October 29, 2018

Tariffs: Impact & Advice for the Promo Industry

Increased products costs, price fluctuations, supply chain disruption and thinner margins could all be coming to the promo market in 2019 as a result of U.S. tariffs on imported Chinese products.

President Donald Trump’s tariffs on billions of dollars of imported Chinese products and components are shaping up to be the defining issue for the promotional products industry in 2019. That’s not a political statement: It’s a business reality forecast by a wide range of distributor and supplier executives. They say the tariffs will trigger everything from far-reaching product price increases and supply chain disruption, to destabilized annual pricing and catalog confusion, to thinner margins, possible diminished sales, and a potential shift in some end-client spend toward so-called “budget items” and products manufactured outside China.

“This is something that goes far beyond the control of our industry,” says Jonathan Isaacson, president of Top 40 supplier Gemline (asi/56070). “It’s going to affect everyone.”

In this report, Counselor details the anticipated impact from tariffs and offers advice on how to prosper amid the tumult.

Tariffs 101

As of early November, the Trump administration had imposed tariffs on about $250 billion worth of imported Chinese goods. Levies affect approximately 6,000 items. Troublingly, promo executives said, the current 10% tariff imposed this fall on $200 billion worth of goods is set to increase to 25% by 2019. As worrying, Trump has said he could impose penalties on an additional $267 billion of Chinese products, effectively taxing everything the U.S. buys from China.

Economists and financial analysts take the president’s threat seriously. “We now assume U.S.-China trade war enters Phase III in 2019, resulting in tariffs on all +$500 billion of imports from China,” J.P. Morgan analysts wrote in a recent report. “There is no clear sign of mitigating confrontation between China and the U.S. in the near term.”

Don't Miss: Is Made-in-the-USA Poised for a Comeback?

Trump aims for the tariffs to reduce the U.S. trade deficit with China – a deficit that was $375.2 billion in 2017. The president’s administration is also utilizing the levies to compel Chinese authorities to open markets in the nation of nearly 1.4 billion people more fully. Trump wants China to start “playing fair” – to strengthen copyright protections and to stop strong-arming American companies into divulging technological secrets in exchange for doing business in the country. So far, Beijing isn’t budging. Authorities there have met Trump’s penalties with retaliatory tariffs on tens of billions of dollars of U.S. exports. The economic upshot for both countries, at least in the short term, is potentially negative, many economists believe. Tariffs will drive up prices on goods in the U.S. and hurt certain industries here, while dragging on China’s economy.

“Total impact on China’s GDP growth is 1%, if China does not take countermeasures,” J.P. Morgan analysts say.

Promo Prices Are Going Up

As the trade war intensifies, the promotional products sector is caught in the maelstrom. That shouldn’t come as a surprise – the promo industry’s main supply chain model has long been rooted in Chinese factories producing a majority of the products suppliers and distributors imprint and sell in the U.S. The model has been successful, enabling the American promo market to benefit from reliable production while keeping product costs down.

But now, the Trump tariffs are disrupting the status quo – and in no more profound a way than being the primary catalyst for sweeping price increases soon to take effect on promotional products imported from China that are subject to import penalties. “Suppliers simply have no choice but to increase prices on impacted products,” says Eddie Blau, CEO of Top 40 supplier Innovation Line (asi/62660).

“This is one of the biggest challenges our industry has faced from an outside pressure. It’s hard, but it’s not insurmountable.”Jonathan Isaacson, Gemline

The majority of suppliers told Counselor they’re holding pricing for 2018. But come 2019, prices on some products are going up – potentially a lot. A definitive industry-wide increase for each affected product category was difficult to pin down. Why? Various unknowns remain, and suppliers could increase prices differently based on what their businesses can bear. Still, with that caveat in mind, industry firms communicated a collective range that put increases as low as 1%, depending on the particular product and supplier, to as much as 25%, should Trump’s import levies accelerate as currently scheduled.

At the ASI Power Summit in October, a majority of surveyed industry leaders forecast the anticipated price jumps to be along the scale of 11% to 20%. “In general, we’ll see more price increases for next year than what we have experienced in the last 10 years,” says Paul Lage, president of Top 40 supplier IMAGEN Brands.

Products in the Crosshairs

Suppliers say they don’t want to increase pricing, but lamented that their hands are tied. Not only are suppliers and their overseas manufacturing partners contending with tariffs, they’re dealing with the macroeconomic uncertainties of the trade war, facing rising costs for labor, raw materials and more, and shouldering growing expenses for ensuring compliance with product safety regulations and socially responsible production.

