June 02, 2021

Post-Pandemic Hiring, Retention a Big Challenge

Promo products firms are struggling with the issue, as are companies across sectors, a survey shows.

Forget good help. These days, any help is hard to find when it comes to some job categories.

That’s a key takeaway from a just-released survey that puts hard data behind complaints U.S. employers have been making for several months amid the post-COVID economic recovery: Hiring and retention is difficult right now – a struggle being felt keenly by some in the promotional products industry as well.

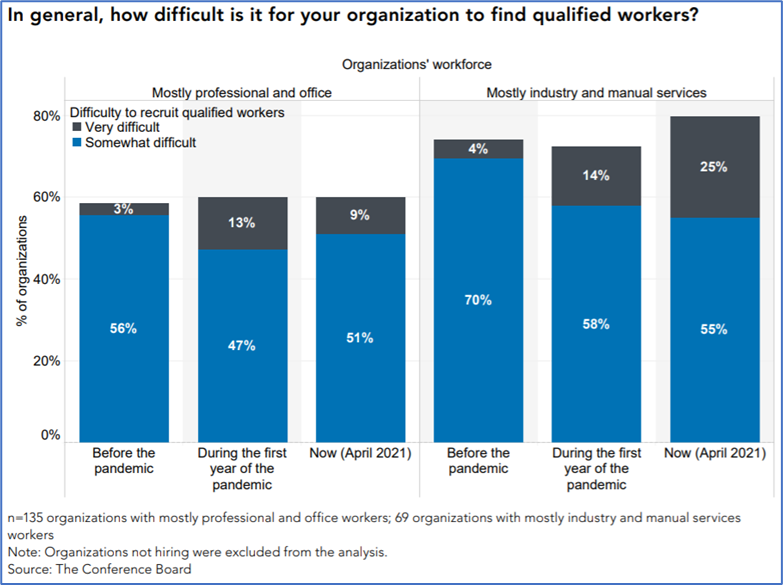

The survey from The Conference Board, a nonprofit nonpartisan think tank, found that 80% of organizations looking to hire mostly industry and manual services workers believe it’s somewhat or very difficult to find qualified workers. The human resources professionals who responded to the survey reported that it’s “very difficult” to hire qualified workers for industry and manual services positions at more than six times the rate they did prior to the pandemic.

The problem is less severe for organizations trying to hire mostly professional and office workers. Still, 60% of such organizations are finding it somewhat or very difficult to hire such employees. While the 60% figure is on par with pre-pandemic levels, the percentage saying it’s “very difficult” – 9% – increased by six percentage points.

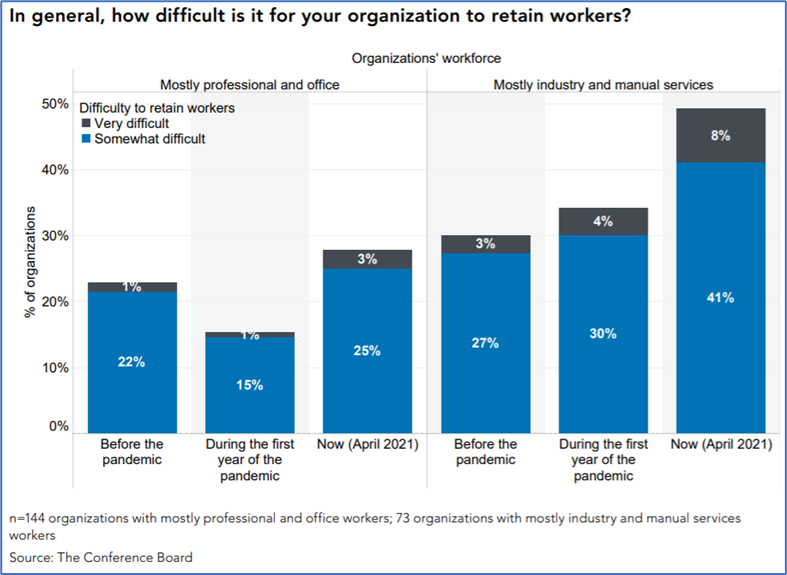

Retention is a headache, too: 49% of organizations with mostly industry and manual services workers report that it is somewhat or very difficult to retain workers, up from 30% before the pandemic. Among those employing mostly professional and office workers, 28% report difficulty retaining workers, up from 23% before the COVID crisis.

“Before the pandemic, industry and manual services workers were high in demand and short in supply. While this changed at the onset of the pandemic, as the economy reopens this trend is resurfacing – and fast,” said Frank Steemers, senior economist at The Conference Board. “This poses a growing challenge to companies that are looking to attract and retain this cohort of the U.S. workforce. On the flip side, it bodes well for the workers themselves, accelerating wage growth and offering more employment opportunities.”

Suppliers in the promo industry say it’s been tough to find and keep workers.

“As we ramp up production to meet growing demand, job openings at all our locations are taking much longer to fill compared to before, particularly in lower-skilled areas where competition is fierce,” said Chris Anderson, CEO of Top 40 supplier Massachusetts-headquartered HPG (asi/61966).

Los Angeles-based Top 40 supplier Sunscope (asi/90075) is experiencing issues retaining entry-level labor, said Chief Operating Officer Dilip Bhavnani. “When an employee can earn almost as much from unemployment and doing nothing compared to working 40 hours a week, it’s tough to keep people employed and motivated,” Bhavnani said. “We have had to offer higher compensation in order to avoid an impact on our operations.”

Some suppliers say the hiring and retention challenges are having a ripple effect on operations and operating costs.

“They’re driving longer lead times for order fulfillment and creating cost pressures in terms of higher wages,” said David Nicholson, vice chairman of Polyconcept, parent company of New Kensington, PA-based Top 40 supplier Polyconcept North America (PCNA; asi/78897).

PCNA, and others, are working to overcome the issues.

“We’re aggressively working on new recruiting strategies,” Nicholson said. “At the same time, we’re also focused on automation and efficiency programs to reduce the impact of the labor shortage and to expand our available capacity.”