Through the first two and a half years, Donald Trump’s presidency has been both a boon and a burden to the business of the promotional products industry. That’s the picture that emerges from interviews Counselor conducted with a cross-section of industry professionals, from mom-and-pop shop owners to boots-on-the-ground salespeople to executives at Top 40 firms.

For instance, there was a general consensus that certain Trump policies have helped bolster the economy, sparking growth and encouraging hiring, which in turn has benefited the promotional products industry – a view held among those who admitted to liking Trump as well as those who disapprove of him. Equally, there was a common belief that fallout from factors like the administration’s international trade disputes has, at least in the short term, triggered repercussions that have made the promo business more challenging.

“There are really two sides to the coin,” says Larry Cohen, president of Top 40 distributor Axis Promotions (asi/128263). “The economy under Trump has been doing well, and in many ways that’s been beneficial to our industry. But that’s been counterbalanced by some of the issues that have arisen because of trade disputes, like tariffs.”

THE GOOD

The “MAGA” Phenomenon

One of the most basic ways Trump has benefited the promotional products industry is his commitment to strategically leveraging branded merchandise, industry execs say. While promotional products have long been components of political campaigns, no other president in history has developed and utilized his own logoed swag to the extent of Trump. By the end of August 2016, Trump had spent $11.5 million total on campaign merchandise, nearly doubling the previous record of $6.7 million set by Barack Obama in 2012.

As a result, Trump has developed a strong personal brand as a president – one that’s readily recognized and viscerally reacted to, be it by enthusiastic supporters or angry opponents.

“While his choice in caps could use some assistance, they show the power of ad specialties,” says Dan Townes, president of supplier Shepenco (asi/86850). “People recognize the brand, and it elicits strong emotions on both sides. What better demonstration of the effectiveness of ad specialties?”

The Economy, Tax Reform & Deregulation

Just like pictures, numbers sometimes speak louder than words. Some macroeconomic data points put check marks in the pro-Trump column. In 2018, the second calendar year of Trump’s presidency, U.S. gross domestic product (GDP) increased an estimated 2.9% – up from about 2.3% in 2017. The 2018 GDP performance was better than any annual mark during Obama’s two terms, according to data from the Bureau of Economic Analysis. During 2016, the final year that Obama was in office, GDP was up about 1.6%.

The facts are that business is up, the economy is up, unemployment is down. Gregg Emmer,Kaeser & Blair

Then there’s increasing employment. Over Trump’s presidency, the U.S. unemployment rate has continued to decline, and has notably been below 4% since March of 2018, data from the Bureau of Labor Statistics shows. “The economy has been good. The recovery started under Obama, but you have to give Trump some credit for it now, as it has continued,” says Craig Nadel, president of Top 40 distributor Jack Nadel International (asi/279600).

Some analysts and a variety of promo pros Counselor spoke with believe Trump’s deregulation initiatives and tax reform helped spur what have been strengthening economic conditions. For example, signed into law on December 22, 2017, the Tax Cuts & Jobs Act is projected to result in net benefits (net tax cuts offset by reduced healthcare subsidies) of about $1.445 trillion over 10 years to individuals, pass-through businesses like partnerships and S corporations, as well as other entities, according to the nonpartisan Congressional Budget Office (CBO). In the first nine months of 2018, U.S. multinational corporations, attracted by the lower tax rates, reportedly repatriated $571.3 billion – money that could, at least in theory, be used for creating jobs and making investments at home.

Specific to deregulation, an analysis from George Mason University’s Mercatus Center shows that the number of restrictive words and phrases contained in the Code of Federal Regulations was 1,079,926 on December 22, 2018 – nearly flat with the count on Trump’s inauguration day. That’s a departure from the preceding Obama and Bush administrations, when restrictions grew at an average of 1.5% annually, according to FactCheck.org.

The Office of Information and Regulatory Affairs, which is under Trump in the executive branch, reported that federal agencies issued 176 deregulatory actions during fiscal year 2018, helping to net savings of $23 billion in regulatory costs. Trump’s more notable deregulatory actions include signing a large rollback of banking regulations that lightened rules for all but the biggest banks.

