August 04, 2020

Manufacturing Expands, But Job Losses Continue

The U.S. manufacturing sector grew for a third straight month.

Manufacturing activity in the U.S. expanded for a third straight month, but job losses continued in the space as demand remained below pre-pandemic levels, according to the Institute of Supply Management’s (ISM) monthly survey of activity in the sector.

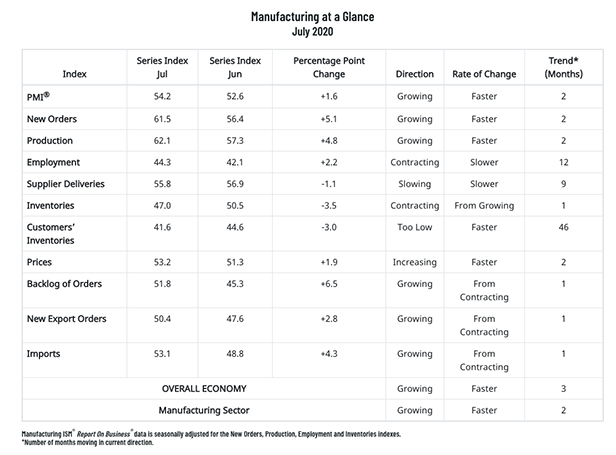

ISM reported that its monthly Purchasing Managers Index (PMI) rose 1.6 percentage points over June to 54.2%. Readings above 50 indicate expansion. PMI had retreated to an 11-year low of 41.5% in April.

@ism: Manufacturing activity continued to rebound, expanding at the fastest pace since March 2019, with the headline index rose from 52.6 in June to 54.2 in July, buoyed by strong growth for new orders and production, both of which had their best readings since autumn 2018. pic.twitter.com/NeaCKcdRIU

— Chad Moutray (@chadmoutray) August 3, 2020

While any growth these days is good news, it comes with a caveat: The expansion is measured only against the previous month’s activity. Overall, U.S. manufacturing remains down following the economic collapse that occurred in late March and April amid the COVID-19 pandemic and its related societal and business shutdowns.

“Diffusion indexes like the ISM capture rates of change of activity, not levels, and output remains depressed,” chief economist Ian Shepherdson of Pantheon Macroeconomics told Market Watch.

Nonetheless, there were positives. ISM’s index for new orders shot up to 61.5% in July from 56.4% in June. Similarly, ISM’s production gauge increased to 62.1%, up from 57.3%. Thirteen of the 18 manufacturing industries that ISM tracks experienced expansion.

Downbeat notes sounded on employment, though. ISM’s employment index stood at 44.2% for July. While that was up from 42.1% in June, the reading below 50 indicated that manufacturers are still slashing jobs as the economy remains in the doldrums.

“General business conditions are in a general slowing pattern,” an executive in the nonmetallic mineral products manufacturing industry told ISM. “Many of the plants are on reduced hours and/or furloughs. About 20% to 25% of plants are scheduled to be consolidated in the next six months to improve margins and profitability.”