March 05, 2018

Buying Groups: Good Or Bad For Promo?

Execs debate a topic that brings strong opinions and little middle ground.

The flame of do-it-yourself American entrepreneurialism burned bright inside Vince Monfils-Yardum. That’s why, after working for a large industry distributorship, Monfils-Yardum decided to branch out on his own. He loved the independence – being in full control of his destiny. Still, he was confronted with a significant problem. As a small independent distributor, Monfils-Yardum found it difficult to secure end-quantity pricing from a handful of important suppliers. It put him in a precarious position. He started to lose out on business. In certain bidding situations, he found himself unable to compete.

Then, he discovered ImpactMDS. After careful study, he joined the buying group – a collection of independent promo products distributors that band together to better leverage their collective buying power and partner with select suppliers.

Suddenly, by being part of ImpactMDS, Monfils-Yardum could get EQP from the key vendors. Discounts on shipping and artwork preparation, along with other advantages realized through the buying group, further improved his competitiveness. Sales started to soar. “It helped turn my business around,” says Monfils-Yardum, owner of Dana Point, CA-based Going Somewhere Sportswear and Promotions. “We could get our foot in the door in more places and have a chance to win over prospects with our service. It added 30% to 40% to my income.”

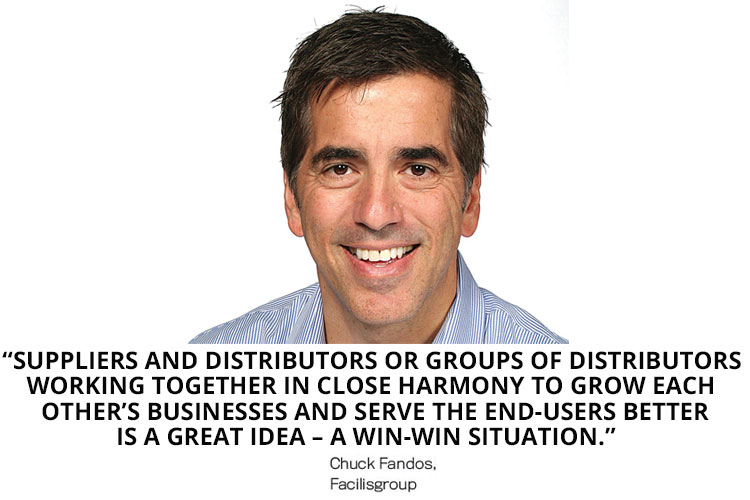

Many distributors who’ve joined industry-leading buying groups can relate to Monfils-Yardum’s story. Indeed, they say belonging to such a group has bolstered their business in ways that go well beyond just securing EQP. It’s also not hard to find suppliers who say participating in the right buying groups has been a boon for their bottom lines. “Suppliers and distributors or groups of distributors working together in close harmony to grow each other’s businesses and serve the end-users better is a great idea – a win-win situation,” says Chuck Fandos, CEO of Facilisgroup.

On the flipside, however, some promotional products executives say buying groups come with considerable downsides for the industry. “I can certainly understand the benefits for distributors to form alliances,” but the buying groups are accelerating “one of the largest trends seen these past few years: A greater percentage of distributor business being directed to fewer suppliers,” says Mark Weissman, VP of sales at New Jersey-based VisionUSA (asi/80060).

In this report, Counselor puts buying groups under the microscope, examining their advantages and drawbacks for individual promo companies and the industry as a whole.

Video Debate

Counselor Editor-in-Chief Dave Vagnoni faces off against ASI Editorial VP Andy Cohen in a lively debate of the most popular topics in business today. In this episode, Dave and Andy duel over this question: Are buying groups good for the industry? Andy says no, but Dave disagrees.

