July 22, 2020

SOI 2020: End-Market Upheaval

Healthcare is up, other markets are not, but there are opportunities within all.

John Corrigan and Sara Lavenduski both contributed to this story.

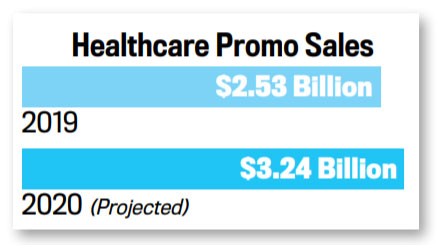

Healthcare: Surging Demand

The greatest need for PPE has been in the healthcare market, which has boosted a traditionally strong promo market into the stratosphere. Consider Lisa Gapen, owner of Generate Sales & Marketing (asi/444517) in Crown Point, IN. Her firm has focused in recent years on giveaways for healthcare educational events. In the face of cancellations, Gapen was still able to pivot and find much-needed PPE for the same customers while being sensitive and avoiding “fear-mongering.” When PPE inventory problems arose, she sourced and sold sanitizer to the tune of 30,000 pieces in three days. “I hadn’t done that many in the previous 12 years,” she says.

Don't Miss: More SOI 2020

Smaller clinics that offer important but non-emergency services such as routine physicals are starting to open back up. One family-owned facility ordered an employee giveaway for its reopening that not only expressed gratitude but also came in handy on the job. Innovatex Solutions Inc. (asi/231194) imprinted stainless-steel tumblers (ICT200) from AdNArt (asi/31518) with the clinic’s logo and personalized them with each employee’s name. The product provided refreshment during the day and extended thanks while also mitigating the chance of accidental sharing. Innovatex also donated extra waterproof pouches they had in inventory so workers could keep their mobile devices germ-free during the day. – SL

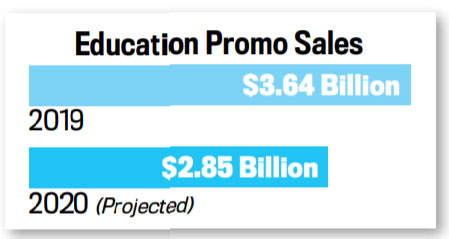

Education: Uncertainty for the Fall

When schools and universities closed campuses this spring and sent students home for virtual learning, the hope was that classes would reopen again in plenty of time to finish the school year. Now, with so much uncertainty lingering about if, how and when schools might reopen in the fall, promo companies servicing this historically strong sector have been left in the lurch.

For Mike Strycharz, owner of SJS Specialty Co. Inc. in Manalapan, NJ, it’s been a tough few months. His main industry is higher education in the Garden State; now, his clients are struggling. One customer has told him they’re in “dire financial trouble.” Still, Strycharz produced gift boxes for graduations containing tassels, lapel pins, chocolates, confetti and a congratulatory letter. Another school asked for 10,000 brochures (not related to COVID-19) for Student Health Services. “Any orders for the fall,” says Strycharz, “will have to be cost-effective because of budget cuts.”

There’s one thing that’s certain: the need for PPE. Chris Anderson, collegiate sales manager for College Hill Custom Threads (asi/164578), says he and his team are banking on face protection being part of everyone’s outfit for the months to come, especially since colleges may require them on campus. “We have multifunctional headwear that protects the neck, ears and face, but that can also be a rally towel, armband and spirit wear, so it’s a statement piece with other uses.” – SL

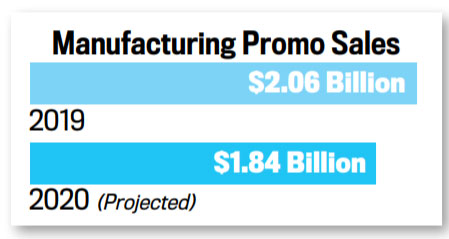

Manufacturing: Prioritizing Protection & Safety

During the coronavirus pandemic, manufacturing and distribution have remained strong markets, depending on which sectors you target. While production of fabricated metals, petroleum, coal, plastics and rubber products has dropped over the past few months, other areas are ramping up, including food and beverage manufacturing and distribution. Whomever is open for business will definitely need one thing: “PPE is huge for manufacturing,” says Stephanie Wurster, sales manager at East Dundee, IL-based Discount Printed Promos (asi/181106). “Factories that are still operating need masks, bandannas and any kind of face shield for their workers to follow CDC guidelines. We’ve been trying to get creative with ways to brand those items.”

