June 03, 2020

McConnell Keen for PPP Changes to Be Approved

The Senate majority leader wants the Senate to pass a House bill that gives small-business owners more flexibility in how they use money from the Paycheck Protection Program.

UPDATE 9:30 AM, June 3, 2020

Disagreement has reared among Republican Senators over how to proceed with approving proposed changes aimed at improving the Paycheck Protection Program. That could prevent a House-approved bill that proposes greater flexibility on PPP for small businesses from being fast-tracked through the Senate. Majority Leader Sen. Mitch McConnell, a Republican from Kentucky, wants the Senate to move swiftly to approve the bill. Senators, however, are divided over whether the House proposal should get a standalone vote without some alterations.

“Leaders had hoped to fast-track the legislation this week with a unanimous consent agreement, but multiple lawmakers including GOP Whip John Thune of South Dakota told CNN that a simple unanimous consent agreement wasn't likely given how widespread disagreements are over the proposal,” CNN reported. That’s likely to cause delays in getting the changes approved, analysts say.

The House bill reduces the share of aid money that small businesses are required to spend on payroll to 60%. It also extends the window businesses have to use the funds to six months – or 24 weeks – as opposed to the two months in the original legislation.

Original story

Senate Majority Leader Mitch McConnell wants the Senate to fast-track approval for changes proposed to the Paycheck Protection Program (PPP).

Multiple media outlets,including CNN, reported that McConnell is speaking with senators to see if there will be unanimous support for a bill the House passed last week that modifies the PPP.

Should all 100 senators be in favor of the House bill, then it could be approved early the week of May 31.

"I hope and anticipate the Senate will soon take up and pass legislation that just passed the House by an overwhelming vote of 417-1 to further strengthen the Paycheck Protection Program so it continues working for small businesses that need our help," McConnell said on June 1.

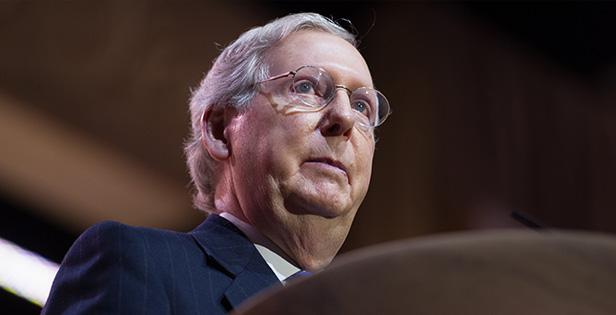

Mitch McConnell

Voted in on May 28, the House bill reduces the share of aid money that small businesses are required to spend on payroll to 60%. Previously, owners were required to spend at least 75% of the funds on payroll in order to ensure the loan would be forgiven.

The bill extends the window businesses have to use the funds to six months – or 24 weeks – as opposed to the two months in the original legislation. It also moves back a June 30 deadline to rehire workers, extends the time businesses have to repay the loan if the debt’s not forgiven and allows companies that get loan forgiveness to defer payroll taxes.

Despite McConnell’s push and near unanimous support in the House, it’s unclear if the bill will have a friction-free ride through the Senate. Sen. Marco Rubio, a Republican from Florida who chairs the Senate’s Small Business Committee, said in a recent statement that the House bill "could create an unintended disincentive to rehiring and create new and serious burdens for PPP borrowers in terms of forgiveness."

Still, Rubio said he would collaborate with the Treasury Department to see if some of those issues could be worked out administratively, rather than having to modify the bill.

The Treasury Department has indicated the concerns would not be a problem, a source told CNN.

As Congress considers changes to the PPP, demand from small businesses for the loans has declined dramatically. Businesses eager for support amid the height of societal lockdown measures tied to the coronavirus pandemic wiped out the initial $349 billion round of PPP funding in 13 days – by April 16. Authorities approved a second $310 billion round of funding on April 27, but approximately $150 billion of that loan money remained untapped as of late May.

The drop in interest is due, in part, to business owners’ confusion over terms and apprehension about being on the hook for paying the loan back.

Overseen by the Small Business Administration, the PPP is part of the $2.2 trillion CARES Act.