November 06, 2023

Q3 Industry Growth Is Slowest in Post-COVID Era

Sales for the largest distributors were nearly flat and mid-sized firms had the biggest gains. Optimism still abounds for Q4.

The promo industry’s growth streak is alive, but the pace of sales acceleration cooled.

That’s the most prominent finding from the just-released Distributor Quarterly Sales Survey from ASI Research, which shows that in Q3 2023 promotional product distributors collectively increased sales for the 10th straight quarter since the recovery from COVID-induced business declines began.

Still, the growth rate – 2.4% on average – was the slowest of any of those 10 quarters.

Distributors increased sales in Q3 2023 by

2.4%

Relatedly, Q3 was only the second time during the recovery that the year-over-year average quarterly rise dropped below 5%. The other happened this year in Q1, when industry growth measured 3.3%.

“There continues to be uncertainty about what’s going to happen with the economy and some businesses are feeling this, causing them to temper spending to a degree,” says Nate Kucsma, ASI’s senior executive director of research, who spearheads the quarterly survey. “While that spending hesitancy among some end-clients certainly hasn’t derailed promo, as shown by the fact that sales increased, it has impacted business to an extent.”

Sales Stall for Promo’s Biggest Players

To wit: During the third quarter, 49% of distributors increased sales compared to the same three-month period in 2022. However, more than a third (35%) experienced a year-over-year decline – the most since the first quarter of 2021, ASI Research shows.

Notably, it was the industry’s largest distributors ($5 million+) for whom the sledding was toughest. They collectively eked out just a 0.3% average increase – well below the rate of consumer inflation and the weakest gain among distributors of various revenue classes. Nearly 4-in-10 (38%) of promo’s largest distributors suffered a sales decline.

“The Q3 slowdown for large distributors is a reflection of the extraordinary performance many had in 2022,” says Nancy Schmidt, CEO of Top 40 distributor AIA Corporation (asi/109480) and a member of Counselor’s Power 50 list of promo’s most influential people. “As the world started to regain a sense of normalcy, companies ramped up their investments. Large distributors naturally benefited from this influx of demand. Comparatively, end-buyer budgets are now representing a more typical level. As a result, large distributors may be experiencing a slowdown in growth as the market normalizes.” In 2022, distributor sales matched an all-time annual record first set in 2019 – $25.8 billion.

Power 50 member Marc Simon also points to an especially robust 2022 as one reason that sales are down a pinch year-to-date for the Top 40 distributorship he helms – HALO Branded Solutions (asi/356000). It’s not the only factor though, the CEO notes.

“We support and will continue to support many of the major global tech companies, and our slight decline is attributable to volatility in the tech sector,” Simon tells ASI Media. “Macro-economic conditions are also affecting us, as we are relatively flat with last year in the rest of our business.”

While gross domestic product in the United States continued to grow through the year’s first three quarters, factors such as high-profile layoffs in the technology sector, continued above-average inflation, soaring interest rates, tougher lending standards, persistent recession fears and geopolitical uncertainty have complicated the marketplace.

35%

The percentage of distributors whose sales decreased in Q3 ’23 – the highest figure since Q1 ’21.

“Over 90% of our accounts were down in Q3 2023 versus Q3 of 2022,” says Bob Herzog, CEO of Top 40 distributor Corporate Imaging Concepts (asi/168962). “Those results span many different verticals and geographies. Our customers have told us that they have all been operating in conditions where their promo budgets have been cut – sometimes significantly.”

Herzog says two sizable anchors seemed to hold down Q3 sales. Some clients have laid off thousands of employees, so it’s a bad look to spend money on promo while cutting back on personnel. Also, customers like public companies are under tremendous pressure to cut costs – and that’s translating to spending less overall, including on branded merchandise.

“We’ve seen a couple of situations where the sales results of some public company customers didn’t seem to justify the severe cost-cutting actions taken,” Herzog says. “It was as if the CEOs were trying to avoid criticism by cutting costs earlier and more deeply than really needed.”

At a session at the recent ASI Power Summit, prominent Power 50 leaders noted that sales have been relatively flat.

