July 22, 2020

SOI 2020: Consolidation in the Cards

The reality of prolonged shutdowns: Many firms may not be able to recover, prompting a wave of closures and acquisitions.

COVID-19 isn’t just shrinking sales of promotional products. It’s likely to reduce the number of companies operating in the industry.

Don't Miss: More SOI 2020

Both promo market leaders and private equity executives who’ve invested in the promo products space believe the recession resulting from the coronavirus pandemic will lead to a rise in business closures and increased mergers and acquisitions. In responding to an ASI survey in July, distributors predicted that, on average, their full-year 2020 sales would be about 35%% lower than their 2019 sales. Some companies simply won’t be able to resurface from such a precipitous plummet.

“The number of distributors and suppliers that are not going to survive this pandemic will shock many people. The blood is already in the water,” says Bret Bonnet, president of Aurora, IL-based Top 40 distributor Quality Logo Products (asi/302967). “Those with a strong cash position and existing book of business will survive. Many who are over-leveraged will not. Capital is going to be an ongoing problem for many no matter what the Fed does to keep the money flowing.”

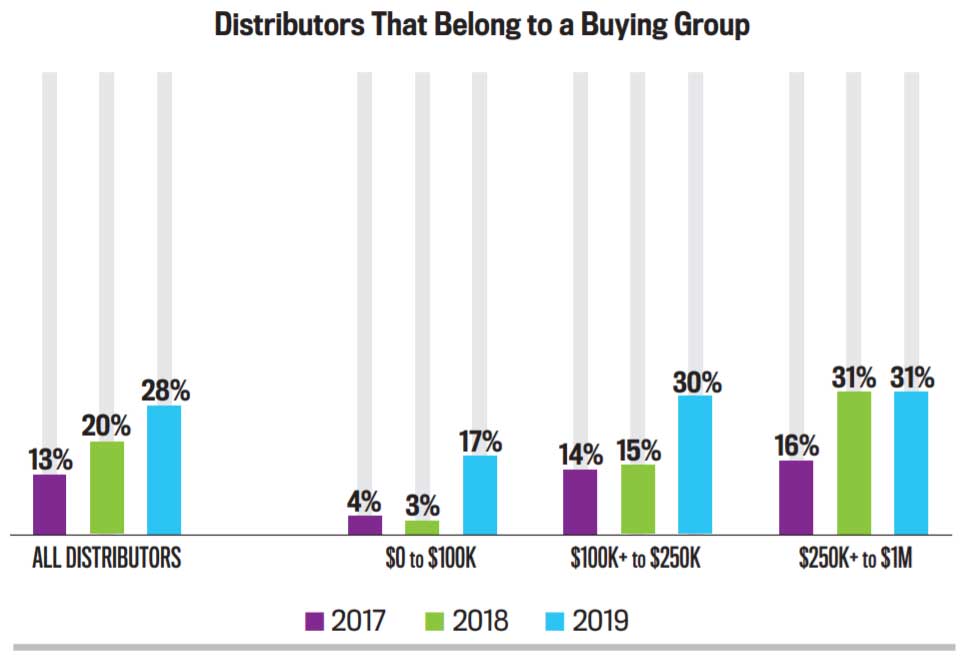

Part of the Group: Distributors, especially smaller distributors with under $1 million in revenue, have increasingly joined buying groups over the last three years.

Brandon Mackay thinks both the supplier and distributor sides of the industry could each see permanent closures of up to 5% of the businesses that were operating before COVID-19. The CEO of West Jordan, UT-based Top 40 supplier SnugZ/USA (asi/88060) says conditions are rife for such widespread shutterings, given the challenges companies have faced, from withered end-user demand to supply chain and inventory issues, to government-mandated temporary closures.

“During the Great Recession of 2008-09, some promo companies that didn’t have the right balance sheet just disappeared,” Mackay recalls. “I speculate it will be the same this time around.”

Craig Nadel, president of Los Angeles-based Top 40 distributor Jack Nadel International (asi/279600), paints a similarly sobering picture. “I expect a lot of companies will go away,” he says, “either completely through bankruptcy or through mergers.”

