February 17, 2022

Distributor Sales Soar 12% in 2021

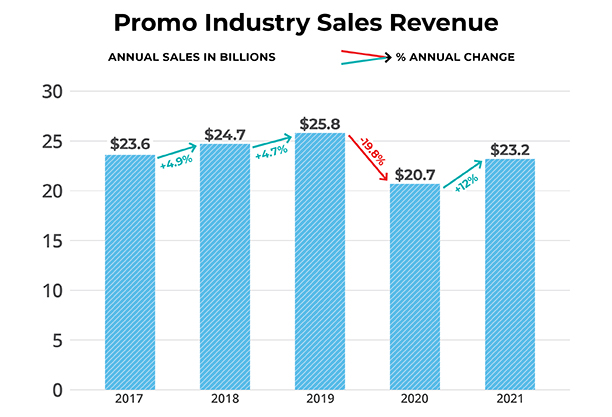

Industry sales increased to $23.2 billion – not quite pre-pandemic levels, but a remarkable recovery that has distributors poised for continued success this year.

Mike Wolfe is feeling energized and excited – and well he should be.

After all, the Top 40 promotional products distributorship he helms, Zorch (asi/366078), just came off a 2021 in which annual sales increased 33% compared to the prior year.

“While some of our accounts were still impacted by the pandemic, most clients resumed normal spending patterns by mid-late Q2 of 2021,” Wolfe, Zorch’s CEO, tells ASI Media. “Their return, combined with several new clients we gained, drove our revenue increase.”

Similar success stories played out en masse in the promo products industry in 2021.

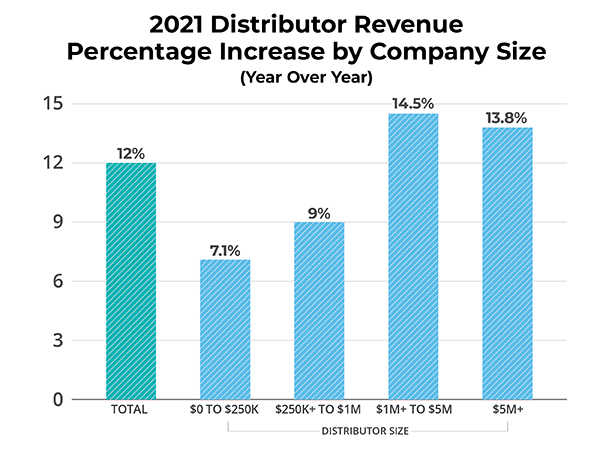

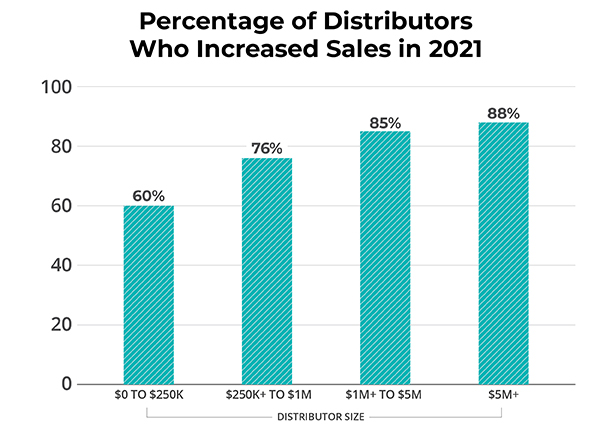

Zorch was among the nearly three-quarters of North American promo distributors (72%) that increased annual revenue in 2021, according to the just-released ASI Distributor Quarterly Sales Survey. On average, distributor sales rose year over year by 12%, bringing total promotional products industry revenue to $23.2 billion.

While that figure remained below the $25.8 billion industry record set in the last full pre-pandemic year of 2019, it represents a remarkable bounce-back for an industry whose collective revenue fell nearly 20% in 2020 due to the marketplace upheaval caused by COVID-19.