“We’re working with our factories and looking at all aspects of our operation to help offset some amount of the tariff impact,” says David Nicholson, president of Top 40 supplier Polyconcept North America, in a comment representative of the efforts of many leading suppliers. “We’re committed to minimizing the extent of the increases, but unfortunately, some level of increases will be inevitable.”

So far, headwear, bags, keychains, technology products and accessories, certain drinkware (including stainless-steel items), stationery, coolers, cases and some outerwear are among the items suppliers and distributors anticipate will be affected by tariff-driven price increases. But, as executives noted, the rises will probably not be limited to those categories.

Don't Miss: 5 Ways to Address Price Increases With Clients

Gregg Emmer, VP/CMO at Top 40 distributor Kaeser & Blair (asi/238600), performed a detailed analysis that shows 32 categories of goods on the tariff list that are tied to items the distributorship sells. Emmer’s unofficial list includes wool, cotton and denim apparel; leather items; rubber items; plastic rainwear; awards – quartz, marble, granite; paper products; dog accessories like leashes; bamboo and wood items; cork products; parts for flashlights; magnifiers; bicycle and motor vehicle accessories; sound amplification products/speakers; golf bags; and more, including some previously mentioned products.

“This is going to be very substantial and very impactful,” says Memo Kahan, president of Top 40 distributor PromoShop (asi/300446).

Without calling out specific companies, promo executives worry some suppliers might try to hold 2018 pricing on tariffed products to capture market share. That, however, is unlikely to be a sustainable strategy, critics note. “You could have companies working on paper-thin margins, but then they go belly up because they just can’t operate that way for long. That creates instability for the industry,” says John Bruellman, president/CEO of Showdown Displays (asi/87188).

Annual Pricing Stability Is Under Threat

With the tariffs and related geopolitical uncertainties, promo pricing could change throughout 2019. Such fluctuation is uncharacteristic of the industry, executives say. Traditionally, promo suppliers have established annual prices and held them. But with tariffs in play, some suppliers aren’t confident they can commit to set prices for the whole of 2019. Prices could go up if more or steeper tariffs are levied, or could go down should the tariffs be rescinded or modified.

The tariffs “could start to reshape how we approach annual prices and program business,” says Melissa Ralston, chief marketing officer of Top 40 supplier BIC Graphic (asi/40480).

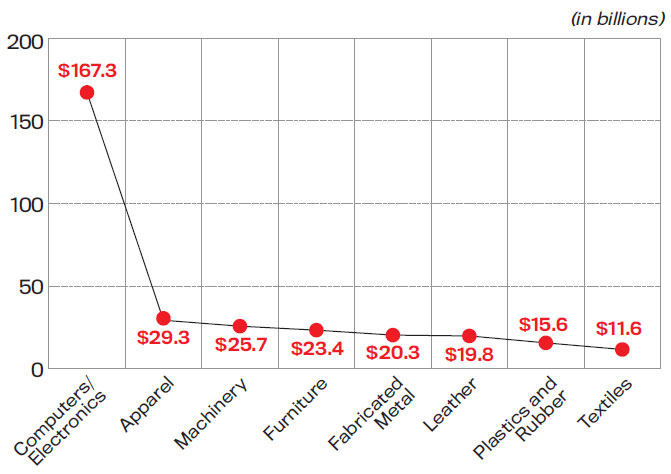

Inside the Deficit: One reason why the U.S., under President Trump’s direction, has imposed tariffs on China is because of the massive $375.2 billion trade deficit between the two countries in 2017. Here’s a look at categories where China holds a major surplus.

The potential for price wobbles is causing repercussions on catalog production. Some suppliers, for example, are publishing catalogs without pricing, or warning that 2019 catalog pricing might not be accurate through the year, and encouraging distributors to check supplier websites or to directly consult with the supplier before quoting. Others are nixing printed catalogs for 2019 and focusing on digital, leveraging the more nimble communication medium that can accommodate price alterations over a year.

“Given the current uncertainty, we’ve made the decision to forgo printing a full-line 2019 catalog,” PCNA wrote in a communication to distributors. “This will enable us to have as much flexibility as possible in reacting to year-end tariff changes.”

