August 13, 2019

Trump Import Tariff Delay Isn’t A Real Reprieve For Promo

Many items that promo products firms import and sell will still be subject to a new tariff of 10% come Sept. 1.

President Donald Trump’s Tuesday announcement that he’ll be delaying the imposition of new tariffs on select Chinese imports sent stocks higher, but isn’t a true reprieve for promotional products companies, as levies affecting many items sold in the ad specialty space are still set to take effect Sept. 1st, industry executives say.

A couple weeks ago, Trump declared he would impose tariffs of 10% on an additional $300 billion in Chinese imports come September.

Now, the president is delaying imposing the tariffs until Dec. 15 on select products that include cellphones, laptop computers, video game consoles, certain toys, computer monitors, and particular items of footwear and clothing, the Office of the United States Trade Representative announced Tuesday. A full list of items currently slated for tariffing on Dec. 15 is here.

Additionally, certain products are being removed from the tariff list based on health, safety, national security and other factors and will not face additional tariffs of 10%, the USTR said. The trade representative’s office also indicated that it will have an exclusion process for the newest round of tariffs. That means that individual companies will be able to avoid the duties if they can convince officials that their businesses would be unduly harmed.

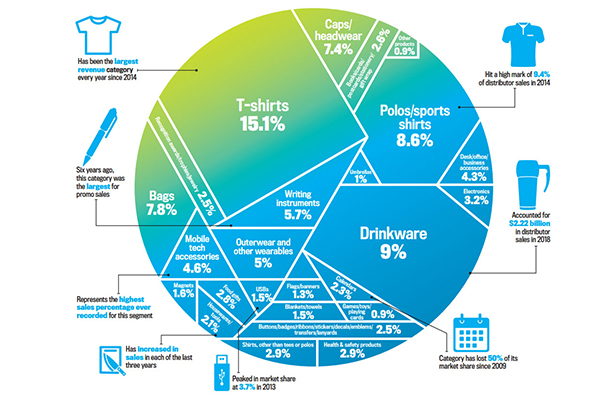

Nonetheless, the majority of products the stateside promo industry sells are produced in China, and 10% tariffs on a range of such items are on track for a Sept. 1 effective date. Products include various types of T-shirts, which as a product category account for 15.1% of annual distributor sales, Counselor State of the Industry research shows. Other items still being impacted Sept. 1 include various types of pens, pencils, sweaters, pullovers and jackets. Indeed, the tariff list for Sept. 1 contains 137 references to “outwear” – or outerwear, a category that, along with other wearables, accounts for 5% of total distributor sales. “The effect on our market will depend on the category but, at this point, as an industry, we are still dealing with the issue of tariffs,” Jonathan Isaacson, president of Top 40 supplier Gemline (asi/56070), told Counselor.

As such, impacted products could see price increases within the promo industry in the months ahead as suppliers replenish stocks with product imported under the tariffs. Jason Lucash, a board member and senior VP of marketing and product at Top 40 supplier HUB Promotional Group (HPG; asi/61966), told Counselor that additional products HPG expects to see impacted by Sept. 1 tariffs include can coolers, speakers and power supply products.

“All the remaining products that weren’t previously hit in the first round of tariffs at the HPG brands are still going to have the tariff come into play in a couple weeks,” Lucash told Counselor. “We obviously are going to try to alleviate the blow to distributors as much as possible and only are going to have the tariff come into play once current inventory positions deplete.”

The promo industry has already experienced price increases on particular items affected by Trump’s placing of tariffs on some $250 billion in Chinese imports to date. China has countered U.S. tariffs with levies of $110 million on American imports – and by not buying American agricultural commodities, among other measures, such as letting the value of the yuan depreciate against the dollar.

The U.S./China trade war has been filled with uncertainty, with the world’s two largest national economies seemingly vacillating between near-deals (earlier this year there was hope a deal would be in place by Memorial Day) and escalating tensions that have rattled markets and triggered fears of a global economic recession. Like those in many industries, promo firms have been caught up in the middle.

“The most difficult thing about this is the uncertainty,” said John Bruellman, president and CEO of Sign-Zone, parent company of Counselor’s 2017 Supplier of the Year Showdown Displays (asi/87188). Bruellman told Counselor: “We are built for transparency, predictability, accuracy and speed for our customers. Our entire model is based on that service for distributors. They rely on it. It becomes much harder to provide that level of service when we don’t know from day-to-day what trade policy will look like.”

Indeed, the trade war and its tariffs have caused repercussions in promo that include destabilized annual pricing and supply chain disruption – the latter having been accelerated as companies move to find sourcing destinations beyond China where goods can be produced. Some worry, however, that the sourcing diversification could, in cases, lead to laxness on product and social compliance regulations that harm industry firms.

Despite the challenges, certain ad specialty companies say they’ve remained nimble and found ways to adapt. “We can’t operate our company based on the fluctuating news that comes out what seems like daily now,” Jon Alagem, president of New York-based distributor Harper+Scott (asi/220052), told Counselor. “When this whole trade war started, Harper+Scott put in measures to assure our clients would not be affected then or as it continues. We have worked with our factories in China, but have also opened offices in other countries to mitigate the pricing risks. We’re in a really good place no matter what the news could be tomorrow.”

Even with contingencies in place, promo firms are eager for an end to the trade tensions. Continued conflict is “a lose-lose situation for the world,” Memo Kahan, owner of Top 40 distributor PromoShop (asi/300446), told Counselor. Unfortunately, certain trade experts and promo industry leaders fear a deal is not forthcoming. “I’m super pessimistic,” Joshua White, general counsel and SVP of strategic partnerships at Top 40 distributor BAMKO (asi/131431), told Counselor. “I think there’s a deeper conflict here about how the world should be structured and tariffs are a symptom. I certainly don’t see China budging at all. My sense is that this is sort of the framework for a new normal that sees China and the U.S. being more overt about the oppositional nature of their respective interests.”