April 20, 2022

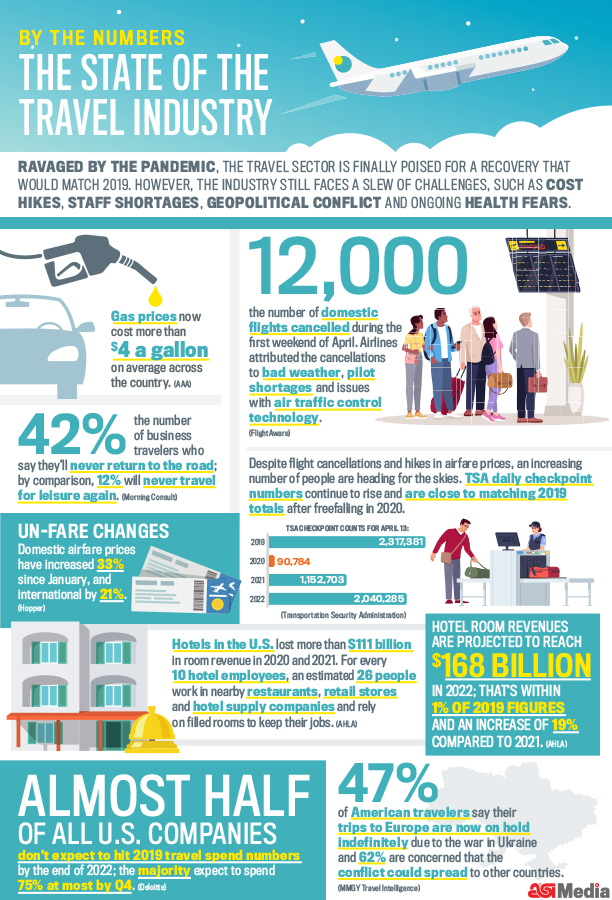

Excitement Builds in Promo Industry for Sales Travel

Exclusive survey results from ASI indicate that the majority of reps are eager to see clients in person. Still, rising costs and cancellations are having a measurable impact on travel.

Jim Nistico loves being on the road. In 2019, the president of Proforma Infinity (asi/300094) in Syracuse, NY, was traveling about 38,400 miles a year by car to see clients across upstate New York and into Vermont – about 700 to 900 miles a week, and anywhere from four to 20 accounts a day. Come hell or high water (or, occasionally, feet of snow) he’d be there, knocking on the customer’s front door with a smile and a bag of products, often unannounced.

But that was before the pandemic upended everything, and Nistico spent about a year using Zoom. It wasn’t the same. “Something’s missing when I’m only working remotely,” he told ASI Media last spring, just before starting to travel again. “I like to look clients in the eye in person when we’re going over projects. That’s where I gain trust and build my business more comfortably.”

So when restrictions lifted tentatively in April 2021 and clients welcomed visitors again, Nistico was back behind the wheel. “We didn’t talk business,” he says of the first customers he saw. “We discussed our families and asked, ‘So how have you been?’ It was great to see actual faces.”

Since then, Nistico has “plugged through” the delta and omicron variants, and he expects business to “skyrocket” this year because of pent-up demand. “Clients are anxious to get back to normal too,” he says. “They’re ready to rock ‘n’ roll. Two years is enough, and they’re enthusiastic and optimistic.”

But things have changed, even for Nistico. He’s on track to drive about 20,000 miles a year these days, still respectable but less than what he clocked pre-COVID, and he supplements in-person selling with prospecting on social media (particularly LinkedIn), which has led to taking on new clients in regions besides the Northeast and using Zoom to sell.

“I have a better balance now,” he says. “It’s less wear-and-tear on the car, it’s a savings on gas which is expensive, and I’m exploring new avenues with clients who are further away. Depending on how big they are, I might even be flying to see them quarterly or every six months.”

It sums up the prevailing feeling in the promo industry: a general eagerness to “get back out there” that’s tempered by the challenges the travel industry is facing as well as the cost-savings and other benefits realized in the past two years.

The promotional products industry has traditionally been travel-heavy. Salespeople thrived on the in-person connection and the innate desire to sell the “touch and feel” of their products.

