October 11, 2019

Promo Distributors’ Sales Rise 4.3% in Q3 2019

The Counselor Confidence Index, however, dropped to its lowest level in six years.

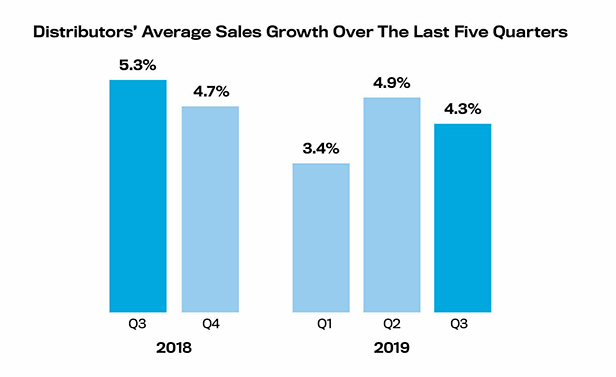

Promotional products distributors increased sales by an average of 4.3% during the third quarter of 2019 compared to the same three-month period the prior year, according to the just-released ASI Quarterly Distributor Sales Survey.

The growth rate was down from Q2’s 4.9% rise and a percentage point off 2018’s third-quarter increase of 5.3%. Still, promo’s performance is more than double what various analysts predict will be U.S. gross domestic product growth of 2% or below for the third quarter.

“We saw a little pullback in Q3, which is possibly the result of larger economic forces – the U.S.-China trade war and fears of a recession – making some end-buyers a little more conservative in their spending,” said Nathaniel Kucsma, ASI’s executive director of research and corporate marketing. “But while there have been some storm clouds, there hasn’t been an actual storm. We’re expecting a fairly strong fourth quarter for the industry.”

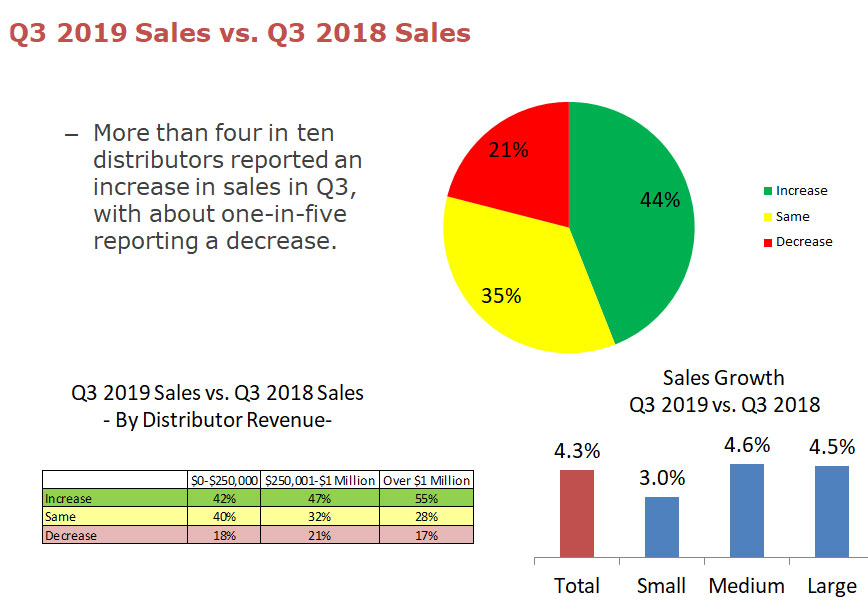

Overall, 44% of distributors reported a year-over-year sales increase in Q3 2019. That was an improvement over Q2, when 39% of firms said revenue rose. In Q3, 21% of distributors reported a drop in sales, while 35% said revenue was flat with the prior year’s third quarter.

Broken down by size, 55% of distributors that generate more than $1 million in annual sales experienced Q3 growth. The average rise was 4.5%. Meanwhile, some 47% of distributors with revenue between $250,001 and $1 million said sales went up. The average rise was 4.6%. Finally, just over four in 10 (42%) distributors with sales of $250,000 or less reported a year-over-year revenue rise. The average uptick was 3%.