There are still traditional areas of promo that will appeal to these clients – especially safety awards. These can include a variety of products, such as branded jackets and headwear or even coolers and grills. Whatever items you present to manufacturing clients, just make sure they’re name brand. “A lot of our vendors have come out with really great, quality items comparable to Yeti and RTIC, but clients don’t even give them a shot unless they’re name brand,” Wurster says. In some instances, items can be co-branded, such as a cooler with the RTIC logo on one side and the option for the client’s logo on another. In some instances, retail brands will only allow another logo imprinted on the packaging rather than the product. Wurster adds: “Co-branding is a hot trend in the manufacturing space.” – JC

“Any orders for the fall will have to be cost-effective because of budget cuts.” Mike Strycharz

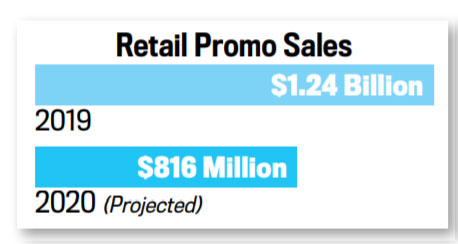

Retail: Whole New Experience

Retail has undergone a remarkable transition in the past decade, as online shopping has expanded and long-established players have closed stores. That transformation will continue, with the retail store experience changing greatly. Michael Emoff, chief vision officer at Shumsky (asi/326300) in Dayton, OH, says retailers deemed essential and those reopening have consistently asked for masks and distancing signage, as well as POS materials and uniforms. Just monitor their ability to pay. “Hospitals pay up front for PPE and it’s no problem,” says Emoff. “Retailers want to negotiate terms, like paying more on the back end. Meanwhile, distributors might not get paid. Companies are buying PPE because they have to, not because they want to. And that means they might not actually have the ability to buy. They didn’t have a PPE budget at the end of 2019, so they’re taking from somewhere else to buy it.”

However, while PPE may have helped promo firms shore up their operations in these difficult months, now’s the time to prepare for the other side and diversify, says Emoff. “PPE has been propping up businesses, but that will eventually stop,” he cautions. “Distributors have been able to sell PPE because larger pharma suppliers wouldn’t sell relatively small quantities, but those orders will go back to the big companies eventually. Start getting orders now in regular promo so you’re ready.” – SL

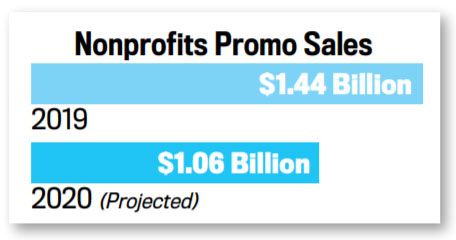

Nonprofits: An Uphill Climb

Things have been doubly hard for nonprofits. Beyond the impact from COVID-19, organizations were contending with a dip in donations due to the Tax Cuts and Jobs Act of 2017, which limited the ability of Americans to earn tax breaks on their charitable gifts by itemizing them as deductions.

Quite simply, distributors must get creative with their merch and marketing strategies to create engagement from lapsed audiences and elicit donations. Columbus, OH-based Z Promotions (asi/365529) is up to the challenge. Instead of delaying fundraisers or scrapping them altogether, the distributor has encouraged clients to hold them online. Rather than giving out participatory T-shirts or thank-you gifts in person, the company can ship tokens of appreciation directly to virtual attendees’ doorsteps. “We’ve gone back to the drawing board to figure out new ways to serve our clients,” says CEO K. Zulene Adams.

Dealing with donors, especially obtaining their contact information for shipping products, requires enormous trust from nonprofits. In order to build that trust, distributors must not only deliver consistent, quality service, but also get involved in the organization’s efforts. Asif Jessani, partner at Lawrenceville, GA-based CCS: Marketing & Technology (asi/350474), has volunteered with nearly all his nonprofit clients. “Being engaged with your community is the best way to break into the market,” Jessani says. “But it has to be authentic. Give back without any expectation. Give back because you care.” – JC

Other Markets to Watch

Elections

Current Status: In election years, the spring and summer are traditionally chock-full of rallies and primaries leading up to Election Day in November. This year looked a bit different. Rallies and meet-the-candidate events disappeared. Some primaries were postponed, while others (like in hard-hit New York) were canceled. Candidate signs still made a statement on roadways, though the number of impressions was severely impacted.

Future Opportunities: As the country heads toward Election Day, consider helping candidates with email marketing, direct-mail pieces and signage, which will get more bang for the buck as restrictions lift and more people head out on the roads.

