February 10, 2023

Distributor Sales in 2022 Match Pre-Pandemic Record

Driven by a return of events, strong demand and inflation-fueled pricing, findings from ASI Research show distributors collectively increased sales by 11.4% to $25.8 billion – the same total as the last pre-pandemic year of 2019.

When promotional products industry revenue fell nearly 20% in 2020, many wondered how long it would take for distributors to earn back the sales they lost.

The answer turned out to be only two years.

The just-released Distributor Quarterly Sales Survey from ASI Research shows that distributors collectively increased sales 11.4% year over year to $25.8 billion in 2022, tying the industry’s all-time record high, which was set in the last pre-COVID year of 2019.

Promo Industry Sales Revenue by Year

(Annual Sales in Billions)

Overcoming supply chain and inventory issues, distributors rose to the challenge to meet rampant demand for branded products. Events returned in earnest, businesses aggressively marketed themselves, and companies continued to use branded merch to help attract and retain workers in a tight employment market.

In addition, 40-year-high inflation helped drive the topline sales number too. Products cost more and distributors passed some of that along to end-clients, elevating revenue.

“The recovery from 2020’s COVID-induced decline has been sharper than I believe most people expected,” says Nate Kucsma, ASI’s senior executive director of research & corporate marketing. Kucsma spearheads the distributor quarterly survey. “The sales increase that our industry experienced in 2022,” he continues, “was buoyed by increased demand due to the return of events and a sharp increase in prices.”

Closing Strong on a Good Year

Like many distributors, Wizard Creations (asi/362568) owned 2022.

The Florida-headquartered promo products distributorship increased full-year sales more than 30% compared to 2021, taking total revenue into the low eight-figure range. Beyond traditional promo solutions, Wizard Creations fueled the sales ascent with franchise uniform business, large format printing installations, and specialty products geared toward the cannabis industry.

This video has key quick-hat stats and insights on distributors’ 2022 sales performance.

“The biggest factor in our success was the continued diversification of our client’s needs in the wake of the pandemic,” says company President Luke Freeman, noting that the addition of talent helped, too. “Remote work was difficult at first,” Freeman continues, “but now we’ve really leaned into it and attracted incredible talent from both within and outside of our industry. These talented folks have helped us pave the way for new growth.”

As with Wizard Creations, distributor success was widespread in 2022.

About 6-in-10 distributorships increased sales last year, with another 22% saying sales were steady. Half of small distributors ($250,000 and under in revenue) increased sales in 2022, and 71% of distributors with $1 million and up in sales did the same. About six in 10 (63%) medium-sized distributors – those in the $250K to $1M range – increased sales.

Growth was greatest with mid-size and large distributors, all of whom had revenue increases over 10% for the year. The industry’s smallest distributorships lagged behind with 2022 revenue growth of 4.7%.

2022 Distributor Annual Revenue Increase by Company Size

(Year Over Year)

“Our sales increased in 2022 and our business surpassed $1 million in revenue for the first time,” reports Sarah Whitaker, owner of Hopkinsville, KY-based distributorship Williams Advertising (asi/360402). “We invested in hiring our first dedicated sales and account rep, and we doubled down on resources and content creation to support her efforts. I think a large part of our sales was a result of events being more in swing in 2022. We also saw an increase in the work we did for political campaigns.”

While recession concerns swirled in the latter half of the year, any worry over an economic slowdown didn’t significantly affect the promo business at the close of 2022. Promo industry sales in Q4 increased by 11.1% compared to the same three-month period in 2021.

Promo Industry Sales Revenue by Quarter

(Year Over Year Increase/Decrease)

The growth rate was down a bit from Q3 (12.4%) and Q2 (13.5%), but far outpaced Q1’s 5.4%. Distributors have recorded double-digit percentage growth in seven of the last eight quarters. Promo’s performance outpaced the broader economy: U.S. gross domestic product grew at a rate of 2.9% in Q4.

Notably, 71% of distributors increased their sales in the fourth quarter – not only the highest percentage of any quarter in 2021 or 2022 (when distributors had their greatest rebound from pandemic lows), but the highest of any quarter since ASI Research started tracking the metric in 2010.

The percentage of distributors who increased sales year over year in Q4 ’22 – the highest percentage since 2010 when ASI Research first started tracking the metric.

The largest distributors ($5 million and over) fared the best in the quarter, with 85% increasing sales compared to the same quarter in 2021. That group increased revenue by 14.3% in the fourth quarter. Meanwhile, small distributors increased sales by 4% in the quarter. In total, more than half of distributors (52%) told ASI that Q4 sales exceeded their expectations.

Q4 2022 Distributor Revenue Increase by Company Size

(Year Over Year)

Success Stories & Top Markets

Encouragingly, 2022 was replete with success stories.

Top 40 distributors 4imprint (asi/197045) and HALO Branded Solutions (asi/356000) both posted annual sales records above $1 billion last year, marking the first time that the industry has billion-dollar distributorships as determined by Counselor’s annual Top 40 rankings.

“This milestone is the result of a singular focus by every member of our team – creating breakthrough results for our clients with innovation, integrity, and collaboration,” says HALO CEO Marc Simon, a member of Counselor’s Power 50 list of promo’s most influential people.

Meanwhile, Top 40 firm Proforma (asi/300094) had a record sales year, surpassing $600 million in revenue thanks, in part, to investments in marketing, technology and sales teams paying off. “$600 million is a titanic figure within the industry,” says Brian Carothers, chief technology officer for Proforma.