“The economy is doing well because of the administration’s policies,” says Sharon Eyal, CEO of Top 40 supplier ETS Express (asi/51197). “A lot of money was sitting on the sidelines during the Obama administration. Thanks to Trump’s business agenda, that money has been deployed.”

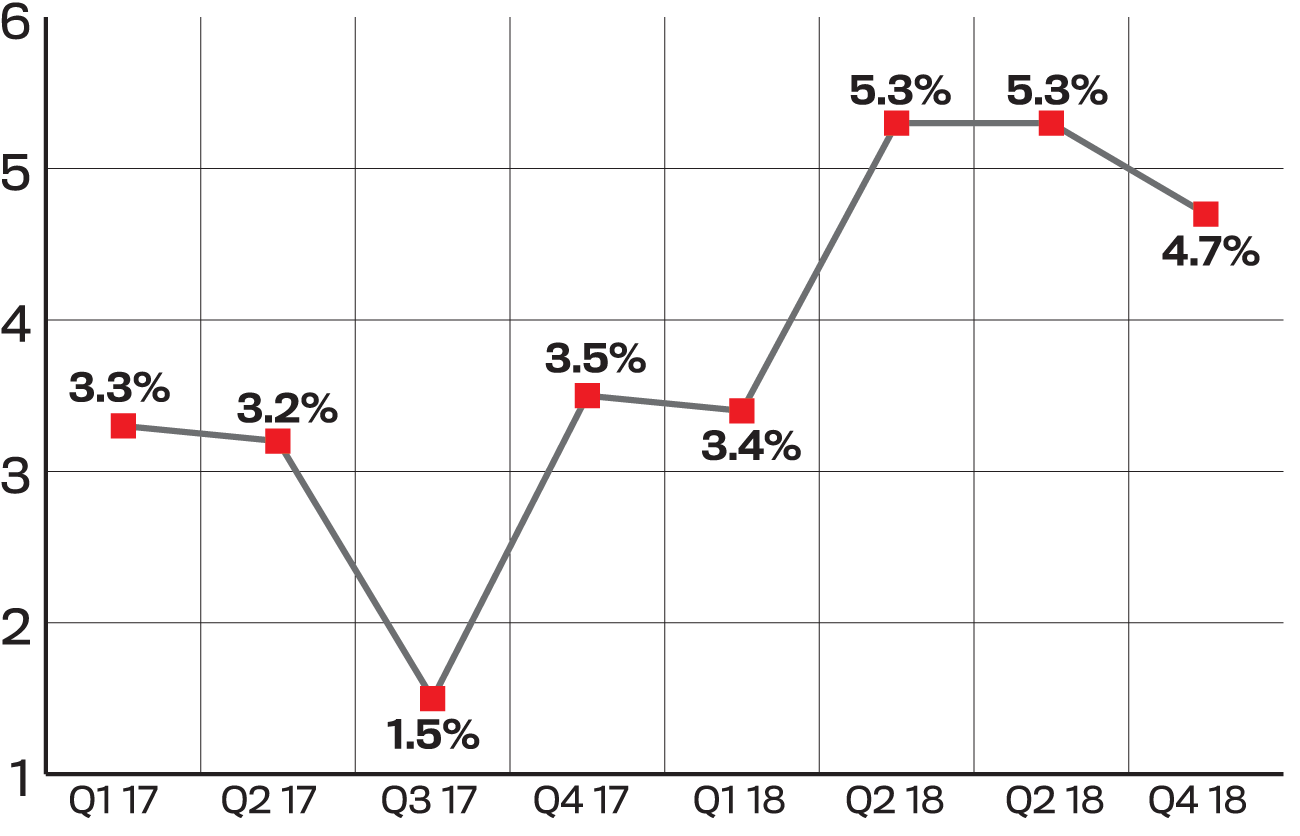

The promo products industry, overall, is benefiting by capturing marketing dollars that have been increasingly freed up, some executives in the market say. In 2018, for instance, distributors grew sales to an all-time record high of $24.7 billion – about a 5% rise over the prior year. Of course, there are many factors that went into that success, but the actual or perceived strength of the U.S. economy has played a part in the higher spend by companies.