Tech

Current Status: The International Data Corporation predicts that IT spending on software, hardware and services for businesses – particularly in hospitality, food services and transportation – will take a huge hit this year, as well as in event marketing and revenue. But there are bright spots. The closures and stay-at-home orders put technology in the spotlight as people moved home to work for several months and dining rooms turned into classrooms. Meanwhile, distributors launched e-commerce sites for businesses looking to sell merchandise to shore up expenses and payroll.

Future Opportunities: Tech companies that serve the healthcare, government and education industries have tons of potential. Continue to help tech firms market their services that keep people connected but distant, especially vulnerable members of the community.

Financial/Insurance Current

Status: The fourth-largest market for promo sales in 2019 is poised to weather the pandemic with characteristic stability. While most banks’ drive-through windows remained open for everyday banking needs, many lobbies were closed, which meant fewer one-on-one conferences for financial advice and more digital banking. It was the same story at insurance agencies. Meanwhile, financial industry conferences and trade shows were canceled.

Future Opportunities: Look to community outreach. A report from consulting firm EY on the impact COVID-19 has had on the financial services industry found that more than half of consumers’ future purchasing decisions within this market will be driven by banks actively supporting the community. Consider how to help banks and insurance agents with outreach needs focused on more than just customer conversions.

Automotive

Current Status: The automotive market has been hit hard by the pandemic, as stay-at-home orders preclude drivers from needing new wheels, meaning many plans to buy have been put on hold for the time being. Job uncertainty has also changed purchasing plans. J.D. Power said in May that car retailers have sold 800,000 fewer vehicles than was forecast before the virus. The rental car segment was also severely impacted by canceled travel; long-time rental giant Hertz filed for bankruptcy in May.

Future Opportunities: The headline on Car and Driver’s website says it all: “Now Is The Best Time To Buy A Car.” Yes, as reopenings begin, the industry may stay tamped down because of large numbers of unemployed (and therefore fewer commuters headed back to the office). But on the flip side, dealers certainly have inventory and an eagerness to sell — and to discount. A marketing blitz that includes mailers and promotional products can entice people with stimulus money and a need to commute again.

Hospitality

Current Status: In the weeks leading up to nationwide stay-at-home orders, event organizers made the tough decisions to cancel or postpone events in virtually every industry. As a result, the American Hotel and Lodging Association found that hotel occupancy in the U.S. had declined 70% in April compared to the same month in 2019, and estimated the industry was losing about $500 million in room revenue every day. Airline passenger traffic was down 90% in May, said trade group Airlines for America, as business and leisure trips were canceled. Meanwhile, Airbnb announced in May that it was letting go a quarter of its workforce after mass trip cancellations this spring. While international travel will suffer long-term, there are some hopeful short-term signs of recovery for out-of-state travel as states reopen.

Future Opportunities: Help hurting companies get back in the game with traveler-friendly merchandise, particularly for road-trip drivers and their companions. Experts predict the “drive market” will come back before the airline industry.

Trade Shows

Current Status: As organizers of major events began pulling the plug in late February and early March, it became crystal clear that the trade show industry was going to feel deep and long-term effects of COVID-19. To add insult to injury, the uncertainty of what the third and fourth quarters will bring, combined with the public’s ongoing fear and collective trauma from mass closures, sickness and fatalities in the spring, means recovery will be nothing short of laborious. Along with small-scale tabletop shows, a few larger shows may return in the fall but full exhibitor, attendee and revenue numbers won't return until 2021 at the earliest.

Future Opportunities: For gatherings that are successfully rescheduled for the fall, distributors will find opportunity not only in mainstays like signage, uniforms and giveaways, but also in PPE, like masks and sanitizer stations, as well as floor decals for distancing and disposable thermometers to check attendees before they’re allowed on the show floor. – SL