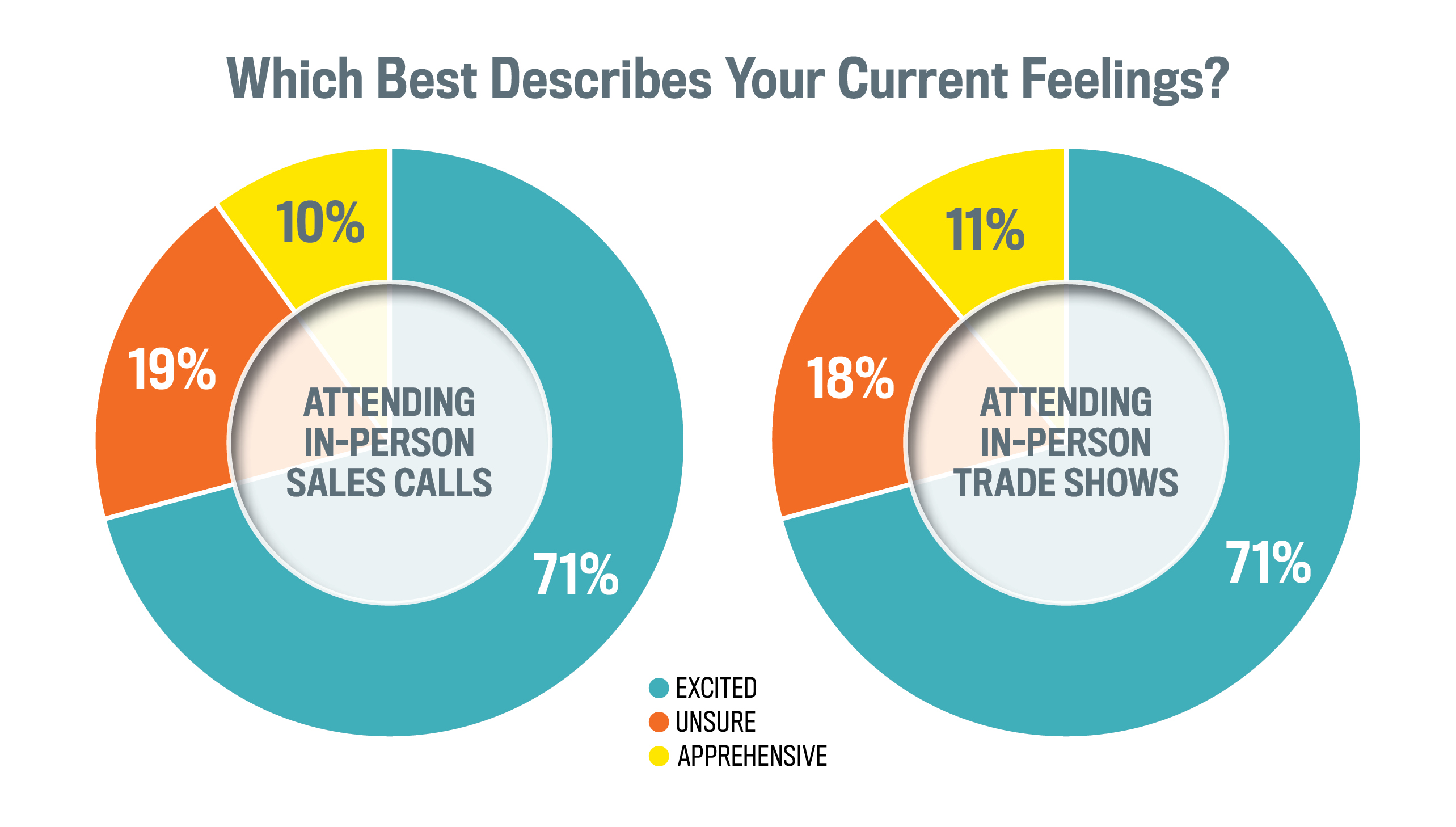

That hasn’t disappeared. An ASI Market Research survey on travel in the promo industry, conducted in February of this year, found that 71% of respondents are enthusiastic about making in-person sales calls. Another 71% are eager to attend trade shows. And seven in 10 respondents are excited to travel for business reasons of any kind.