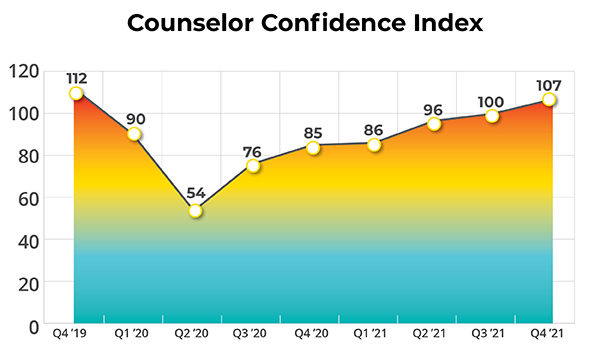

“Distributors powered through the ongoing challenges of the pandemic to drive impressive year-over-year growth,” says Nate Kucsma, ASI’s senior executive director of research and corporate marketing. Kucsma spearheads the quarterly sales survey. “Mounting confidence among distributors suggests many believe that 2022 could be another strong year,” he shares.

Indeed, the Counselor Confidence Index, which measures distributors’ financial health and optimism, has risen to 107 – a pandemic-era high and comfortably above the baseline reading of 100. At the lowest point in its more than 20-year history, the index stood at just 54 in the second quarter of 2020 when societal restrictions related to COVID were at their height.

“We’re expecting a strong year for the industry when compared to 2021,” Wolfe says of 2022. “As long as the societal situation continues to improve, with events returning and the like, the market for promo should continue to improve.”

Added Leo Friedman, CEO of Chicago-headquartered distributorship iPromo (asi/229471): “People are over COVID and the demand for in-person experiences, meetings and formal gatherings is already skyrocketing. All that is good news for our industry.”

A Topsy Turvy Year of Challenges & Success

Promo’s annual sales gain in 2021 was never a guarantee.

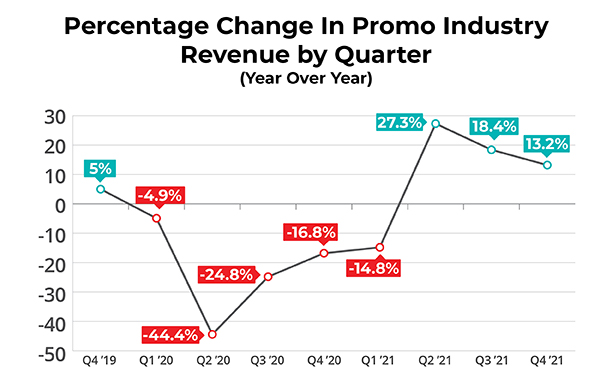

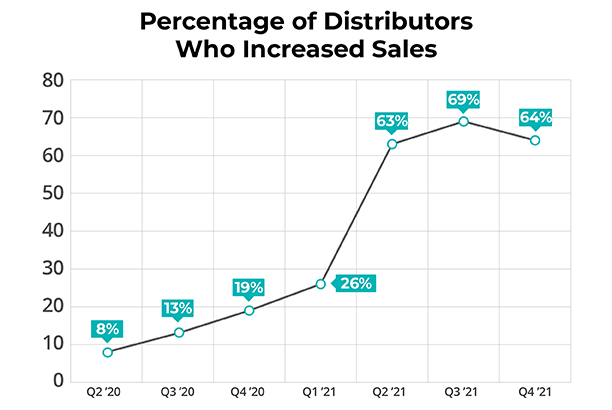

The year got off to a rough start when distributors’ first quarter sales declined, on average, by almost 15% – a performance that marked the fifth straight quarter in which the industry revenue total retreated year over year.

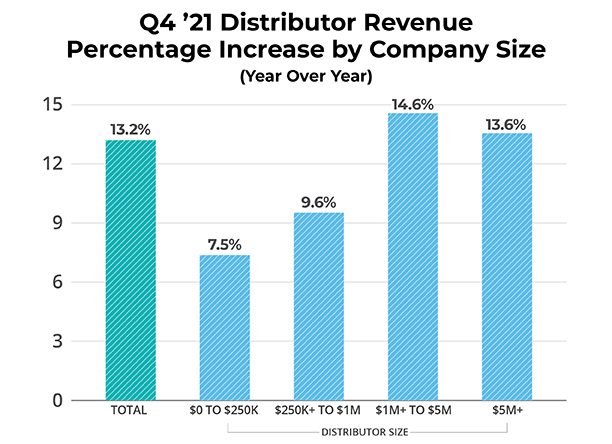

Still, business momentum picked up considerably in Q2 amid the broader reopening of society and widespread vaccination rollout. For Q2, distributor sales rose 27.3%, a year-over-year gain followed by an 18.4% rise in Q3 and a 13.2% jump in Q4.