An Altered Landscape

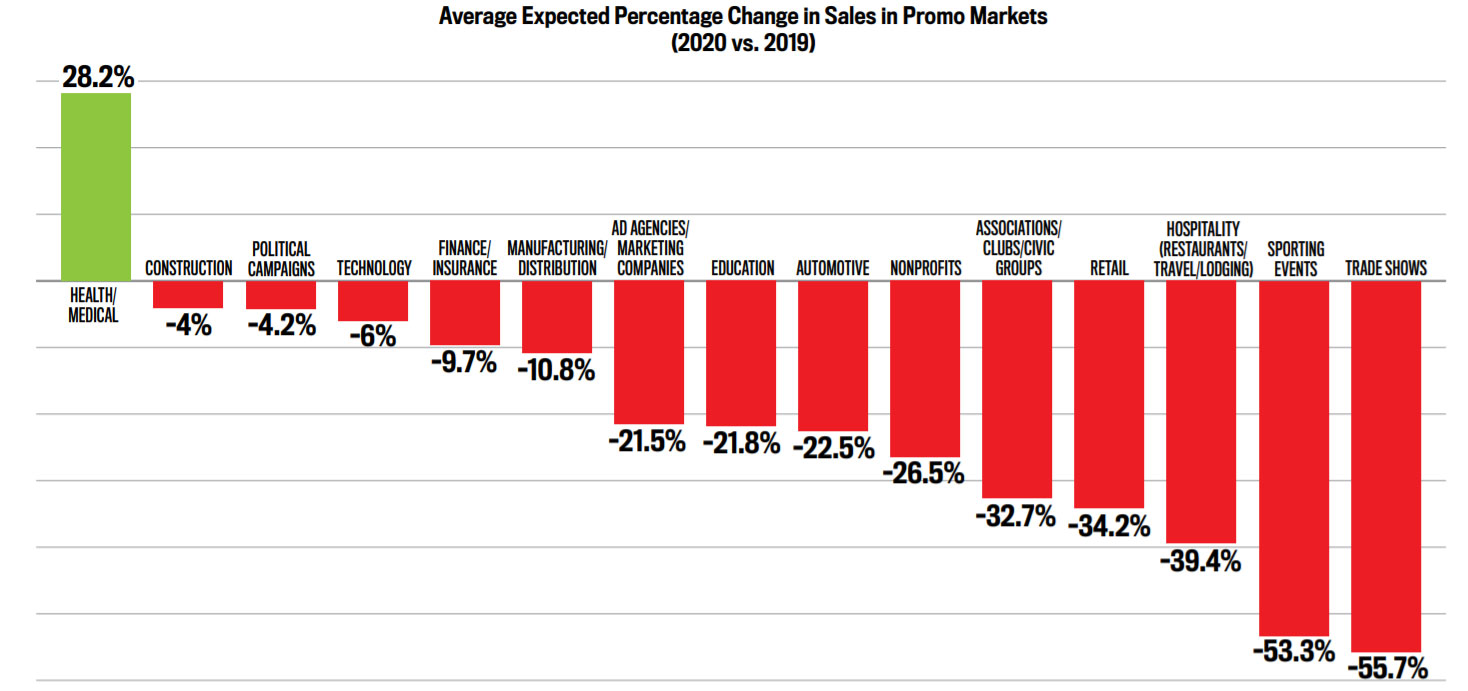

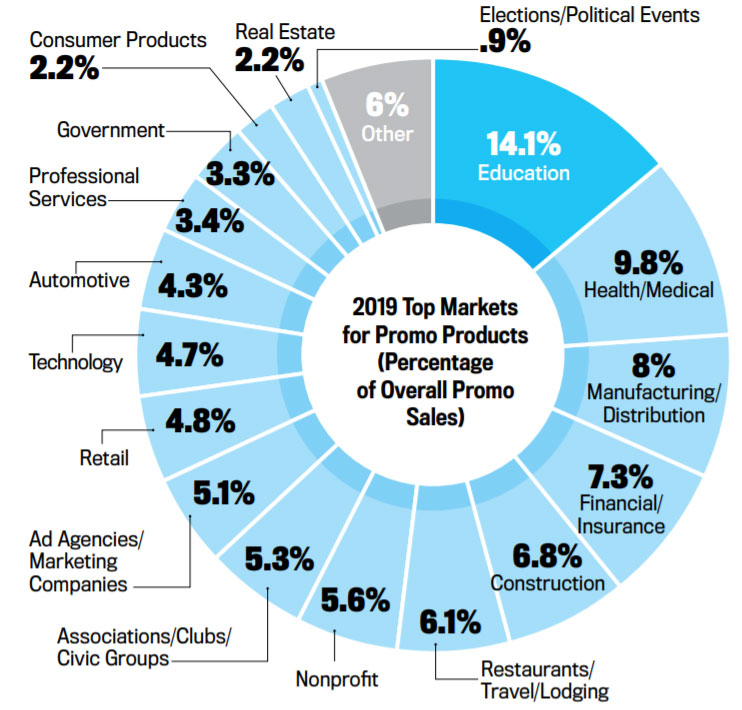

Healthcare is the only major market to rise in 2020, while anything requiring travel or congregating (hospitality, sports and trade shows) are poised to suffer greatly this year.

Click here for a larger image of the above chart.

Projected Top Five Promo Markets in 2020: Health & safety is expected to overtake education for the top spot, and construction is projected to surpass finance for the fourth largest market.

Market Examination: Education ended 2019 as the top overall market for the sixth year in a row, a run that’s unlikely to continue this year. Click here for a larger image of the above chart.