We love the promo industry. But we know it can be better.

How? In this series of stories, ASI Media explores five big ideas that can transform the world of promo. These aren’t quick fixes or simple changes. But with enough consideration, ambition and coordination, we think they’re all possible. And our beloved industry – and the people who live and breathe it – will be better off for it.

Like so many others in the promotional products space, Scott Slade has remained in near constant problem-solving mode over much of the last three years. The CEO of Top 40 supplier Tekweld (asi/90807) has faced rising lead times, troubling supply chain issues, challenges accessing raw materials and factories running at inefficient levels, if not sitting completely dark for days or weeks at a time.

The reason, of course, is the once-in-a-century COVID-19 global health pandemic which ignited a series of challenges for an industry long reliant on goods from China, the pandemic’s origin and epicenter. And with approximately 90% of imported promotional items coming from the country, the realities hit the promo industry hard. Companies and leaders were forced to act – with speed and decisiveness – to counter the upheaval.

5 Ideas to Improve Promo

1. How to Change Our ‘Brandfill’ Image Problem

2. Can the Promo Industry Go Plastic Free?

3. The Path to Getting Out of China

4. Use These Ideas From the World’s Biggest Companies to Improve Diversity

5. The Blueprint to Improving Promo’s Convoluted Order Process

In Tekweld’s case, Slade split up capacity to multiple factories and increased purchases to keep more goods on hand. The latter decision necessitated investing in 115,000 square feet of additional warehouse space so Tekweld could confidently fulfill client orders. It’s been an ongoing juggling act of managing inventory, communicating with overseas factories and developing measures to mitigate risk.

“Our factories in China are doing their part to be good partners and working with us closely to make sure capacity is there and that we’re forecasting properly, but it’s required constant attention,” Slade says.

Percentage of suppliers who are actively exploring new countries for sourcing due to the uncertain trade situation with China.

(Counselor 2022 State of the Industry Report)

U.S. reliance on China – Chinese manufacturing, specifically – has long lingered as a looming issue in the promotional products industry. It emerged as quite the hot topic amid the Trump Administration’s well-publicized tariff battles. (In fact, 72% of distributors were greatly concerned about the impact of tariffs this year, according to the most recent Counselor State of the Industry report.) But it was the pandemic which exposed the fragility of the supply chain, and in particular the perils of being so dependent on a single country’s manufacturing prowess. When China ceased running like a well-oiled manufacturing machine, it rattled the promotional products world.

Nearly 80% of distributors said this year they lost an order due to a supply chain issue. China certainly does not bear responsibility for every supply chain hiccup, and sourcing from other countries (particularly overseas) doesn’t offer much reprieve from the delays and soaring costs that now comes with importing products.

Still, the promo industry’s significant ties to China – combined with hovering geopolitical tensions and frustrating production issues triggered by the pandemic – sparked new questions about how, or even if, the promo industry could untangle itself from the world’s most populous nation and its greatest manufacturing hub.

Bound Together

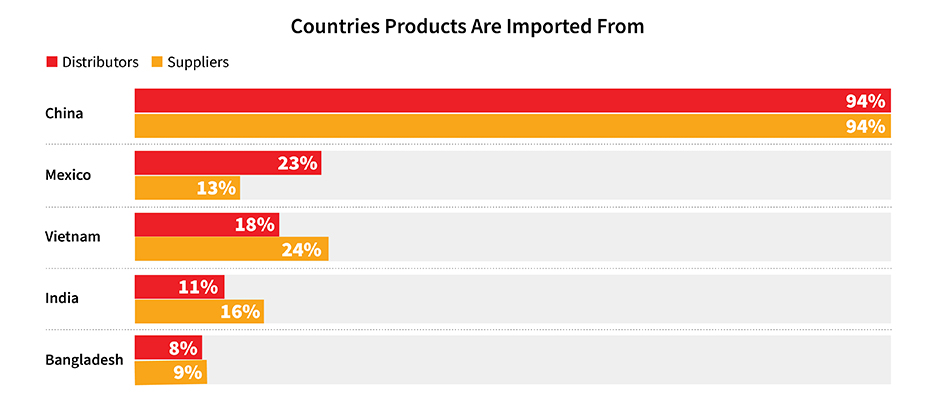

The ties between promotional products and China run deep. Of the suppliers and distributors who bring in goods from overseas, 94% of them import from China. No other country on the supplier or distributor side is over 25%.

“China is so integral to our industry because it has become a nearly one-stop shop for all the goods you might need,” Slade says.