“Half the country will condemn anything Trump does regardless of the positive or negative actuality,” says Gregg Emmer, vice president and chief marketing officer at Top 40 distributor Kaeser & Blair (asi/238600). “The facts, however, are that business is up, the economy is up, unemployment is down, and there are more jobs available than workers at the moment. All that benefits our industry.”

Some are really making the most of what promo execs like Emmer characterize as the positive momentum. As an example, Matt Gledhill increased his annual sales by 33% in 2018 and was up 53% year-over-year during the first few months of 2019. “For me, 2018 was the tipping point. Everything really started to pick up,” says the vice president of sales and marketing at Walker Advertising (asi/354440).

From adult drink brands to aerospace companies and credit unions, clients across Gledhill’s portfolio have been eager to up their investment in branded merchandise. Gledhill says he doesn’t pay attention to politics and doesn’t attribute — or not attribute for that matter — the sharp rise in client interest and willingness to spend over the last two years to anything emanating from D.C. Still, he’s unequivocal that 2018 and 2019 have been stellar for his personal book of business. “I’ve been busy working 12-hour days to meet demand, and I haven’t even had to call on anybody this year,” Gledhill says.

In some cases, promo firms are gaining on the back end, too. Howard Potter, CEO of A&P Master Images (asi/102019), a New York-based distributorship/apparel decorator that increased sales more than 13% to nearly $2 million in 2018, says tax cuts have directly helped him hire more staff and make business-improving investments.

“Last year, we hired five full-time staffers and invested in more stock and supplies to help lower our costs so we could maintain or lower pricing to our customers,” Potter says. “We’re also investing more money into our custom software to allow more work to be done more cost-efficiently.” There’s been a trickledown effect for Potter’s employees, too. “Between the tax savings and bulk buying,” Potter adds, “we’ve freed up enough money to give five staffers pay increases.”

Promo Distributors' Year-over-Year Quarterly Sales Gains Under Trump

More Are Saying It With Swag

Over the last several years, the use of imprinted products – especially apparel – to promote causes and political/social positions has grown. The powerful emotions that Trump stirs among ardent supporters and impassioned detractors, all within the more politically charged climate he’s had a hand in creating, have definitely played into propagating the phenomenon.

“Trump’s winning the election has caused an uptick in political advertising and some of that has come our way,” says Emmer.

A lot of money was sitting on the sidelines during the Obama administration. Thanks to Trump’s business agenda, that money has been deployed. Sharon Eyal, ETS Express

Amy Baker spoke of similar results at her business. “When people are taking notice of current politics, then people are buying T-shirts, signs, buttons, stickers and more,” says Baker, co-founder/owner of Threadbare Print House, an apparel decorating shop in Oregon. “By default, when people are involved in politics, it’s good for our industry.”

Baker, who makes no bones about being adamantly anti-Trump, has tapped into the desire among her business’ audiences for imprinted products that express opposition to the president. When, for instance, Trump called Hillary Clinton a “nasty woman,” Threadbare printed the phrase on T-shirts and began retailing them. “We sold out immediately,” says Baker. Wearers donned the tee as a form of ironic protest to what they perceived as the dismissive sexism in Trump’s comment. “This brought people into our shop seeking out the T-shirt who later sent commercial business our way,” Baker says.

A similar scenario happened on Trump’s inauguration day. “We offered to print the phrases ‘Together We Rise’ and ‘Fiercely Feminist’ onto any T-shirt people would bring us,” Baker says. “Hundreds of people came to our shop that day.” During the event, Baker says there was a sense of power in the community coming together that created a lasting impression that people still talk about – and that’s helped Threadbare attract customers. “As a business owner, I’ve benefited from not shying away from my personal beliefs,” Baker adds.

