December 02, 2019

China Insists On U.S. Tariff Rollback

The reported hardline position could postpone a ‘Phase One’ trade deal, causing more complications for the American promo products industry.

When it comes to tariffs, China appears to be digging in its heels – and that could further complicate and postpone a “Phase One” trade deal between China and the U.S.

Early this week, China’s state-run Global Times newspaper cited government sources that said Beijing’s number objective in an initial trade agreement is getting the U.S. to remove tariffs already in place on hundreds of billions of dollars in Chinese imports.

“Sources with direct knowledge of the trade talks told the Global Times…that the U.S. must remove existing tariffs, not planned tariffs, as part of the deal,” the Global Times reported.

Trade deal must include US tariff rollback says China’s Global Times https://t.co/ca07jvBg4S

— SCMP News (@SCMPNews) December 1, 2019

President Donald Trump has been reluctant to rollback levies, believing they provide the U.S.’s greatest leverage in the trade war. Trump has even threatened to increase import duties should the U.S. and China not reach a deal.

While Trump last week said the U.S. and China were near to an agreement and Chinese President Xi Jinping said he desires a deal, leaders have made such representations multiple times before during the trade war. No deal has yet been signed. In November, trade experts and sources close to the White House told Reuters that a deal might not occur until 2020, as China firms its position on tariff removal.

Currently, the U.S. stands to impose tariffs of 15% on approximately $156 billion more in Chinese imports on Dec. 15. The U.S. previously placed tariffs of 25% on $250 billion in China-made products, as well as tariffs of 15% on about $112 billion in Chinese goods. U.S. importers – and, ultimately, their customers – pay the levies.

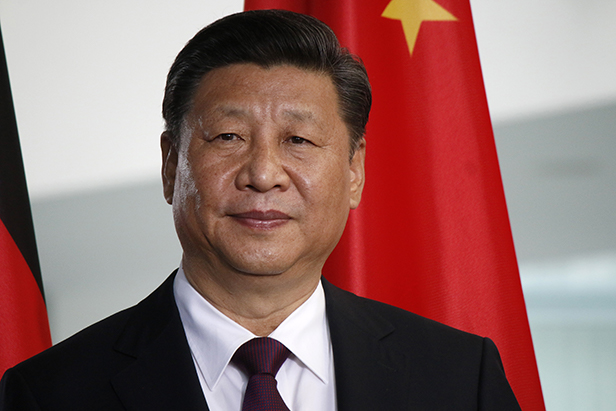

Xi Jinping, President of China

Some analysts think Beijing is in no rush to make a “Phase One” deal, which Trump said in October was all but done for a few particulars. Believing Trump is an increasingly weak political position in the U.S., Chinese negotiators could be looking to stretch out talks long enough to hold talks with a new U.S. administration. Furthermore, Beijing could feel emboldened by unexpectedly strong manufacturing data. In November, China’s official manufacturing purchasing managers’ index rose to 50.2, indicating an expansion in output. Meanwhile, U.S. manufacturing activity in November contracted for the fourth straight month:

The Institute for Supply Management reported that manufacturing activity contracted for the fourth straight month. The composite index ticked down 48.3 in October to 48.1 in November, which was not far from the 10-year low recorded in September (47.8). pic.twitter.com/AABqHPPSFi

— Chad Moutray (@chadmoutray) December 2, 2019

As the U.S./China trade war persists, Trump opened up a new front in the global trade conflict on Monday when he pledged to restore tariffs on all steel and aluminum shipped to the U.S. from Brazil and Argentina. Leaders for those two countries said they would engage in talks with the U.S. over the pledged tariffs.

Brazil and Argentina have been presiding over a massive devaluation of their currencies. which is not good for our farmers. Therefore, effective immediately, I will restore the Tariffs on all Steel & Aluminum that is shipped into the U.S. from those countries. The Federal....

— Donald J. Trump (@realDonaldTrump) December 2, 2019

The U.S./China trade imbroglio has directly impacted the American promotional products industry, causing issues that include increased product prices, destabilized annual pricing, challenges in producing catalogs and an ever more uncertain selling environment that some fear could cause end-buyers to reduce their spending on ad specialties. The trade conflict has also made longer-term planning more difficult for some suppliers and caused suppliers (and certain distributors that source direct from abroad) increasingly to look beyond China to produce products. As the search for new sourcing destinations accelerates, some industry leaders worry that more product safety and social responsibility issues will arise.

Writing instruments and a spectrum of apparel products – including T-shirts, the single-largest product category in terms of sales in the promo industry – are among the items affected by tariffs. Other affected promo categories include bags, stationery, select drinkware, headwear, tech and accessory items, and more.