(ASI Market Research)

Still, the corporate travel industry is in a vastly different place than it was pre-pandemic. According to October 2021 data from business intelligence company Morning Consult, 39% of business travelers said they’ll never return to the road. That number rose to 42% in February. (By comparison, only 12% of travelers said in February they would never travel again for pleasure.)

The lingering headwinds facing corporate travel are vast: cautious employers, hesitant clients (with many still working from home), ongoing flight delays and cancellations, staff shortages across the board, testing requirements and costs, geopolitical unease after the Russian invasion of Ukraine, energy price hikes, and threats of a new virus variant identified in recent weeks. Meanwhile, inflation in the U.S. is at a 40-year high and rising.

In addition, there’s a “new normal” of travel that’s anticipated to stay in place for a while – one that includes masking on flights and frequent sanitizing, along with slow service, delays and cancellations, and higher costs. (The CDC’s public transportation mask mandate was struck down by a federal judge on April 18, prompting several airlines to make them optional on flights.)

So while most reps continue to acknowledge the importance of business travel, they’re left weighing its benefits against cost and time savings as well as the effectiveness of technological tools. Even with that, promo’s enthusiasm for travel is too strong for it to go away. Ultimately, though, there may just be less of it.

Travel Troubles

During Thanksgiving last year, the number of air travelers reached over 90% of pre-pandemic traffic. Airlines simply couldn’t keep up, and the resurgence of traffic during the holiday season led to flight cancellations hitting a new record of more than 2,600 on New Year’s Day.

Those cancellations are continuing in 2022. According to travel site Hopper, American, Southwest and United have already cut the number of spring and summer flights they had originally planned, due to staff shortages, rising fuel costs and supply chain woes. Just one weekend in late March saw airlines cancel 3,400 flights due to Florida storms and a technology issue. Future cancellations are becoming the norm; Southwest, for example, has already pulled about 325 flights a day from April 3 to June 4 due to lack of pilots, attendants and ground crew. United canceled 2,500 flights slated for May and more than 20,000 from June to August.

Meanwhile, airfare is surging; Hopper says domestic ticket prices have increased 33% since January, and international by 21%. Much of that has been since late February, when Russia invaded Ukraine. Fuel costs have since skyrocketed, and that’s causing downward pressure on an industry that’s struggling to recover.

Click here for a PDF of the above infographic.

The U.S. Travel Association doesn’t expect corporate travel – both number of trips and dollars spent – to recover to 2019 levels until 2024. Before COVID, according to PwC, businesses spent about $300 billion a year on corporate travel; 20% of that went to airfare. And those business travelers, though representing only 12% of total passengers, accounted for about 75% of profit on some flights.

“We’re not making any changes to our travel policy, even with the increased fuel costs. We’re even more focused on getting in front of our customers.” John McMaude, Brand Lone Star LLC

“The airlines were basically shuttling people from Chicago to New York City and back every week,” says Dr. Jan Louise Jones, professor of Hospitality and Tourism at the University of New Haven’s Pompea College of Business. “They were hit so hard. The business was gone overnight. And corporate travel impacts leisure travel.” Jones adds that corporate travelers were a surefire way to fill seats on many domestic routes, and they would then use their frequent flyer miles and points for vacations. “Now, there aren’t as many flights across the board because there aren’t as many people traveling for business,” she says.

Thwarted air travel plans impact so many other sectors: ground transportation, hotels, restaurants, event spaces, recreational activities and more. Also, companies everywhere are struggling to hire and retain staff, which makes scaling back up to meet increasing demand next to impossible. Ellen Overcast, vacation specialist at Main Street Getaways, a Dream Vacations franchise in Kutztown, PA, warns her clients that the travel experience won’t feel like 2019 just yet.

“I tell clients they have to have a different mindset,” she says. “You have to be flexible, otherwise don’t go. Service will be slower everywhere, and companies have hired new people who are still learning. I really feel for those working 12-hour days right now. We’re going to be experiencing this a while longer.”

The overall effect is that, across all industries, some businesses aren’t ready yet to ramp up travel frequency. Deloitte reported last month that almost half of companies don’t expect to hit 2019 travel spend numbers by the end of this year; the majority expect to spend 75% at most by Q4.

Companies are left weighing the cost-savings and convenience of staying at home or in the office vs. the positives of in-person relationship building. “It’s very expensive to send people anywhere,” says Jones. “But businesses won’t survive if they don’t get back to normal.”

