January 22, 2019

Studies: Consumer Sentiment Plummets, US Growth Could Slow

January sentiment fell to its lowest level since President Donald Trump was elected, while the IMF predicts slowed economic growth in the US for 2019.

The partial government shutdown, the unstable stock market, trade war with China and other potential economic headwinds weighed heavily on Americans in January, driving consumer sentiment down to its lowest level of Donald Trump’s presidency, according to the University of Michigan’s closely-watched Surveys of Consumers. Meanwhile, a separate analysis from the International Monetary Fund released this week predicted US economic growth in 2019 and 2020 will be slower than 2018.

US consumer sentiment took its biggest dip in January in five years falling from 98.3 in December to 90.7, missing the 97.0 forecast by a wide margin. Attitudes are now back to about where they were before the 2016 election. pic.twitter.com/mBmVU70OVh

— Joseph Trevisani (@JosephTrevisani) January 18, 2019

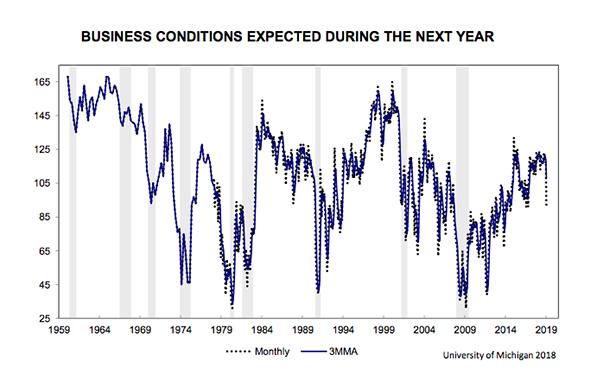

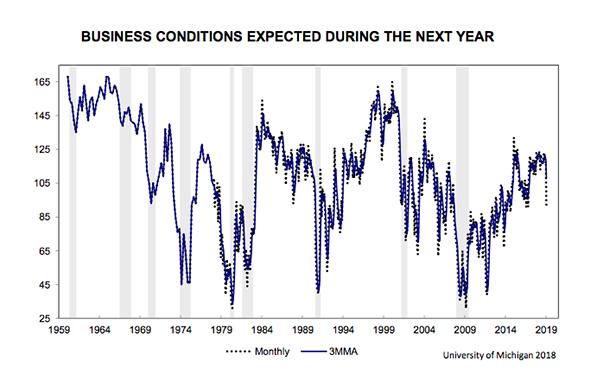

The Index of Consumer Sentiment’s 90.7 reading in January was down 7.7% from December and 5.2% from January 2018. The performance came in below all estimates Bloomberg received from economists. Relatedly, the Current Economic Conditions Index tallied 110, down 5.3% from December and about a half-percent from the prior year. The January Index of Consumer Expectations, meanwhile, dropped 10% month-over-month and more than 9% year-over-year to 78.3. “The year-ahead outlook for the national economy (was) judged the worst since mid-2014,” said Richard Curtin, chief economist for the University of Michigan surveys.

From the University of Michigan Surveys of Consumers.

Curtin said the erosion in sentiment resulted from issues that include the partial government shutdown, the impact of import tariffs, instabilities in financial markets, the global slowdown, and the lack of clarity about monetary policies. “Aside from the direct economic impact from these various issues on the economy, the indirect effect meant that half of all consumers believed that these events would have a negative impact on Trump's ability to focus on economic growth,” Curtin said.

To sustain the current economic expansion, evolving job and wage prospects are necessary, but those polled weaker in January, Curtin said. “Consumers now sense a need to buttress their precautionary savings, which is typically done by reducing their discretionary spending,” said Curtin.

While the #govermentshutdown hasn't killed the stock market rebound, it's taking a toll on consumer sentiment.

— Zach Scheidt (@ZachScheidt) January 22, 2019

This could affect retail sales and the wealth effect heading into the spring. #stocks #Retail pic.twitter.com/CTvMo5Sx0q

Nonetheless, analysts noted that the decline in January consumer optimism does not yet indicate the start of a sustained downturn in economic activity. Still, if certain clouds gather into a full-fledged storm, that could change. “Confidence will rebound should the White House and lawmakers find a quick resolution to the current impasse,” said economists Yelena Shulyatyeva, Tim Mahedy and Carl Riccadonna in a statement for Bloomberg. “However, a prolonged shutdown, or more stock market volatility, would likely unsettle consumers even as conditions in the labor-market remain tight and the economy continues to grow above trend.”

The standoff between Trump and Democrats led by House Speaker Nancy Pelosi that has created the partial government shutdown has showed no signs of abating. While there has been some positive news lately about potential easing of trade tensions between Washington D.C. and Beijing, a breakthrough does not appear imminent.

“Aggregate data continue to portray a relatively benign picture that seems increasingly inconsistent with a sense of growing economic malaise and souring business, consumer and investor sentiment,” - @EswarSPrasad https://t.co/KfLPDJJhqp

— Christopher R. Narayanan (@TheWallStCowboy) January 22, 2019

On Monday, the International Monetary Fund slightly downgraded its global growth forecast for 2019, putting the year-over-year increase at 3.5% in 2019 and 3.6% in 2020. In autumn, the IMF was predicting global growth of 3.7% for both years. According to the IMF, U.S. growth could slow to 2.5% in 2019 and drop further to 1.9% in 2020, a result of the tailing off of fiscal stimulus (such as Trump tax cuts), higher interest rates and trade war with China. In a bright note, the IMF said that the pace of expansion in the U.S. would still be above the country’s estimated potential growth in both years.

Despite the outlook downgrades, it’s too soon to say if a global recession is in the cards, officials said.

“After two years of solid expansion, the world economy is growing more slowly than expected and risks are rising,” said Christine Lagarde, managing director of the IMF. “Does that mean a global recession is around the corner? No. But the risk of a sharper decline in global growth has certainly increased.”

Lagarde said the move was due to the high level of economic risks that are accelerating around the globe https://t.co/KY2gtNNUNV #WEF19

— CNBC International (@CNBCi) January 22, 2019