April 21, 2017

Promotional Product Sales Report: West

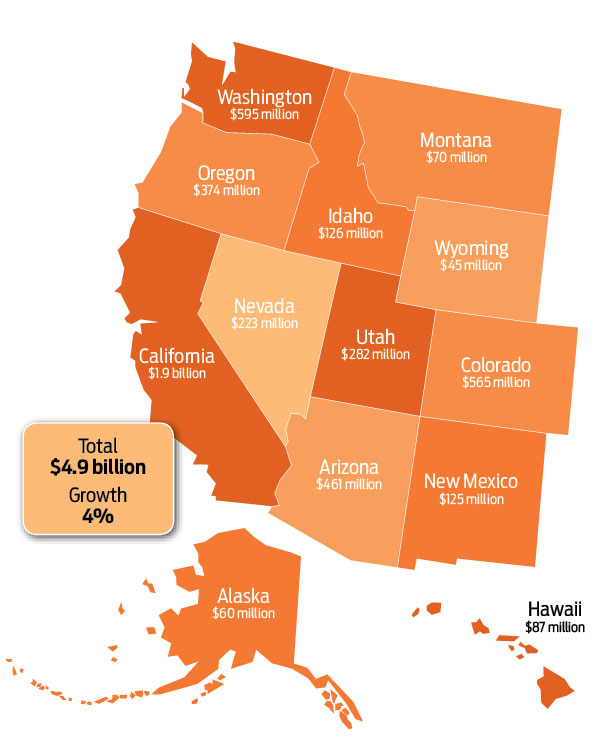

Strength in technology and optimistic growth leads to a sunny view out West.

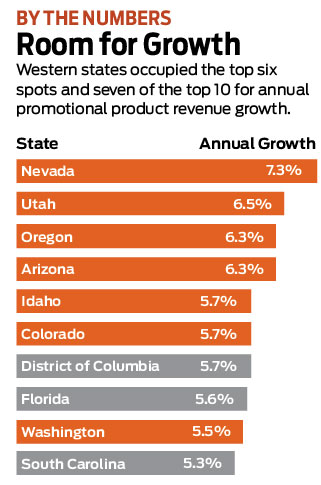

he technology hotbed you need to know out West is in … Utah? Yes indeed. Promotional product sales surged by 6.5% last year in the state (for a total of $282 million), thanks in part to what Forbes called a “burgeoning tech sector” in naming Utah its 2016 Best State for Business. The high-tech hotbed is home to companies like Vivint Smart Home, Fusion-io, AtTask, Boostability, Qualtrics and many more like them. Photobook startup Chatbooks relocated to Salt Lake City because “there was creative and technical talent in a secret spot where I wasn’t competing with rocket ships,” co-founder Nate Quigley told Forbes.

he technology hotbed you need to know out West is in … Utah? Yes indeed. Promotional product sales surged by 6.5% last year in the state (for a total of $282 million), thanks in part to what Forbes called a “burgeoning tech sector” in naming Utah its 2016 Best State for Business. The high-tech hotbed is home to companies like Vivint Smart Home, Fusion-io, AtTask, Boostability, Qualtrics and many more like them. Photobook startup Chatbooks relocated to Salt Lake City because “there was creative and technical talent in a secret spot where I wasn’t competing with rocket ships,” co-founder Nate Quigley told Forbes.

The state is another example of a region that is demonstrating exemplary growth through its technology affiliations. And distributors are taking notice. Even though the technology market accounted for approximately 4% of promotional products sales in 2016, it was the highest percentage revenue category for distributors earning $1 million to $10 million in sales regardless of where they were located.

>> State Spotlight: Franchise Opportunities in Arizona

Craig Nadel, president of Jack Nadel International (asi/279600), points to the technology sector when it comes to growth in the West. The big news: “the huge amount of IT money,” he says. “Snap (who we don’t work with) is a recent example. They recently went public with a huge market cap. Those companies have a lot to spend.” JNI’s tech clients include CA-based Oracle and Instagram.

It’s not just the tech giants, however. Across the West there are thousands of potential IT companies of all sizes. In California alone a search on Manta for Information Technology providers brings up 20,566 businesses.

With this vast array of options in the tech market, distributors can’t expect to pitch the same old stuff and expect to succeed. “Tech people pride themselves on being disruptive and thinking out of the box, and they want to carry that ethos throughout the entire organization, in all regards,” Nadel says. It’s also a matter of demographics, adds Nadel; the younger employees and target audiences of these tech firms means that more creative and “out there” gifts will generate interest.