M&A Predicted to Accelerate

Even before the pandemic, mergers and acquisitions were proceeding at a robust pace in the promo industry.

“This resulted from the economies of scale and the additional capabilities that create more value than smaller or mid-sized businesses could bring to bear acting independently,” asserts Marc Simon, CEO of Sterling, IL-based Top 40 distributor HALO Branded Solutions (asi/356000). “These benefits will continue to be available even in the whirlwind of these challenging and stressful times.”

HALO has been, arguably, the promo market’s leader in acquisitive activity in recent years. Since 2018, the company announced acquisitions that included the purchase of three fellow Top 40 distributors – CSE, Sunrise Identity and, in early 2020, Axis Promotions.

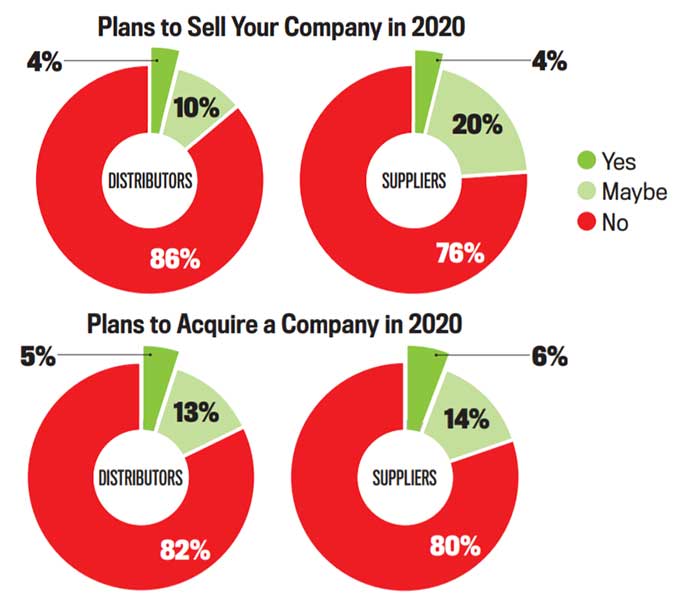

Making a Move: Suppliers indicated they’re more likely than distributors to sell their company this year – an indication of the difficulties facing suppliers from the shutdowns and anemic sales.

With the upsides of M&A that were available pre-COVID still in play and with the financial distress many industry companies are now experiencing, Simon and other executives expect mergers and acquisitions to ramp up. The reasons? Companies will struggle to reduce their operating expenses to be solvent, and lack the necessary liquidity to weather a prolonged downturn. “The highly fragmented nature of our industry and the presence of so many smaller companies make promo particularly vulnerable,” Simon adds. “As such, it seems inevitable that the pandemic will drive more mergers and acquisitions.”

“The number of distributors and suppliers that are not going to survive this pandemic will shock many people. The blood is already in the water.” Bret Bonnet, Quality Logo Products

Nancy Schmidt, CEO of Appleton, WI-based Top 40 distributor AIA Corporation (asi/109480), also anticipates that industry consolidation will be a major trend. “As distributors and suppliers have had to quickly shift their product offerings and keep up with the demand,” she says, “we will likely experience accelerated industry consolidation as a result of COVID-19.”

Simon shares the perspective of certain other industry executives who believe M&A will be more prevalent among suppliers. “The existence of fixed operating expenses that cannot be easily reduced, coupled with the working capital investment in inventory that suppliers need, make the necessity of action that much more pronounced,” he says.

Continued Presence of Private Equity

In recent years, another factor that’s fueled industry consolidation through M&A has been the influx of private equity money into the promo space. (Top 10 distributors and suppliers that are PE-backed include HALO, Polyconcept and alphabroder.) PE has been increasingly attracted to promo because of what principals have described as the market’s past and future growth, as well as its fragmented nature that opens the door to opportunities for additional profitable acquisitions. That interest will remain and could even intensify.

