On January 20, 2021, Joseph R. Biden, Jr. was sworn in as the 46th president of the United States. He moved into the Oval Office amid the stark reality of deep national division, an uncertain economy and a pandemic that continues to grip the country.

Since then, the president’s administration has unleashed a flurry of executive actions – more than 40 as of this writing during Biden’s first week or so in office – that address everything from the government’s handling of the coronavirus to key initiatives regarding environmental policy.

With a new president in office and one party now controlling Congress, promotional products executives are watching with eagerness or trepidation over how their businesses will be affected. Because no doubt, Biden’s policies on economic issues like tariffs, taxes and minimum wage are poised to have a profound impact on the promo industry.

So what should promo companies expect? To answer that, here are three pressing questions, and the predictions that will shape the industry in the next four years.

1. Will Biden Remove Trump’s China Tariffs?

Short answer: Not right away, and it’s unclear when, if ever, the Democrat would nix the levies. In a trade war that spanned much of his presidency, Donald Trump imposed tariffs on approximately $370 billion in China-made imported products. Since the majority of products that North American promo firms sell are made in China, the levies have long caused a lot of concern for the industry.

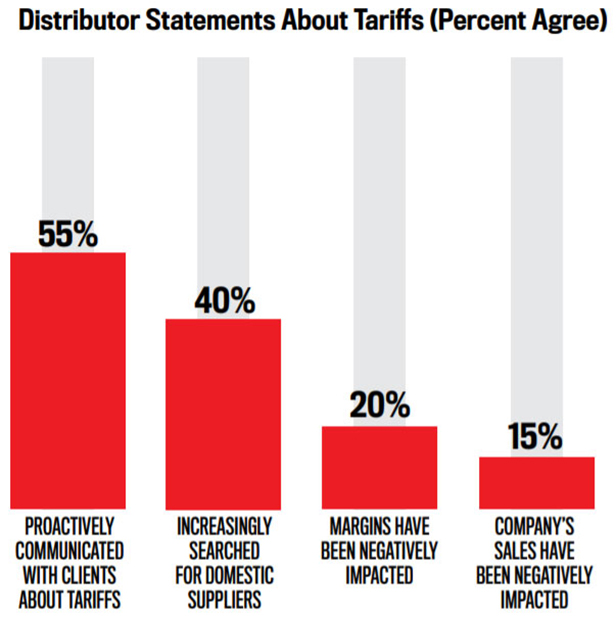

The tariffs triggered price increases on some promo items and compelled many suppliers, as well as distributors who source direct from overseas, to hasten or begin the reconfiguration of their supply chains to move at least some production out of China. Fortunately, the levies don’t appear to have had an overwhelmingly negative impact on promo sales: Only 15% of distributors say the tariffs negatively affected sales to end-clients, according to Counselor’s 2020 State of the Industry report.

For all the worry about tariffs driving up the costs on imported goods from China and hurting sales, the impact has been fairly minor. (Counselor 2020 State of the Industry Report)

Still, the supply chain disruption and back-end maneuvering to keep prices from ballooning, plus the unstable relationship between Washington, D.C. and Beijing, were a strain for many promo companies. A majority of industry professionals want the tariffs abolished and trade relations normalized.

“I would like to see the Biden administration resolve the China trade dispute and end the current tariffs,” says the leader of a Top 40 supplier firm. (Some industry sources cited for this article asked to be quoted anonymously given the potentially volatile political topic. ASI accommodated those requests.) “However, while I’m sure Biden’s approach to China will be less confrontational, it’s unclear whether that will mean the end of tariffs within the next few years.”

That appears to be a spot-on assessment. Biden has indicated that he doesn’t intend to immediately remove the tariffs. He also plans to keep in place, at least for a time, the Phase 1 trade agreement that Trump inked in January 2020 with China.

Presidential Priorities

What should the Biden administration’s top business priorities be? Counselor Power 50 members respond.

“My top priority would be for the administration to get control of the virus, which includes working with states on science-based plans to slow the spread, with more widely-available testing and adequate PPE to get us through the spring. There should be a sound plan for rolling out the vaccine efficiently and widely, along with education so that most Americans choose to get vaccinated.”– Jo Gilley, CEO, Overture Promotions (asi/288473)

Before deciding how to proceed on China and tariffs, Biden has said that he wants to review the current agreement with Beijing and strategize with the United States’ traditional allies in an effort to form a unified, “coherent” approach to dealing with China.

While the particulars remain to be determined, Biden told The New York Times that his goals for a China strategy would be to “pursue trade policies that actually produce progress on China’s abusive practices — that are stealing intellectual property, dumping products, illegal subsidies to corporations” and forcing “tech transfers” from American companies to their Chinese counterparts.

