July 10, 2019

SOI 2019: Effects Of U.S.-China Trade War On The Promo Products Industry

The trade war between the U.S. and China has proven increasingly problematic for promo firms, and more uncertainty may lie ahead.

If inevitability had a sound, it was the ping coming from the distributor’s inbox. Days after President Trump placed 25% tariffs on $200 billion worth of Chinese imports, a supplier had emailed a message. The note explained that in the “coming weeks, we will be increasing prices from 10% to 20%.”

More SOI 2019: Back to Main Page

An outpouring of similar emails from suppliers to distributors made May a disconcerting month for the promo market. The messages highlighted the inarguable reality that the U.S./China trade war had driven price hikes on levy-listed promo products – and triggered a bevy of related disruptions that have been felt by many industry firms over the last year. “It’s affecting everyone,” says Jonathan Isaacson, president of Top 40 supplier Gemline (asi/56070).

Podcast

Dave Vagnoni interviews the CEO of CIC to get his take on the rise of distributor profit margins, the impact of tariffs on promo and the top markets to target for sales.

That initial burst of tariffs could be just an opening volley. President Trump has threatened to impose 25% tariffs on an additional $300 billion in Chinese imports, which would include promos in almost every category. Practically nothing would be exempt from levies, placing distributors in a tough spot.

“If we have to increase pricing to the end-consumer, we’ll start to push them into other avenues of spending for their marketing dollar,” says Bob Herzog, CEO of Top 40 distributor Corporate Imaging Concepts (asi/168962).

A Lasting Mark

Even if all tariffs are rescinded tomorrow, they’ll have already left an indelible imprint on promo. For instance, they’ve caused suppliers – and distributors who source directly from China – to rethink the supply chain. Firms could shift production to the U.S. or partner with more domestic manufacturers to counter rising overseas costs.

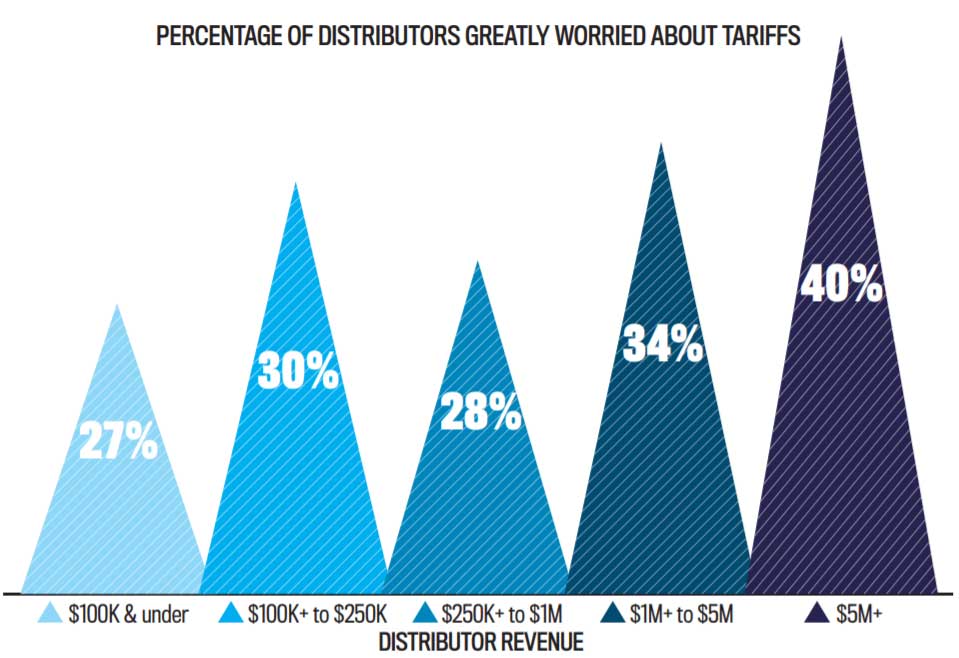

With the promo market’s dependence on China for production, it’s no surprise the majority of distributors are feeling uneasy about tariffs. A prolonged trade war would push prices higher, affecting margins and possibly even the value perception of logoed goods.