China boasts the systems, infrastructure, raw materials and, in many cases, the compliance documentation to appease its Western world partners. (By sheer numbers alone, the country’s labor force is also quite enviable – 70% of the nation’s 1.4 billion residents, for example, are ages 15-64 – though younger generations are reluctant to work in factories.) Those inherent qualities allow the country to satisfy the end-consumer’s ultimate desire for a quality product at the lowest possible price.

China … and Everybody Else

China is still by far the predominant option for importing products. In fact, nearly 95% of both suppliers and distributors who import products source from the country.

(Counselor 2022 State of the Industry Report)

(Counselor 2022 State of the Industry Report)While tariffs on Chinese goods caused consternation among U.S. companies and continue to resonate as a concern as 2023 approaches, COVID-19 produced bigger and more intense waves. China’s strict pandemic lockdown protocols generated production and shipping delays, which contributed to rising freight costs and congested ports. The discord forced North American-based promo companies into exhaustive planning and demanded a heightened focus on sourcing and procurement functions. For some, the waters remain choppy.

“Many suppliers who were conservative in ordering inventory during the COVID lull are still playing catch-up,” observes Mark Lenox, vice president of merchandising and creative for Top 40 distributor IMS (asi/215310).

Scott Pearson, who’s taken about four dozen trips to Asia over the last two decades and tracked China’s rise as the hub for (nearly) all things promotional, says the pandemic and its resulting supply chain disruption provided a hard lesson in the folly of homogeneous sourcing. “Diverse options are necessary because you can’t be bottlenecked if something goes south,” says Pearson, who spent 18 years with former Top 40 supplier Sweda before launching 6AM Sourcing, a company specializing in sourcing custom apparel and promotional products from North America as well as Asia, in 2018.

Still, many insiders agree that getting untangled from China isn’t a straightforward, simple solution. China claims decades of perfecting its systems, building its talent base, strengthening its infrastructure and cultivating relationships with North American companies. In fact, some domestic promo companies say they don’t know where they would be if not for their Chinese partners.

“Even through COVID, our partners in China have done a good job and been there to support us,” says CJ Schmidt, CEO of Top 40 supplier Hit Promotional Products (asi/61125) and a member of the Counselor Power 50 list. “For 20 years, we’ve tried to go elsewhere, and it hasn’t worked. Without China and the relationships we’ve forged there, we’d be in trouble.”

Indeed, China has a robust history of hitting the time, quality and price standards its domestic partners seek. Pearson and his team at 6AM Sourcing regularly run logistics and cost-of-goods analyses for clients based on a particular project’s needs, comparing China to Mexico, where 6AM continues building a presence. More often than not, he reports, China emerges victorious because of budget and price.

“China is still set up for creating an easy process from quote to source to complete to ship,” Pearson says. “The country took on manufacturing and owned it.”

China boasts the systems, infrastructure, raw materials and, in many cases, the compliance documentation to appease its Western world partners. (By sheer numbers alone, the country’s labor force is also quite enviable – 70% of the nation’s 1.4 billion residents, for example, are ages 15-64 – though younger generations are reluctant to work in factories.) Those inherent qualities allow the country to satisfy the end-consumer’s ultimate desire for a quality product at the lowest possible price.

“China is so integral to our industry because it has become a nearly one-stop shop for all the goods you might need.” Scott Slade, Tekweld

As well, many of these countries aren’t generating the raw materials themselves. There again, China is the provider – blended fabrics being one notable example. China also remains the overwhelming source for hard goods as well.

To wit, Pearson recalls working on a 100,000-piece order for a tequila company. The spirit maker wanted a four-inch Aztecan-printed salsa bowl as a gift-with-purchase, and Pearson immediately tabbed Mexico as the obvious source. When the pre-production samples arrived, however, Pearson noticed they were from China. Given that project’s capacity needs and timeline, the Mexican-themed product was subsequently made in China. “That’s a testament to the complexity of things now,” Pearson says.

Compared to other nations, China also got a jumpstart on compliance issues as well as third-party qualifications and testing. While China remains a frequent target of human rights and labor groups, it nevertheless sits ahead of many other countries in addressing the compliance issues Western partners require. “The corporate and social responsibility we’ve built with partners in China, that’s hard to recreate in an instant elsewhere,” Schmidt says.

As summed up by Steve Starr, senior vice president of global programs for Top 40 distributor CIC (asi/168962): “This isn’t as simple as picking up and moving to another country or facility.”

