June 17, 2019

Economy Watch: Retail Sales Increase In May, Revised Upwardly For April

Still, consumer sentiment was down in early June amid slowing employment and tariff concerns.

Retail sales in the U.S. were up 0.5% month-over-month and 3.2% year-over-year in May, according to a report from the Commerce Department. The department also upwardly revised April’s numbers from a previously reported decline of 0.2% to a rise of 0.3%. The macro data is important to the promotional products industry, which tends to trend in the general direction of the overall economy.

Core retail sales – those that exclude spending on automobiles, gasoline, building materials and food services – rose 0.5% in May and 0.4% in April, data showed. Such sales are most strongly connected with the consumer spending aspect of gross domestic product. Consumer spending drives approximately 70% of GDP.

The May retail sales performance helps somewhat ease fears that second quarter economic performance would be anemic amid the escalating trade war with China and its concerns about tariffs, analysts said. Relatedly, industrial production was up 0.4% in May – the first such increase of the year, officials said. Given such numbers, the Atlanta Fed raised its second-quarter GDP growth estimate by seven-tenths of a percentage point to a 2.1% annualized rate.

Courtesy of stronger retail sales & industrial production, @AtlantaFed’s GDPNow forecast for 2Q19 rose to 2.1% pic.twitter.com/rf92I2a3KI

— Liz Ann Sonders (@LizAnnSonders) June 17, 2019

Still, some economic headwinds might be blowing.

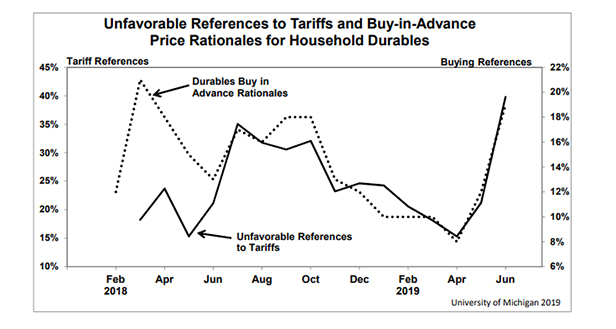

While the unemployment rate remained at a 50-year low of 3.6% in May, employers added only 75,000 jobs during the month – a weak showing. Furthermore, the University of Michigan’s closely-watched Index of Consumer Sentiment declined 2.1% month-over-month to 97.9 during the first couple weeks of June. Slowing employment and President Donald Trump’s recent imposition of 25% tariffs on $200 billion in Chinese imports acted as anchors on consumer sentiment. For similar reasons, the University of Michigan’s Index of Consumer Expectations dropped 5.2% month-over-month in early June to 88.6. Despite the declines, “the data indicate that real personal consumption expenditures will advance by 2.5% in the year ahead,” said Richard Curtin, chief economist for the University of Michigan surveys.

From University of Michigan