Of course, as ASI Research’s data showed, it wasn’t just Top 40 firms powering impressive gains. Whitestone Branding (asi/359741), a distributorship with roots in New York City and Austin, TX, had a dynamite year, increasing annual sales 83% relative to 2021.

Founder Joseph Sommer says Whitestone was able to compete for and secure larger enterprise-level business/clients – one factor in the growth acceleration. Whitestone also has an ideal customer profile it aims to stay within; that strategic focus helped the firm recruit and win the right kind of business. Whitestone grew sales in verticals that included event planning, technology, financial services, retail, healthcare and beauty/cosmetics. “This was due to our having a deep understanding of what success looks like for those types of companies,” Sommer shares.

Speaking of markets: Overall, the ones in which promo distributors generated the most sales in the fourth quarter were, in top five order, education, healthcare, construction, nonprofit and manufacturing. “By and large, our industry is healthy and the overall pie is growing,” Sommer says.

Most Robust Markets in Q4 2022

Business was good north of the border too, with many Canadian distributors reporting an excellent 2022.

Toronto-headquartered Top 40 distributor Genumark (asi/204588) says sales increased 27% to more than $60 million (Canadian). Acquiring new clients, the end of lockdowns in Canada, increased spending by existing clients, employee gifting, and inflation helped fuel the topline sales rise. Genumark was especially proud of a project it did for the nonprofit Sirivik Food Centre.

“We found many of our customers were eager and willing to spend more on higher quality gifts for their teams,” says CEO Mitch Freed, a Power 50 member.

Mergers and acquisitions have been on the rise in promo, and a strategic acquisition helped McCabe Promotional (asi/264901) grow revenue in 2022. Still, the Ontario-based distributorship’s sales were up about 25% even before the acquisition. New business development was essential to the increase. “We analyzed what industries we were doing well in and we doubled down on our efforts there,” says company President Jamie McCabe.

A Confident Close, But What Lies Ahead?

At the conclusion of 2022, distributors were literally feeling the most optimistic they have since the onset of the COVID-19 era.

The Counselor Confidence Index, which measures distributors’ financial health and business optimism, rose to a pandemic-era high of 109. That’s still shy of the reading of 112 experienced in the last quarter before COVID set in (Q4 2019), but the tally represents significant progress, being more than double the pandemic-period low of 54 (Q2 2020) and healthily above the baseline reading of 100. The index’s all-time high is 117, which occurred in Q3 2018.

Counselor Confidence Index

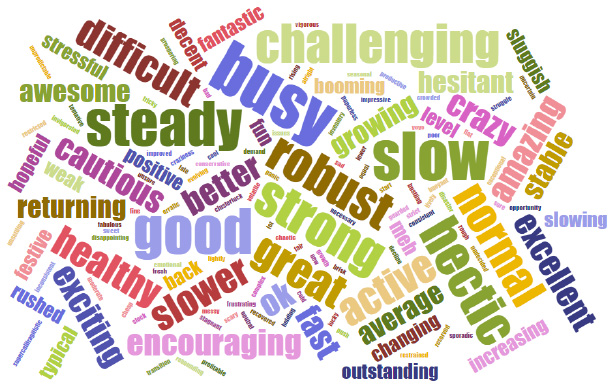

Industry-wide, distributors frequently used words like “robust,” “strong,” “great” and “good” to describe the Q4 marketplace, but words like “slow,” “challenging” and “difficult” were also common. The disparity at the end of last year hints that there’s not a strong consensus on how promo will fare in 2023 – a reality born of the fact that there’s uncertainty over the degree to which potential macroeconomic millstones like recession, rising interest rates and higher unemployment could possibly drag on industry growth. For instance, high-profile, widescale layoffs at tech giants like Google, Amazon, Meta and Microsoft have been a point of concern.

As for 2023, Freeman says Wizard Creations has set the goal of increasing revenue 40% compared to last year. He’s confident the distributorship will hit the target, though is less bullish on industry-wide sales prospects. This year “will be a slower growth curve for many of the industry’s largest distributors,” Freeman predicts. “Promo as a whole could see a flat or potentially even a down year.”

What One Word Describes Q4 2022?

Distributors used these words most frequently to describe Q4 market conditions.

Renya Nelson is more upbeat about the merch market in 2023.

“I think this will be a strong year for the industry pending the economic outlook,” says Nelson, who is CEO of Salt Lake City-based distributorship Brand+Aid (asi/145193). “It seems that budgets are opening more to promo with hybrid work environments. At Brand+Aid, we’re aiming to more than double our 2022 sales this year. Based on conversations we’ve had with our top clients, we see a lot of spending and event activations on the horizon.”

McCabe is forecasting that his distributorship will increase annual sales by 25% in 2023. “The distributors I speak to are all plotting similar growth,” he shares.

Sommer feels end-markets that typically require customers to take on debt to make purchases – think real estate and automotive – could suffer in 2023 due to increasing interest rates. As such, they may not spend as much on promo – one reason he believes that larger economic factors could cause the industry as a whole to experience a slight retreat in sales this year. Nonetheless, he’s confident about Whitestone’s ability to excel.

“Whitestone will increase sales, despite all the turbulence in the economy,” Sommer says. “We’ll be prospecting new business more regularly and aggressively. We’ve set company-wide sales targets higher than where we closed last year and we’re all incentivized to hit those numbers. I have no doubt in my team’s ability to rise to the challenge.”