‘Everyone’s Ready’

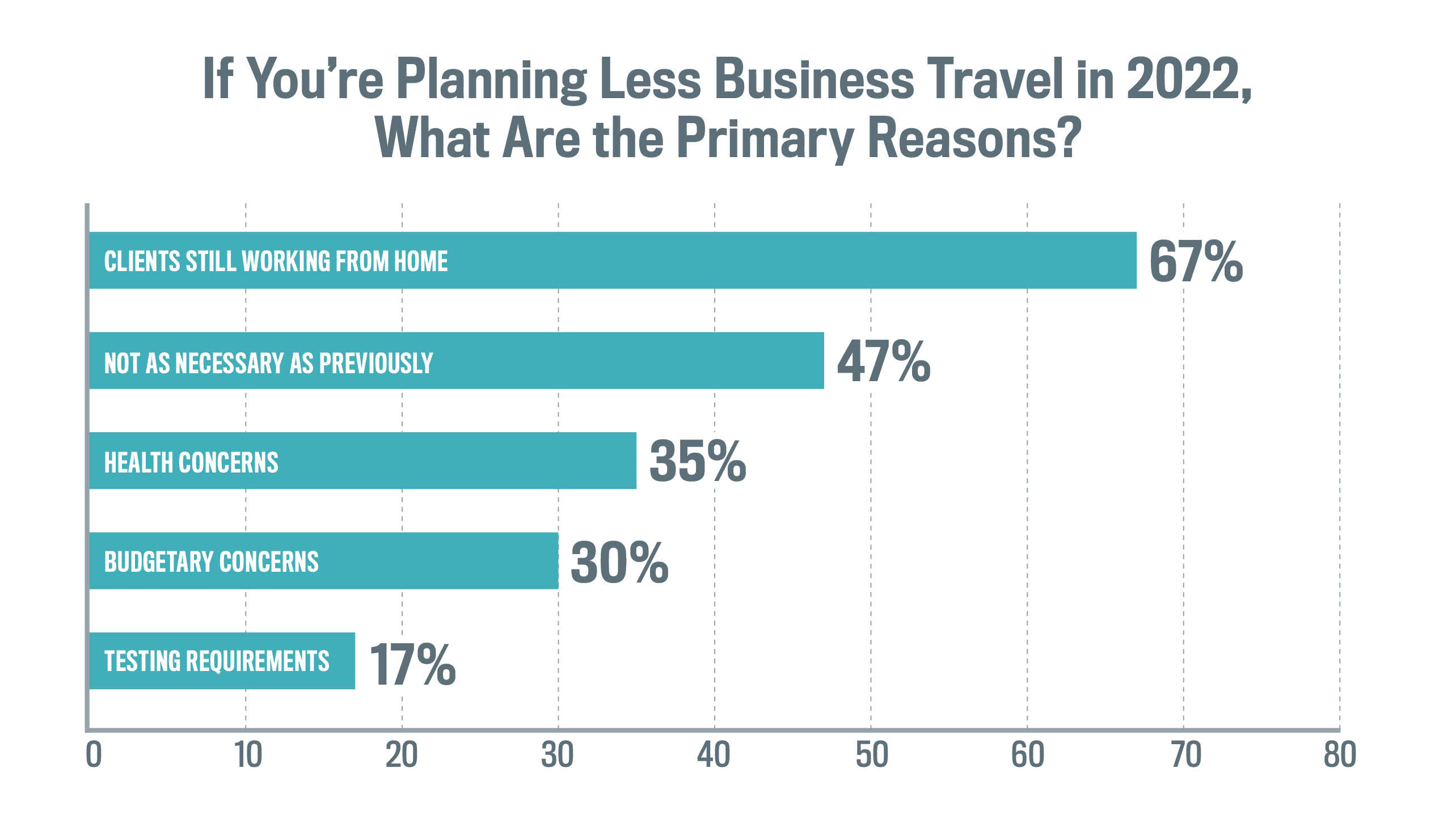

For the promo industry, there are certainly factors holding back travel. For those planning to travel less in 2022, two-thirds chose clients still working remotely as the primary reason why. Efficiency of working virtually, health and budget concerns as well as testing requirements were also cited.