Janet Yellen, the U.S. Secretary of the Treasury, made comments the week of January 18 that indicated the Biden administration could continue to take a hawkish stance on China, given what she characterized as that country’s “abusive, unfair and illegal practices.”

“China,” Yellen said, “is undercutting American companies by dumping products, erecting trade barriers and giving away subsidies to corporations.”

2. Will Biden’s Tax Policies Hurt Promo Companies?

If implemented, they potentially could, but when that implementation will occur, or even if it will as currently envisioned, is up in the air.

Among other measures, Biden has stated he’d like to increase the corporate tax rate from 21% to 28% and reinstate the Alternative Minimum Tax, which requires corporations with $100 million or more in income to pay the standard rate or a 15% minimum tax, whichever is higher.

Yellen recently told the Senate Finance Committee that the U.S. could afford a higher corporate tax rate if it coordinates with economies around the world. “We look forward to actively working with other countries through the [Organization for Economic Cooperation and Development] negotiations on taxes on multinational corporations to try to stop what has been a destructive, global race to the bottom on corporate taxation,” Yellen said.

Beyond corporate tax raises, Biden would like to hike the marginal income tax on people earning more than $400,000 from 37% to 39.6%. Biden has also advocated for changes to deductions and increases to social security and Medicare taxes that would have some small businesses paying more in such taxes, according to analysts like Tom Wheelwright, CEO of WealthAbility, which helps business owners and investors reduce their taxes.

Wheelwright, for instance, performed a hypothetical analysis for Entrepreneur magazine in which he demonstrated how the owner of a business with $1.5 million in gross revenue would pay $112,150 more in taxes if Biden’s tax agenda were implemented.

All that has promo pros nervous. Some owners and executives fear their companies’ bottom lines will suffer, dragged down by a greater tax burden. Perhaps even more concerning, promo executives across the board worry that heavier taxation will compel end-clients to spend less on promotional products, not to mention potentially cause other consequences like reduced hiring, which could hurt promo sales and the economy as a whole.

“The Biden administration will not be good for business, and since our industry is primarily B2B, that will ultimately be a problem for our industry,” says Gregg Emmer, vice president/chief marketing officer at Batavia, OH-based Top 40 distributor Kaeser & Blair (asi/238600)

Presidential Priorities

What should the Biden administration’s top business priorities be? Counselor Power 50 members respond.

“What should the Biden administration do? That would be a continuation of the Trump policies of reduced regulation, positive tax policy relief and a pro jobs platform that would get us back to pre-virus numbers. But based on the statements of Joe Biden and Kamala Harris, there is no possibility that this will happen.”– Gregg Emmer, Chief Marketing Officer, Kaeser & Blair (asi/238600)

Still, some analysts contend that the likelihood of Biden aggressively pursuing tax changes immediately is low. Executives inside and outside the promo industry have asserted that the new administration will have its hands more than full dealing with the pandemic and getting its economic stimulus plan approved and rolled out, which could table any tax change push, at least for a while. Significantly, Biden has asserted that short-term emergency stimulus spending can be funded through borrowing, adding that it doesn’t require offsetting tax increases or spending cuts.

“I suspect the vaccination effort and economic recovery will occupy most of the time and focus over the first two years, so we’re unlikely to see any significant moves out of the gate on taxes,” says the Top 40 supplier executive.

In line with that thinking, the CNBC Global CFO Council Survey, which polls chief financial officers of North America-based multinational corporations, found that about 6-in-10 CFOs believe it’s unlikely that Biden will pass a corporate tax hike to 28% within his first two years in the White House.

Nonetheless, those who fear tax increases shouldn’t feel too secure. Some analysts believe that Biden will eventually press his tax agenda, possibly after COVID is better contained.

“We know that tax rates are likely going up,” Dan Wiener, who runs the Independent Adviser for Vanguard Investors and is chairman of Adviser Investment Management, told CNBC. The question, he added, is just a matter of when. It might not be in 2021, but could come in 2022 or later, Wiener predicted, adding: “I don’t think individual tax rates are the bigger concern. I think corporate tax rates and capital gains are going to be the main focus.”

3. What Does Biden’s Economic Stimulus and Minimum Wage Plans Look Like?

Before taking office, Biden called the $900 billion stimulus plan that Congress and the Trump administration passed in late December to battle the devastating economic impacts of COVID-19 “just a start.”

The Democrat made clear he meant what he said when, on January 14, he unveiled the “American Rescue Plan” – a proposed $1.9 trillion stimulus package aimed at fighting the virus, injecting life into the economy, and helping Americans who have fallen into dire financial straits.

