August 09, 2021

Promo Distributors’ Sales Rise 27.3% in Q2

The gain marks the first year-over-year quarterly increase since 2019.

Promo’s run of quarterly declines has ended, and Candace Mangold is beaming.

The co-owner of Corvus Crafts (asi/169246) in Port Townsend, WA, says that sales at her small mom-and-pop promo distributorship soared year over year in the second quarter of 2021.

“The increase in sales is directly related to businesses reopening and events going back to in-person,” says Mangold. “Our county has opened up to full capacity and we’re inundated with orders.”

Distributors throughout the promotional products industry tasted similar success in Q2, which ended June 30.

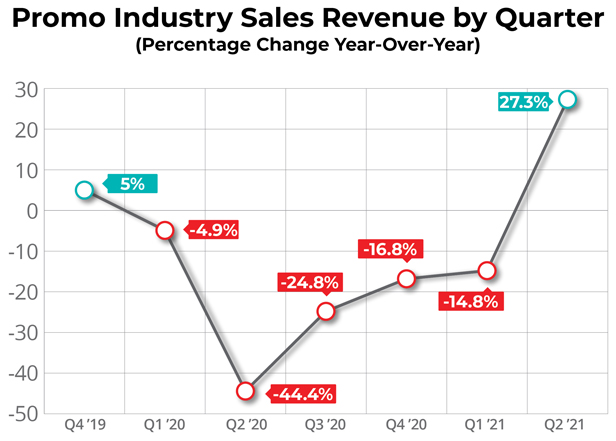

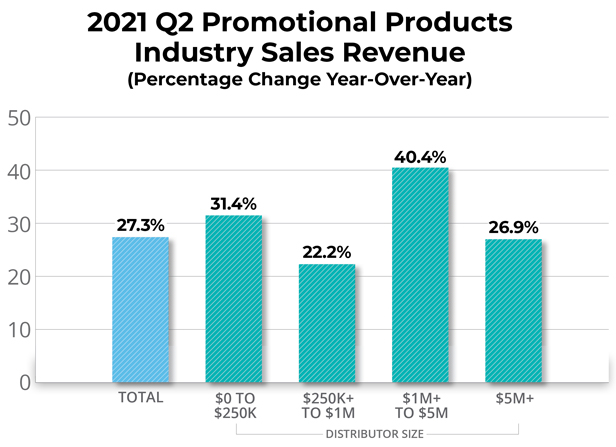

COVID-19’s societal disruption caused distributors’ collective sales to decline year over year for five straight quarters through Q1 2021. But the retreat stopped in the second quarter, with distributors’ sales increasing 27.3%, on average, compared to the same three-month period in 2020, according to exclusive research from the just-released ASI Distributor Quarterly Sales Survey.

“Our billed sales increased 31.86% in the most recent quarter,” says David Bywater, president and general manager of Iowa-based distributorship Bankers Advertising Company (asi/131650), Counselor’s 2021 Distributor Family Business of the Year. “Factors that drove the increase included a return to normal business, plus events.”

Nonetheless, the industry’s rebound comes with caveats.

The rise occurred in relation to the disastrous second quarter of 2020, when distributor sales plummeted 44.4% on average as a direct result of societal shutdowns stemming from COVID. Compared to the second quarter of 2019 – the last second quarter in which business conditions were a pre-pandemic “normal” – Q2 2021 distributor revenue was down nearly 30%.

“While business is certainly looking up, challenges remain for the remainder of the year as the industry continues to claw its way back to the heights of 2019, when annual distributor revenue was an industry record $25.8 billion,” notes Nate Kucsma, ASI’s executive director of research and corporate marketing.

Those challenges include supply chain disruption that’s led to inventory shortfalls, higher product prices, longer production times, and transport holdups that have delayed order delivery. In some instances, the issues cost distributors sales. Challenges also include a mounting surge in COVID-19 cases triggered by the virus’ delta variant.

“If the variant brings the country to its knees again and we have to go back into isolation, I think we’re going to be back on the struggle bus,” says Mangold. “However, I’m already planning for that and am willing to continue to pivot as needed.”