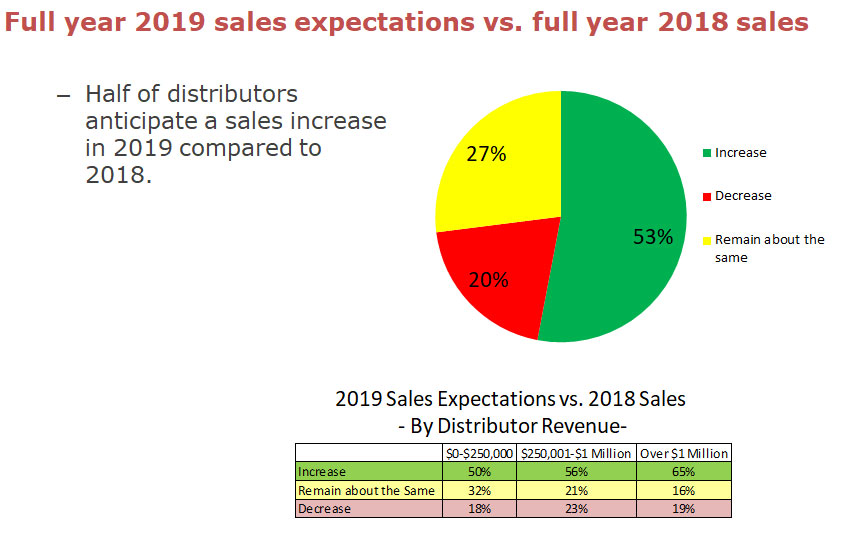

Looking ahead, more than half of all distributors – 53% – expect their sales for the whole of 2019 will increase, with one in five anticipating a decline. Steve Flaughers is among the optimistic. The owner of Proforma 3rd Degree Marketing, an affiliate of Top 40 distributorship Proforma (asi/300094), told Counselor that his Ohio-based firm increased sales 21% in the third quarter. Factors that fueled the gain included 3rd Degree’s partnering with more suppliers on end-user calls, a more aggressive social media push and a drive to incorporate pop-up stores for clients. “We are on track to have a record year,” Flaughers told Counselor. “We anticipate a very strong fourth quarter.”

Elsewhere, Top 40 distributor Zorch (asi/366078) was another of the promo industry’s third-quarter success stories. Mike Wolfe, CEO of the Chicago-based company, told Counselor that sales were up in the low-to-mid teens in terms of percentage growth. “It was the result of a combination of existing account growth, combined with business from new accounts,” Wolfe said.

The story was similar at Arizona-based Stowebridge Promotional Group (asi/337500). Company President Kathy Finnerty Thomas said third-quarter sales rose more than 16% – a jump primarily catalyzed by successful referrals that empowered the firm to capture new business from different departments within the organizations of current clients. “August was one of our biggest months ever,” Finnerty Thomas told Counselor.

At Top 40 distributor Jack Nadel International (asi/279600), third quarter sales leapt 20%, President Craig Nadel told Counselor. Factors included pivotal strategy decisions panning out, hiring good people and self-promotions. “We’ve had a good run of it,” Nadel told Counselor.

Of course, not every industry firm saw a gain. Sales at the two-person Canada-based distributorship Linéaire Infographie inc. (asi/253727) were down a pinch in Q3, but that was primarily a result of pulling back on advertising spending. Profits, however, are stronger – something principals anticipate will hold for the whole of the year, too. Furthermore, “we expect our total sales for 2019 to be about the same as last year, if not better,” Linéaire’s Christine Courtemanche told Counselor.

Despite the overall positive sales momentum in the industry, a notable sour note sounded in ASI’s Q3 findings. The Counselor Confidence Index, which measures distributors’ feelings about the current and future health of their businesses, dropped to 110 – the lowest level since tallying the same reading six years earlier in Q2 2013.

While still above the baseline reading of 100, and far from the all-time low (79) experienced in 2009 during the Great Recession, the fact remains that the Confidence Index has now declined for four straight quarters – down from its all-time high of 117 in the third quarter of last year. The drop is primarily a result of growing anxiety about the U.S.-China trade war and the potential for domestic and global economic conditions to deteriorate in the months ahead. Slower growth, or a recession, has the potential to erode sales and profits in promo.

Still, many in the industry remain confident. Howard Potter, CEO of Utica, NY-based distributor/decorator A&P Master Images, is among them. His company’s sales jumped more than 11% in Q3 – an increase driven in part through improved customer service, quality and turnaround times, as well as positive word of mouth and grassroots marketing/community involvement. Potter believes Q4 – and 2020 – will lead to continued sales expansion for the ad specialty space as a whole. “I think we’ll see industry sales increase 5% to 10% next year,” he told Counselor.

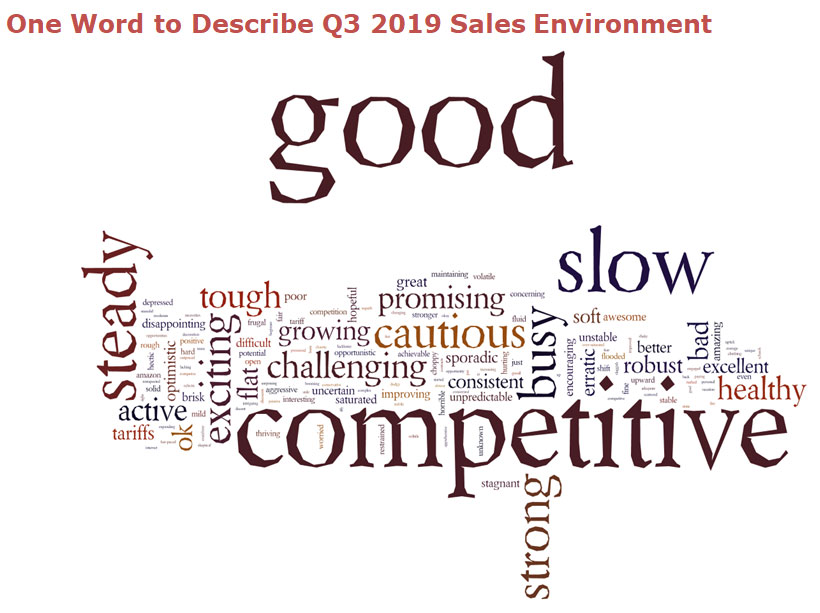

Words distributors most often used to describe the Q3 2019 sales environment.