October 18, 2019

Gildan Predicts 2019 Sales Decline as Weak Demand Derails Q3

Some analysts see the performance as representative of economic headwinds that could hit the branded apparel/promotional products space.

On the back of a third quarter that saw decreased sales and profits, Top 40 promotional products supplier Gildan (asi/56842) is now predicting that its full-year 2019 sales will be less than in 2018.

In an announcement made Thursday, the Montreal-based apparel manufacturer said that preliminary results indicate that its Q3 sales declined 2%, compared to last year’s third quarter, to about $740 million. Similarly, Gildan said that, when it reports its finalized Q3 results on Oct. 31, investors can expect to see diminished earnings: GAAP diluted earnings per share for Q3 2019 will likely be $0.51, while adjusted diluted EPS will probably tally $0.53, both of which are 7% drops compared to the prior year’s third quarter.

“Specifically in the U.S. imprintables channel, where the company was expecting low-single-digit growth in distributor point-of-sales (POS), actual POS during the third quarter was down high-single-digits compared to last year,” Gildan said in a statement. “Further, in international imprintable markets where the company was forecasting growth, continued softness in Europe and China resulted in lower international sales for the quarter.”

Gildan expects the weakness to continue in the fourth quarter, with the company anticipating that “distributor inventory destocking will negatively impact sales by approximately $100 million.”

Consequently, Gildan predicts its 2019 sales to be down by low single digits compared to 2018 – a departure from a previous prediction of mid-single-digit growth. Relatedly, GAAP-diluted EPS is projected to be $1.50 to $1.55, while adjusted diluted EPS is expected to be in the range of $1.65 to $1.70. The prior forecast had the ranges as GAAP-diluted EPS of $1.80 to $1.85 and adjusted diluted EPS of $1.95 to $2.00. In 2018, Gildan’s diluted earnings per share for the year increased 3.1% to $1.66.

Gildan also lowered its adjusted EBITDA prediction for 2019, from a previous forecast of more than $615 million to a range of $545 to $555 million, which is, even at the high end, more than $40 million less than 2018’s $595.5 million.

Following the announcement, Bloomberg reported that Gildan suffered its worst stock drop since 2008, with shares falling as much as 34%. The poor performance in Gildan’s printwear division – which includes sales to the promotional products market – had some financial analysts opining that the weakness could be representative of a beginning slowdown in the promo space.

“The printwear channel is reliant on demand from the promotional products channel, and it is possible that economic anxiety has caused some companies to reduce discretionary spending,” Keith Howlett, an analyst at Desjardins Capital Markets, wrote in a note to investors.

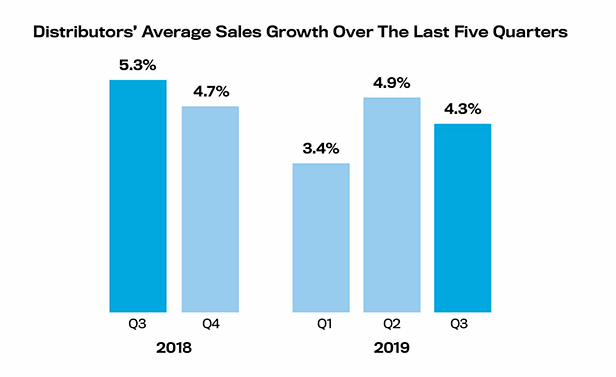

While nothing is certain, the dour outlook is not representative of industry-wide performance during 2019’s third quarter, according to the recently released ASI Quarterly Distributor Sales Survey. During Q3, promo distributors increased sales by 4.3% on average. That performance is more than double what various analysts predict will be U.S. gross domestic product growth of 2% or below for the third quarter.

“While there have been some storm clouds, there hasn’t been an actual storm. We’re expecting a fairly strong fourth quarter for the industry,” said Nathaniel Kucsma, ASI’s executive director of research and corporate marketing.

For sure, a range of industry distributors reported strong third quarters. Top 40 firm Jack Nadel International (asi/279600) told Counselor that sales were up about 20%. Meanwhile, mom-and-pop distributorship A&P Master Images in Utica, NY said sales jumped 11% year over year in Q3.

“We are on track to have a record year,” Steve Flaughers, owner of Ohio-based Proforma 3rd Degree Marketing (asi/300094), told Counselor. His company’s sales rose 21% in the third quarter. “We anticipate a very strong fourth quarter.”