While the growth rates slowed in Q3 and Q4 compared to Q2, that’s due to some of the wild marketplace variables of the pandemic.

Consider: Q2 2021’s growth was something of an anomaly because sales took a massive nosedive (down 44.4%) during the COVID-driven societal shutdowns of Q2 2020. Meanwhile, in Q3 and Q4 2020, sales began to recover thanks to business stemming from demand for personal protective equipment and later due to kitting initiatives and a broader return of promo business.

Because of that difference, explains Kucsma, it was harder to have as robust year-over-year quarterly growth in Q3 and Q4 2021 compared to Q2. Nonetheless, along with Q2, the double-digit annual gains experienced in the third and fourth quarters of last year were the greatest quarterly increases of at least the previous decade, and particularly impressive for an industry that typically experiences low-to-mid single-digit percentage gains.

“The past two years have been like no other in recent history,” says Mark Lenox, vice president of creative and merchandising at Top 40 distributor IMS (asi/215310).

Promo’s leap forward in sales in 2021 occurred despite rampant supply chain disruption that caused problems like inventory shortages, slower production/fulfillment times and higher product prices. For sure, some distributors believe that their sales performance last year would have been even better, were it not for supply chain stumbling blocks.

“Of course,” states Lenox when asked if supply line challenges held back sales, at least to some extent. “We had especially significant delays in the fourth quarter.”

When will the #promoproducts industry's supply chain woes end? What will things be like in 2022? Some quick insights in this short video.@ASI_MBell @Tim_Andrews_ASI @asicentral pic.twitter.com/a1YDo0zyck

— Chris Ruvo (@ChrisR_ASI) January 20, 2022

Still, IMS engineered what Lenox described as strong year-over-year growth in 2021 – a common scenario in the branded merchandise world as distributors of all sizes worked closely with partners and used their own dexterous sourcing to circumvent the challenges. Focusing on gifting and kitting/drop-shipping to meet the high demand for appreciation and recognition initiatives from a spectrum of clients was key to the success of many distributors.

“There was a lot of shifting and it was definitely a lot of hard work to get orders finalized, and yet we got them done and the suppliers helped tremendously,” says Memo Kahan, president of Top 40 distributor PromoShop (asi/300446), which increased annual revenue 48% in 2021. “Our business was strong and did really well as long as inventory was available. We had great success as a new avenue of opportunities came in kitting and distributing packages to people’s homes and around the world.”

For the full year, distributors with company revenue in the range of $1 million to $4.9 million increased sales, on average, by 14.5% – the highest among all distributor sizes.

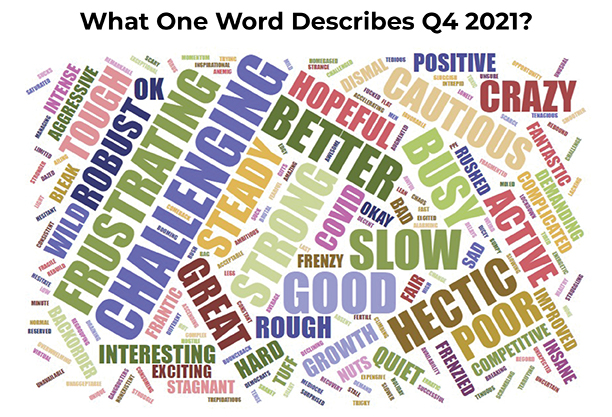

Meanwhile, nearly two-thirds (64%) of distributors drove year-over-year sales gains in Q4 – a decline from the previous quarter, but still the second highest percentage of any quarter for at least the last decade. More than 8-in-10 (85%) distributors reported that their Q4 sales were either better than expected (57%) or as expected (28%).