“It’s not hard to see we’re in the middle of a once-in-several-generation economic crisis, within a once-in-several-generation public health crisis,” Biden said in discussing his plan. “A crisis of deep human suffering is in plain sight and there’s no time to waste. We have to act and we have to act now.”

We have no time to waste when it comes to getting this virus under control and building our economy back better. Tune in as I announce my American Rescue Plan. https://t.co/4YAg0nhJMn

— Joe Biden (@JoeBiden) January 15, 2021

As part of the plan, Biden has proposed a new $15 billion grant program for struggling small-business owners. This would be in addition to the latest round of $284 billion in Paycheck Protection Program loans that became available in January 2021. Biden’s plan would make a $35 billion investment in local financing programs that provide businesses with low-interest loans.

While additional stimulus for business could be welcomed by many in promo, there’s an aspect of Biden’s stimulus initiative that has many in the industry concerned: Minimum wage. Biden’s plan calls for more than doubling the federally mandated minimum wage, from the current $7.25 to $15. States can have their own mandated minimum wage, but it can’t be less than the federal standard.

Biden maintains that the minimum needs to be increased to bring low-wage workers out of poverty. “No one in America should work 40 hours a week making below the poverty line,” Biden said recently.

Presidential Priorities

What should the Biden administration’s top business priorities be? Counselor Power 50 members respond.

“There needs to be a focus on taking care of our people, our health and our ability to function as a productive society. All of us need to have income and the ability to pay for living necessities. If we can start with that, we can begin the process of stabilizing our lives and the lives of our families and peers.”– Memo Kahan, President, PromoShop (asi/300446)

Some promo executives are concerned that a minimum wage hike will cause a steep rise in overhead, potentially affecting everything from product price to profit. An executive at a New York-based supplier firm – a state that has been steadily raising its wage to a $15 minimum – says the issue isn’t just about a jump in the minimum itself. There are ripple effects, like compensating other workers proportionately based on job responsibility and the minimum wage increase. “It’s also how do you scale everyone up who was previously in the $16-to-$20 range,” the executive said. “Do you leave them, or do you slide them up too?”

Biden appears poised to press the minimum wage issue. On Jan. 22, he signed an executive order that instructed federal agencies to identify federal workers who are earning less than $15 an hour and make recommendations to help increase their wages. Relatedly, Biden directed the government to lay the groundwork for requiring federal contractors to pay at least $15 per hour to employees – a move that could potentially impact promo firms and their clients that do business with the federal government. Furthermore, Democrats in Congress have introduced a bill that would increase the wage floor to $15 an hour, four years after the proposed law’s effective date. On the day the bill would become law, the minimum would immediately increase to $9.50 an hour. Each year thereafter the wage would rise until reaching $15.

In addition to more support for business and a higher minimum wage, Biden’s rescue plan calls for $1,400-per-person direct payments to most households. Combined with $600 stimulus checks that went out in late December and early January, that would bring the latest direct per-person stimulus support to $2,000 – a figure most Democrats and some Republicans say they favor. Last spring and summer, eligible adults received $1,200 stimulus checks as part of COVID-driven economic relief.

Also, the plan would increase the federal per-week unemployment benefit from $300 to $400, extending it through the end of September, and inject $350 billion into state and local government aid. Outside of business, the plan would increase child tax credits, extend eviction and foreclosure moratoriums and subsidize COBRA health insurance benefits.

In February, Biden could issue a second plan that delves into initiatives for economic recovery and more. Both stimulus plans will need congressional approval.

“We will get right to work to turn (Joe) Biden’s vision into legislation that will pass both chambers and be signed into law,” Sen. Chuck Schumer, the Democratic leader in the Senate, and House Speaker Nancy Pelosi, a Democrat from California, said in a joint statement.

Even so, it appears a vote might not happen until March at the earliest.

Democrats control both the House of Representatives and the Senate, which increases the likelihood that Biden could achieve Congressional approval on everything from his stimulus plans to his tax agenda.

However, support from Congress isn’t a guarantee. The slim majority in the Senate (it’s 50-50, with Vice President Kamala Harris having the tie-breaking vote) means that Republicans have the power to filibuster. Democrats could bypass the filibuster through what’s known as a budget reconciliation process, which would require just 51 votes for a particular measure – like the American Rescue Plan – to gain approval. Nonetheless, that would likely require every Democratic Senator to be on board, something that doesn’t appear to be the case. (Notably, Republicans have proposed a different, $618 billion stimulus plan.) It will be a recurring story over the president’s first two years in office – his ability to advance his initiatives with a legislative body so evenly split.