‘Locked Out’

As Weissman tells it, a distributor client annually placed about $50,000 worth of orders with Vision USA. But then, apropos of nothing it seemed, sales declined. Weissman soon learned the reason: The client had joined a buying group and was now directing the bulk of its business to the organization’s partner suppliers, and VisionUSA was not one of them. It’s a vexing scenario Weissman and other suppliers say they’re encountering with increasing regularity. While VisionUSA still generates sales with the buying group distributors, Weissman believes that barriers the groups erect are inhibiting business.

“We don’t have full access to their sales and support team,” Weissman, who’s been in the industry for nearly 40 years, says of his company’s experience with distributors in one large buying group. “We’re unable with most to get our products on their websites, unable to be included in presentations to clients, unable to receive invitations to their events, and unable with some to conduct idea/sales meetings at their locations. This limits our overall opportunity for growth.”

Richard Danziger says he’s experienced similar shunning from once-loyal distributors. “There are companies that don’t work with us anymore, and the reason they give is that they need to write most of their business with the buying group suppliers. If they can get a product from a group supplier, then that’s what they’re supposed to do, even if we offer the same discount or other incentives,” says Danziger, president of supplier Bankers Pens (asi/38285).

For Danziger, Weissman and others, buying groups’ impetus to incentivize group distributors to place orders with partner suppliers – who agree to various terms and often provide rebates to be in the groups – will accelerate consolidation within the promo products space. That could one day result in a new industry dynamic in which the thousands of small and mid-sized suppliers that currently compose an essential part of the industry’s structure give way to vastly fewer – but much larger – supplier companies, critics believe. The consolidation could, they say, ripple out to small and mid-sized distributors, many more of which will find they must join buying groups or big distributorships to stay afloat.

“I believe that were we not VisionUSA, featuring many patented made-in-the-USA products, with multiple industry-recognized awards for decorating excellence and numerous years of solid exposure in our industry, we would be in need of consolidation or partnerships with the larger industry suppliers to gain maximum access to distributors who are part of one of the distributor buying groups,” Weissman says.

Even before widespread consolidation might occur in the future, critics think the buying groups’ practice of directing distributor spend to partner suppliers is hurting many suppliers in the present – unfairly retarding their growth by tilting the playing field. “You have small and mid-sized suppliers increasingly getting locked out by distributors not because of product selection or price or service but strictly because they’re not part of the buying group,” says Danziger.

The increasing consolidation of spend with select suppliers could inhibit innovation within the promo market, some suppliers feel. “Typically, our industry was made up of mom-and-pop businesses that provided a lot of the ingenuity, but when they’re losing business because of buying groups and large distributor consolidation, that’s going to deprive them of the resources they need to pioneer that innovation,” Danziger says.

But then why not just join the groups? For one thing, smaller suppliers might be unable to commit to the groups’ terms for inclusion. Even if the supplier can handle the rebate requirements, provide EQP and meet other conditions, the firm could be precluded from joining because another supplier in the group already carries a highly similar product line. “They want to limit companies with overlapping lines,” says Danziger.

For buying group critics, the state of affairs is frustrating. “I’m not sure what can be done. Legally, you can’t prevent buying groups from happening. Do mid-sized suppliers then team up to form a supplier group of some type? I’m not sure that changes anything,” Danziger says. “It doesn’t solve the problem.”

Partners in Success

For proponents of buying groups, the criticism that they’re going to trigger mass consolidation and related detriments holds little water. “Revenue for all the buying groups combined will still not be enough to even begin to approach any meaningful market share in an industry with over 20,000 distributors, some 140,000-distributor salespeople and 4,000 or 5,000 suppliers,” says Rod Brown, CFO at MadeToOrder (asi/259540), a member of the Reciprocity Road buying group. “The industry is simply too large and fragmented to freeze out good suppliers from access to distributors and inhibit fair competition.”

Picking up a similar theme, a number of people interviewed for this article said while distributors in buying groups clearly have incentives to work with the group’s partner suppliers, they’re not bound to do so. “Our distributors remain completely independent. They can buy from whomever they want, so no one is ever ‘frozen out.’ We operate in a free market system,” says Jamie Coggeshall, founder of the Advertising Industry Mastermind Group (AIM), an industry buying group.

