April 04, 2019

Promotional Products State and Regional Sales Report - 2019

Our exclusive report reveals that state promotional products sales are thriving.

Research by Nate Kucsma

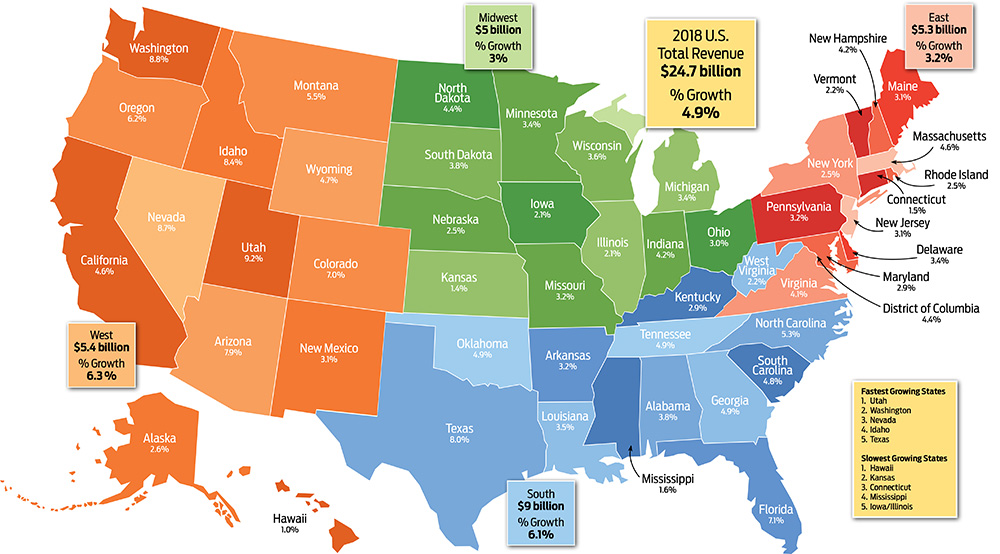

The promotional products industry in 2018 generated a record $24.7 billion in revenue, including sales growth of 4.9%, its strongest increase since 2014. Those positive figures didn’t just appear out of thin air. It’s an encouraging number, built by the sales distributors are recording in each and every pocket of the United States.

The evidence of that can be seen in this year’s State & Regional Sales Report. A total of 39 states (and one district) increased their sales growth from 2017, including several that made leaps of multiple percentage points.

Of course, not all growth is created equal. The South and West made the most gains in 2018, filled with the largest promotional product economies (Texas, California, and Florida) and the fastest growing (the top 16 come from these two regions).

Click here for a larger image of the map above.

“One of the key factors in the South is certainly migration into states such as Florida and Texas,” says Nate Kucsma, executive director, research and corporate marketing for ASI. “Increases in population lead to stronger economies, and vice versa, and that really is driving this region ahead of the others.”

After years of gaining ground, the West has finally overtaken the East as the second largest promotional products region in the country. The region is thriving thanks to its attractive job market, ongoing tech boom, growing population and affordable living.

Facebook Live

Editor-in-Chief C.J. Mittica and Research Executive Director Nate Kucsma offer an in-depth view of the Advantages State and Regional Report, including which areas are growing the fastest and why.

The story is more nuanced for the East and Midwest. Promo products sales in the East did grow by nearly a percentage point, but the region “has stagnated, especially compared to other regions,” Kucsma says. “There’s not any explosive growth to speak of; it’s pretty much business as usual.”

The Midwest may be growing the slowest, but it’s “certainly showing signs of coming out of the tough business environment that it’s been in for a while,” Kucsma says. “The growth was fairly widespread and evenly distributed, so this is promising for the region as a whole.”

Will these positive trends continue throughout 2019? It remains to be seen. The specter of tariffs looms over the industry and could have an impact. But distributors aren’t waiting around to find out: They’re too busy making the most of the countless opportunities available to them – tapping into exciting markets and leveraging the biggest trends. With our spotlight on each region of the U.S., you can too.

South: An influx of new workers and curious tourists offer limitless promo opportunities. Read more here!

West: The draw of affordable living and job availability offers a robust path to growth. Read more here!

Midwest: Resurgent cities are powering unexpected growth in America’s heartland. Read more here!

East: With buyers willing to spend for better quality, optimism reigns supreme. Read more here!