Uncertainty over tariffs has led some suppliers to avoid producing physical catalogs, to offer print catalogs without pricing, or to put costs in their catalogs with the caveat that they’re subject to change – a shakeup for an industry that’s typically held to stable annual prices.

“This will be the first step in moving away from the annual pricing commitment and toward a variable pricing model,” says Howard Cubberly, general manager at Goldstar (asi/73295). “While it’ll present difficulty in programs, company stores and repeat business, there really will be no choice.”

Still, while tariffs are a challenge, some promo veterans believe the market will collectively overcome them. “Our industry is resilient and creative,” says Bill Korowitz, CEO of Top 40 supplier The Magnet Group (asi/68507). “Before tariffs, we had Prop 65. Before that, it was product safety. We’ll get through this with honest dialogue.”

A Domestic Revival

Tariffs on Chinese imports are fueling more requests for made-in-the-USA promotional products, while pushing sales at some suppliers higher.

Beth Friese, marketing services manager at Fey Promo (asi/54040), says the Minnesota-based supplier has experienced greater growth in its U.S.-made products than its imported items since the tariffs took effect. “The uncertainty and concern of tariff impact has resulted in more interest in made-in-the-USA,” says Friese. “This interest has brought renewed attention to these products.”

Laurie Woodruff Jackson, founder of supplier Woody’z (asi/98175), which primarily offers stateside-manufactured plastic drinkware, says her Santa Ana, CA-based company has had large former customers return since November of 2018. “The tariffs seem to have pushed the obstacles for doing business in China to the point that it’s not worth the potential cost savings,” Woodruff Jackson says.

Top 40 supplier BIC Graphic (asi/40480) produces nearly 50% of its order volume in U.S. facilities. Since tariffs on $200 billion in Chinese imports took hold last September, BIC has experienced a “slight uptick” in inquiries and website-based searches for USA-made products. Interest has been especially strong in proprietary brands, including BIC writing instruments and KOOZIE.

Will the appetite for American-made last? It depends on several factors. If the U.S. were to suddenly lift tariffs, suppliers sourcing from China could reduce prices, stalling domestic manufacturing momentum. It’s also possible that broader negative economic fallout from import levies could choke marketing budgets. “While we’re expecting further ramp-up in made-in-the-USA products, especially in Q3 and Q4, we’re also monitoring the impact tariffs will have on end-customers and whether it’ll lead to reduced spending on promotional items,” says Friese.