In the debate, another knock against buying groups is that they exist primarily to shake suppliers down on price. Certain pros interviewed for this article who participate in industry groups admit that with some groups that could be the case – though it’s not so in their collectives. Continuing, they point out that buying groups are different just like individual companies, and aren’t inherently good or bad.

When organized and operated ethically, buying groups, a term some group members object to as pejorative (preferring “co-operative” or even “guild”), can deliver immense mutual value for distributors and suppliers – and, by extension, the industry. That value and fairness comes from establishing partnerships in which both distributors and suppliers benefit from participating, advocates say. From a distributor’s perspective, as articulated earlier, a leading advantage is EQP that bolsters price competitiveness, helping the firms retain their desired status as truly independent businesses.

Leaders and/or members of groups that include Facilisgroup, The PeerNet Group, ImpactMDS, AIM, The Partnering Group, Reciprocity Road, Premier Group and others say there’s an array of additional advantages. These can include group-backed training and the sharing of best practices. “By having a trustworthy, safe environment to brainstorm with others within the same industry, we’re able to bounce ideas off of each other as well as continue to build up and learn from our successes and challenges,” says Sara Webb, a buying group advocate whose company, InTandem Promotions (asi/231285), belongs to The Partnering Group.

Buying group distributors say that additional advantages can include the sharing of costs for various services, technology supports and solutions, joint marketing initiatives, peace of mind on product safety thanks to the vetting of suppliers, and streamlined access to vendors that yields attentive service and quicker conflict resolution.

At PeerNet, a multitude of these benefits come to bear. For example, knowledge-share among members perpetuates adoption of best practices that drive growth for group firms, says PeerNet CEO Darlene Blaum. Plus, there are e-commerce and tech initiatives, online tools to enable sharing across companies, joint direct-mail campaigns, a custom catalog and shared searchable online catalogs (branded individually), as well as in-person networking events between distributors and suppliers.

Among other upsides, PeerNet members are occasionally privy to exclusives. “We’re often approached by suppliers outside of the industry who want to enter the industry but not hire a sales force,” says Blaum. “We are very selective, but often get unique opportunities to exclusively sell new products not yet in the industry and introduce them to our supplier partners.”

PeerNet distributors say being in the group helps drive growth at their companies. “Aside from our amazing employees, our membership in PeerNet has been the single most important factor in our success,” says Larry Cohen, president of Top 40 distributor Axis Promotions (asi/128263). “The guidance and advice of my PeerNet members, the PeerNet executive team and supplier partners have enabled us to grow and prosper at a faster pace, and without the missteps that we might have made if we were going at it alone.”

It’s a story distributors from other groups tell, too. When Dei Rossi Marketing (asi/178198) joined Facilisgroup seven years ago, the Texas-based distributorship was doing $2.7 million in sales. Now, annual revenue tallies around $13 million, but Dei Rossi has only had to add one employee, thanks largely to support gained through Facilisgroup, including the group’s @ease technology system. “Being in the group maximized all our efficiencies,” says Ray Sadler, Dei Rossi director of operations. “I’m with the same people I was with in the beginning, and everyone is making more money.”

Upsides for Suppliers

For suppliers, there can be ample upsides, too – provided they join groups that treat them as partners, advocates say. With such groups, benefits can include increased access to a broader network of quality distributorships, facilitated marketing and advertising, more consistent repeat business from distributors in the groups, and a greater likelihood that a prospect will become a first-time customer – all of which can culminate in sales increases. “It’s all about access, commitment to support your line, and opportunities with companies you may not have a relationship with,” says Paul Lage, CEO of Top 40 supplier Gill Studios (asi/56950).

Cutter & Buck (asi/47965), another Top 40 supplier, is part of 10 buying groups. One of the biggest benefits the Seattle-based company experiences is the ability to market products effectively to a wide range of distributors through group catalogs and online marketing efforts. “Having one point of contact for providing marketing materials, which then get distributed to all end-customers of each distributor member of the buying group, allows us to get great exposure and reach a much larger number of end-customers with minimal effort on our part,” says Brad Moxley, corporate business development manager at Cutter & Buck.