Price unknowns and potential fluctuations are causing headaches for distributors trying to produce 2019 catalogs, too. Kaeser & Blair has been burning the midnight oil to devise a plan that would prevent catalogs with inaccurate pricing making it into circulation. “Having 100,000 printed catalogs with inflated pricing would certainly be an impact for us,” says Emmer. “I can see that duplicated many times over in the industry.”

While there isn’t universal consensus, some promo executives think the disruption is hastening in a “new normal” related to printed catalogs and price fluctuation throughout a year. “Even if the tariffs are rescinded, we see a potential shift away from published printed prices and to more digital platforms that can handle constant change,” says Ralston.

Adds Lage: “This event will probably disrupt the industry in the sense of being dependent on catalogs and annual pricing deals. The commerce world is changing much faster than our industry standards. We’ve seen several suppliers not produce a catalog this year. We think you will see several more in the next couple of years not printing catalogs. Eventually, there will be a new standard for our industry.”

Impact on Distributors & End-Clients

Of course, absorbing the whole of tariff-related product price increases isn’t smart or feasible for distributors. That’s why many are planning to move some of the increase to end-clients. “Most of the tariffs are too large for us to absorb, so we’ll have to pass on the cost increases to our customers,” says Bob Herzog, CEO of Top 40 distributor Corporate Imaging Concepts (asi/168962). Even so, distributors say they aren’t just unloading the burden on customers. Many also expect to eat margin in order to stay relevant and competitive. “I see profits going down next year,” said Kelly Moore, owner of distributor Moore Promotions (asi/601617).

Diminished profits aren’t the only potential consequence for distributors. Kathy Finnerty Thomas, president at Stowebridge Promotion Group (asi/337500), anticipates program business her Arizona-based distributorship conducts will have to be renegotiated in light of new cost realities. “We’ll see a huge impact in 2019,” she says.

Meanwhile, some fear clients could draw back on promotional products spending and devote available cash to other marketing media. “We’re competing for hard-fought advertising dollars in a marketplace that has an abundance of alternative options,” says Joshua White, general counsel and SVP of strategic partnerships at Top 40 distributor BAMKO (asi/131431). “As tariffs drive up the cost of brand impressions, promo becomes less cost competitive.”

Others, like Emmer, worry smaller clients will lack the budgets to buy promo products if price increases are too large. “During the last recession, we saw the economic hit on the small customers cause them to simply stop using specialty advertising,” Emmer says. “If we have to increase costs by 25%, it’ll likely have a similar effect.”

“We’re committed to minimizing the extent of the increases, but unfortunately, some level of increases will be inevitable.”David Nicholson, PCNA

Along related lines, certain industry leaders are anxious that the most significant harm from tariffs will be the negative reverberations they could send rippling through the U.S. economy. One concern is that clients, trying to mitigate increased costs of their own, might pull back on ad spending, including promo.

“Our challenge will be to convince them to keep their spend at a high level by being nimble with our product offerings,” Herzog says.

Another concern is that U.S.-based exporters impacted by China’s retaliatory tariffs could also eliminate or reduce their investment in branded merchandise as their businesses/industries suffer. Despite GDP growth in 2018, the Trump administration approved paying up to $12 billion in government assistance to U.S. farmers to make up for shortfalls caused by the trade war. “While tariffs certainly damage our industry, the greater destruction of the economy is our greatest threat,” says Finnerty Thomas.

Given the potential for those dark clouds to gather, some industry leaders say it wouldn’t be hard to imagine 2019 registering the first year-over-year sales decline in the $23.6 billion promotional products industry since the Great Recession. “There’s a possibility that overall industry volume slows or declines as the value and ROI for promotional products becomes less compelling,” says Nicholson.

Nonetheless, Nicholson and others caution that it’s too soon to etch a pessimistic outlook in stone. Both distributors and suppliers Counselor spoke with believe savvy consultative distributors will be able to keep revenue streams up, in part by properly preparing/educating clients for the price increases and guiding customers to products that fit their spending plans. Those can include comparatively lower-priced items and products unaffected by tariffs, including goods produced in nations other than China.

“We anticipate some movement from tariff-bearing products to non-tariff bearing products, and changes of countries of origin,” says Jay Deutsch, CEO of Top 40 distributor BDA (asi/137616).

Lage expresses a similar view. “I don’t think end-users are going to change their budgets for promotional products,” he says. “I do think they’ll change the products that they buy within the industry to meet their needs with the money they have to spend.”

