April 15, 2021

Cimpress Shares Preliminary Q3 Results

Sales were down, and the company had an eight-figure operating loss, but there were positives, too. The Top 40 firm also announced a new debt transaction.

Top 40 distributor Cimpress (asi/162149), parent company of Vistaprint and former Top 40 firm National Pen, reported that preliminary results show that its total global sales declined 3% year over year to $579 million during the firm’s fiscal third quarter of 2021, but business revved up in March – a sign of positive things to come, the Dundalk, IE-based company believes.

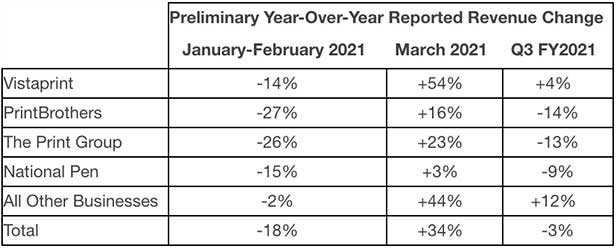

Cimpress’ third quarter corresponds to the calendar year first quarter – January through March. During the first two months of 2021, sales were down compared to the prior year across all business units, but come March, sales increased across all units compared to the same month in 2020.

Robert Keane, CEO of Cimpress

Partially, that’s a consequence of March 2020 sales having been so awful due to the onset of COVID-19, but that’s not the only reason. The 54% year-over-year increase Vistaprint experienced in March was strong enough to power that business unit – which is Cimpress’ flagship business – to a 4% increase for the entire quarter compared to the prior year’s quarter. Analysis shows clients, in certain regions, are increasing investment in print and promo again.

“We have begun to see recovery in the parts of the world where pandemic restrictions have been lifted or are less severe,” Cimpress said in a statement. “For example, preliminary Vistaprint bookings in Australia grew approximately 10% for the third quarter, while bookings across European countries declined by approximately 7%; likewise, bookings from customers in less restricted U.S. states such as Florida, Texas and Georgia are recovering more quickly compared to bookings in U.S. states such as California, Pennsylvania or New York that have been more restricted.”

This chart shows the year-over-year performance of Cimpress’ various business units.

National Pen’s sales, up 3% year over year in March, were down 9% year over year for the full quarter. Companywide, Cimpress experienced an operating loss of $16 million in its fiscal Q3, preliminary results show. EBITDA was reported at $55 million. Total debt stood at $1.34 billion.

Speaking of debt: Cimpress said that it’s raising a senior secured Term Loan B of approximately $1.15 billion to repay existing secured debt and to bring liquidity onto its balance sheet. Cimpress plans to use the new debt to redeem its 12% second lien notes due 2025, repay amounts drawn under its revolving credit facility and repay all borrowings in respect of a Term Loan A under its secured credit facility. The transaction will be approximately net leverage neutral on a pro-forma basis, according to the company.

Cimpress is expected to announce its full third-quarter fiscal 2021 results on April 28.

“Amidst the ongoing pandemic, we see much reason for optimism,” said Cimpress CEO Robert Keane. “We may continue to see some bumps in the road in the near term, but we are increasingly confident based on recent trends and we have an opportunity to continue growing our market share, leveraging the investments we have made over recent years.”

Based on estimated 2019 North American promotional products revenue of $477 million, Cimpress ranked sixth on Counselor’s most recent list of the largest distributors in the industry. The new rankings are due out in the summer of 2021.