Top Markets & Success Stories

Cooley Group’s (asi/168125) sales were hot last year, with the firm achieving 10% annual revenue growth.

“Our 2021 revenue was above pre-pandemic levels,” says Phil Yawman, president of the upstate New York-based distributorship, which leveraged strong client relationships and its e-commerce platform to generate business with preexisting clients and attract new, large employee appreciation and retention projects. “Our 10% growth,” Yawman continues, “is also a reflection of how well we performed during COVID, as we had relatively less decline in 2020 than the industry and most other distributors of our size.”

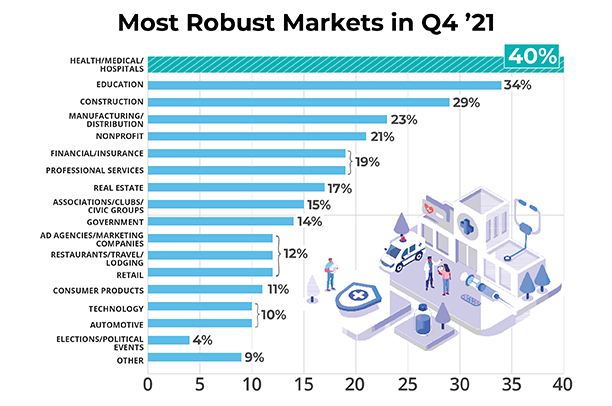

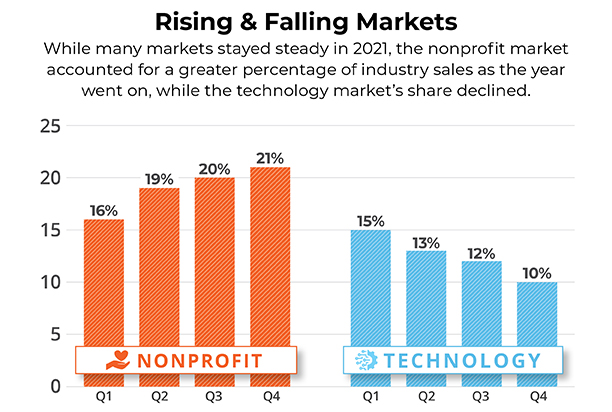

Yawman notes that Cooley Group’s top end-markets for selling into included healthcare and, as the year went on, higher education. In that, the firm’s experience was representative: Distributors reported that the top markets for sales in the fourth quarter were healthcare followed by education. Construction, manufacturing and nonprofits rounded out the top five markets.

“We anticipate the continued rebound in our higher education vertical for all of 2022,” says Yawman. “We are also well-positioned to continue to grow the several large accounts we added in 2021.”

At iPromo, healthcare, education and government were the markets that most helped propel a rise in merch sales. “Promotional products and corporate gifts have become more intertwined than ever, driving the average order size up by over 50%,” shares Friedman. “In addition, robust drop-shipping capabilities from our supplier partners have made it easier for us to deliver products just in time and to individuals at their homes.”

Elsewhere, booming business with consumer brands was a leading reason PromoShop’s sales elevated nearly 50%, while Zorch executed its annual revenue rise through greater sales within large corporate programs.

At IMS, sales acceleration occurred across a variety of markets.

“We have clients across industry verticals and saw increased activity with most of them,” states Lenox of IMS. “In particular, our quick-service restaurant clients saw a nice increase as dining activity increased substantially in 2021 versus 2020… We expect COVID and its impact to wain in the second quarter and anticipate further increases in revenue as long as our suppliers can provide us the product we need in a timely manner.”

The positivity is a common sentiment, for while challenges remain in 2022, there’s a general feeling among distributors that even better days are ahead.

Jo Gilley, CEO of Top 40 distributor Overture Promotions (asi/288473) and a member of Counselor’s Power 50 list of promo’s most influential people, is among the executives who believe that distributors’ total sales this year will outpace 2021.

“Trade shows and events are moving back to in-person,” Gilley notes. “The supply chain bottlenecks will improve throughout the year.”

As they’ve done throughout the COVID-19 pandemic, promo pros will need to exhibit adaptability and ingenuity to make the predicted success a reality.