July 15, 2020

Facebook Study Shows COVID’s Impact on Business

Sales and employment are down as small businesses worldwide face what the report’s authors say is the “challenge of a lifetime.”

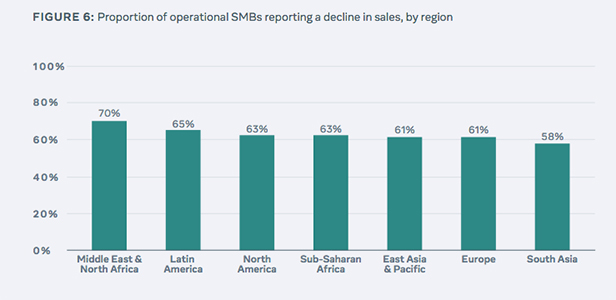

Nearly two-thirds of small businesses in North America (63%) experienced a decline in sales between January and May 2020 compared to the same period the prior year, largely as a result of economic and societal disruption caused by the coronavirus pandemic.

That’s one of the sobering findings in the Global State of Small Business, a just-released report from Facebook and partners that assesses the impact of COVID-19 and its related societal lockdown measures on small businesses around the globe.

The report’s findings are based on survey responses from more than 30,000 small-business leaders in more than 50 countries. The stark findings show the worldwide scope of COVID’s impact on smaller firms.

“Small businesses are the unsung heroes of the global economy – creating jobs and growth in every country and helping to reduce poverty and income inequality. But they are facing the challenge of a lifetime,” wrote Facebook Chief Operating Officer Sheryl Sandberg and others in an introduction to the report. “The COVID-19 pandemic isn’t just a public health emergency; it’s also an economic crisis that is hitting small and medium-sized businesses exceptionally hard.”

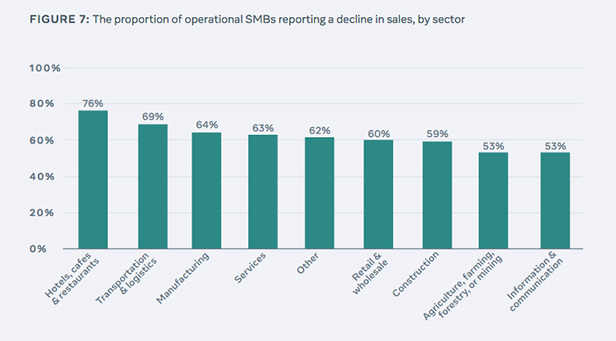

Findings in the 49-page report show that sales for small businesses were down across sectors globally. Hospitality businesses like hotels, cafes and restaurants were especially hard hit, with 76% of such businesses reporting a year-over-year decline. Transportation/logistics (69%) and manufacturing (64%) ranked second and third, respectively, when it came to the industries with the greatest percentage of businesses reporting revenue reductions.

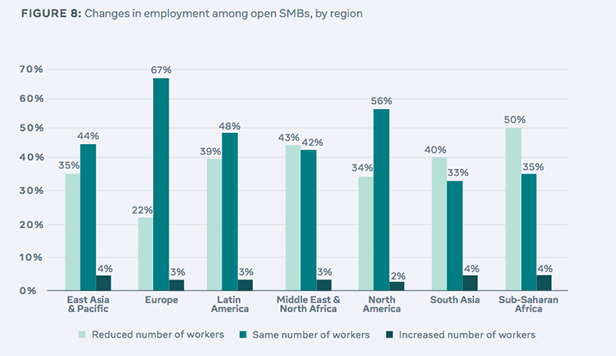

The pandemic has driven down employment at small businesses across regions. Some one-third (33%) that were operating at the time of the survey reported that they had reduced their workforces as a result of COVID-19. Sub-Saharan Africa had the most widespread employee reductions, with 50% of small business leaders there reporting they’d cut staff. In North America, 34% of small business leaders said they reduced employment.

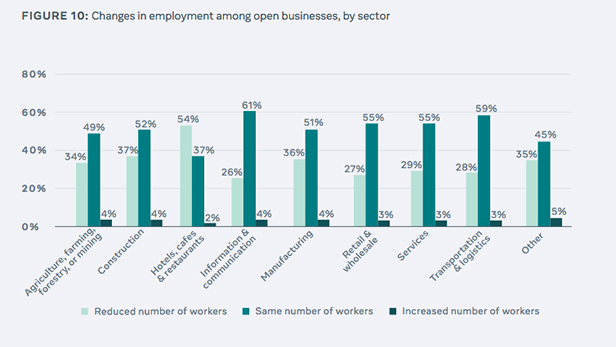

The survey showed that small businesses operating in the hotels/cafes/restaurants, construction and manufacturing sectors were most likely to scale back staffing.

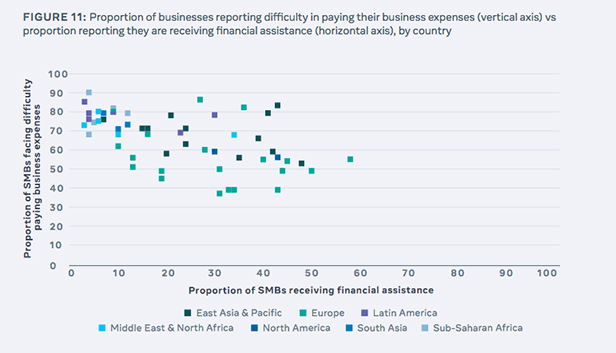

According to the survey, about a quarter (23%) of small businesses reported receiving financial support. Still, there was significant variation among regions.

“Far greater proportions of SMBs reported receiving some form of financial assistance, such as grants or loans, across countries sampled in East Asia and the Pacific (29%), Europe (30%), and North America (37%),” the report said. “Indeed, in some countries, such as Australia, Belgium, and Ireland, around 50% or more of businesses reported receiving financial support.”

The report continued: “The picture was very different in many other countries surveyed. In several countries, including Turkey, Romania, Hungary, and Vietnam, fewer than 15% of SMBs reported receiving financial assistance at the time of the survey. A similar proportion was evident in sampled countries within the Latin America (12%), South Asia (10%), and the Middle East and North Africa (12%) regions.”

Among businesses surveyed, 26% reported that they had closed between January and May 2020 - over 50% in some countries, such as Ireland and Bangladesh. Micro-businesses, defined as businesses owned and operated by one individual, closed to a greater extent than those with multiple employees. Approximately 30% of micro-businesses reported that they were closed at the time of the survey, relative to 25% of small businesses with one or more employees. Female-led SMBs have been disproportionately impacted. These businesses were 7 percentage points more likely to be closed compared to male-led SMBs.

Overall, however, 74% of surveyed businesses from around the world said they plan to reopen. Nonetheless, ample challenges lie ahead. “In the aggregate sample, the three near-term challenges most commonly cited by businesses that were operational at the time of the survey were lack of demand (47% of SMBs), cash flow constraints (37%), and repaying outstanding loans (19%),” the report explained.

Read the fully study here.