games are now primarily downloaded (74% last year, compared to 20% in 2009) and don’t require a store visit.

Further, offering on-pack promotions – something you can’t get when you buy the same thing somewhere else – is a good way to differentiate, Mounger says. For a video game, putting a character into a promotional item creates high perceived value because as a licensed product, consumers can’t get it anywhere else. “If you just download it, though, you can’t get that collectible case,” Mounger says.

“If you can buy the same product on Amazon, my guess is that you are struggling,” he says of retailers who aren’t pursing these avenues.

Mike Emoff, owner of Shumsky (asi/326300), says GWPs “are now strategic” whereas, “before, it was fluff.” Retailers have to be smart about GWPs now, plan way ahead and conduct ample quality and safety testing says Emoff – which creates an opportunity for creative and thorough distributors.

Such a change can work to the distributor’s benefit by boosting margins for better quality goods. A prominent national retailer Shumsky is working with has decided not to try to compete on price, but rather with exclusivity. “They are doing a lot of GWP to draw clients in,” he says, “and they’re coming to us for that retail look, because that product is actually on their shelves.”

Accordingly, products that are a natural fit with the brand should be chosen. An athletic retail product, for example, would match well with items like high-end water bottles and a tasteful headband.

Promotional items for the retail market also need to match consumer expectations of retail quality. Emoff says retailers with high brand value want the quality and presentation (including hang tags and high-end packaging) to be “like you’d see in a regular retail store.” Shumsky serves as a partner with a prominent retailer that does a lot of consumer-facing promotional wear, and also runs retail store operations for several employee-recognition programs in the tech and healthcare sectors; the product carried in those web-based and pop-up stores are filled with product similar to the Gap, but they’re branded, Emoff says. In healthcare, for example, the stores provide a unique opportunity for employees to shop somewhere besides a place like Walmart to buy scrubs.

Shah echoes the necessity for higher-quality apparel offerings when it comes to retail promotional products, saying the B-to-C customer wants “more modern and retail-esque products.”

He says he is seeing differences in what these companies want for their apparel design as well. “There’s not as much logo-on-the-left-chest anymore,” he says, “and more custom cut-and-sew. They’re also requesting more eco-friendly and socially conscious products.”

Aiming High

Local retail stores offer a much simpler avenue to finding decision-makers, but the task becomes increasingly complex as retail corporations scale up and go national (or even international). Between local stores and franchises and the myriad departments within corporate headquarters, where should a distributor start?

Mounger says Sunrise’s success has come from reaching out to corporate offices. “That is the only way to drive large-scale promotions,” he says, as many of his clients don’t even have regional buyers anymore. He also recommends going to the marketing team. “You want to stay away from procurement,” he says. “They have no money and are trying to drive costs down.”

Others echo the same sentiment: aim high. “We’ve always gone top-down,” says Shah, adding that Overture typically is in constant communication with both procurement and marketing, “and that has worked for us.”

“The higher you can go, obviously, the better,” says Rick Towne, president of POP Solutions Group in Germantown, TN. “I would say more times than not, go corporate.” He adds that promo companies should aim to speak with directors of merchandising or marketing, except in unique situations where “you’re providing signage for exterior or interior construction business,” in which case the real-estate department is a good bet, he says.

Emoff says the HR team is the best first contact for him regardless of industry, typically because that department’s promotional buys tend to center on company culture. “HR usually communicates with marketing,” he says, “but the HR gate is easier to open.”

So how then to win the retailers’ trust? Emoff advises relying on case studies with established numbers to verify their success. “Go in with data as opposed to a relationship,” he says. “You want to be able to show a retail chain that a gift with purchase drives 20% more sales.”

Such a tactic homes in on a major pain point for retailers: a breakdown in trust with customers. “Today, consumers look for new,” Caine says. “They look for change and they like being early adopters.” Beyond the quality of their products and services, retail companies need marketing solutions that will attract consumers, then persuade them to stay. Offering proof of the effectiveness of those marketing ideas can seal the deal.

The social media effect

There’s a changing dynamic in the way retailers are connecting with and influencing customers. “The established channels of TV and newsprint are no longer shaping our shopping habits,” says Steve Caine of consultancy Bain, paving the way for social media influencers to win out over traditional advertising.

“Historically, brands controlled what people knew about their product,” says Caine, “but now we learn through social media, Instagram and YouTube, so if I’m not reinventing and strengthening my value proposition, I fall out of favor.”

As a result, brands can use promotional products to take hold of the narrative on social media. Scott Pearson, executive VP at Logomark (asi/67866), says the uptick in e-commerce usage has led him to encourage clients to pursue more self-promotional campaigns on social media. “It’s all about engagement and an experience,” Pearson says. He highlights Pelican Products (whose items are exclusively distributed by Logomark in the promotional industry) as one example: “We are seeing them do more challenges, like ‘forward this post to five friends and get a free water bottle.’”

Sarah Protzman Howlett is a contributing writer for Advantages.