April 26, 2018

Distributor Sales Rise in First Quarter

Promo products distributors increased their sales in the first quarter of 2018 by 3.4%, according to new data released by ASI. The rise in sales isn’t as high as the 3.5% jump recorded in the fourth quarter of 2017, but is up from the 3.3% reported in the first quarter of last year.

Podcast

Listen as Counselor’s Dave Vagnoni and ASI Research Director Nate Kucsma talk about first-quarter results, what’s behind them and what’s ahead for the rest of the year.

Top 40 distributor AIA Corporation (asi/109480) has seen similar gains among its AIA owner community, said CEO Matt Gresge. In Q1, AIA owners achieved 3.7% growth, but total gross profit dollars grew by more than 10%, indicating owners are enjoying higher margins on their sales, according to Gresge. More than 30% of AIA owners saw first-quarter sales grow by more than 10%, the company said.

“We’ve found that AIA owners who are most focused on selling complete solutions to their customers are enjoying the most growth,” Gresge said.

Sales at TJM Promos Inc. (asi/342485) are also in line with average industry Q1 gains. “We had an exceptional single large order in January of 2017 that throws our numbers off a bit. Without it, our growth is right at that 3.4% overall and I’d expect 3.6%-4% growth overall for the year,” said Justin MacDonald, the firm’s general manager.

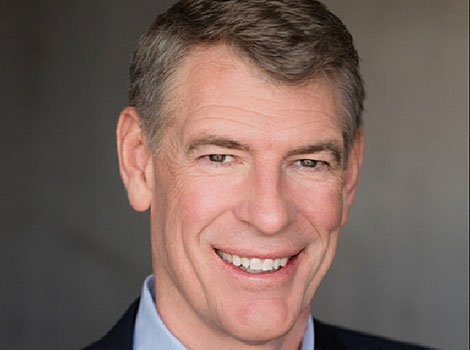

AIA Corporation CEO Matt Gresge

AIA Corporation CEO Matt Gresge

About 39% of distributors reported an increase in sales in the first quarter, while 22% reported a decrease. In a departure from the usual trend, mid-size distributors (those with between $250,000 and $1 million in sales) increased their sales the most, with 3.6% year-over-year growth for the quarter. Meanwhile, large distributors (more than $1 million in revenue) had sales rise 3.2% compared to the first quarter of 2017. Small distributors (with annual sales under $250,000) experienced a bump up in sales of 2.9%.

“It’s really exciting to see mid-size distributors with the most growth,” said Danny Rosin, president and co-owner of Brand Fuel (asi/145025), which reported 12.9% growth in the first quarter. “Brand Fuel’s growth is coming from clients spending their dollars on higher quality, more expensive items, edging our average order size up. We’ve also capitalized on human resources’ dollars because companies recognize they must invest in talent recruitment and retention strategies in competitive markets. Our services – online stores, fulfillment and experiences divisions – are growth contributors as well.”

The Counselor Confidence Index (CCI), which gauges the health and optimism of distributors, edged higher, reaching 115 in Q1 of 2018. That’s up from 114 in Q4 2017 and marks three consecutive quarters of CCI jumps. Compared to the OECD (Organization for Economic Co-operation and Development) Business Confidence Index from 2013 through Q1 2018, it appears distributors in the promotional products industry are as confident, or even more confident, than U.S. businesses as a whole.

Gresge expects the momentum to continue in Q2, both for the industry as a whole and for AIA owners. In fact, he said the company is already seeing a record level of booked orders that’ll be invoiced in the second quarter.

“I’ve noticed over time that the promotional products industry sales typically correlate to changes in U.S. GDP,” Gresge said. “In 2017, the GDP was up and so were the industry’s sales. As the GDP is expected to grow more in 2018, it’s also likely that the promotional products industry will continue to flourish.”

The improvement of the CCI reflects a general sense of optimism among distributors as they plan for the remainder of this year and into 2019. More than half of distributors (56%) are predicting a year-over-year increase in sales overall for 2018.