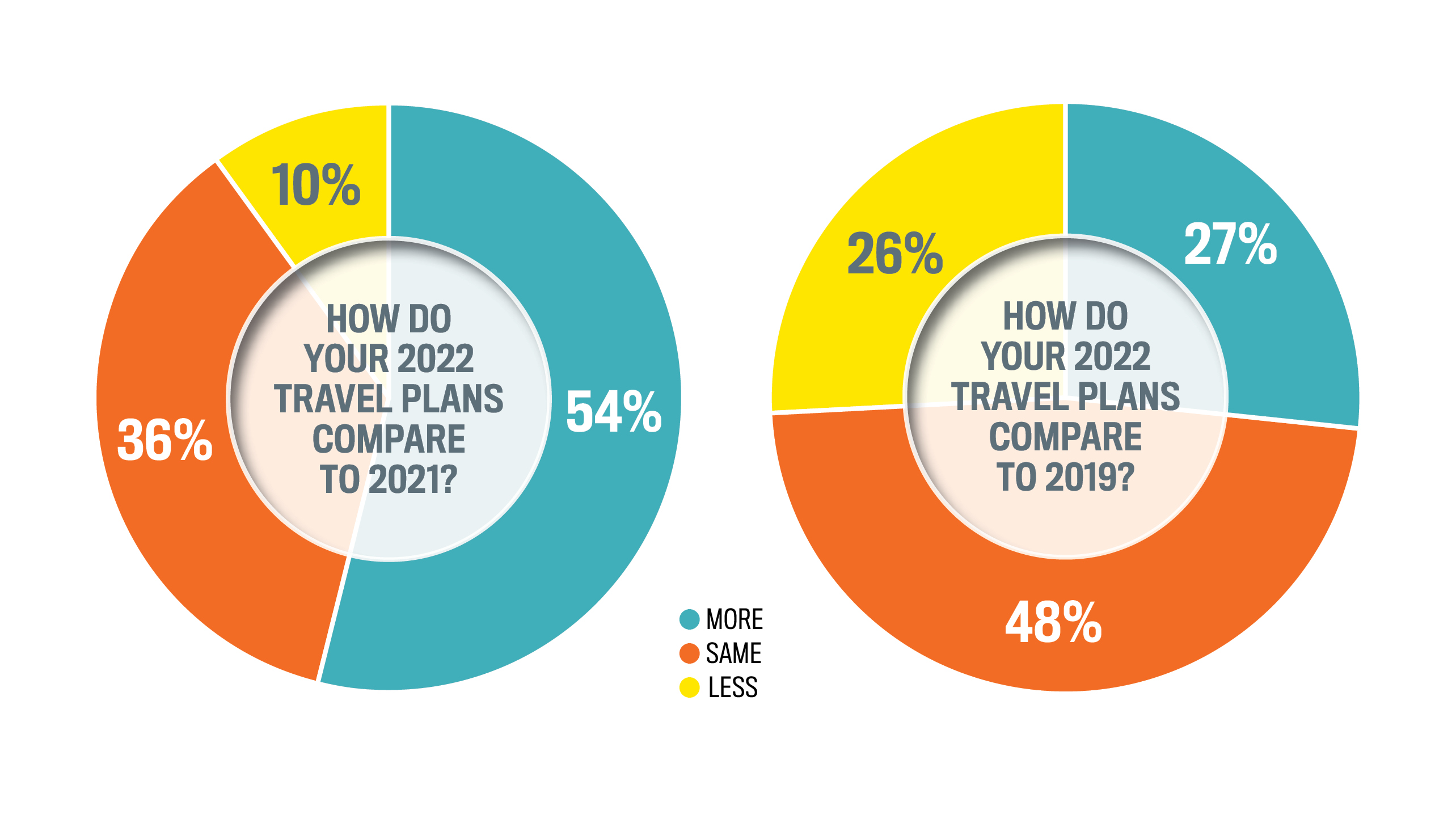

Still, nearly 55% of survey respondents said they’d be traveling more this year than in 2021 and more than 47% said they’d be traveling at the same frequency this year as they did in 2019, before COVID.