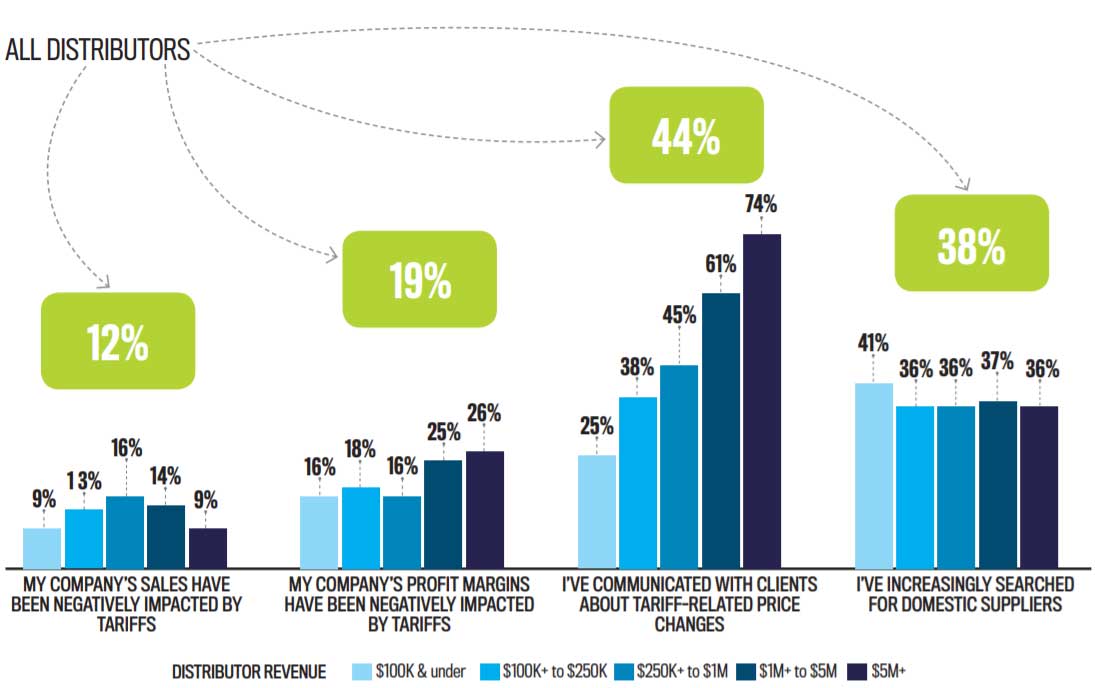

The economic conflict between the U.S. and China has affected distributors in several ways beyond prices. For example, more than one-third of distributors have searched for domestic buying options, flipping their Asia-first sourcing approach.

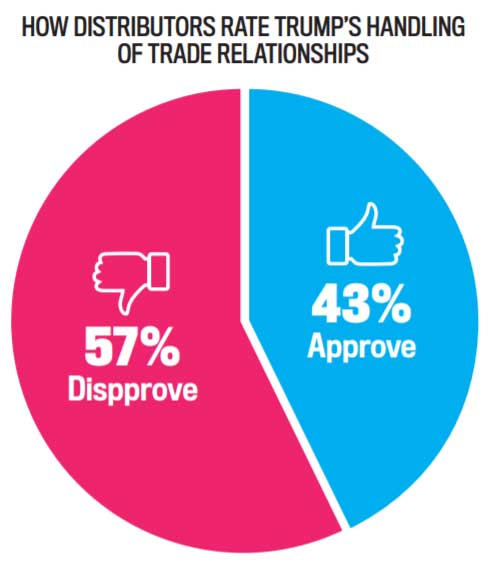

Counselor asked distributors if they think the Trump administration’s international trade policies – including tariffs on Chinese imports – have been good for the promo products industry. While some see the potential for long-term gains, like a reduced trade deficit, most distributors disagree with the president’s strategy.

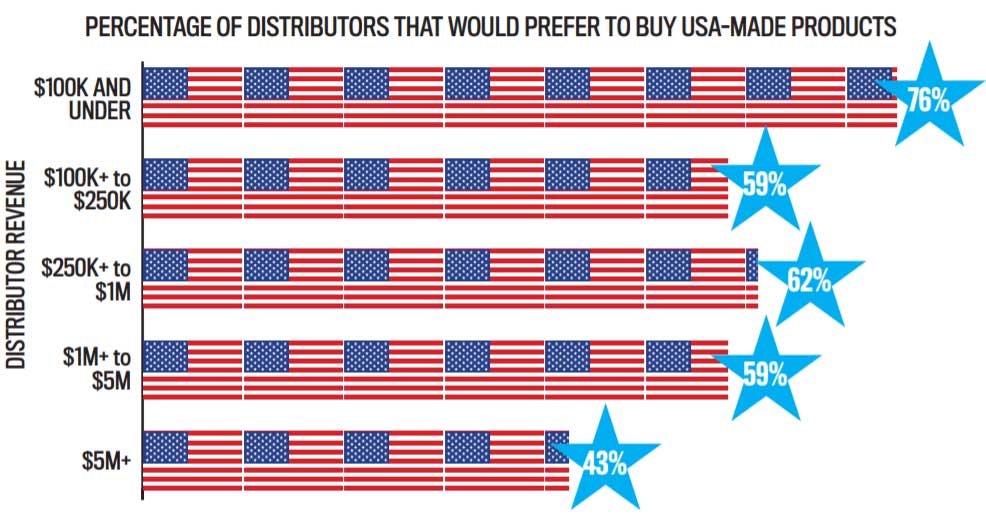

If given a choice, small distributors would rather buy promo items from domestic manufacturers. The largest revenue class of distributors has a different view, suggesting it would take a prolonged period of tariffs to change their price-driven overseas sourcing patterns.