September 26, 2018

Cintas Reports Fiscal Q1 Growth

The Top 40 firm said that total revenue and net income from continuing operations increased.

Top 40 distributor Cintas (asi/162167) reported this week that total revenue for its fiscal 2019 first quarter, ended Aug. 31, increased 5.4% year-over-year to $1.7 billion.

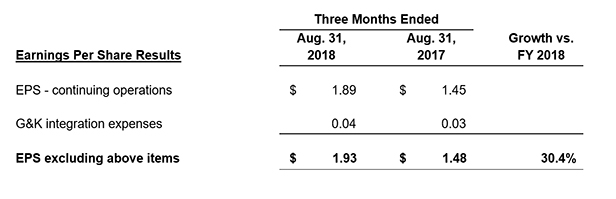

Meanwhile, net income from continuing operations rose too, jumping nearly 32% over the same period during the prior fiscal year to $212.5 million in 2019, Cintas said. Relatedly, earnings per diluted share from continuing operations accelerated, increasing 30% to $1.89, according to the company.

“We are pleased with our start to fiscal 2019 and look forward to another successful year,” said Scott D. Farmer, Cintas’ chairman and CEO. “We remain focused on integrating the G&K acquisition, continuing the implementation of our enterprise resource planning system, and increasing the number of businesses we help get ready for the workday.”

Scott D. Farmer, Cintas chairman and CEO.

According to Cintas, Q1 operating income of $265.2 million was up 6.5%. The increase occurred despite a $19 million stock-based compensation expense related to a change in Cintas’ retirement policy, which lowered retirement age and tenure requirements. Integration-related expenses tied to the G&K Services acquisition dragged on operating income too, the company said.

Cintas also reported that a lower effective tax rate, engendered by federal tax reform, helped the gains in net income from continuing operations and EPS from continuing operations. The company noted that last fiscal year’s first quarter tax rate was 26.5%; the rate in fiscal Q1 2019 was 12%, said Cintas.

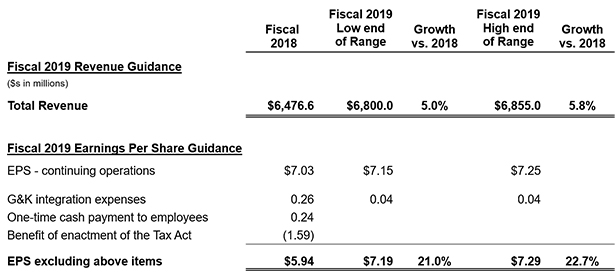

Buoyed by the positive Q1, Cintas is increasing its annual financial guidance for fiscal 2019. “We are raising our revenue guidance from a range of $6.75 billion to $6.82 billion to a range of $6.80 billion to $6.855 billion and EPS from continuing operations from a range of $7.00 to $7.15 to a range of $7.19 to $7.29,” said Farmer. “Fiscal 2019 guidance excludes any future integration expenses related to the acquired G&K business.”

With estimated 2017 North American promotional product revenue of $168.2 million, Cintas ranked 14th on Counselor’s most recent list of the largest distributors in the industry.