Confidence Rising

Despite such concerns, distributors on the whole are the most confident they’ve been since before the pandemic.

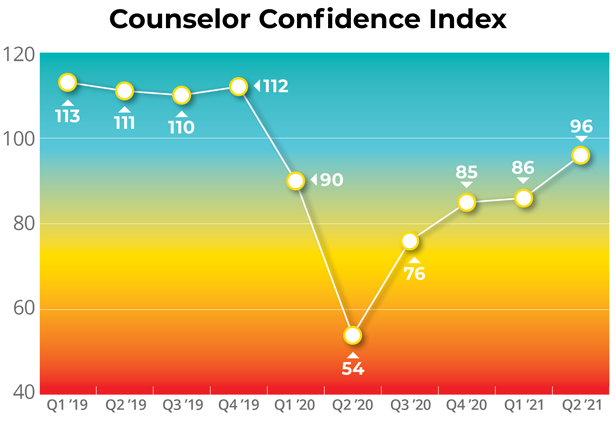

The Counselor Confidence Index, which measures distributors’ financial health and optimism, climbed to a reading of 96 in the second quarter. That’s still below the baseline of 100 and the pre-coronavirus tally of 112 seen in the fourth quarter of 2019, but it’s also a 78% increase from the all-time low of 54 experienced in Q2 2020.

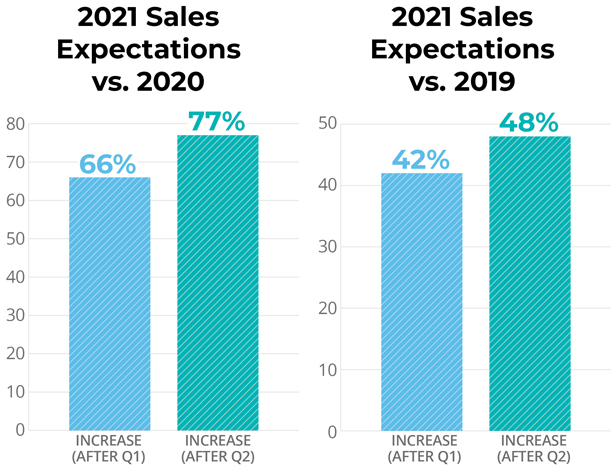

The confidence is fueling a generally optimistic outlook for the rest of 2021. Nearly 8-in-10 distributors (77%) believe that their full-year 2021 sales will be greater than their full-year 2020 revenue. Nearly half (48%) even think they’ll beat their 2019 performance when the year is said and done.

“We feel sales will continue to grow in Q3 and Q4,” says Bywater. “Right now, we’re exceeding 2019 sales year-to-date. Our best-selling season is ahead if the economy continues to recover. We’ve added products and capabilities to increase options for our customers, and are meeting weekly with our sales partners to help address needs and opportunities.”

Christopher Faris is feeling similarly upbeat.

“We were up 24% in Q2, and I think our performance in the third and fourth quarters of this year will surpass what we did last year,” says Faris, founder/CEO of Beverly, MA-based Boost Promotions (asi/142942).