THE TIMELINE

Impact on Business: Trump’s Five Biggest Decisions

THE BAD

Trade Disputes & Import Tariffs

The Trump administration has imposed tariffs on $250 billion in imported Chinese products. The 10% tariffs on about $200 billion of those goods that went into effect last autumn have undoubtedly caused waves in the North American promo industry, which imports the vast majority of products sold here from China.

While suppliers have taken steps to mitigate the impact of the levies, the unavoidable reality is many firms that import tariff-affected products from China have had to increase prices. Top 40 firm Polyconcept North America (PCNA) provides a representative example of the handwringing Trump tariffs have caused China-importing suppliers.

In a mid-March communication to distributors, PCNA said it would be increasing second-quarter pricing on affected products to account for the tariffs it’s paying. The decision wasn’t made lightly. After tariffs went into effect last year, PCNA held pricing through the end of 2018. Then, during the first quarter, PCNA refrained from passing along the full brunt of the 10% tariffs in an effort to lighten the blow to distributors. But on the eve of the second quarter, with the levies still in play, PCNA’s hands were effectively tied.

(U.S. Labor Dept.)

“We need to make a further adjustment to our prices to cover the remaining tariff costs,” PCNA President David Nicholson wrote to distributors. “Consistent with our strategy in January, we’ve employed an approach to minimize the increases as much as possible – particularly around key categories and price-sensitive items.”

Because of the levies, some suppliers have also discontinued particular items or are importing lower volumes. The hope is that the tariffs will be lifted sooner rather than later, which would potentially allow suppliers to replenish stock at a lower a price. “You worry that, at some point, there could be shortages,” says Cohen.