Diversifying Beyond

So, where might the industry go from here? According to the Counselor State of the Industry report, 98% of distributors are concerned about supply chain disruptions, a nod to continued challenges plaguing China even as the impact of COVID-19 wanes. In August, for instance, some factories in southwest China closed “after reservoirs to generate hydropower ran low in a worsening drought,” Bloomberg reported.

The promo industry’s reliance on China can change, but many foresee a long, drawn-out process taking at least a decade – if not decades – to build diverse categorical capacity, infrastructure and systems elsewhere in the world. “It took decades for Chinese manufacturing to support the needs of the Western world,” Pearson says, “and China will continue leading – at least for now.”

“Diverse options are necessary because you can’t be bottlenecked if something goes south.” Scott Pearson, 6AM Sourcing

SOI data shows that 55% of suppliers actively explored other countries besides China due to the uncertain trade situation. Nearshoring (sourcing close to the end-market) has emerged as an increasingly appealing option, with Mexico in particular a popular spot for expansion. [Read more on Mexico by scrolling down to the “Destination Mexico” article within our State of the Industry international coverage.] Of note, 6AM Sourcing has started developing a supply chain in Mexico with an office in Mexico City, factories in Guadalajara and a sourcing team in Monterrey. Today, Mexico represents about 35% of 6AM’s business and includes products like apparel, bags, stationery and cups. It’s been a process, Pearson acknowledges, but it’s enabled 6AM to offer a viable alternative to its customers.

To diversify sourcing beyond China, some suggest looking not away from China but rather to China and a different kind of promising export: the nation’s manufacturing talent. In bringing proven Chinese talent to a new country to create operational and process flows mirroring China’s best manufacturing, promotional products sourcing could potentially turn in quick time when paired with calculated investments. It’s worth noting, Slade adds, that some Chinese manufacturers are themselves opening in other countries to solidify their partnerships with the Western world and diversify their own operations.

Capital investments from governments could similarly accelerate manufacturing in other countries and soften China’s hold on the promotional products industry. However, promo executives that ASI Media spoke with question the appetite national leaders and the population at large in countries like India have for manufacturing. As North American companies continue offshoring their tech talent and workforce, Slade suspects opportunities in those fields remain a more appealing proposition.

And as compelling as Made in the USA might sound as a tagline, it’s much more difficult to execute in practice. Some companies, like Tekweld and IMS, continue trying to manufacture or source more items domestically, including products like printed corrugate and acrylic products like phone stands and air fresheners. Though more costly than Chinese alternatives, some clients favor products that are both sustainable and support their organizational causes.

“Clients find value in telling the story behind how products are made and supporting the people who make them,” says Emmy Gottschalk, vice president of client operations and procurement at IMS. “The industry can continue to promote the message of sustainable local sourcing versus low-cost sourcing to help expand on this industry shift.”

Ultimately, though, U.S. manufacturing is unlikely to be a realistic solution on a large scale, especially as the nation further sheds its manufacturing roots and hustles toward a service economy. On the labor and costs front, China and many others lap the U.S.

“There are viable reasons to move things over and diversify to other countries, but at the end of the day, a lot of people are still counting on China,” Slade says. “It’s the nature of our global economy at this point.”

Discovering the Path Ahead

Like others, Gottschalk stands increasingly hopeful the promo industry can shed its over-reliance on China, even if that seems a daunting, long-term initiative requiring significant time, effort and investment.

“I think recent events in the world have started to shift the thinking of more consumers and a younger generation entering the marketplace that values product differently,” Gottschalk says.

“Clients find value in telling the story behind how products are made and supporting the people who make them. The industry can continue to promote the message of sustainable local sourcing versus low-cost sourcing to help expand on this industry shift.” Emmy Gottschalk, IMS

Gottschalk and her IMS colleague Lenox both hope to see the industry’s trade organizations work toward spotlighting vetted, alternate sources for distributors outside of China, including potentially having a special area at industry events showcasing such manufacturers. Such a move they say would help champion sustainable local sourcing as an important trend. In addition, Lenox says working with key overseas sourcing agencies might also help promo companies locate other manufacturing resources.

Starr says promo companies control the purse strings and he remains hopeful the industry aligns under one thoughtful group of standards – an admittedly challenging feat given the livelihoods and business at stake. “But as an industry,” he says, “we have the opportunity to get behind the right standards.”

Starr touts the importance of transparency and the power of buying decisions to stir industry-wide changes. He urges promo companies to diversify their supply chain where possible and to pursue change in small steps, such as committing to reduce sourcing from China by 3% on an annual basis.

“It might be painful,” Starr says, “but it is possible.”