Second Quarter Success

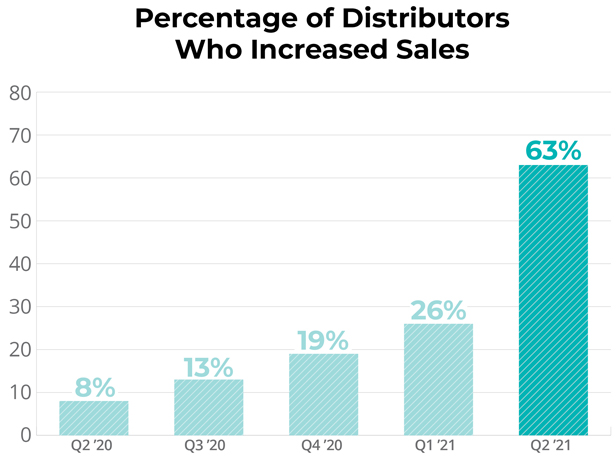

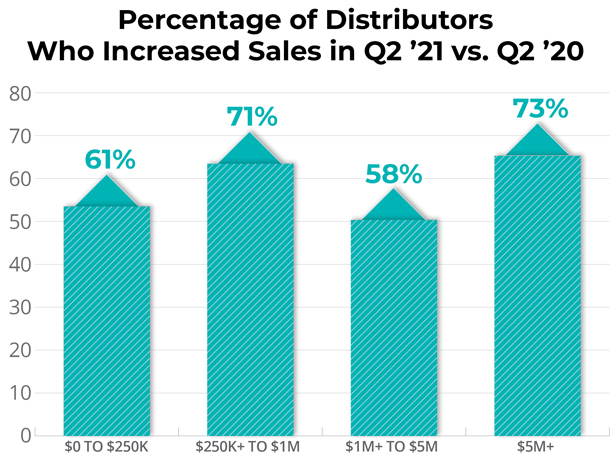

Overall, 63% of distributors reported that their sales rose year over year in Q2 2021, compared to just 8% who reported an increase in the COVID-ravaged quarter of the year prior.

Encouragingly, distributors of all revenue sizes reported average increases in sales for the April-through-June period.

Distributors with annual revenue between $1 million and $5 million fared best with a 40.4% year-over-year sales jump. The industry’s smallest distributors – those with less than $250,000 in yearly sales – powered a gain of 31.4%. The largest firms – those pulling in above $5 million – executed a sales climb of 26.9%, while those in the $250,000 to $1 million range advanced 22.2%.

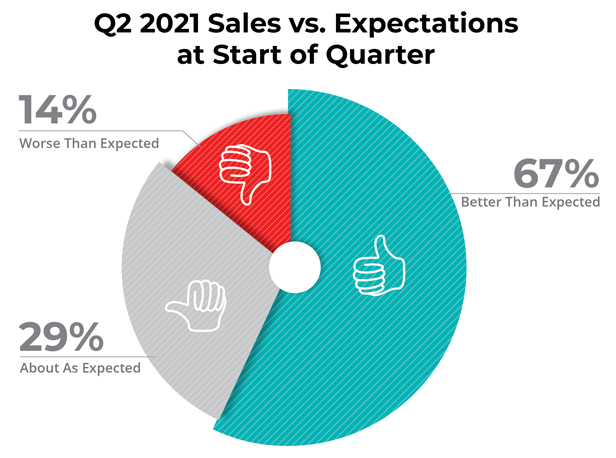

For more than two-thirds of distributors (67%), the second quarter performance outpaced their expectations, while 29% reported that sales were about what they expected.

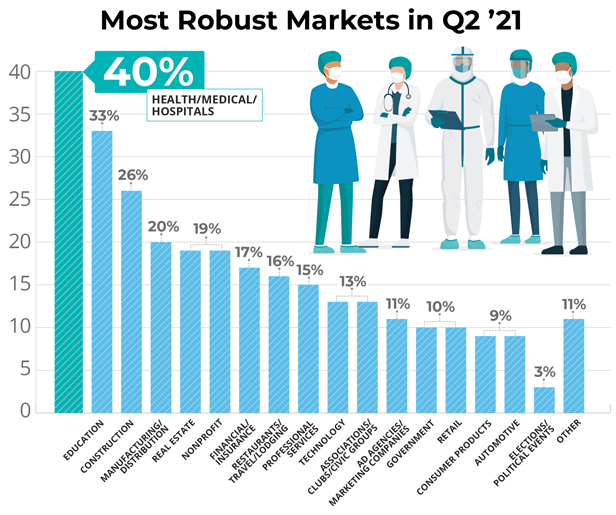

Distributors told ASI that they generated business with a variety of end-markets. Still, there were standouts. In top six order, firms identified healthcare, education, construction, manufacturing/distribution, real estate and nonprofit (tie), and financial/insurance as the most robust markets for promo sales last quarter.

For Bankers, healthcare, manufacturing and financial provided fertile ground for sales. “Some of this work was for employee retention and expressions of gratitude, while other projects were directed at welcoming customers back,” explains Bywater.

Overture Promotions (asi/288473), a Top 40 distributor based in Waukegan, IL, noted that clients in delivery services, cannabis, pharmaceuticals, telecommunications and banking were especially keen for promotional products in Q2.

