May 21, 2020

Magic Johnson Giving Out $100 Million in Loans

The NBA legend teamed up with MBE Capital Partners on the initiative that aims to help minority- and women-owned businesses through economic challenges created by coronavirus.

NBA legend Earvin “Magic” Johnson had a reputation for coming through in pressure-cooker moments on the basketball court.

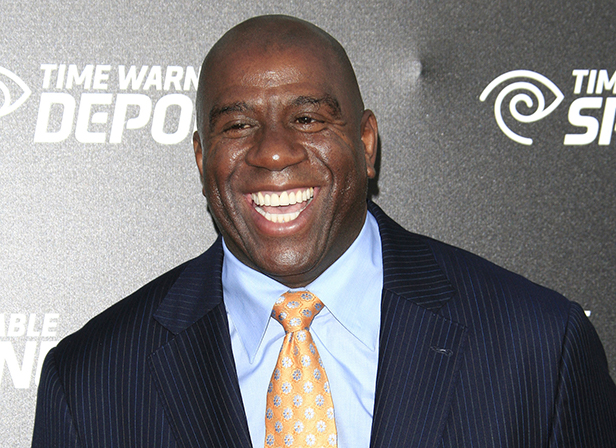

Magic Johnson

The 60-year-old Hall of Famer and five-time NBA champion is now doing so again in his post-sports role as successful entrepreneur and philanthropist.

Johnson has teamed up with New York City-based MBE Capital Partners to offer $100 million in loans to minority- and women-owned businesses experiencing economic hardship due to stay-at-home orders related to the coronavirus pandemic.

Funded through Johnson’s EquiTrust Life Insurance Company, the money is available through the Paycheck Protection Program, which the Small Business Administration oversees.

“This will allow them to keep their employees and keep their doors open,” Johnson told CNBC’s “Squawk Box” on May 19.

Johnson noted that many minority- and women-owned businesses, particularly in urban communities, are at risk of closing for good because of the economic carnage caused by COVID-19. It’s important that doesn’t happen, he says.

“We have to remember that these businesses have been in urban communities for a long time,” Johnson told CNBC. “They’ve been doing great things, and they probably didn’t have a relationship with the banks when the stimulus package went out. So now, we’re able to say, ‘Hey, you can have a relationship with us.’ ”

The Johnson-backed initiative aims to help 100,000 businesses in urban communities, according to Rafael Martinez, CEO of MBE.

“There is a ton of money left,” Martinez said. He noted that, through planned work with depository banks, the available funding could be multiplied to $1 billion or more.

On March 29, the Coronavirus Aid, Relief, and Economic Security Act (CARES Act) went into effect. It’s a federal law that provides for emergency financial assistance to the tens of millions of Americans trying to survive the economic devastation caused by COVID-19. Initially, the CARES Act included $349 billion in forgivable loans to small businesses to help with job retention and other expenses, through the PPP. The funds quickly ran dry. In April, Congress approved an additional $310 billion in PPP funding. There’s still money available in the second round of funds.