For example, JNI did a promotion for Instagram for its annual Instameet that was a playful gift kit of game pieces and miscellaneous components to inspire social media postings and build a sense of community among participants.

>> Case Study: Nostalgia Products Make Big Impacts

Outside of marketing and promotion, tech firms are looking to staff positions in their growing businesses. “Those companies have a hard time finding talent,” says Nadel. “And they go to colleges to try and get the good computer science and electrical engineering people to join them rather than another tech company.” With that younger age bracket, earbuds, backpacks and fashionable T-shirts are effective promotions.

What type of products do these consumers respond to favorably? Four of the 12 Western states (California, Oregon, New Mexico and Colorado) are noted for tech-products such as USB drives and power banks as being the most impactful on recipients, according to ASI Research.

Greg Armstrong, vice president of sales development at Proforma (asi/300094), sees the impact of technology on sales across the Western region of the U.S. “Technology continues to be a critical component of what we bring to the market and how we deliver it,” he says. “Clients have been expressing a greater interest in products that either support technology or are built around it. Their marketing campaigns and initiatives are technology driven, making company stores and digital media key to the marketing solutions we provide. The corporate presence of companies in the West like Microsoft, Google and Apple push this region to be more trendsetting than reactive.”

Also, the technology boom cuts across industries. David Schmaeling, owner of Proforma Color Press (asi/300094) in Ventura, CA, sees such crossover in construction. His client Procore, which makes project management software for the construction industry, is growing again and in need of engineers; Procore grows as construction picks up with the economy. Construction itself uses all sorts of technology along its supply chain. “The economy is definitely coming back,” he says. “Companies are now getting the thumbs-up to start projects.”

Key Trends

Retail’s Struggles

Retail’s Struggles

“The biggest development in our region and throughout the U.S. is the decline of the brick and mortar retail center, and therefore their customers,” says Eden McClellan, president/COO of Los Angeles-based Icon Blue (asi/229398). “Online shopping has eroded market share for the retailers, resulting in multiple store closures.” Despite the drop, traditional retailers still have promotional needs. In fact, it’s more important than ever to reward loyalty and build morale. For retail clients, gift-with-purchase projects are hot, “but a majority of the business is for employee recognition, motivation and years-of-service awards,” McClellan says. “In addition, we’re noticing more business for community events that our retail clients are involved in, such as T-shirts and caps for company volunteer efforts.”

Take Time to Celebrate

Big sectors in the West include hospitality, entertainment and tech companies – all of which are people and/or project focused. “The programs these companies are utilizing promo products for tend to be centered on team-building and company celebrations,” McClellan says, such as corporate anniversaries and fun events for completing projects. “Products remain fairly wide range, with a strong focus on apparel. Fast, efficient turnaround and some light graphic design are services that are always appreciated.”

Strong Industries

In addition to technology, Proforma's Greg Armstrong notes other key industries that propel promotional product sales such as healthcare, entertainment and education. “They continue to grow and have a very strong corporate presence in the West,” he says. “The West also continues to be one of the largest consumer bases in the country, particularly along the coast.”

Go Old-School

The millennial-rich employee base of the Western area tech market responds well to clever, fun promotions with a vintage twist. David Schmaeling of Proforma Color Press has found that clients under age 30 take to items that predate their childhood. “They like the retro vibe,” he says. “It gives them that ‘neat to be a kid’ feeling.” Millennials, born between 1980 and 2000, came along way after the heyday of classic toys from the 1950s to 1970s, items such as the Spirograph, Viewfinder, Lite-Brite, Magic 8 Ball, Etch A Sketch, Silly Putty, Weebles, Troll dolls, Hoppity Hop balls and Punch-Me toys. Therefore, these toys have a freshness to them that’s appealing. Many old-school toys are readily available from industry suppliers today. The key is to tie them into a promotion with a nod to the past while selling the promise of the advertiser’s technology to create a better present or future.

The Call for Made in the USA

Over half (53%) of promo products recipients in the U.S. have a more favorable opinion of an advertiser if the product was made in the USA. That sentiment is even stronger in the Western states of Montana, Wyoming, Idaho, Alaska and Hawaii (57%), and Washington and Oregon (56%). Greg Marks, owner of Proforma affiliate IdentiBrands (asi/491827) in Phoenix, has noted the demand for American-made apparel across the West. Younger buyers in particular are looking for USA-made T-shirts that are soft with high quality fibers and stylish details. The kicker, however: they don’t necessarily want to pay the higher price for the finer garment.

Tonia Kimbrough is a contributing writer for Advantages