“Delivery services and cannabis had consistent demand throughout the pandemic,” says CEO Jo Gilley. “Other markets are emerging as employees return part-time to workplaces and customers are doing more in-person engagement.”

Faris’ Boost Promotions scored ample success with the beer, wine and spirts industry – but that wasn’t all. “Really, all end markets are up since most of them were shut down over the past year,” Faris shares. “Everything stems from the economy reopening.”

Distributors like Bankers, Overture and Corvus Crafts explain that ramped up apparel sales were key to second quarter business. Kitted solutions also continued to be popular. Others say it was difficult to name a particular product category as standing out much above the rest; many were performing well given the spike in demand for promo items.

“We’re selling,” says Faris, “a wide range of products.”

PPE’S Retreat & Supply Chain Headaches

One category of products that definitely didn’t perform in Q2 2021 at nearly the levels it did in the second of quarter of 2020 was personal protective equipment (PPE).

With traditional PPE supply chains in a stronger position and mask mandates loosened or lifted during the quarter, the demand from end-clients for promo distributors to provide face masks and the like diminished. The drop was reflected by the fact that PPE items fell out of the Top 10 most searched terms in ESP, ASI’s database of products from throughout the industry.

In total, 24% of distributors reported that their second quarter sales declined year over year, and for some of these distributors, the decrease in unrepeatable PPE business from 2020’s Q2 was a significant factor.

For instance, Los Angeles-based Top 40 distributor BAMKO’s (asi/131431) sales of traditional promotional products increased a massive 85% in Q2 this year, but its overall sales fell 35% – a direct result of PPE business free-falling from nearly $50 million in the second quarter of 2020 to just under $1 million in Q2 2021.

Similarly, Overture Promotions Q2 sales eroded about 25% compared to the previous year. “We had huge PPE orders in Q2 2020, which were not repeated in 2021,” Gilley shares. “We do anticipate making up the difference by year’s end.”

HALO Branded Solutions (asi/356000), promo’s largest distributor, told ASI Media that it overcame a decline in PPE sales to be essentially flat in revenue in a year-over-year quarterly comparison. “That represents robust growth in promotional product sales and sets us up well for the remainder of the year,” says CEO Marc Simon. “We expect continued growth and believe 2021 results will exceed 2020.”

Like other executives, Simon’s optimism comes even though promo’s supply chain woes have made business more difficult and complicated.

Got 1 minute? Then you can get the basics on what's causing inventory shortfalls & rising prices in the #promoproducts industry with this vid. More depth? Read: https://t.co/rTZceaX0dP @Melissa_ASI @Tim_Andrews_ASI @ASI_MBell @asicentral pic.twitter.com/N7aT0U7TY5

— Chris Ruvo (@ChrisR_ASI) June 8, 2021

“The supply chain issues are adding additional stress to projects,” says Gilley. “Most clients don’t love the extended lead times but are still ordering the merchandise. Our sales teams are having to work harder and source creatively to get goods to customers on time.”

Mangold says the issues have, in cases, hurt business. “Hats are hard to come by these days and sometimes common sizes of apparel are completely sold out,” she says.

Adds Bywater: “Due to inventory issues, we’re needing to find substitute products, which often cost more, and we have had orders canceled due to production delays and stock outages. Thankfully, our customers are being very fair about this. They will often accept a partial order to get something in their hands.”

No one has an easy fix to the supply chain crisis. But in this latest article, @ChrisR_ASI reports that suppliers continue to work tirelessly and explore avenues to help distributors and make the best of a tough situation.

— C.J. Mittica (@CJ_ASIMedia) August 4, 2021

https://t.co/rkVU090xVy

Faris and other distributors say clearly communicating with clients about the issues, setting expectations, and presenting workable solutions (even if they’re not ideal) can go a long way toward keeping sales moving amid the tumult. It’s one reason he and others remain confident their businesses will prosper in the second half of another wild, COVID-impacted year.

“Simply put, the economy is open, clients are heading back to the office and events are back on,” says Faris. “All that bodes well for us.”