(ASI Market Research)

“It was wonderful,” says Justin Davies, COO of Wet-It! Swedish Treasures (asi/98116) in Rutherfordton, NC, upon his return from the ASI Show Fort Worth in February. “Everyone’s ready to get back to pre-COVID life. The volume of distributors on the floor seemed to be bigger than it was before the pandemic. People want to socialize.”

“We’re 100% ready from every angle,” says Greg Brown, COO at Citadel Brands, the parent company of AWDis (asi/45222) in Charlotte, NC. “Sales calls and trade shows unify our market, and we’re eager to go.”

Others say they made few changes to travel schedules during COVID, even if it meant staying masked and distanced. “We never really stopped face-to-face client meetings or having them come to our showroom for presentations,” says T.J. Ciaravino, owner of Vestal, NY-based Worldwide Sport Supply (asi/603943), where the team mostly travels across the Northeast by car (though they’re considering flying to a show in Las Vegas this fall). He says upcoming travel plans haven’t changed because of the recent surge in fuel prices; they’ll be counting it as part of the cost of doing business these days.

Ciaravino’s team went to the alphabroder (asi/34063) Northeast EXPO in Connecticut in late January and the two-day Impressions Expo in Atlantic City in March; it was slower than pre-COVID, he says, but they were able to see the entire floor in three hours and had meaningful conversations with exhibitors. “It’s time to get out, shake hands and build new relationships again,” says Ciaravino.

It’s been a similar situation at Brand Lone Star LLC (asi/145085) in Austin, TX. President John McMaude says he and his team never stopped traveling, and attended ConneX and FASIlitate events in 2021 and ASI Fort Worth in February. “We’re not making any changes to our travel policy, even with the increased fuel costs,” he says. “We’re even more focused on getting in front of our customers.”

In neighboring Arkansas, Jill McMahon, owner of American Signs & Banners (asi/120765) and RMAC Outdoor Advertising in Texarkana, says that after a year and a half of virtual selling, she and her team started visiting clients again in Q4 of 2021. They’ve also been attending their customers’ grand opening (or re-opening) ribbon cuttings, where the enthusiasm is high. But other factors besides COVID now have her worried.

“I’m very happy about our newfound freedom,” says McMahon. “But now I’m concerned about escalating world conflict and inflation.”

“I tell clients they have to have a different mindset when they travel. You have to be flexible, otherwise don’t go.”Ellen Overcast, Main Street Getaways

Even in New Jersey, where restrictions were some of the heaviest in the country, promo companies weren’t completely locked down. “I’ve been traveling the same as usual and meeting clients without fear for over a year,” says Paul Kraml, owner and creative director at Kraml Design (asi/245602) in Hamilton, NJ. “I’m definitely not letting COVID interfere with business.” With fuel costs rising, Kraml chooses to drive his Mazda MX-5 Miata, which gets 35 mpg, instead of his GMC Canyon pickup at 17 mpg. “Other than that, travel plans remain the same and any additional costs are passed onto the client,” he says. “We all have no choice if we want to continue making a profit.”

Tim Feijer, executive director at PromoPlace (asi/144084), a 2022 Counselor Best Place to Work in Ancaster, ON, says he and his team are anxious to see people again, and that’s become a real possibility since the government in Ontario has lifted many virus restrictions. That province had some of the world’s longest-lasting and draconian lockdowns.

“For the most part, clients are open to visiting us or having us visit them,” he says. “We love the idea of being back on the road. We realized how much we miss traveling. Fuel prices are part of doing business, and meeting our clients face-to-face is key to it as well.”

Staying Close to Home

Still, there are those in no rush to get back on the road. According to the recent survey by ASI, more than 13% are still “apprehensive” about in-person shows and 10% about sales calls.

“We’re OK with making a few in-person calls but we’re still not doing trade shows yet,” says Ken Pulliam, vice president of business development at Binders Inc. (asi/40547) in Charlotte, NC. “Mostly, we’ve been sending samples to our customers and following up with Zoom to discuss the items and their project. It seems to be working and keeps us safe.”

(ASI Market Research)

Top 40 distributor PromoShop (asi/300446) has sales reps across North America, from California to Florida to New Jersey and even Windsor, ON. Even though they’re allowed to travel again to see clients, no one’s submitted a request yet.

“No one’s ready,” says PromoShop President Memo Kahan, about reps and their clients. “They’re allowed to go and we’d love to spend our travel budget, but no one has.”

