September 23, 2019

Chairman of Coach Invests in Harper+Scott

The NYC-based distributorship says the investment will propel initiatives to drive greater growth.

A little more than five years ago, Jon Alagem and Michael Scott Cohen founded Harper+Scott (asi/220052).

Fast forward to the present, and the New York City-based distributorship is on track to generate $35 million in revenue in 2019, a 42% year-over-year increase that propels the firm’s march toward Top 40 promo distributor contention.

And now, Alagem, Cohen and their team have a fresh infusion of capital to help fuel initiatives they say will drive even greater growth.

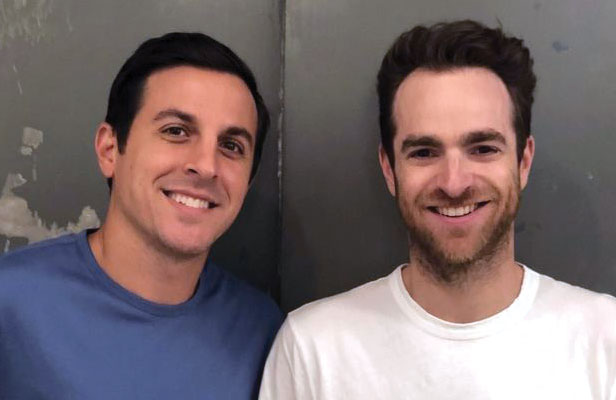

Michael Scott Cohen and Jon Alagem, Harper+Scott

On Monday, the company leaders told Counselor that Harper+Scott has raised an undisclosed investment from financial heavyweights that include Lew Frankfort, the chairman and former CEO of luxury brand Coach, and John Howard, who is co-managing partner of Irving Place Capital. Alagem noted that Howard’s investment comes through a group that he formed with investor Noah Rabinsky of Summerfield Capital.

The investors hold a minority stake in the company, which remains privately held with Alagem and Cohen at the helm. Harper+Scott ranked 38th on Counselor’s 2019 “Best Places To Work” list, and there’s a podcast with co-founder Michael Scott Cohen here.

“We feel that we’ve barely scratched the surface of what we’re capable of achieving,” Alagem told Counselor. “With this investment, we’re going to be able to build an even more robust company.”

Milk Bar, a chain of dessert and bakery restaurants, is a Harper+Scott client.

Alagem told Counselor that the cash infusion will help with the development of a new company technology platform, lead to important hires and aid in the expansion of Harper+Scott’s direct manufacturing footprint, particularly to countries beyond China. The investment will help empower Harper+Scott to further enhance sustainability initiatives that the company says are already strong – and, thus, a key differentiator in a crowded market.

“At Harper+Scott, we always put sustainability first in the products we design and develop,” Alagem told Counselor. “That’s critical, because for us, most of the products we do are custom – built by us for our clients. That enables us to educate clients about sustainability – to provide them documentation about true sustainability and how they can be more sustainable.”

Yoga mats Harper+Scott created for Compass, a real estate company.

The soup-to-nuts business model, which entails everything from product ideation and development, to actual production and fulfillment, has enabled Harper+Scott to become an 8-figure player in promo, while winning a consistently growing number of household-name clients. Customers include Sephora, Milk Bar, L’Oréal Paris, Covergirl and more. “Our goal is to take as much off of our clients’ plates as possible,” says Alagem. “We make it stress-free.”

Alagem noted that NYC-based Josh Goldberg of Threadstone was the banker on the investment deal.