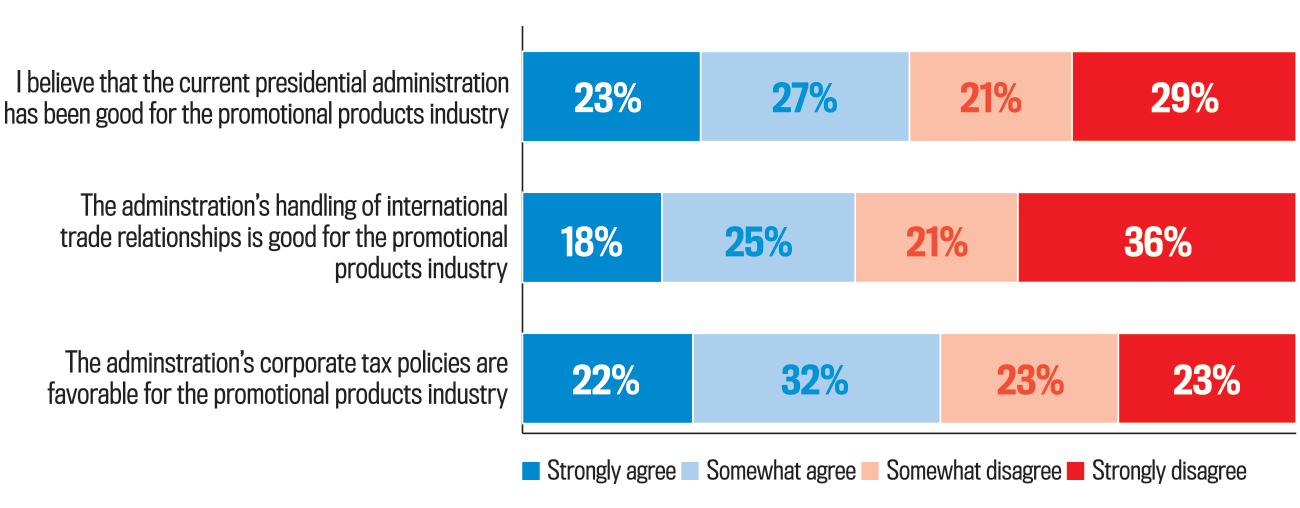

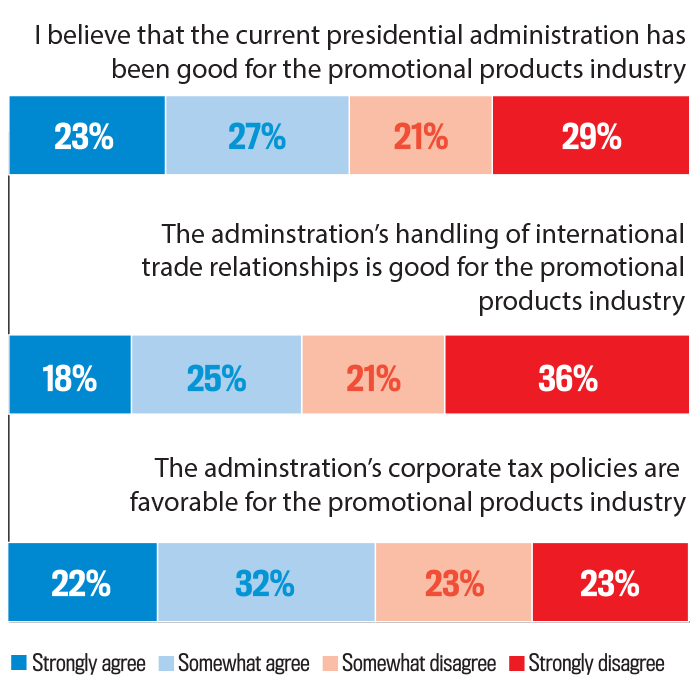

Distributor Agreement With Statements on the Trump Administration

Unsurprisingly, tariff-fueled price jumps have had distributors popping ibuprofen, too. “We’re seeing price increases across the board from suppliers, which we’re either absorbing or passing on to end-users,” says Danny Braunstein, vice president of sales and business development at Talbot Promo (asi/341500), a Canada-based distributor that’s felt hikes from American suppliers – and, interestingly, Canadian suppliers, too. “Our clients’ promotional product spend isn’t growing at the same rate as cost increases. If this trend continues, I’d expect at some point it’ll start to negatively impact our industry.”

Indeed, a fear distributors have is that the price increases will compel some end-buyers to divert budget away from promo products to other marketing mediums. “We’ve had some clients say, ‘You better build the tariffs into your costs, or we’re just not going to order,’” says Cohen. “Obviously, that puts more pressure on us.”

(U.S. Commerce Dept.)

To their credit, the team at Cohen’s Axis Promotions has reacted proactively. They’ve educated clients about tariffs and how the levies have been dealt with as best as possible. They say they’ve become more conscientious with sourcing, searching for client-appropriate alternative products that aren’t laden with tariffs. They’ve combed over details like country of origin to see if comparable items made in nations outside of China, like Vietnam, Cambodia and the U.S, are available. “The tariffs filter down to everything we do,” says Cohen. “They’re part of every discussion.”

Beyond price increases, the tariffs – and the broader trade disputes with China and even Canada/Mexico over NAFTA – have cast a cloud of uncertainty over the promo sector, many industry pros contend. Trump initially pledged to increase the tariff rate from 10% to 25% by January 2019 – a timeframe he then pushed back until March, before again postponing the increase. Still, it remains an option. Combined with other factors, which include that Trump may decide to drop the tariffs at any time, it’s more difficult for suppliers and distributors to plan and provide solid longer-term pricing.

As a result, some suppliers this year avoided producing physical printed catalogs, offered print catalogs without pricing, or put costs in their catalogs with the caveat that they’re subject to change. That’s quite a shakeup for an industry that, on the whole, has long held to stable annual prices.

We’ve had some clients say, ‘You better build the tariffs into your costs, or we’re just not going to order.’ Obviously, that puts more pressure on us. Larry Cohen, Axis Promotions

“The uncertainty of the potential outcome of some of the administration’s policies has made it difficult to do some longer range planning,” says Braunstein. “In particular, when pricing products for North American and global programs, it’s made it very difficult to commit to long-term agreements with suppliers and clients.”