Some companies were using virtual means of selling as a cost-savings method way before COVID. Now, they say, virus restrictions showed just how effective they are.

“We haven’t had a trade show booth since 2002, and we haven’t attended a show since January 2020,” says Chris Goes, secretary of Goes Products Co. (asi/57650) in Delavan, WI. “Skype was our primary method of selling for years. In-person selling has practically disappeared for us. COVID has helped people to focus on in-house methods of servicing distributor clients, which has reduced their travel costs too.”

According to respondents who were unsure or apprehensive about travel, when they do return to the road or the skies, they and their employers will be more selective about where they go in terms of time and money spent. That includes smaller shows closer to home, as well as shorter events with specific agendas and objectives.

James Means, owner of Full House Enterprises Inc. dba Bluegrass Promos (asi/199720) in Leitchfield, KY, says he still hasn’t traveled beyond his state’s borders, choosing instead to save money and time by staying close to home. And Kyle Emge, owner of Colorado Marketing Group (asi/165238) in Denver, hasn’t traveled much at all since COVID, instead spending more time dealing with supply chain issues and filling orders. “Generating new business has become much harder,” he says. “I mostly use the phone and email for reaching out to cold leads. People are still buying and there’s demand, it’s just very difficult to find stock and we’re working more for orders.”

Overseas Struggles

The enthusiasm for travel by promo professionals isn’t translating to international trips. Of survey respondents with international clients, only 15% said they would be visiting them in 2022. The reasons range from the war in Ukraine to testing requirements to even rumblings of another COVID wave spreading through Asia and Europe.

It’s certainly impacting international industry events. In late March, the organizers of PSI Düsseldorf, Europe’s largest promo products trade show, canceled its in-person plans for 2022. It was originally scheduled for January, then postponed to April due to COVID concerns. Now, they plan to host it in January 2023, citing a “generally restrained business attitude” in the industry as the main reason for canceling.

(ASI Market Research)

A March survey of American travelers by MMGY Travel Intelligence, the market research arm of travel and tourism marketing agency MMGY Global, found that 62% are worried about the conflict in Ukraine spreading to other countries, which has impacted their European travel plans. That’s compared to 31% concerned with COVID. Nearly half (47%) said their trips to the region are on hold due to the conflict.

Overcast says she’s had a few cancellations in recent weeks. “Even if they weren’t going anywhere near Ukraine, there’s still a lot of uncertainty,” she says. “Another deterrent is the testing requirement to return to the U.S. Travelers don’t want to risk testing positive and not being able to get back.”

To add to the confusion, each country has varying rules for testing. Jones, who’s currently planning a study abroad trip for students, says it’s “a nightmare.” “There are too many different policies,” she says. “It’s just a whole other layer of stress. Testing abroad can be expensive, sometimes more than $100 each, and businesses don’t want to pay.” While there are insurance reimbursement options these days, says Overcast, travelers still have to pay out-of-pocket up front. Some hotels and resorts in Mexico and the Caribbean offer free tests, but it can depend on a minimum number of nights or booking a “premium” level trip.

But Brendan Kennedy, founder and CEO at The NxTStop (asi/72823) in Arlington, TX, says he was never completely grounded during COVID, mostly because he uses the products his company offers: functional travel apparel and accessories, including many that feature antimicrobial fabric finishes.

“I was still traveling about once or twice a month during the height of the pandemic, including internationally three or four times that year,” he says. “That’s ramping up more now. I was in Costa Rica in February 2022 and Mexico twice in March. I’ve never gotten COVID.” Even with testing and an increase in fuel costs, his travel plans haven’t changed.

A good number of people in the promo industry want to travel, and they are, despite the many obstacles. But it remains to be seen how much travel frequency will increase this year. What’s clear is how the corporate travel landscape – both the sector itself and as a sales practice – has changed due to the pandemic, perhaps permanently.

“I’m not sure how much travel we’ll be doing in the near future,” says Kahan at PromoShop. “But I hope we get back to it soon.”

Take Advantage of Travel Savings From ASI

ASI members can benefit from partnerships with leading travel industry providers, such as Avis and Budget for car rentals, as well as Hotel Engine for booking rooms. Visit the ASI Member Benefits page for more information.