Along the same lines, the pros at Origaudio (asi/75254) say that participating in different buying groups gains their line valuable exposure with distributors across the U.S. “With the thousands of distributors nationwide, it’s impossible to get in front of all of them no matter how many regional, national or industry shows and events we attend,” says CEO Jason Lucash. “Being part of buying groups allows us the opportunity to grow our network of distributor clients and expand our reach.”

And that can help rev up revenue. Just ask Fossa Apparel (asi/55141). Last year, the California-based supplier more than doubled sales with distributors in Facilisgroup, which Fossa joined several years ago. “Being in the group opened some gates for us. It gave us new opportunities to prove what we can do,” says Michelle Chen, Fossa sales director and co-founder.

Drawbacks for Suppliers

Despite the benefits, there are drawbacks to being in buying groups, participating suppliers admit. “All of our buying group members receive several benefits, including end-quantity pricing, no setups, free virtuals, amazing customer service, out-of-this-world packaging and innovative products,” says Lucash. “Providing all these services with discounted pricing on top of a rebate seems like a one-two punch for us. However, the positives of buying groups (that we’re a part of) far outweigh all these drawbacks.”

Nevertheless, some industry pros say buying group suppliers are, in general, experiencing more pressure lately for longer credit terms, higher rebates, program cost pricing and growth rebates. “There are national convention and meeting costs that are prevalent, too. And they all add up to costs we’ve never before experienced. That can put a supplier’s CFO to the test,” says Shawn Kanak, vice president of sales at Towel Specialties (asi/91605).

Given these dynamics, suppliers would be wise to evaluate the groups to ensure there are enough positives to warrant participation, some supplier executives say. “If you aren’t retaining a majority of the spend for your product category, you’ll find it’s hard to justify the costs to be included,” says Kanak. “Our enhanced focus is to partner with the buying organizations that fully support us. That’s where we see the greatest benefit of the partnership.”

Towel Specialties’ approach to working with buying groups is bearing fruit. “It’s helped us grow and we know there’s a very positive result in this top-level membership status,” says Kanak. “True partnerships with quality buying groups and top-tier supplier partners can work. I see it. I live it. I choose to participate because we know we’re being treated fairly.”

Adapting & Evolving

While suppliers outside buying groups remain concerned about what they believe are the groups’ deleterious impacts, they’re still striving to adapt and thrive in the marketplace. VisionUSA’s strategy centers in capitalizing on its unique value proposition. “Our approach is to continue to market our strengths – USA manufacturing, USA product testing and compliance, large quantity quick turn based on USA production and innovative patented designs. We also look to focus not on the corporate office of (buying group) distributors but target the individual sales reps whose clients can benefit from what VisionUSA can provide,” says Weissman.

At Bankers Pens, the team is pouring energy into expanding and diversifying the product line, deepening inventory, enhancing delivery and becoming more aggressive on price. It’s part of a concerted effort to win more business, particularly with small and mid-sized distributors that don’t participate in buying groups. “We’re choosing our market,” says Danziger. “We hope that model is going to work.”

By The Numbers

125

Number of distributors across North America in Facilisgroup. The group has 80 supplier partners

More than $700 million

Total sales of Facilisgroup distributors in 2017

More than 100

Number of industry suppliers that offer end-quantity pricing or better through the Advertising Industry Mastermind Group

$415 million

Collective sales volume of distributors in The PeerNet Group

25

Number of years The PeerNet Group has existed

$225 million

Aggregate sales by Reciprocity Road distributors

$10 million

Reciprocity Road asks prospective new distributor members to be able to document a minimum of $10 million in promotional products sales or show demonstrable evidence that their prior two years indicate growth that the tally could be achieved in the next year

More than $100 million

Collective sales of distributors in The Partnering Group