September 13, 2024

Federal Government Finalizes Tariff Increase on China-Made Steel, Aluminum

While promo executives are working to determine what precise impacts may be, some think the steeper levies could lead to higher prices on products that contain such materials, like drinkware.

Higher tariffs are coming.

On Friday, the Office of the United States Trade Representative (USTR) finalized approval – with some modifications – of a plan put forward in May by President Joe Biden to increase tariffs on about $18 billion worth of products imported from China.

Most notably for the promotional products industry, the tariff rate on a wide range of steel and aluminum products is rising from 7.5% to 25% – a move that, industry executives have said, could potentially lead to price increases on China-made items that utilize these materials, including stainless-steel drinkware, pens and certain household goods.

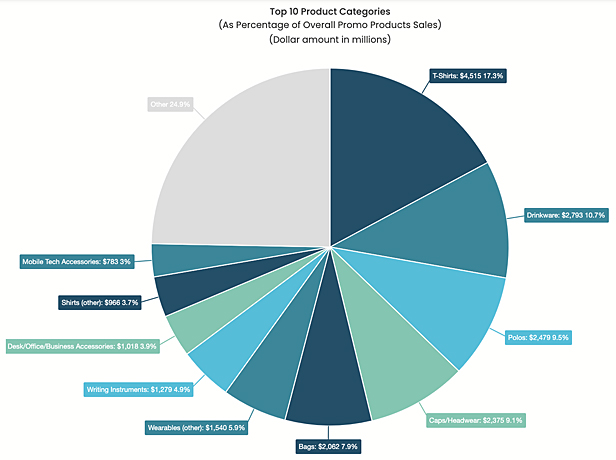

The heightened tariffs on steel and aluminum are set to take effect on Sept. 27, 2024. Drinkware is the second bestselling product category in promo, accounting for about 10.7% of sales, according to Counselor’s 2024 State of the Industry report. Writing instruments account for about 5% of the industry’s collective sales.

“There are going to be consequences for any USA end-markets that utilize imported Chinese aluminum and steel, with the promotional products market being no exception,” Chris Anderson, CEO of Counselor Top 40 supplier HPG (asi/61966) and a member of Counselor’s Power 50 list of promo’s most influential people, told ASI Media.

Tariffs make it more expensive to import a product/material. In an effort to maintain reasonable margins, importers may look to pass at least some of that cost along to customers, triggering a chain effect that ultimately leads to higher price tags for end-buyers in B2B commerce and consumers at the B2C level.

Still, Anderson asserted that suppliers must do everything possible to stave off or limit price increases, though they may still be necessary to a degree.

“[Price increases] should be a last resort, and should be accompanied by thoughtful product alternatives that allow distributors to win the business, regardless of what is happening in Washington – or beyond.” Chris Anderson, HPG (asi/61966)

“In the face of newly imposed tariffs, as in the case of any change to unit economics, it is the supplier’s responsibility to bring distributors a variety of solutions and alternatives, rather than simply passing along price increases,” Anderson said. “That is not to say that price increases shouldn’t or couldn’t happen – they are a necessary reality when the costs of doing business increase. However, they should be a last resort, and should be accompanied by thoughtful product alternatives that allow distributors to win the business, regardless of what is happening in Washington – or beyond.”

Some suppliers said they weren’t sure yet exactly what impacts the tariffs will have. “There’s been some confusion recently as to whether finished goods would be tariffed as opposed to raw materials and we haven’t clarified that yet,” said one Top 40 executive.

Meanwhile, certain promo executives believe the tariffs could potentially compel more suppliers and distributors to seek sources outside of China for products/materials covered by the heightened levies. Such geographic sourcing diversification has been underway for years in promo.

“The increased tariffs on steel and aluminum could further accelerate the trend of moving away from an overreliance on China,” said Jeff Lederer, a Power 50 member and co-leader of the investment firm that owns Counselor Top 40 distributor Myron (asi/278980).

“Still,” Lederer continued, “in the short term, there may be disruptions to the supply chain and inventory levels. However, companies like Myron will ultimately adapt and manage these increased costs, just as they have with previous tariff hikes.”

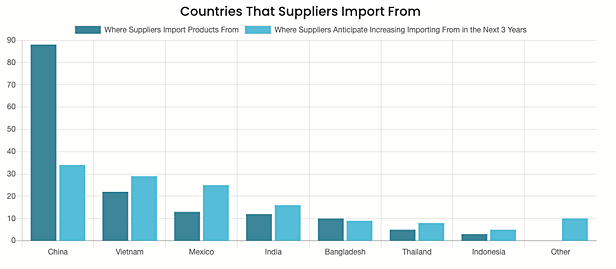

Even as industry companies diversify supply chains to countries beyond China, that nation remains the top international destination for merch market manufacturing.

China is promo’s main sourcing hub, ASI Research shows.

To wit, about nine in 10 North American suppliers who import do at least some of that importing from China, according to the Counselor 2024 State of the Industry report. Even if more promo production moves away from China, the country is poised to remain promo’s dominant sourcing hub for the foreseeable future.

In addition to the rising tariffs on steel and aluminum, the USTR also finalized rate jumps for products that include China-made EVs (100% tariff rate), semiconductors (50%) and lithium-ion batteries (25%). The USTR doubled tariffs on Chinese face masks, surgical gloves and syringes.

The USTR said the heightened tariffs aim to protect American businesses and workers from what it described as China’s unfair trade practices. Biden’s administration has said those practices include saturating global markets “with artificially low-priced exports,” a situation created by China’s alleged state-driven excess production capacity.

“Today’s finalized tariff increases will target the harmful policies and practices of the People’s Republic of China that continue to impact American workers and businesses,” said Ambassador Katherine Tai.

Reuters reported that China has vowed retaliation against the tariff hikes.