“We would expect to see a pickup in add-on acquisition by private equity-backed firms in the promotional products industry in the months ahead,” says Jeff Robich, principal at Cleveland, OH-based private equity firm Blue Point Capital Partners, which is invested in promo companies that include Gardena, CA-based Top 40 supplier Next Level Apparel (asi/73867). “PE-backed portfolio promo companies that were performing well before COVID-19 will try to take advantage of the market disruption to execute strategic acquisitions.”

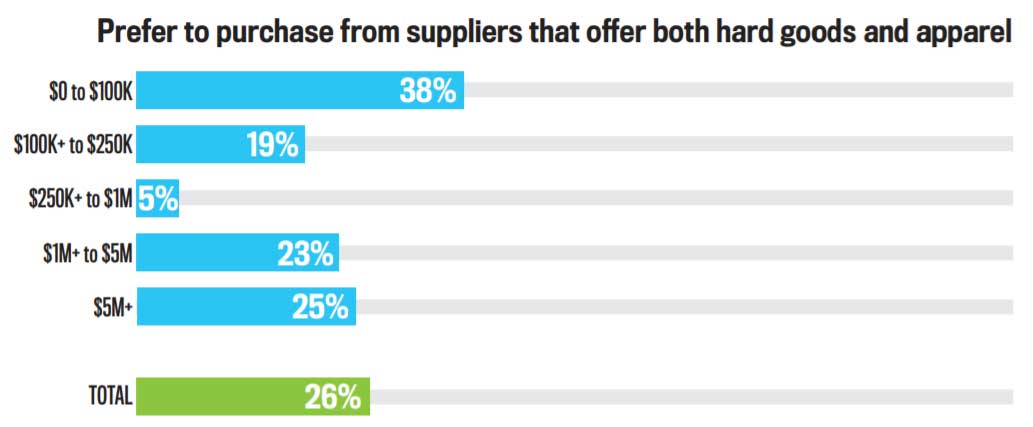

Simplified Spending: A consolidated marketplace may tilt toward suppliers that successfully offer a broader array of products – a setup favored most by the smallest distributors.

Other private equity executives see things differently. There could be a temporary dip in transactions as “M&A markets adjust and business performance reflects typical recessionary challenges,” says Scott Finegan, managing director at Chicago-based private equity company Pfingsten Partners, which acquired Sign-Zone, parent company of supplier Showdown Displays (asi/87188), in 2017.

Ultimately, however, Finegan believes PE interest in promo “will stay strong in the months and years ahead. … Consolidation is inevitable as companies look to scale and expand their product offerings to better serve their customers.”

As far as consolidation goes, Simon picks up on a similar theme. “We’re in for a prolonged period of promotional products revenue decline,” he says. “Owners and operators who aren’t prepared for this will find themselves under great stress. Some will permanently close while many will find merger partners. The stronger companies will come out of this with much greater market share in what will likely be a smaller market for more than a couple of years.”

Consolidation Through Partnering

The monumental business challenges that COVID-19 has instigated could cause more distributors to join larger distributorship networks that allow smaller firms to retain ownership of their businesses. The pandemic could also compel more small and mid-sized distributors to become part of industry partnering organizations commonly called buying groups.

That’s all according to certain industry executives who see the activity as another type of consolidation. While the distributorships wouldn’t be going away or giving up their current ownership under such scenarios, they would be joining bigger, more encompassing organizations, leading to greater consolidation of spending power in the promo space.

Appleton, WI-based Top 40 distributor AIA Corporation (asi/109480) is among the top distributorships that allow other distributors to join its network and benefit from various services, partnerships and back-end support while still allowing the companies to keep independent ownership. AIA CEO Nancy Schmidt expects a rise in interest in AIA as more companies look to partner to gain scale, upgrade technology and benefit from professional services they wouldn’t be able to get on their own.

“Consolidation can take many forms,” says Schmidt. “The distributor segment of the promotional products industry is large and fragmented, and in the current environment of uncertainty, we think more distributors will seek to manage risk by consolidating.”