Supplier executives Jeremy Lott, CEO of Top 40 supplier SanMar (asi/84863), and Pierre Montaubin, CEO of Top 40 supplier Koozie Group (asi/40480) stated that lower-priced items were gaining traction, while both Daron Hines, president of Top 40 distributor Staples Promotional Products (asi/120601), and Jo Gilley, CEO of Top 40 distributor Overture Promotions (asi/288473), are seeing belt-tightening with clients. “Our sales reps are working harder, even though it’s flat,” said Gilley. “They’re quoting more things to get the order than in the past.”

‘One Day at a Time. One Foot In Front of the Other’

It wasn’t just the industry’s biggest companies feeling headwinds for promo industry sales in Q3.

What ASI Research characterizes as large distributors – those that annually generate between $1 million and $5 million in revenue – produced an average 1.7% year-over-year sales rise. However, 45% of such companies experienced a decline in revenue compared to the same quarter in 2022, which was the highest percentage of any distributor revenue class.

As with the extra-large ($5M+) distributors, similar factors dented the performance of firms in the $1 million to $5 million category – normalizing client spend following heavy COVID bounce-back investment in 2022, a high year-over-year comparative number to match, and certain clients cinching shut their purses amid downsizing and a nervy economic outlook. Sometimes, too, it was just a matter of quirks particular to a company’s situation.

45%

Percentage of distributors in the $1 million to $5 million annual revenue category that experienced a sales drop in Q3 2023.

“For us, the third quarter will be the only down quarter of the year,” says Travis Powell, founder/CEO of Blue Phoenix Branding powered by Top 40 distributor Proforma (asi/300094). Blue Phoenix is in the $1 million to $5 million distributor class. Powell adds: “We anticipated the decline, as last year we had anomaly projects that led to some sales we knew would not be replicated.”

Jean Beauclair, product marketing manager at Shreveport, LA-based RP Promotions (asi/311729), also in the $1 million to $5 million category, says that sales dropped double digits due to the loss of a major client. The customer’s departure was beyond the firm’s control. “We’re in a rebuilding year,” Beauclair tells ASI Media. “One day at a time. One foot in front of the other.”

Success Stories

Despite the challenges, it shouldn’t be lost that overall distributor sales did increase. And none more so than for distributors in the $250,001 to $1 million revenue category. These mid-sized firms powered a 4.4% average sales jump, as more than half (54%) generated a year-over-year revenue rise.

Awesome Advertising (asi/128275) was among the mid-sized distributors that had a successful third quarter. The North Carolina-based firm engineered double-digit Q3 sales growth. Owner Angie Gallo-Hughes shares that much of that increase was down to good old-fashioned hustle.

“My sales are up because I pound the emails and the phone calls,” says Gallo-Hughes. “I use a lot of self-promos and that helps, too. The biggest thing that helps me get new clients though is that I donate a lot for my local people and word gets out.”

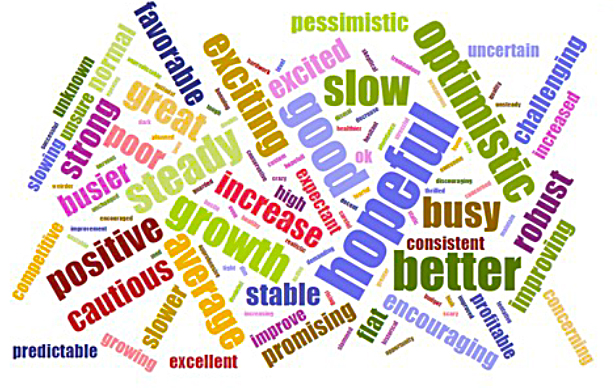

Distributors used a variety of positive terms to describe Q3 in a single word – “good” “hopeful” and “optimistic.” Still, more downbeat words like “cautious” and “challenging” appeared too, highlighting a complex quarter in which growth slowed and average sales increases varied among distributors of different revenue classes.

Gallo-Hughes has found a nice niche, working often with credit unions and lumber yards. “I belong to a credit union, and I’ve learned the lingo over the past 20 years, so that helps me get my foot in the door when cold calling these types of accounts,” she explains.

Backhome Creations, a Kentucky-based Century Club Dealer for Top 40 distributor Kaeser & Blair (asi/238600), increased sales 23% in Q3 2023 compared to the same quarter last year. That put the firm among the 48% of distributors with revenue under $250,000 that accelerated revenue in Q3 2023.