Migrating Production Away From China

In light of the tariffs, China’s manufacturing sector stands to potentially suffer, as American importers across industries seek out alternative countries in which to build at least certain items. While an effort to diversify supply chains into countries beyond China has been underway to varying degrees among some promo suppliers, the tariffs are starting to compel a broader, concerted effort to move more production into different countries.

At this year’s ASI Power Summit, industry leaders were asked to describe the impact of tariffs in one or two words. This wordcloud shows their answers. The larger the word, the more people gave that answer.

“We’ve already looked at ways to source outside China and increase our USA demand,” says Brandon Mackay, CEO/president of Top 40 supplier SnugZ/USA (asi/88060). “We’re seeing some success there and we’re just getting started, but our sourcing team feels up to the task.”

Showdown Displays, which produces items that include signs, banners and tabletop displays, is also exploring sourcing options in countries beyond China. Nations range from Turkey, India and Taiwan to Korea and Mexico. “We’re trawling the globe,” says Bruellman.

“Most of the tariffs are too large for us to absorb, so we’ll have to pass on the cost increases to our customers.”Bob Herzog, Corporate Imaging Concepts

Showdown Displays isn’t the only company casting a worldwide net. “The greater shift will see production moving out of China into other regions, including Malaysia, Mexico and Africa,” says Kahan, adding that the U.S. is unlikely to see much production return.

Still, supply chains don’t simply move overnight, and China will remain the industry’s manufacturing hub for at least the short term, even as some production migrates. “These supply chains are complicated and built over years,” says Isaacson. “If you’re talking about reforming them somewhere else, that takes considerable time and money. You have to establish the infrastructure, and make sure everything is right to meet regulations and properly address social responsibility.”

Certain suppliers are reluctant to begin shifting production, but are coming to view such a move as inevitable. “We certainly don’t want to move away from China for our supply chain,” says Blau. “The country’s infrastructure was built to support a robust export industry and it works very well. Our suppliers have become more sophisticated over time, learning to improve their manufacturing quality, communications and overall understanding of the promotional products industry in the U.S. Having said that, we’re certainly considering moving some product categories elsewhere, and we’ll be spending more energy on that effort in the coming year.”

Notably, American importers in promo and other industries steering production away from China could potentially ricochet disruption back to the North American promo market. Partner factories suppliers rely on in China could close, shift into different types of production or face backlogs as a result of being overwhelmed with work gained from factories that have closed up shop. “If suppliers don’t have enough time to move their supply chains, it could result in a shortage of factory capacity to produce some of the products we sell here,” says Isaacson.

Despite the challenges tariffs present, promo execs believe the industry will ultimately adapt, grow and thrive, as it always has. “This is one of the biggest challenges our industry has faced from an outside pressure,” says Isaacson. “It’s hard, but it’s not insurmountable.”

Adds Finnerty Thomas: “As entrepreneurs, it’s our job to navigate the ever-changing landscape, try to foresee the problems on the horizon and put solutions in place. It’s not our job to sit and worry about what’s beyond our control, but to do the best with what we have.”

Tariff Timeline

April 2017

The U.S. Trade Representative investigates whether steel/aluminum imports pose a threat to national security.

August 2017

The U.S. begins a formal investigation into certain policies and practices of the Chinese government tied to technology transfer and intellectual property.

January 2018

President Trump issues a 30% tariff on solar imports after U.S. manufacturers petition for relief.

March 2018

U.S. imposes tariffs on imported steel and aluminum from all nations, including China. In response to U.S. action on steel and aluminum, China places tariffs on $3 billion of U.S. goods.

May 2018

Joint talks in Washington lead to the U.S. agreeing to hold off on tariffs, as China says it will significantly increase purchases on goods made in the U.S.

June 2018

After disagreements about previous deals, the U.S. announces tariffs on $50 billion in imports from China. Trump threatens more tariffs if China retaliates. China does. Trump announces the U.S. will put tariffs on another $200 billion of Chinese exports.

August 2018

Trump threatens to increase the proposed tariff on $200 billion of Chinese imports to 25%, up from 10%. China unveils a list of $60 billion worth of U.S. imports it plans to apply tariffs on if U.S. follows through on threats.

September 2018

Effective September 24, U.S. announced a 10% tariff on $200 billion of Chinese exports until the end of 2018. Tariffs will rise to 25% afterward.