December 05, 2022

VF Corp. Searching for a New CEO

There’s an interim top executive in place following former CEO Steve Rendle’s immediate retirement from the global apparel and footwear maker whose brands sell in the promo products industry.

VF Corporation is on the hunt for a new CEO.

The Denver-headquartered global maker of apparel and footwear announced that its CEO/president of six years, Steve Rendle, is retiring effective immediately. Rendle was also chairman of VF Corp.’s board of directors.

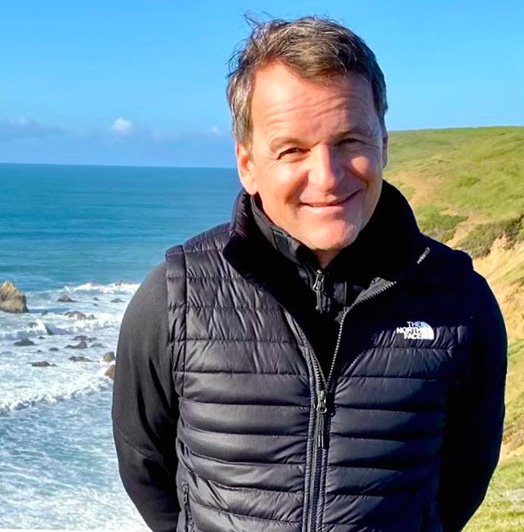

Benno Dorer, interim CEO, VF Corp.

The company, which owns brands that sell in the promotional products market, including The North Face, Dickies and Jansport, has begun a search for a permanent CEO/president. VF Corp. has retained an executive search firm that will assist in the evaluation of internal and external candidates.

As the search continues, Benno Dorer will serve as interim president/CEO. Dorer is lead independent director of the VF board of directors. Richard Carucci, a board director since 2009, will become interim chairman of the board.

“The board thanks Steve for his many contributions and leadership during his nearly six years as CEO and nearly 25 years with VF,” said Dorer. “Steve’s commitment to the business, passion for building strong brands and focus on culture have helped VF evolve our portfolio of strong active-lifestyle brands and establish VF as a purpose-led company. We wish Steve well in his future endeavors.”

Rendle described it as an “honor” to have led VF Corp. “I depart with the deepest gratitude for the extremely talented and dedicated global team at VF,” he said. “I remain as confident as ever in VF’s tremendous potential and look forward to watching the company’s continued success.”

Rendle’s retirement came as VF Corp., a publicly traded company, cut its estimate for how much annual sales will increase this year. The firm now projects full-year revenue to rise by 3% to 4%, down from the previously anticipated 5% or 6%. It expects full-year earnings to register between $2.00 to $2.20 per share. That’s down from an earlier guidance that put earnings in the range of $2.40 to $2.50. VF Corp. reported full-year earnings of $3.18 per share last year.

VF Corp. said the downgrades “reflect the impact of weaker-than-anticipated consumer demand across its categories, primarily in North America … as well as order cancellations in the wholesale channel to manage trade inventories. Also impacting the outlook, but to a lesser degree, are the higher-than-expected impacts from inflation on consumer discretionary spending in Europe and ongoing COVID-19 related disruption in China.