Owner Sally L. Back says the success came through working primarily with clients in the education, manufacturing and utilities industries, as well as providing solutions for a grocery chain. Her education sector business includes selling to a large technical college.

“Among my clients in particular, people have had a much more optimistic outlook overall now that COVID isn’t as big of a threat,” says Back. “That’s made a huge difference in my sales.”

This chart refers to the percentages of promo distributors surveyed who characterized the end-market in question as “robust” for promo sales in the third quarter of 2023.

Education, healthcare, nonprofit, construction, and associations/clubs/civic groups were the top five end-markets for promo sales in Q3. Nonprofits and associations experienced especially strong growth, says Kucsma, noting that the percentage of distributors characterizing such verticals as “robust” for merch sales each increased notably.

Ohio-based PENSRUS.com (asi/293400) counted itself among the 51% of $1 million to $5 million in revenue distributors to elevate sales in the third quarter compared to last year’s Q3. Owner Brett Wilkinson tells ASI Media that a more intense focus on generating reorders and capitalizing on opportunities with restaurant groups and religious organizations helped spur growth.

“We’ve seen,” says Wilkinson, “an uptick in places that fell off drastically during COVID.”

A Strong End to the Year?

The momentum for PENSRUS.com is continuing in Q4. The average dollar value of the firm’s orders is up, even if margins are being squeezed a bit due to pressures like higher shipping costs. Wilkinson is confident that the distributorship will finish 2023 strong, with full-year sales rising relative to 2022.

He isn’t the only distributor feeling comfortable about the months ahead, even as the industry contends with marketplace challenges.

Proof is that the Counselor Confidence Index, which measures distributor financial health and optimism, increased by two points in the third quarter, rising to a reading of 103. That’s above the baseline of 100, and while below the levels seen in the 2013 through 2019 pre-COVID years, it’s not a bad showing relative to other tallies recorded in the pandemic recovery period.

“Distributor confidence stabilized and improved slightly, which suggests that at the outset of Q4 sales are coming in OK for many,” says Kucsma, ASI’s research lead. “The precipitous drop in business some have feared amid economic concerns hasn’t broadly materialized, and many industry firms feel their sales will be flat or up some in Q4 – and they’re good with that.”

To Kucsma’s point, 41% of distributors believe their sales in the fourth quarter/holiday period of 2023 will increase compared to last year’s Q4. Another 4-in-10 (42%) anticipate that sales will hold steady.

Gallo-Hughes of Awesome Advertising is predicting a gain. “This final quarter is going to put me over last year’s annual sales,” she tells ASI Media. “My overall sales will increase substantially.”

Based on booked business, Powell of Blue Phoenix Branding believes the firm’s fourth quarter revenue will rise 20%, helping to power a 10% annual sales elevation in 2022.

“As the year began, a number of clients indicated a tightening of the belt,” Powell says. “Despite that warning, we’ve not seen it. Some of our verticals are perhaps less affected by economic factors.”

AIA CEO Nancy Schmidt says: “Business in Q4 is off to a strong start, and we’re cautiously optimistic about the coming months. While we anticipate a healthy fourth quarter, with sales expected to follow our historical patterns of seasonal lift, the broader economic landscape remains a concern for us all. We’re committed to helping our network of distributor owners navigate the complexities of the market, focused on a strong and sustainable growth trajectory.”

For sure, distributors aren’t operating in a vacuum. Most industry pros ASI Media spoke with acknowledge that everything from factors like continued challenges with inflation to fallout from geopolitical tragedies like the wars in Israel and Ukraine have the potential to negatively affect spend on promo, depending on exactly how things play out. Even so, as Schmidt speaks to, distributors are pushing forward, navigating the complicated times and working hard to keep business moving.

“The fourth quarter is off to a very strong start, and we anticipate approximately matching the strong fourth quarter we enjoyed last year,” says HALO CEO Simon. “The economy, interest rate prospects and geopolitical events combine to make us cautious as we plan for next year. Nonetheless, we’re excited for a big rebound in 2024, as several major pieces of new business are now in implementation.”

Sally Back is feeling good about what lies ahead, too.

“I have seen many ups and downs in my 26 years in this business,” says the owner of Backhome Creations. “I’m very grateful that things are definitely looking up, and I expect that to continue in the coming year.”