Other hurdles tariffs have created or heightened include: Compelling suppliers to ramp up efforts to diversify their supply chain to destinations outside China, a lengthy and complex process; and, in cases, diminished profits on orders as some tariff costs are absorbed.

Not everyone in promo views the Trump tariffs as a bad thing, though. Suppliers specializing in made-in-the-USA products and firms carrying such products as part of their offerings have attempted to market the advantages of stateside-made goods. The fact that the cost-gap on affected Chinese products and their USA-made counterparts may have closed a bit has been welcomed by suppliers that focus on U.S. production, too. “Fast turn times, no tariff surcharges and stability in pricing are all things we can market and provide,” says Rich Carollo, president of Lion Circle (asi/67620), which manufactures its line in Chicago.

Carollo tells Counselor that Lion Circle’s sales were up in the third and fourth quarters of 2018. Still, he stopped short of attributing that to anything to do with tariffs. “I can’t exactly say if it was impacted by trade regulations or just the overall health of the promo industry,” Carollo says. Since the tariffs went into place, Top 40 supplier BIC Graphic (asi/40480) says it’s also received a “slight uptick” in interest for its made-in-the-USA items, especially top-sellers like BIC Sticky Notes and KOOZIE britePix can coolers that are produced domestically.

“The longer tariffs go, it definitely bodes well for our company,” says Lion Circle’s Carollo. “Tariffs are supposed to be the great equalizer for American manufacturing.”

Other promo pros think the tariffs will ultimately help the promo industry and the American economy at large. “It’s a battle that’s long overdue,” says Eyal. “We’ll all benefit from it at the end of the day. Unfortunately, most people look at what’s in front of them and not what’s to come.”

(FactCheck.org)

Potter expressed a similar view. “The tariffs the U.S. is charging to import have to be done to create balance,” he says, adding that he hopes the levies will help lead to increased on-shoring of manufacturing for the promo industry and other sectors.

Despite such hopes, what good or bad the future holds is unclear. As the situation stands today, however, the Trump tariffs have proved to be a rather large monkey wrench for promo products companies. “It’s caused turmoil,” says Cohen.

A ‘Sugar High’ Economy?

While tax reform, deregulation and the perception among decision-makers that Trump is a pro-business president could be helping the American economy, there are those in promo and beyond that fear his policies and positions are poised to damage the nation’s economic health over time – or, at minimum, not do much to aid it. That’s a concern for promo pros, as industry fortunes often correlate to the relative strength of the broader economy. “The U.S. is doing OK,” says Cohen. “But for how long?”

For example, the CBO has estimated that the Tax Cuts & Jobs Act could heap nearly $2 trillion onto the national debt over 10 years. That’s $2 trillion beyond the additional $10 trillion or so already anticipated to be piled on during the timeframe. “The growing deficit will be a problem at some point,” says Nadel.

Furthermore, tax reform and deregulation may have provided an economic jolt, but not necessarily one that’s sustainable. For instance, the tax reform legislation has received criticism for worsening income inequality and leading to higher healthcare costs among other factors that could eventually put a drag on the economy.

The tax cut gives a sugar high. It feels like introducing termites to your house. Craig Nadel, Jack Nadel International

“The tax cut gives a sugar high,” says Nadel. “I benefited from it, but I think it was poor public policy. It exacerbates income inequality and that hurts the country both economically and socially. It’s not something that happens right away, but lays a bad foundation for the future. It feels like introducing termites to your house.”

Based on a range of factors beyond just Trump’s policies, top economists predict that U.S. growth will slow. The Federal Reserve Board and Federal Reserve Bank presidents have released a median forecast projecting that U.S. economic growth will fall to 2.3% in 2019 and 2% in 2020. The CBO projects real GDP growth to register 2.4% this year and 1.7% next year.

Among particular analysts, promo pros and other business leaders, there’s worry, too, that what some term the American protectionism that Trump triumphs may come back to bite the country, given that trade is truly global. “The world is so interconnected,” says Cohen. “There are opportunities we might have missed – and could miss – for being part of and contributing to greater global growth.”